PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836458

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836458

Vein Illuminator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

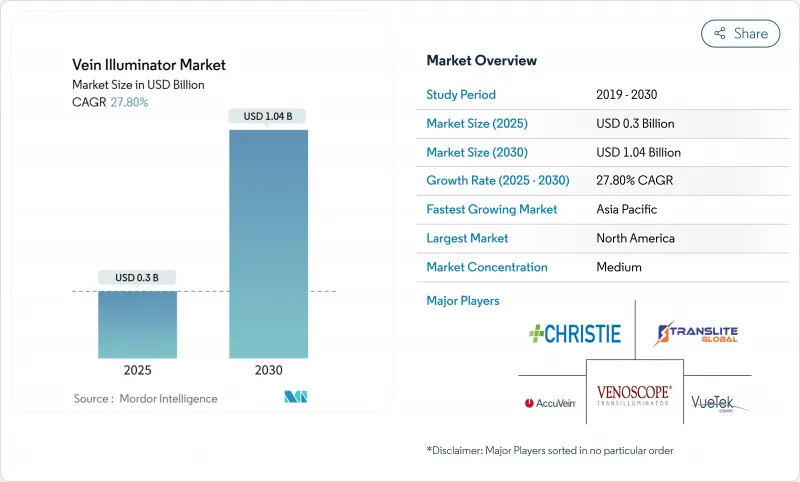

The Vein Illuminator Market size is estimated at USD 0.3 billion in 2025, and is expected to reach USD 1.04 billion by 2030, at a CAGR of 27.80% during the forecast period (2025-2030).

Robust growth reflects health systems' focus on first-attempt venipuncture success, an outcome now tied to U.S. Medicare's value-based purchasing scores. Demand is amplified by aging and obese populations that make traditional vein palpation unreliable, while rising chronic-disease monitoring requires more frequent blood draws. Technology improvements in near-infrared (NIR) imaging, falling component costs, and portable form factors further accelerate adoption. Asia-Pacific's push to localize medical-device manufacturing and China's hospital modernization are tilting future revenue toward cost-optimized systems. Competitive pressure is intensifying as local firms introduce low-price NIR devices that undercut established brands while premium models layer on AI guidance and multi-modal imaging.

Global Vein Illuminator Market Trends and Insights

Rising First-Attempt Success Rates Drive Quality Metrics

Clinical trials in pediatric units showed first-stick success climbing to 74.1% with AccuVein AV400 compared with 40.7% using palpation, trimming procedure time from 169 seconds to 44 seconds. Health-system executives translate these gains directly into higher HCAHPS patient-experience scores, which shape Medicare reimbursements, elevating device purchases to strategic priorities. Patient surveys reveal 93% of respondents rate hospitals higher when staff employ visualization tools.

Growth in Chronic-Disease Blood Draws

More frequent HbA1c, lipid, and renal tests among diabetic and cardiovascular cohorts raise annual venipuncture volumes, stressing phlebotomy capacity. Aging vasculature and drug-induced vein fragility heighten failure risk, prompting facilities to equip labs with portable NIR finders that cut repeat sticks and consumable waste.

High Capital and Per-Unit Device Costs

Premium NIR systems list between USD 4,000 and USD 27,000, squeezing budgets of small hospitals. Experimental open-source models built from recycled optics have demonstrated comparable vein contrast for USD 25, hinting at future price erosion.

Other drivers and restraints analyzed in the detailed report include:

- Ageing and Obese Populations Challenge Traditional Methods

- Hospital Push for Patient-Experience KPIs

- Lack of Reimbursement Codes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Near-Infrared Illumination controlled 50.3% revenue in 2024, underpinning the vein illuminator market with a mature, cost-efficient platform. Ultrasound-Augmented units, posting 31.8% CAGR to 2030, carve share in difficult-access patients via deeper imaging and synergy with existing ultrasound carts. Transillumination remains a pediatric niche due to softer light, while multispectral hybrids gain research traction. Patent filings such as the dual-mode VeinCAP system illustrate convergence trends toward single devices offering NIR plus diffuse hyperspectral views. As feature sets widen, vendors differentiate on AI algorithms that auto-grade vein quality and log success metrics to electronic health records.

Hand-held and Portable devices occupied 61.2% of 2024 revenue because nurses favor pocketable tools that shift easily between wards. Wearable and Clip-On Modules, climbing at 34.1% CAGR, free clinicians' hands during complex cannulations, and feed video to smart glasses for teaching. Table-top carts persist in blood banks where mounted cameras stay calibrated for long draws. IoT connectivity is redefining design priorities: next-generation wearables integrate Wi-Fi and cloud dashboards that benchmark first-stick rates, transforming basic lights into quality-management nodes.

Vein Illuminator Market is Segmented by Technology (Near-Infrared (NIR) Illumination, Transillumination, and More), Product Type (Hand-Held and Portable, Table-Top/Cart-Mounted, and Wearable and Clip-On Modules), Application (Intravenous (IV) Access, Blood Draw/Venipuncture Assistance, and More), End-User (Hospitals and Clinics, Blood Donation Camps and Blood Banks, and More), and Geography.

Geography Analysis

North America retained 37.2% 2024 revenue leadership on the back of sophisticated infrastructure and reimbursement programs that pay for patient-experience outcomes. U.S. hospitals embed first-stick statistics into quality dashboards, ensuring repeat device orders. Canada's single-payer system favors province-wide contracts that lower per-unit costs, while Mexico's private medical-tourism clinics install finders as patient-comfort differentiators.

Europe's multi-payer environment produces steady uptake; Germany's university hospitals pilot multi-modal units, and the United Kingdom's NHS negotiates bulk pricing to support vascular-access safety goals. CE Mark harmonization smooths cross-border sales and encourages newer entrants from Scandinavia and Eastern Europe.

The vein illuminator market size in Asia-Pacific is expanding at a 33.2% CAGR, making it the global growth engine. India's Production-Linked Incentive scheme subsidizes domestic device plants, reducing import reliance. China's hospital-upgrade program requires equipment that boosts nursing efficiency; local brands undercut imports by bundling visualization with IV kits. Japan's super-aged population and high device standards favor premium dual-mode systems, while South Korea's start-ups test AI-enabled smartphone adapters for home infusion services.

- AccuVein Inc.

- Christie Medical Holdings Inc.

- TransLite LLC (Veinlite)

- VueTek Scientific LLC

- Venoscope LLC

- Near Infrared Imaging Inc.

- ZD Medical Inc.

- VeinSight (Surmount Electronic)

- Shenzhen Vivolight Medical Device and Technology Co.

- Veincas Medical Ltd.

- SIFSOF LLC

- NextVein LLC

- Infinium Medical Inc.

- B. Braun Medical Inc.

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Baxter International Inc.

- GE Healthcare Technologies Inc.

- Osang Healthcare Co., Ltd.

- Kingmaker Biomedical Inc.

- Dhanika Instrument Co.

- Zhongke Micro-Light Medical Equipment Co.

- YSENMED Medical Equipment Co.

- Xavant Medical (Pty) Ltd.

- ALEH Medical Laser and Systems

- FY Medical Devices Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising first-attempt success rates for IV and phlebotomy

- 4.2.2 Growth in chronic-disease related blood draws

- 4.2.3 Ageing and obese populations with difficult venous access

- 4.2.4 Hospital push for patient-experience KPIs

- 4.2.5 AI-integrated mobile vein-finder apps

- 4.2.6 Adoption in cosmetic/aesthetic injections

- 4.3 Market Restraints

- 4.3.1 High capital and per-unit device costs

- 4.3.2 Lack of reimbursement codes

- 4.3.3 Training gaps in low-resource settings

- 4.3.4 Regulatory ambiguity for aesthetic-only devices

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 Near-Infrared (NIR) Illumination

- 5.1.2 Transillumination

- 5.1.3 Ultrasound-Augmented

- 5.1.4 Multispectral/Hybrid

- 5.1.5 Others

- 5.2 By Product Type

- 5.2.1 Hand-held and Portable

- 5.2.2 Table-Top/Cart-Mounted

- 5.2.3 Wearable and Clip-On Modules

- 5.3 By Application

- 5.3.1 Intravenous (IV) Access

- 5.3.2 Blood Draw/Venipuncture Assistance

- 5.3.3 Sclerotherapy and Varicose Vein Treatment

- 5.3.4 Emergency and Critical Care

- 5.3.5 Cosmetic/Aesthetic Injections

- 5.4 By End-user

- 5.4.1 Hospitals and Clinics

- 5.4.2 Blood Donation Camps and Blood Banks

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Rehabilitation and Nursing Homes

- 5.4.5 Academic and Research Institutions

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AccuVein Inc.

- 6.4.2 Christie Medical Holdings Inc.

- 6.4.3 TransLite LLC (Veinlite)

- 6.4.4 VueTek Scientific LLC

- 6.4.5 Venoscope LLC

- 6.4.6 Near Infrared Imaging Inc.

- 6.4.7 ZD Medical Inc.

- 6.4.8 VeinSight (Surmount Electronic)

- 6.4.9 Shenzhen Vivolight Medical Device and Technology Co.

- 6.4.10 Veincas Medical Ltd.

- 6.4.11 SIFSOF LLC

- 6.4.12 NextVein LLC

- 6.4.13 Infinium Medical Inc.

- 6.4.14 B. Braun Medical Inc.

- 6.4.15 Koninklijke Philips N.V.

- 6.4.16 Siemens Healthineers AG

- 6.4.17 Baxter International Inc.

- 6.4.18 GE Healthcare Technologies Inc.

- 6.4.19 Osang Healthcare Co., Ltd.

- 6.4.20 Kingmaker Biomedical Inc.

- 6.4.21 Dhanika Instrument Co.

- 6.4.22 Zhongke Micro-Light Medical Equipment Co.

- 6.4.23 YSENMED Medical Equipment Co.

- 6.4.24 Xavant Medical (Pty) Ltd.

- 6.4.25 ALEH Medical Laser and Systems

- 6.4.26 FY Medical Devices Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment