PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836447

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836447

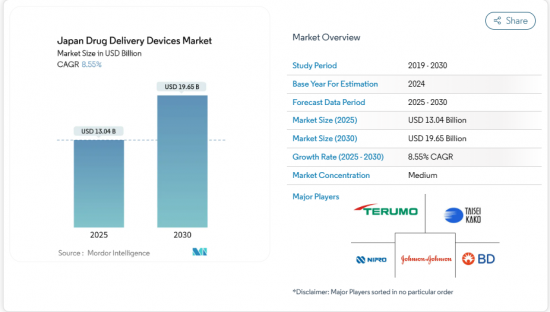

Japan Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Japan drug delivery devices market reached USD 13.04 billion in 2025 and is forecast to climb to USD 19.65 billion by 2030, expanding at an 8.55% CAGR.

The main growth engines are the country's unprecedented aging profile, the rising prevalence of chronic diseases, and policy shifts that reward self-administration technologies. Injectable products currently dominate usage patterns, yet rapid gains in implantables and smart-connected formats signal a broader pivot toward sustained-release and data-enabled care. The government's fast-track pathway for Software as Medical Device (SaMD) injectors, together with National Health Insurance (NHI) reimbursement of wearables, is accelerating time-to-market for next-generation devices. Supply-side innovation is also stimulated by a noticeable "drug-loss" gap, where more than 80 therapies remain unapproved in Japan, opening opportunities for firms that can navigate complex regulatory checkpoints. Heightened competition, however, collides with workforce shortages and regional care disparities, ensuring continued demand for automation and home-based solutions.

Japan Drug Delivery Devices Market Trends and Insights

High Burden of Chronic Diseases and Aging Population

Japan counts 24 million older adults managing multiple chronic conditions. Device designers therefore prioritise simplified interfaces, reduced dosing frequency, and safety locks that accommodate limited dexterity and cognitive changes. Controlled-release implants that exploit senescence biomarkers are gaining R&D attention, positioning local firms to capture export opportunities for geriatric-friendly solutions. The demographic pressure will remain structural, supporting steady demand well beyond the forecast window.

Government Push for Home-based Care (NHI Reimbursement for Wearables)

Insurance coverage for remote consultations and selected wearables fuels investment in self-administration platforms. Yet reimbursement for disease-specific digital rehab remains incomplete, creating a patchwork that innovators must navigate. Urban uptake is strong, while rural regions still lack robust home-care staffing and IT backbones, tempering near-term volume gains. Even so, policy direction is clear: shift care from hospitals to homes to offset staff shortages.

Stringent PMDA Validation for Combination Products Increases Time-to-Market

Half of approved autoinjectors received clearance only after the parent drug's initial approval, underscoring sequential review hurdles. Foreign firms often face added uncertainty around device-drug human-factor studies, stretching timelines despite PMDA consultation programmes in Washington, DC. The resulting delay advantages incumbent domestic players with deeper regulatory know-how.

Other drivers and restraints analyzed in the detailed report include:

- Fast-track Approval Pathway for SaMD-Enabled Smart Injectors

- Technological Advancements and Shortage of Medical Professionals

- High Up-front Cost of Electronic Pumps Limits Smaller Clinics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injectables commanded 543.25% of Japan drug delivery devices market share in 2024, sustained by broad applicability in diabetes and oncology. Autoinjector approvals climbed steadily as ergonomic designs improved safety and convenience. Meanwhile, implantables are forecast to post a 10.40% CAGR, supported by workforce shortages that favour long-acting solutions. Japan drug delivery devices market size for implantables is projected to rise sharply as developers refine biodegradable matrices that minimize replacement surgeries.

Inhalation devices are the next rising category, backed by dry-powder innovations. Transdermal patches continue to appeal to older patients who prefer painless, steady dosing. Ocular inserts and nasal pumps stay niche but attract R&D for targeted CNS or ophthalmic therapy. Competition is shifting as digital entrants challenge mechanical incumbents with sensor-equipped applicators. Investments in senescence-targeted release systems further differentiate domestic portfolios.

Injectable routes controlled 56.34% of the Japan drug delivery devices market in 2024 owing to their entrenched role in biologics delivery. The inhalation route, however, is forecast to expand at 9.08% CAGR, driven by patient-friendly triple therapies such as AstraZeneca's Breztri. Japan drug delivery devices market size for inhalation products is thus set for robust growth as formulators achieve higher lung deposition efficiency.

Transdermal pathways hold steady appeal, while oral mucosal routes gain visibility for rapid-acting pain or rescue medications. Nasal and ocular pathways remain small but could accelerate once awareness barriers drop. The route mix increasingly reflects patient autonomy goals and the search for non-invasive, home-compatible options.

Drug Delivery Devices Market Report is Segmented by Device Type (Injectable Delivery Devices, Inhalation Delivery Devices, and More), Route of Administration (Injectable, Inhalational and More), Technology (Conventional Mechanical, Needle-Free Jet and More), Application (Diabetes Mellitus, Oncology, and More), End User (Hospitals, Ambulatory Surgical Centers, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Taisei Kako Co., Ltd.

- Terumo

- Mitsubishi Tanabe Pharma

- Otsuka Pharmaceutical Co.

- Nipro

- Daiichi Sankyo Co.

- Beckton Dickinson

- Johnson & Johnson

- Cook Group

- Bayer

- Novartis

- GlaxoSmithKline

- Pfizer

- Sanofi

- Eli Lilly and Company

- AstraZeneca

- Roche

- Medtronic

- West Pharmaceutical Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of Chronic Diseases and Aging Population

- 4.2.2 Government Push for Home-based Care (NHI Reimbursement for Wearables)

- 4.2.3 Fast-track Approval Pathway for SaMD-Enabled Smart Injectors

- 4.2.4 Rise of Biosimilars Requiring Novel Delivery Formats

- 4.2.5 Technological Advancements in Drug Delivery Devices

- 4.2.6 Shortage of Medical Professionals Creating Need for Advaced drug Delivery Devices

- 4.3 Market Restraints

- 4.3.1 Stringent PMDA Validation for Combination Products Increases Time-to-Market

- 4.3.2 High Up-front Cost of Electronic Pumps Limits Smaller Clinics

- 4.3.3 Low Patient Awareness of Nasal & Pulmonary Devices

- 4.3.4 Domestic CDMO Capacity Constraints for Complex Devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Injectable Delivery Devices

- 5.1.2 Inhalation Delivery Devices

- 5.1.3 Infusion Pumps

- 5.1.4 Transdermal Patches

- 5.1.5 Implantable Drug Delivery Systems

- 5.1.6 Ocular Inserts & Delivery Implants

- 5.1.7 Nasal & Buccal Delivery Devices

- 5.2 By Route of Administration

- 5.2.1 Injectable

- 5.2.2 Inhalation

- 5.2.3 Transdermal

- 5.2.4 Oral Mucosal (Buccal & Sublingual)

- 5.2.5 Ocular

- 5.2.6 Nasal

- 5.3 By Technology

- 5.3.1 Conventional Mechanical

- 5.3.2 Electronic / Smart / Connected

- 5.3.3 Needle-free Jet

- 5.3.4 Controlled / Sustained-release Systems

- 5.4 By Application

- 5.4.1 Diabetes Mellitus

- 5.4.2 Oncology

- 5.4.3 Cardiovascular Disorders

- 5.4.4 Respiratory Diseases (Asthma, COPD)

- 5.4.5 Infectious Diseases (e.g., RSV, Influenza)

- 5.4.6 Auto-immune & Others

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Home-care Settings

- 5.5.4 Retail Pharmacies & Clinics

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Taisei Kako Co., Ltd.

- 6.4.2 Terumo Corporation

- 6.4.3 Mitsubishi Tanabe Pharma

- 6.4.4 Otsuka Pharmaceutical Co.

- 6.4.5 Nipro Corporation

- 6.4.6 Daiichi Sankyo Co.

- 6.4.7 Becton, Dickinson and Company

- 6.4.8 Johnson & Johnson

- 6.4.9 Cook Medical LLC

- 6.4.10 Bayer AG

- 6.4.11 Novartis AG

- 6.4.12 GlaxoSmithKline plc

- 6.4.13 Pfizer Inc.

- 6.4.14 Sanofi SA

- 6.4.15 Eli Lilly and Company

- 6.4.16 AstraZeneca plc

- 6.4.17 Roche Holding AG

- 6.4.18 Medtronic plc

- 6.4.19 West Pharmaceutical Services

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment