PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836441

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836441

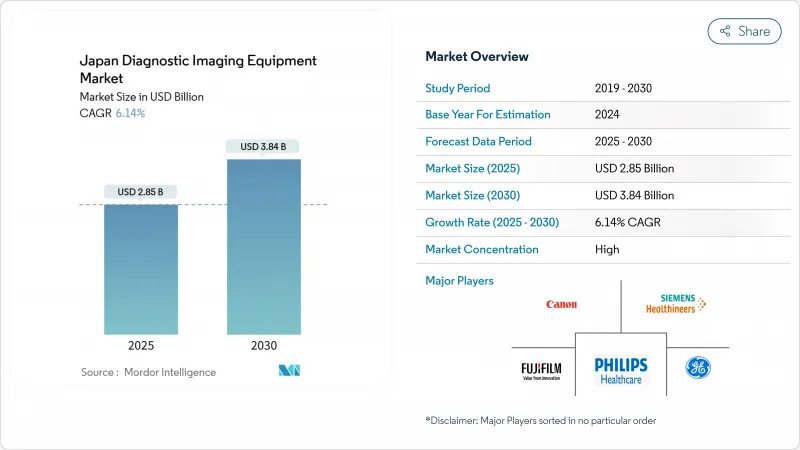

Japan Diagnostic Imaging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan diagnostic imaging equipment market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 3.84 billion by 2030, at a CAGR of 6.14% during the forecast period (2025-2030).

The current market underscores the country's strong foundation in medical technology, built on an aging population, high equipment density, and active government digitization programs. Investors view the segment favorably as Society 5.0 and Medical DX policies accelerate AI integration, prompting hospitals to modernize fleets quickly. Manufacturers benefit from rapid replacement cycles; for example, Canon Medical Systems expects imaging revenue to move from JPY 553.8 billion (USD 3.7 billion) in FY-2023 to JPY 582 billion (USD 3.9 billion) in FY-2024. At the same time, radiologist shortages have lifted demand for AI-assisted workflows and teleradiology, mitigating workforce constraints. Collectively, these factors position the market for sustained mid-single-digit growth through the decade.

Japan Diagnostic Imaging Equipment Market Trends and Insights

Rising burden of chronic diseases

Cancer prevalence lifts equipment utilization across modalities. Gastric cancer alone affects roughly 1 million Japanese each year, spurring uptake of advanced endoscopic imaging such as AI Medical Service's gastroAI that delivers 91.4% sensitivity for early lesions. Providers therefore prefer multi-modal suites capable of completing several scans in one visit, a trend boosting high-resolution CT and MRI installs throughout the Japan diagnostic imaging equipment market.

Growing geriatric population

With 29.56% of residents aged 65 or older in 2023-and rural areas surpassing 60%-portable solutions have become critical. Canon's upright CT, which shortens exams by 40% for musculoskeletal cases, aligns with mobility limits common in elder care. As the Japan diagnostic imaging equipment market expands, point-of-care devices support home-visit nurses and mobile clinics serving super-aged communities.

High acquisition & lifecycle costs of products

Price sensitivity delayed Shimadzu's domestic imaging sales, which fell 2.3% in 1H-FY 2024 as clinics postponed replacements. Consequently, vendors are piloting pay-per-scan financing and shared-service models to ensure that budget-constrained buyers remain engaged in the Japan diagnostic imaging equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid technological advancements

- Government initiatives favoring early-stage screenings and domestic innovations

- Stringent regulatory regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

X-ray systems maintained a 30.13% share of the Japan diagnostic imaging equipment market in 2024, underlining their role as the entry point for routine diagnostics in almost all clinical settings. Computed tomography now carries the fastest 7.25% CAGR, supported by photon-counting platforms that lower dose while improving contrast. As a result, the Japan diagnostic imaging equipment market size allocated to CT is projected to outpace traditional modalities by 2030. MRI adoption remains stable, driven by neurological and orthopedic demands, whereas ultrasound enjoys steady upgrades through AI-guided workflow tools. Nuclear imaging and mammography grow steadily under national cancer-screening programs. Together these trends illustrate how the Japan diagnostic imaging equipment industry is migrating from basic radiography to advanced, multimodal precision imaging.

Growing differentiation pressures favor vendors offering hybrid scanners and AI overlays that unify multi-modal outputs on a single viewer. Canon, Fujifilm, and GE HealthCare are investing in algorithm-ready consoles to extend equipment life cycles and safeguard margins within the fiercely competitive Japan diagnostic imaging equipment market.

Fixed rooms captured 81.21% of 2024 revenue and remain the operational backbone for tertiary hospitals. Nevertheless, mobile and hand-held units are forecast to grow 7.92% CAGR through 2030 as remote-island medical MaaS pilots equip vans with bedside X-ray, handheld ultrasound, and cloud PACS links. The market size attached to portable categories could therefore double over the decade. For rural prefectures, compact battery-powered ultrasound devices from Philips and Fujifilm represent a cost-effective path to universal imaging access.

Manufacturers pursue ruggedized designs and AI-on-edge capabilities to withstand transport vibration and patchy connectivity. The Japan diagnostic imaging equipment industry now evaluates total ecosystem value-software, training, and service contracts-rather than unit sales alone, creating space for ancillary players in data security and telehealth platforms.

The Japan Diagnostic Imaging Equipment Market Report is Segmented by Modality (X-Ray, MRI, Ultrasound, Computed Tomography, Nuclear Imaging, Mammography and Other Modalities), Portability (Fixed Systems and Mobile and Hand-Held Systems), Application (Cardiology, Oncology, Neurology, and More), and End-User (Hospitals, Diagnostic Imaging Centres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Canon

- FUJIFILM

- Shimadzu

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Carestream Health

- Esaote

- Hologic

- SAMSUNG (SamsungHealthcare.com)

- Mindray

- YOSHIDA DENZAI KOGYO Co., Ltd.

- United Imaging Healthcare Co., Ltd.

- Konica Minolta

- Agfa-Gevaert

- Planmeca

- Neusoft

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Rising burden of chronic diseases

- 4.1.2 Growing geriatric population

- 4.1.3 Rapid technological advancement

- 4.1.4 Government initiatives favoring early-stage screenings and domestic innovations

- 4.1.5 Point-of-care & portable imaging demand in elder-care facilities

- 4.1.6 Expansion of private outpatient imaging centers

- 4.2 Market Restraints

- 4.2.1 High acquisition & lifecycle costs of products

- 4.2.2 Stringent regulatory regulations

- 4.2.3 Shortage of trained radiologists and technologists

- 4.2.4 Radiation-dose safety concerns

- 4.3 Pricing Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Modality

- 5.1.1 X-ray

- 5.1.2 MRI

- 5.1.3 Ultrasound

- 5.1.4 Computed Tomography

- 5.1.5 Nuclear Imaging

- 5.1.6 Mammography

- 5.1.7 Other Modalities

- 5.2 By Portability

- 5.2.1 Fixed Systems

- 5.2.2 Mobile and Hand-held Systems

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Neurology

- 5.3.4 Orthopedics and Trauma

- 5.3.5 Gastroenterology and Hepatology

- 5.3.6 Women's Health and Obstetrics

- 5.3.7 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Surgery and Specialty Clinics

- 5.4.4 Home-care / Long-term-care Facilities

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Canon Medical Systems Corporation

- 6.3.2 Fujifilm Holdings Corporation

- 6.3.3 Shimadzu Corporation

- 6.3.4 GE HealthCare

- 6.3.5 Siemens Healthineers AG

- 6.3.6 Koninklijke Philips N.V.

- 6.3.7 Carestream Health Inc.

- 6.3.8 Esaote SpA

- 6.3.9 Hologic Inc.

- 6.3.10 SAMSUNG (SamsungHealthcare.com)

- 6.3.11 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.3.12 YOSHIDA DENZAI KOGYO Co., Ltd.

- 6.3.13 United Imaging Healthcare Co., Ltd.

- 6.3.14 Konica Minolta Inc.

- 6.3.15 Agfa-Gevaert Group

- 6.3.16 Planmeca Oy

- 6.3.17 Neusoft Medical Systems Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment