PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836440

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836440

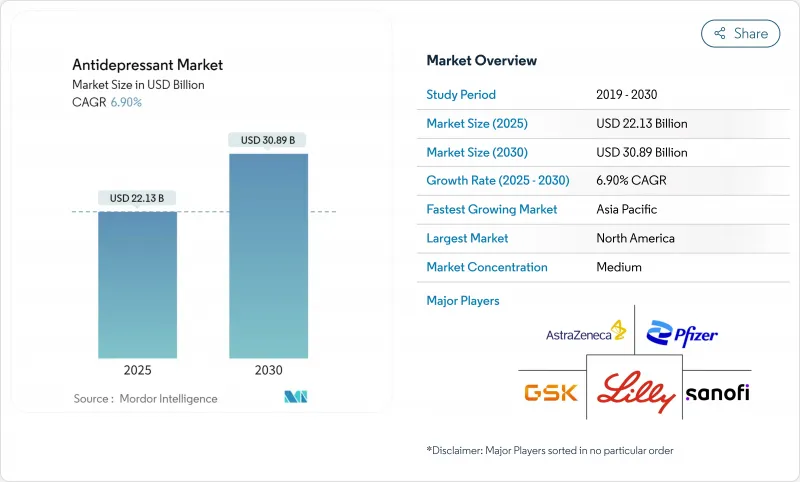

Antidepressant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The antidepressants market was valued at USD 22.13 billion in 2025 and is set to reach USD 30.89 billion by 2030, advancing at a 6.9% CAGR during the forecast period.

Growth rests on rapid-acting glutamatergic medicines that shorten symptom-relief times, AI-enabled precision prescribing, and steady uptake of telehealth-based mental-health services. North America anchors demand, yet Asia-Pacific now dictates the steepest growth curve as stigma recedes and insurance cover widens. Intensifying competitive activity ranges from the USD 14.6 billion Johnson & Johnson-Intra-Cellular Therapies deal to a string of FDA fast-track designations for next-generation agents. Regulatory flexibility around novel mechanisms (for example, the FDA's 2025 esketamine monotherapy clearance) pairs with expanding digital front doors to care, creating sizable entry points for innovators. Patent-expiring brands and ensuing generic erosion temper topline prospects, yet focused lifecycle and combination-therapy tactics cushion revenue gaps. Meanwhile, sustainability mandates on active-pharmaceutical-ingredient (API) discharge tighten cost structures but reward early adopters of green chemistry.

Global Antidepressant Market Trends and Insights

Rising Prevalence of Major Depressive Disorder

Global depression cases climbed to nearly 300 million by 2024, with major depressive disorder representing the largest share. Post-pandemic stress, economic uncertainty, and social isolation have sustained incidence rates, especially among women and older adults. Broader primary-care screening protocols and integrated behavioral-health teams now channel more patients toward evidence-based pharmacotherapy. Insurers increasingly reimburse long-term maintenance regimens, positioning the antidepressants market for continued volume growth. Pharmaceutical pipelines respond with agents promising faster onset and better tolerability, matching evolving clinical expectations.

Ageing Population with Higher Depression Risk

Late-life depression afflicts over 20% of adults older than 50 and far higher proportions in long-term-care settings. Chronic comorbidities complicate choice and dosing of antidepressants, driving R&D toward molecules with minimal drug-interaction potential. Dedicated geriatric trials and formulation tweaks (for example, lower-dose sustained-release tablets) underscore a strategic pivot toward older cohorts. Health-system budgets also face rising indirect costs linked to untreated geriatric depression, spurring earlier pharmacologic intervention.

Adverse-Event Profile & Black-Box Warnings

All antidepressants carry FDA black-box warnings about suicidality in patients under 25. High discontinuation rates linked to sexual dysfunction and weight gain spur non-adherence. Innovations like Exxua advertise reduced sexual-side-effect risk, but require electrocardiogram monitoring for QT prolongation, adding complexity. Spravato's dissociative profile mandates REMS-certified clinics, limiting uptake outside urban areas.

Other drivers and restraints analyzed in the detailed report include:

- Frequent Product Launches of Next-Gen SSRIs/SNRIs

- Expansion of Tele-psychiatry & E-Prescriptions

- Shift Toward Digital Therapeutics Curbing Drug Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SSRIs retained a 43.75% antidepressants market share in 2024 owing to decades-long physician familiarity and broad formulary inclusion . Yet the antidepressants market now pivots toward rapid-acting glutamatergic drugs, whose 6.9% CAGR to 2030 will materially enlarge the class footprint. Esketamine's monotherapy sanction and oral R-ketamine tablets in Phase III exemplify this surge. SNRI incumbents still command meaningful volume, bolstered by dual efficacy in neuropathic pain. Atypicals such as bupropion attract patients seeking weight-neutral or smoking-cessation benefits, cushioning erosion in older tricyclic segments.

Pipeline data confirm a widening mechanistic palette: AMPA-receptor potentiators, neurosteroid agonists, and 5-HT2A psychedelic analogs are each in mid-stage trials. Sustained interest from large-pharma neuroscience franchises coincides with venture-backed biotech exploration, positioning the antidepressants market for successive innovation waves. Brand-lifecycle extensions around SSRIs-including deuterated chemistry and micro-dosing regimens-retain relevance, yet forward-looking strategic capital plows into non-monoaminergic paths promising competitive differentiation.

Major Depressive Disorder held 37.25% of the antidepressants market size in 2024, reflecting its prevalence and strong reimbursement support across health plans. Zurzuvae's 2024 approval opened a dedicated postpartum-depression submarket projected to climb 7.21% CAGR to 2030. The new once-daily, 14-day neuroactive-steroid course offers relief within 3 days, appealing to new mothers seeking rapid functional restoration. OCD and bipolar-depression niches continue to leverage SSRI and adjunctive antipsychotic use; yet targeted pipeline molecules such as lumateperone aim to sharpen efficacy in symptom clusters like mixed-features depression.

Patient-advocacy campaigns and employer-sponsored maternal-health benefits hasten postpartum-depression diagnosis and treatment specialist referral, cementing long-run volume contributions. Meanwhile, payers increasingly segment formularies by disorder-specific clinical performance, rewarding assets that demonstrate remission within defined timeframes. Hence, manufacturers defending MDD franchises diversify into postpartum or geriatric sub-labels to lock in premium pricing across multiple depressive spectrums, fortifying their stance in the wider antidepressants market.

The Antidepressant Market Report Segments the Industry Into Product (Selective Serotonin Reuptake Inhibitor (SSRI) and More), by Depressive Disorder (Major Depressive Disorder, and More), by Route of Administration (Oral, Parenteral and More), by Distribution Channel (Hospital Pharmacies, and More) and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.56% of global revenues in 2024 thanks to high per-capita spend, broad insurance coverage, and rapid adoption of accelerated-approval drugs. US FDA policy that balances expedited pathways with stringent post-marketing surveillance anchors the region's innovation status. Canada's centralized formularies speed nationwide uptake once Health Canada clears a new agent. Mexico's Seguro Popular expansion pulls more patients into formal care, lifting generic-SSRI volumes.

Asia-Pacific records the swiftest trajectory at an 8.12% CAGR as urbanization and mental-health literacy grow. China's 2024 inclusion of toludesvenlafaxine in the National Reimbursement Drug List validated government commitment to psychiatric care funding. India's domestic-manufacturing push lowers generic costs, widening rural access. Japan's super-aged demographics and universal health insurance sustain high per-patient drug utilization despite cost-containment efforts. South Korea leverages advanced digital-health infrastructure to integrate mood-tracking wearables with prescription management, illustrating the tech-enabled future of antidepressant care.

Europe shows stable expansion as the European Medicines Agency's centralized marketing authorization streamlines cross-border launches, while national health-technology-assessment bodies enforce cost-effectiveness hurdles. Germany leads digital-therapeutics reimbursement under its DiGA program, creating complementary or substitutive pressure on drug use. Stringent EU environmental standards on pharmaceutical effluent impose incremental compliance costs, nudging manufacturers toward closed-loop water-recycling plants. Central-Eastern Europe's rising income levels support branded-generic penetration, though capacity constraints in outpatient psychiatry remain a growth obstacle.

- Johnson & Johnson

- Alkermes plc

- H. Lundbeck

- Otsuka

- Axsome Therapeutics

- Relmada Therapeutics, Inc.

- Sage Therapeutics

- Seelos Therapeutics, Inc.

- COMPASS Pathways plc

- GH Research PLC

- Biohaven Ltd.

- Atai Life Sciences N.V.

- Revive Therapeutics Ltd.

- Teva Pharmaceutical Industries

- Dr. Reddy's Laboratories Ltd.

- Cipla

- Sun Pharmaceuticals Industries

- Viatris

- Pfizer

- GlaxoSmithKline

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing prevalence of partial/non-response to SSRI/SNRI therapy

- 4.2.2 Rapid commercial uptake of esketamine (Spravato) in key markets

- 4.2.3 Rising payer willingness to reimburse novel-mechanism add-ons

- 4.2.4 Psychedelic-assisted therapy clinics scaling in North America & Europe

- 4.2.5 FDA Breakthrough & Fast-Track designations accelerating pipelines

- 4.2.6 AI-enabled precision-psychiatry tools boosting treatment matching

- 4.3 Market Restraints

- 4.3.1 High cost & REMS burden for intranasal esketamine administration

- 4.3.2 Stringent insurance step-edit requirements delaying uptake

- 4.3.3 Social-stigma & regulatory uncertainty around psychedelic agents

- 4.3.4 Limited specialist capacity for intensive dosing & monitoring

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Drug Class (Value)

- 5.1.1 NMDA Receptor Antagonists

- 5.1.2 Atypical Antipsychotic Augmentation

- 5.1.3 Monoamine Modulators (SSRI/SNRI, MAOI, TCA)

- 5.1.4 Psychedelics & Novel Compounds

- 5.1.5 Others

- 5.2 By End User (Value)

- 5.2.1 Hospitals

- 5.2.2 Specialty Clinics

- 5.2.3 Homecare & Telepsychiatry

- 5.2.4 Research & Academic Centers

- 5.3 By Distribution Channel (Value)

- 5.3.1 Retail Pharmacies

- 5.3.2 Hospital Pharmacies

- 5.3.3 Online Pharmacies

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson (Janssen)

- 6.3.2 Alkermes plc

- 6.3.3 H. Lundbeck A/S

- 6.3.4 Otsuka Pharmaceutical Co., Ltd.

- 6.3.5 Axsome Therapeutics, Inc.

- 6.3.6 Relmada Therapeutics, Inc.

- 6.3.7 Sage Therapeutics, Inc.

- 6.3.8 Seelos Therapeutics, Inc.

- 6.3.9 COMPASS Pathways plc

- 6.3.10 GH Research PLC

- 6.3.11 Biohaven Ltd.

- 6.3.12 Atai Life Sciences N.V.

- 6.3.13 Revive Therapeutics Ltd.

- 6.3.14 Teva Pharmaceutical Industries Ltd.

- 6.3.15 Dr. Reddy's Laboratories Ltd.

- 6.3.16 Cipla Ltd.

- 6.3.17 Sun Pharmaceutical Industries Ltd.

- 6.3.18 Viatris Inc. (Mylan)

- 6.3.19 Pfizer Inc.

- 6.3.20 GlaxoSmithKline plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment