PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836443

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836443

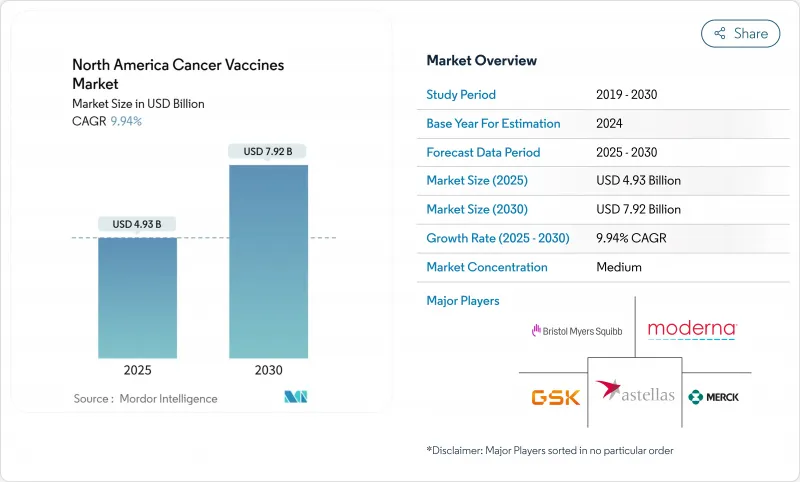

North America Cancer Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America cancer vaccines market is valued at USD 4.93 billion in 2025 and is forecast to reach USD 7.92 billion by 2030, advancing at a solid 9.94% CAGR.

Rising clinical success of mRNA platforms, supportive public funding, and broader reimbursement policies are moving therapeutic vaccines from experimental status to mainstream precision-oncology tools. The American Cancer Society expects more than 2.04 million new cancer diagnoses in 2025, enlarging the eligible population for preventive and therapeutic vaccination programs. mRNA-driven pipelines, particularly for melanoma, are gaining momentum after breakthrough therapy designations, while hospital systems invest in point-of-care manufacturing hubs that shorten lead times for individualized products. Meanwhile, stronger coverage decisions by the Centers for Medicare & Medicaid Services (CMS) improve physician confidence that vaccine-based regimens will be reimbursed.

North America Cancer Vaccines Market Trends and Insights

Surging Cancer Incidence & Screening Rates

Early detection programs are identifying cancers at stages where vaccine-based interventions can add meaningful benefit. The United States expects more than 2.04 million new cancer cases in 2025, a historic first above the 2 million mark . Canada projects 247,100 new cases in 2024, with male incidence surpassing female levels, opening room for gender-specific vaccine campaigns . Provincial HPV-based screening in British Columbia is enabling earlier cervical lesion detection, which strengthens the clinical value proposition of both preventive and therapeutic vaccines. Routine skin imaging for high-risk individuals is likewise catching melanoma at stages where mRNA vaccines have shown benefit. Together, rising incidence and better screening broaden the pool of treatable patients, helping the North America cancer vaccines market grow at nearly double-digit speed.

Accelerating Government & VC Funding for Vaccine Pipelines

Federal agencies are positioning advanced vaccine science as a national security priority that extends well beyond infectious-disease preparedness. The U.S. Department of Health and Human Services granted USD 590 million to Moderna in January 2025 for pandemic influenza work, but the same production lines can pivot to oncology payloads . BARDA's Accelerator Network 2.0 is channeling multi-year grants into rapid-response therapeutics, including cancer vaccines, which lowers venture-capital risk. The National Cancer Institute earmarked USD 4.25 million in FY2024 for the Cancer Immunoprevention Network to finance early research. ARPA-H's APECx program is applying artificial intelligence to antigen discovery, shrinking development cycles from years to months. With layered public and private capital, platform companies can scale manufacturing quickly, supporting the long-run expansion of the North America cancer vaccines market.

Stringent CMC Validation & Long Lead-times

Chemistry, Manufacturing, and Controls (CMC) rules are rigorous for products that change from patient to patient. The Coalition for Epidemic Preparedness Innovations notes that stability and analytics reviews alone can add 18-24 months to timelines. Each personalized mRNA batch must pass individual sterility and potency checks, lengthening production by 4-6 weeks. The U.S. Food and Drug Administration is still drafting guidance on AI algorithms used in neoantigen prediction, introducing regulatory ambiguity. Firms with deep quality-control expertise can absorb the overhead, but smaller entrants may struggle, which tempers near-term growth in the North America cancer vaccines market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Advances in mRNA & Neo-antigen Platforms

- CMS Reimbursement Expansion for Therapeutic Vaccines

- Competition from Next-gen Cell & Gene Therapies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recombinant products led the North America cancer vaccines market with 45.54% share in 2024, powered by mature supply chains and decades of regulatory familiarity. However, the segment is forecast to cede momentum to mRNA vaccines, which are expanding at a 10.71% CAGR through 2030. Moderna and Merck's V940 secured FDA breakthrough status after demonstrating a 49% risk reduction for melanoma recurrence. Other mRNA candidates, such as BioNTech's BNT111, are posting meaningful response rates when combined with checkpoint inhibitors. The shift underscores a structural advantage: synthetic RNA avoids cell-culture bottlenecks, letting producers pivot quickly to new indications.

Automation and AI are now embedded in end-to-end workflows, trimming development cycles from several years to under twelve months for follow-on products. Viral-vector and DNA platforms continue to play niche roles but face limits in immunogenicity and scalability. Whole-cell and dendritic approaches carry high costs tied to individualized processing. As these realities become clearer, capital reallocates toward RNA specialists, anchoring medium-term expansion of the North America cancer vaccines market.

Preventive modalities still dominate, accounting for 90.56% revenue in 2024, largely due to nationwide HPV programs with robust CMS coverage. Yet therapeutic products are accelerating at 10.84% CAGR as real-world evidence validates their role in adjuvant and neoadjuvant settings. Canada's updated guidelines endorse single-dose HPV schedules for ages 9-20, improving coverage while freeing budgets for therapeutic pilots.

Mount Sinai's PGV001 study maintains 5-year survival in almost half of participants across multiple tumor types. Vvax001 has shown a 94% reduction in cervical intraepithelial neoplasia lesions. Health-system pilots increasingly combine prophylactic and treatment strategies, envisioning lifetime immunization pathways. These developments reinforce strong growth prospects for therapeutic injections, sustaining the North America cancer vaccines market expansion toward 2030.

The North America Cancer Vaccines Market is Segmented by Technology (Recombinant Vaccines, and More), Treatment Method (Preventive Vaccines and Therapeutic Vaccines), Cancer Type (Cervical Cancer (HPV), Melanoma and More), Delivery Route (Intramuscular, Intravenous, and More), and Geography (United States, Canada, and Mexico). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Astellas Pharma

- Merck

- GlaxoSmithKline

- Bristol-Myers Squibb

- Dendreon Pharmaceuticals

- Aduro Biotech

- Sanofi

- F. Hoffmann-La Roche AG (Genentech)

- Moderna

- BioNTech

- Inovio Pharmaceuticals

- Gritstone bio Inc.

- Agenus

- ImmunoGen

- Bavarian Nordic

- Northwest Biotherapeutics

- Celldex Therapeutic

- Vaccinex Inc.

- Transgene

- Geneos Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging cancer incidence & screening rates

- 4.2.2 Accelerating government & VC funding for vaccine pipelines

- 4.2.3 Rapid advances in mRNA & neo-antigen platforms

- 4.2.4 CMS reimbursement expansion for therapeutic vaccines

- 4.2.5 Hospital-based personalized manufacturing hubs

- 4.2.6 Cross-border clinical-trial harmonization within USMCA

- 4.3 Market Restraints

- 4.3.1 Stringent CMC validation & long lead-times

- 4.3.2 Competition from next-gen cell & gene therapies

- 4.3.3 Limited cold-chain infrastructure for novel lipid-NP vaccines

- 4.3.4 Public vaccine-safety skepticism

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Recombinant Vaccines

- 5.1.2 Viral Vector & DNA Vaccines

- 5.1.3 mRNA/Neoantigen Personalised Vaccines

- 5.1.4 Whole-cell & Dendritic Cell Vaccines

- 5.1.5 Other Technologies

- 5.2 By Treatment Method

- 5.2.1 Preventive Vaccines

- 5.2.2 Therapeutic Vaccines

- 5.3 By Cancer Type

- 5.3.1 Cervical Cancer (HPV)

- 5.3.2 Prostate Cancer

- 5.3.3 Melanoma

- 5.3.4 Other Cancers

- 5.4 By Delivery Route

- 5.4.1 Intramuscular

- 5.4.2 Intradermal / Sub-cutaneous

- 5.4.3 Intravenous

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Astellas Pharma Inc.

- 6.3.2 Merck & Co. Inc.

- 6.3.3 GlaxoSmithKline plc

- 6.3.4 Bristol-Myers Squibb

- 6.3.5 Dendreon

- 6.3.6 Aduro BioTech Inc.

- 6.3.7 Sanofi S.A.

- 6.3.8 F. Hoffmann-La Roche AG (Genentech)

- 6.3.9 Moderna Inc.

- 6.3.10 BioNTech SE

- 6.3.11 Inovio Pharmaceuticals

- 6.3.12 Gritstone bio Inc.

- 6.3.13 Agenus Inc.

- 6.3.14 ImmunoGen Inc.

- 6.3.15 Bavarian Nordic

- 6.3.16 Northwest Biotherapeutics

- 6.3.17 Celldex Therapeutics

- 6.3.18 Vaccinex Inc.

- 6.3.19 Transgene SA

- 6.3.20 Geneos Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment