PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836465

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836465

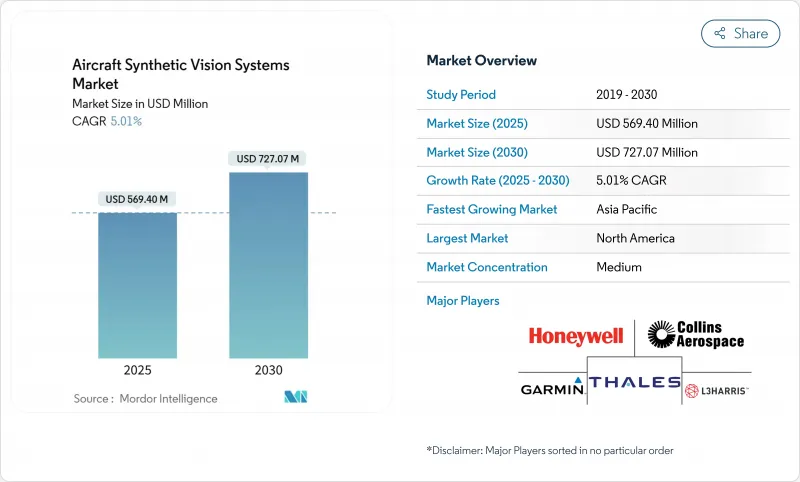

Aircraft Synthetic Vision Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft synthetic vision systems market reached USD 569.40 million in 2025 and is forecast to reach USD 727.07 million by 2030, expanding at a 5.01% CAGR.

Adoption is accelerating as US and European regulators mandate cockpit upgrades that deliver higher situational awareness during low-visibility operations. Airline and business-jet operators view synthetic vision as the most cost-effective path to compliance because the software can be embedded in existing flight-deck architectures, minimising downtime. Concurrently, air-framer partnerships focused on AI-driven terrain-rendering engines are lowering pilot workload while opening ancillary revenue streams for data-subscription services. Growth prospects are also buoyed by advanced air-mobility programs and sixth-generation fighter projects that treat synthetic vision as a core safety layer. These factors underpin a solid outlook for the Aircraft Synthetic Vision Systems market across OEM line-fit and retrofit channels.

Global Aircraft Synthetic Vision Systems Market Trends and Insights

Rising Business-Jet Deliveries with Factory-Fitted Combined Vision Suites

Deliveries of new business jets now routinely include combined vision suites that merge synthetic and enhanced vision on a single display. Bombardier's Global 8000 and Cessna's Citation Ascend integrate these features as baseline equipment, eliminating costly aftermarket installations. Operators benefit from lower pilot workload, while manufacturers capture recurring upgrade revenue on legacy fleets scheduled for retrofits in 2025-2026.

Rapid Adoption of SVS-Enabled Huds in Gen-6 Fighter Cockpits (US And EU)

Sixth-generation fighter programs like the NGAD F-47 rely on helmet-mounted displays that fuse tactical data with real-time terrain imagery. Collins Aerospace's Gen III helmet for the F-35 already demonstrates how synthetic vision replaces night-vision gear, paving the way for wider military adoption. Subsequently, civil platforms inherit these hardened technologies, shortening certification cycles.

Certification Bottlenecks for Database-Centric Vision Algorithms

Machine-learning terrain databases do not fit neatly into deterministic DO-178C frameworks, prolonging approvals and raising development costs. In some cases, OEMs and avionics vendors limit the complexity of SVS features to reduce certification risk. Thus, features like dynamic terrain rendering, urban 3D modeling, or integration with EO/IR feeds are delayed. For instance, Mercury Systems' image-integrity tools provide partial relief but still require Design Assurance Level C validation, a hurdle for smaller suppliers. Certification costs are passed on to operators in most cases, making SVS upgrades more expensive. This limits their commercial viability in the markets for small turboprop aircraft and helicopters.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Low-Visibility Approach Credits at Tier-2 Airports

- Urban-Air-Mobility eVTOL Programs Requiring High-Integrity SVS

- Cost Sensitivity in Turboprop and Light-Helicopter Retrofits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary flight displays held 45.51% of the aircraft synthetic vision systems market share in 2024 because pilots rely on these central screens for all critical flight cues. Heads-up and helmet-mounted displays exhibit the fastest growth at 11.50% CAGR, largely due to defence orders and the trickle-down of military technology into civil variants. Garmin's SVT upgrade path shows operators adding 3-D terrain onto existing PFDs without re-wiring the cockpit. The aircraft synthetic vision systems market size for helmet-mounted solutions is projected to increase by 2030 as advanced air-mobility platforms favour wearable displays for weight savings.

The segment's momentum extends to integrated combined-vision products that overlay infrared imagery onto synthetic terrain, delivering all-weather capability without added monitors. Universal Avionics' ClearVision set a precedent for wearable HUD adoption in commercial jets, while Collins Aerospace adapts fighter-grade helmets for civil rotorcraft. These developments reinforce the aircraft synthetic vision systems market as a technology continuum rather than a discrete product, enabling cross-platform learning and volume efficiencies.

Display hardware captured 40.12% revenue in 2024 because every installation still needs certified screens. Yet software and terrain-obstacle databases are growing at 9.51% CAGR, reflecting a pivot toward AI-rich content that refreshes during flight. This shift explains why the aircraft synthetic vision systems market size linked to software is forecast to overtake hardware-only packages in the late 2020s.

Suppliers increasingly licence rendering engines separate from displays, allowing operators to swap in lower-cost commercial-off-the-shelf monitors. Honeywell's MEMS-based KSG7200 reference system highlights a broader trend toward sensor-fusion modules that package processing power within existing LRUs. Database subscriptions create recurring cash flows and cement customer relationships, underscoring software's strategic value in the aircraft synthetic vision systems industry.

The Aircraft Synthetic Vision Systems Market Report is Segmented by Type (Primary Flight Display, and More), End User (Military, and More), Installation Type (OEM Line-Fit, and More), Component (Display System and More), Platform (Fixed-Wing Aircraft, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35.25% of global sales in 2024, supported by the FAA's clear rules on Enhanced Flight Vision and robust business-jet utilisation. Operators embrace synthetic vision to secure approach credits that keep schedules intact during winter storm activity. Defence contracts such as the F-47 program deepen the regional expertise pool, allowing suppliers to amortise R&D across civil and military lines.

Asia-Pacific is the fastest-growing arena at 8.75% CAGR because governments in China, India, and Indonesia are upgrading secondary airports while encouraging ACMI carriers to expand fleets. The aircraft synthetic vision systems market finds fertile ground in these nations, where low-visibility procedures were once the preserve of flagship hubs. Satellite-based augmentation and new GNSS constellations further boost uptake as ground-based ILS rollouts slow.

Europe grows steadily on the back of SESAR directives and strong defence programs. EASA's All Weather Operations framework gives carriers economic incentives to add synthetic vision without installing CAT II/III ground systems. Sustainability goals add another driver: optimised flight paths enabled by accurate terrain models cut fuel burn and CO2. These factors sustain a balanced expansion of the continent's aircraft synthetic vision systems market.

- Honeywell International Inc.

- Collins Aerospace (RTX Corporation)

- Garmin Ltd.

- Thales Group

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Mercury Systems, Inc.

- Aspen Avionics, Inc.

- Avidyne Corporation

- ENSCO Inc.

- Astronics Corporation

- Universal Avionics Systems Corporation

- Esterline Technologies (TransDigm Group Incorporated)

- BAE Systems plc

- Genesys Aerosystems (Moog, Inc.)

- Saab AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising business-jet deliveries with factory-fitted combined vision suites

- 4.2.2 Rapid adoption of SVS-enabled HUDs in Gen-6 fighter cockpits

- 4.2.3 Demand for low-visibility approach credits at Tier-2 airports

- 4.2.4 Urban-air-mobility eVTOL programs requiring high-integrity SVS

- 4.2.5 OEM partnerships around AI-based terrain-rendering engines

- 4.2.6 Mandated retrofit of SVS under FAA NextGen and EASA SESAR timelines

- 4.3 Market Restraints

- 4.3.1 Certification bottlenecks for database-centric vision algorithms

- 4.3.2 Cost sensitivity in turboprop and light-helicopter retrofits

- 4.3.3 Limited GPU thermal budgets in cockpit-mounted hardware

- 4.3.4 Cyber-hardening gaps in connected avionics buses

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Primary Flight Display

- 5.1.2 Navigation Display

- 5.1.3 Heads-up and Helmet-mounted Display

- 5.1.4 Other Types

- 5.2 By Component

- 5.2.1 Synthetic Vision Computer/Processing Unit

- 5.2.2 Air-data and GPS Sensor Suite

- 5.2.3 Display System

- 5.2.4 Software/Terrain-Obstacle Databases

- 5.2.5 Other Components

- 5.3 By Platform

- 5.3.1 Fixed-Wing Aircraft

- 5.3.2 Rotary-Wing Aircraft

- 5.3.3 Unmanned Aerial Vehicles (UAV)

- 5.3.4 Advanced Air-Mobility/eVTOL

- 5.4 By Installation Type

- 5.4.1 OEM Line-fit

- 5.4.2 Retrofit

- 5.5 By End User

- 5.5.1 Military

- 5.5.2 Commercial

- 5.5.3 General Aviation

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 Egypt

- 5.6.5.2.2 South Africa

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Collins Aerospace (RTX Corporation)

- 6.4.3 Garmin Ltd.

- 6.4.4 Thales Group

- 6.4.5 Elbit Systems Ltd.

- 6.4.6 L3Harris Technologies, Inc.

- 6.4.7 Mercury Systems, Inc.

- 6.4.8 Aspen Avionics, Inc.

- 6.4.9 Avidyne Corporation

- 6.4.10 ENSCO Inc.

- 6.4.11 Astronics Corporation

- 6.4.12 Universal Avionics Systems Corporation

- 6.4.13 Esterline Technologies (TransDigm Group Incorporated)

- 6.4.14 BAE Systems plc

- 6.4.15 Genesys Aerosystems (Moog, Inc.)

- 6.4.16 Saab AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment