PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836446

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836446

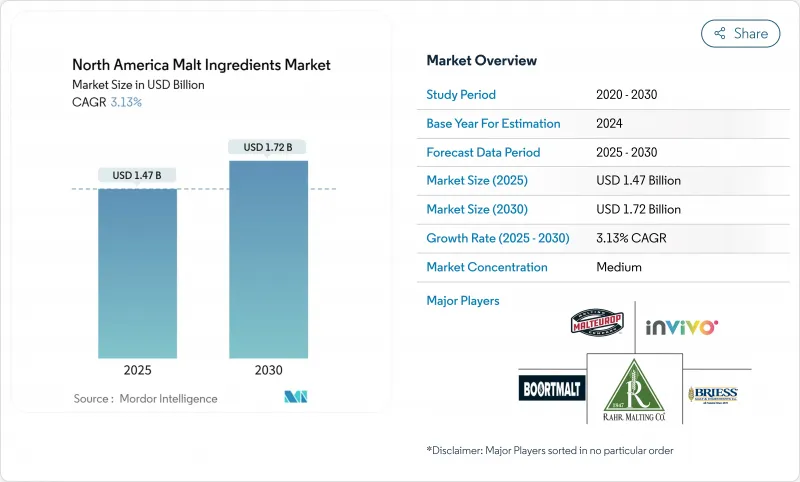

North America Malt Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America malt ingredients market is estimated to be USD 1.47 billion in 2025 and reach USD 1.72 billion in 2030, growing at a CAGR of 3.13%.

Barley has long served as the primary source for malt ingredients in North America. Yet, as brewers and food formulators increasingly seek gluten-tolerant and clean-label alternatives, the demand for wheat and rice malts is on the rise. Craft producers predominantly favor dry malt formats for their shelf stability. This shift not only underscores the importance of compliance but also offers a competitive edge to established maltsters. Furthermore, integrated grain sourcing spanning the United States, Canada, and Mexico not only mitigates raw material volatility but also caters to a diverse application base in the food, beverage, and pharmaceutical sectors. While alcoholic beverages continue to dominate, the market is witnessing a diversification in end uses. Non-alcoholic malt-based drinks are emerging as a popular choice, with consumers gravitating towards them as natural energy boosters and healthier alternatives to sugary sodas. In this realm, dry malt extracts are favored for their solubility and nutritional benefits. The pharmaceutical industry also values malt ingredients, utilizing them as excipients and flavoring agents in syrups and tonics. These ingredients cater to formulations that demand a mild sweetness and specific viscosity. Such cross-industry demand underscores North America's status as a mature yet dynamic malt ingredients market, with projections indicating wheat and liquid malt extracts will experience the most significant growth rates.

North America Malt Ingredients Market Trends and Insights

Rising Popularity of Craft Beer and Microbreweries

In North America, the surging popularity of craft beer and the proliferation of microbreweries are fueling robust growth in the malt ingredients market. As consumers increasingly gravitate towards unique, flavorful, and artisanal beers, microbreweries and craft brewers are diversifying their malt selections, turning to specialty and premium malts to set their products apart. In contrast to large-scale commercial breweries that often resort to adjuncts like corn or rice for cost-cutting, craft brewers emphasize flavor complexity and authenticity. They lean heavily on high-quality malts to shape both the foundational and specialty characteristics of their beers. This paradigm shift has spurred a surge in demand for malt ingredients, with craft breweries representing a substantial share of total malt consumption. The microbrewery landscape is witnessing exponential growth, with a steady influx of new entrants each year, intensifying the demand for varied malt profiles. For instance, data from the Brewers Association highlights that in 2024, the United States boasted 9,796 operational craft breweries. This tally included 2,029 microbreweries, 3,552 brewpubs, 3,936 taproom breweries, and 279 regional craft breweries .

Growing Preference for Natural and Clean Label Ingredients

Regulatory changes promoting clean labeling are increasing the value of malt ingredients that emphasize transparency and traceability while maintaining functionality. The Food and Drug Administration (FDA)'s updated Current Good Manufacturing Practice regulations under the Food Safety Modernization Act (FSMA) require malt processors to conduct thorough hazard analyses and implement preventive controls. This positions compliant processors to meet the needs of food manufacturers seeking reliable and verified supply partners. Barley, with its 80% complex carbohydrate content, meets consumer demand for natural ingredients that provide functional benefits without synthetic additives. According to the Brewers Association, the TTB's decision to withdraw its proposed ingredient labeling rule has created regulatory stability for alcoholic beverages. This allows malt suppliers to focus on voluntary transparency initiatives that help differentiate their premium products. The current regulatory environment benefits established processors with strong quality systems while creating challenges for smaller players lacking compliance infrastructure.

Growing Trend Towards Gluten-Free Diets

As consumers increasingly avoid gluten, ingredient choices in the food and beverage sectors are shifting. This trend not only pressures traditional barley-based malts but also paves the way for alternative grain processing. While rice malt is pricier to produce than its barley counterpart, it boasts advantages in gluten-free brewing and niche applications, where compliance with regulations can justify its premium price. In the United States, domestic malting barley production falls short of meeting local demand, leading to imports and a resultant supply vulnerability, especially in light of the rising trend towards gluten-free substitutes. Hemp seeds, with their high protein content and essential fatty acids, emerge as functional alternatives, stepping into roles traditionally held by malt, especially in providing protein and flavor depth. Yet, rice, with its superior yields and malting qualities, presents a sustainable avenue for processors ready to pivot towards alternative grains. However, the regulatory constraints surrounding THC content in hemp products curtail their immediate potential as substitutes.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Non-Alcoholic Malt Beverage and Health Tonics

- Technological Advancements in Malt Roasting and Enzymatic Conversion

- Limited Consumer Awareness About Malt Benefits in Non-Beverage Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, barley grain commanded a dominant 87.15% share of North America's malt ingredients market. This stronghold stems from barley's established agronomic foundation, its high diastatic power, and its consistent performance in both brewing and food applications. Two-rowed barley stands out as the top choice for malting, thanks to its uniform kernel size, dependable enzyme production, and versatility in both large-scale and craft brewing. While traditional varieties like CDC Copeland have long been staples, they're now being overshadowed by advanced cultivars such as CDC Fraser and AAC Connect. These newer varieties boast superior disease resistance and enhanced processing traits, mirroring the industry's pivot towards efficiency and resilience in the face of climate challenges.

Wheat malt, despite its smaller market share, is on an upward trajectory, forecasted to expand at a robust 4.50% CAGR through 2030. Wheat malt's rising prominence drives this surge in gluten-tolerant brewing and its role in refining beer's mouthfeel, head retention, and overall product distinction. With its clean-label allure and versatile functionality, wheat malt is carving out a significant niche in both the craft brewing arena and the specialty food domain. As consumers increasingly gravitate towards texture-rich and premium products, wheat malt is solidifying its status as a pivotal growth catalyst. This trend is especially evident among processors who are diversifying their sourcing strategies and honing specialized processing techniques.

The North America Malt Ingredients Market is Segmented by Source (Barley, Wheat, Others), by Form (Liquid, Dry), by Application (Alcoholic Beverages, Non-Alcoholic Beverages, Food, Pharmaceuticals, Animal Feed), and by Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Malteurop Malting Company

- InVivo Group

- Rahr Corporation

- Boortmalt

- Maker's Malt

- Montana Craft Malt, LLC

- Skagit Valley Malting LLC

- Mecca Grade Estate Malt, Inc.

- TexMalt

- Admiral Maltings, LLC

- Epiphany Craft Malt, LLC

- Riverbend Malthouse, LLC

- LINC Malt

- Blacklands Malt, LLC

- Murphy & Rude Malting Co. LLC

- Double Eagle Malt, LLC

- Niagara Malt LLC

- Briess Malt & Ingredients Co.

- Root Shoot Malting, LLC

- O'Brien Brewing and Malting Company Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Popularity of Craft Beer and Microbreweries

- 4.2.2 Glowing Preference for Natural and Clean Label Ingredients

- 4.2.3 Expansion of Non-Alcoholic Malt Beverage and Health Tonics

- 4.2.4 Technological Advancements in Malt Roasting and Enzymatic Conversion

- 4.2.5 Utilization in Distilled Spirits Industry

- 4.2.6 Increased Preference for Slow-Digesting Carbohydrates

- 4.3 Market Restraints

- 4.3.1 Growing Trend Towards Gluten-Free Diets

- 4.3.2 Limited Consumer Awareness About Malt Benefits in Non-Beverage Application

- 4.3.3 Strict FDA Guidelines on Labeling

- 4.3.4 Traceability Mandates Under Food Safety Modernization Act (FSMA)

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Barley

- 5.1.2 Wheat

- 5.1.3 Others

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Dry

- 5.3 By Application

- 5.3.1 Alcoholic beverages

- 5.3.2 Non-alcoholic beverages

- 5.3.3 Food

- 5.3.4 Pharmaceuticals

- 5.3.5 Animal Feed

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Malteurop Malting Company

- 6.4.2 InVivo Group

- 6.4.3 Rahr Corporation

- 6.4.4 Boortmalt

- 6.4.5 Maker's Malt

- 6.4.6 Montana Craft Malt, LLC

- 6.4.7 Skagit Valley Malting LLC

- 6.4.8 Mecca Grade Estate Malt, Inc.

- 6.4.9 TexMalt

- 6.4.10 Admiral Maltings, LLC

- 6.4.11 Epiphany Craft Malt, LLC

- 6.4.12 Riverbend Malthouse, LLC

- 6.4.13 LINC Malt

- 6.4.14 Blacklands Malt, LLC

- 6.4.15 Murphy & Rude Malting Co. LLC

- 6.4.16 Double Eagle Malt, LLC

- 6.4.17 Niagara Malt LLC

- 6.4.18 Briess Malt & Ingredients Co.

- 6.4.19 Root Shoot Malting, LLC

- 6.4.20 O'Brien Brewing and Malting Company Ltd.

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK