PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836466

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836466

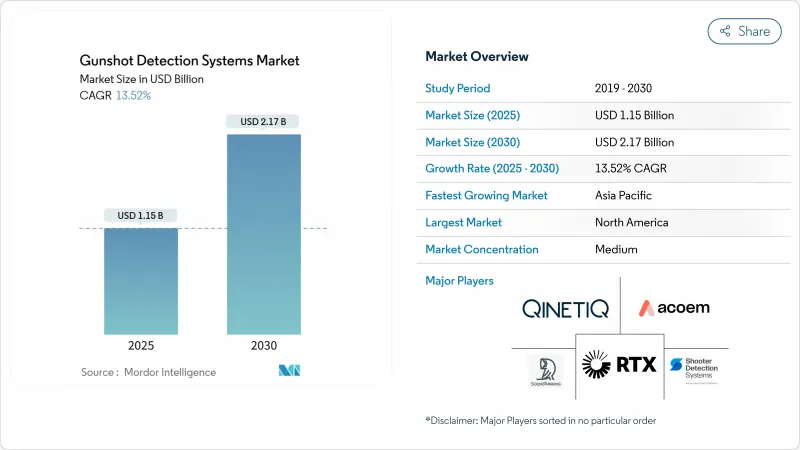

Gunshot Detection Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The gunshot detection system market is valued at USD 1.15 billion in 2025 and is forecasted to advance to USD 2.17 billion by 2030, representing a 13.52% CAGR.

Uptake stems from rising urban gun violence, steady public-sector funding, and the proven ability of dual-sensor platforms to cut false alerts. Providers have pivoted from hardware sales to subscription services, giving municipalities access to continuous upgrades without large capital outlays. Technology convergence with video analytics, autonomous drones, and real-time crime-center platforms expands the market's addressable footprint into education, critical infrastructure, and battlefield awareness. North America leads with wide-area city deployments and strong grant pipelines, while Asia-Pacific is accelerating on the back of smart-city spending and domestic sensor innovation.

Global Gunshot Detection Systems Market Trends and Insights

Escalating gun-related violence in major cities

Cities experiencing higher firearm incidents are adopting detection networks as first-line infrastructure. The US recorded 40,886 gun-violence deaths and 31,652 injuries in 2024, creating a USD 557 billion economic burden. Only 15% of gunfire was reported through 911 in San Francisco, but audio sensors captured the remainder, supplying dispatchers with geolocated alerts in under a minute.Independent clinical research also showed transport times for gunshot victims falling from 4 minutes to 2 minutes after deployment, improving survival odds. These benefits strengthen the funding case for additional square-mile coverage.

Growing federal and municipal safety-tech grants

Dedicated grant programs are lowering adoption barriers for mid-sized jurisdictions. Several US states have ring-fenced awards for AI-enabled gun detection in K-12 facilities, alongside city-level allocations that cover subscription fees. A national technology assessment underscored the importance of solutions with open APIs and CAD integration, further steering awards toward interoperable vendors.

High deployment costs challenge widespread adoption

Traditional networks cost USD 65,000-95,000 per square mile each year, limiting roll-out beyond large cities. Subscription models that convert capital to operating expense are gaining traction, while edge-processing units such as the ATD-300 cut server loads and sensor counts, lowering total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Accuracy gains from acoustic and IR sensor fusion

- Modernization of soldier situational-awareness kits

- Evidentiary reliability and false-alert concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor deployments accounted for 60.26% of 2024 revenue, cementing their status as the primary layer of urban gunfire intelligence. Wide-area mesh arrays triangulate shock waves across alleys, parks, and arterial roads, filling the 85% reporting gap detected in city data sets. Linking alerts to surveillance cameras enables joint audio-visual verification, giving patrols actionable evidence within 60 seconds. This integration supports the broader smart-city mandate to overlay disparate sensors on a unified command platform.

Indoor solutions are accelerating at a 11.48% CAGR as education boards, arenas, and corporate campuses respond to rising active-shooter incidents. Dual acoustic-infrared devices such as Guardian achieve 99.9% in-situ accuracy, even in echo-rich hallways. Pilot studies in school corridors using laboratory-calibrated microphones further improved classification to 99.99% accuracy, setting a new benchmark for enclosed-space performance. Combining alerts with building-automation systems triggers lockdowns and mass-notification channels, extending value beyond first response.

Fixed installations represented 52.75% of the gunshot detection system market size in 2024 due to their suitability for high-density neighborhoods. City agencies value their continuous monitoring and integration with existing fibre backbones. Data from police audits showed only 15% of outdoor gunfire reached emergency lines, highlighting the importance of fixed nodes in capturing silent incidents.

Soldier-mounted and portable formats are projected to log a 15.69% CAGR as defence forces prioritise compact situational-awareness gear. Shoulder-worn sensor packs weighing under 230 grams communicate with radio headsets, improving survivability during urban operations. Vehicle-mounted arrays round out the category, giving patrol cars and armored transports on-the-move detection that feeds automatically into dispatch consoles for route adjustment.

The Gunshot Detection Systems Market Report is Segmented by Application (Indoor and Outdoor), Installation (Fixed, Vehicle, and More), Solution (Systems and Subscription-Based Gunshot Detection Services (SaaS)), End User (Defense and Military, Law Enforcement Agencies, Commercial and Critical Infrastructure, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest share at 40.78% in 2024. Persistent firearm incidents, combined with federal programmes such as the Justice Assistance Grant, underpin continuous spending on the gunshot detection system market expansion. Integration with real-time crime centers in New York, Chicago, and San Francisco demonstrates operational maturity, while philanthropic funding streams expand coverage into underserved neighborhoods.

Europe is characterised by strong privacy frameworks that shape deployment design. Vendors must accommodate data-minimisation rules and limited retention periods, favouring edge-processed alerts rather than continuous recording. Uptake among metropolitan police services in the United Kingdom, France, and the Netherlands focuses on protecting transit hubs and tourist districts.

Asia-Pacific is projected to post the fastest regional CAGR of 9.49% as smart-city programs roll out in China, India, and Southeast Asia. Domestic sensor makers benefit from government incentives, and rising urbanisation heightens demand for scalable perimeter security. Defence ministries in the region are also trialling soldier-mounted variants, borrowing from the US and European battlefield experience.

South America faces high homicide rates in several capitals, which is driving municipal pilots despite constrained budgets. Subscription plans that bypass heavy upfront costs are gaining traction. The Middle East and parts of Africa adopt the technology mainly to safeguard critical energy infrastructure and large-scale events, often bundling gunshot detection with drone surveillance for rapid interdiction.

- SoundThinking, Inc.

- Raytheon BBN (RTX Corporation)

- Thales Group

- QinetiQ Group plc

- ASELSAN A.S.

- ACOEM Group

- Databuoy Corporation

- Microflown AVISA

- Israel Aerospace Industries Ltd.

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Shooter Detection Systems LLC

- Safety Dynamics, Inc.

- EAGL Technology, Inc.

- Louroe Electronics, Inc.

- Pelco (Motorola Solutions, Inc.)

- AmberBox, Inc.

- Nextivity, Inc.

- Knightscope, Inc

- Omnilert LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating gun-related violence in major cities

- 4.2.2 Growing federal and municipal safety-tech grants

- 4.2.3 Accuracy gains from acoustic and IR sensor fusion

- 4.2.4 Modernization of soldier situational-awareness kits

- 4.2.5 Insurance-premium discounts for protected sites

- 4.2.6 Real-time-crime-centre demand for API-ready feeds

- 4.3 Market Restraints

- 4.3.1 High capex and OPEX for multi-node deployments

- 4.3.2 Evidentiary reliability and false-alert concerns

- 4.3.3 Privacy/civil-liberty litigation risk

- 4.3.4 Budgets shifting to multi-sensor drone platforms

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Indoor

- 5.1.2 Outdoor

- 5.2 By Installation

- 5.2.1 Fixed

- 5.2.2 Vehicle-Mounted

- 5.2.3 Soldier-Mounted/Portable

- 5.3 By Solution

- 5.3.1 Systems

- 5.3.2 Subscription-Based Gunshot Detection Services (SaaS)

- 5.4 By End-User

- 5.4.1 Defense and Military

- 5.4.2 Law Enforcement Agencies

- 5.4.3 Commercial and Critical Infrastructure

- 5.4.4 Campus and Educational Institutions

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SoundThinking, Inc.

- 6.4.2 Raytheon BBN (RTX Corporation)

- 6.4.3 Thales Group

- 6.4.4 QinetiQ Group plc

- 6.4.5 ASELSAN A.S.

- 6.4.6 ACOEM Group

- 6.4.7 Databuoy Corporation

- 6.4.8 Microflown AVISA

- 6.4.9 Israel Aerospace Industries Ltd.

- 6.4.10 Rafael Advanced Defense Systems Ltd.

- 6.4.11 Rheinmetall AG

- 6.4.12 Shooter Detection Systems LLC

- 6.4.13 Safety Dynamics, Inc.

- 6.4.14 EAGL Technology, Inc.

- 6.4.15 Louroe Electronics, Inc.

- 6.4.16 Pelco (Motorola Solutions, Inc.)

- 6.4.17 AmberBox, Inc.

- 6.4.18 Nextivity, Inc.

- 6.4.19 Knightscope, Inc

- 6.4.20 Omnilert LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment