PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836467

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836467

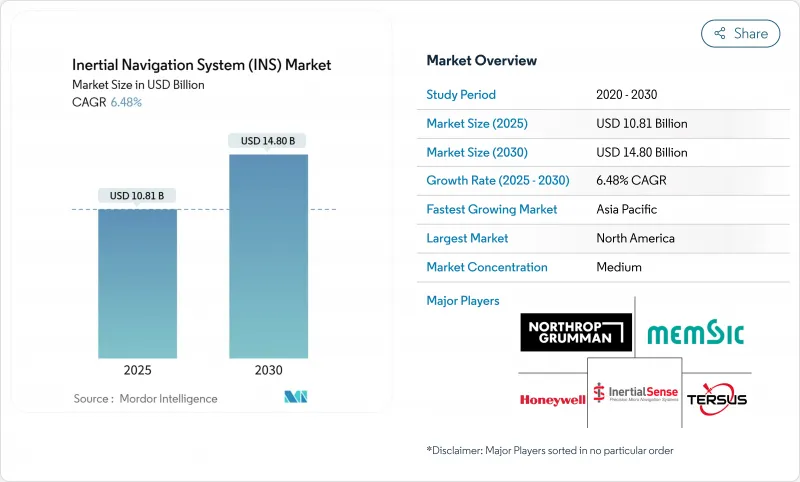

Inertial Navigation System (INS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The inertial navigation system market size stands at USD 10.81 billion in 2025 and is projected to climb to USD 14.80 billion by 2030, advancing at a 6.48% CAGR.

Heightened defense allocations, including the U.S. Department of Defense's USD 141 billion research budget that earmarks USD 1.5 billion for GPS-Enterprise initiatives, are anchoring demand for resilient navigation platforms. Breakthroughs such as the U.S. Naval Research Laboratory's Continuous 3D-Cooled Atom Beam Interferometer are also addressing drift limitations that restrict performance in GPS-denied scenarios. Strategic acquisitions-exemplified by Honeywell's EUR 200 million (USD 226 million) purchase of Civitanavi Systems-are consolidating sensor know-how and extending global reach. Cost-efficient MEMS architectures broaden adoption beyond defense, while optical and quantum-based gyroscopes open premium niches. Commercial spaceflight, autonomous vehicles, and unmanned systems each offer a multiyear runway for scale as governments and enterprises prioritize resilient Positioning, Navigation, and Timing (PNT) solutions.

Global Inertial Navigation System (INS) Market Trends and Insights

Increased Military and Defense Spending

Defense modernization is funneling unprecedented capital toward the inertial navigation system market. The USD 141 billion U.S. RDT&E allocation dedicates USD 1.5 billion to GPS-Enterprise programs that integrate seamlessly with high-precision INS payloads. European contractors mirror this momentum; Thales recorded EUR 25.3 billion (USD 27.5 billion) in 2024 orders that included navigation equipment for land and naval platforms. Naval initiatives such as the AN/WSN-7 Ring Laser Gyro Navigator underscore a tactical pivot toward GPS-independent operations. NATO's adoption of standardized Ships Inertial Navigation Systems highlights alliance-wide harmonization. Collectively these programs accelerate demand for navigation-grade sensors with radiation tolerance and electronic-warfare resilience.

Growing Adoption in Autonomous Vehicles

Vehicle OEMs view robust INS as a prerequisite for Level 4-5 autonomy, catalyzing a sizable slice of the inertial navigation system market. Loosely coupled 5G-IMU fusion schemes have demonstrated 14 cm accuracy for 95% of run-time, eclipsing legacy GPS-only methods. The sector's 8.2% CAGR reflects adoption in mass-market models, not merely premium fleets. MEMS gyros fabricated with silicon-carbide achieve Q-factors of 4.6 million at 80 °C, sustaining bias instability below 0.5°*h-1-an outcome well suited to high-temperature automotive cabins. Sensor fusion using Unscented Kalman Filters has cut RMS errors to under 5 m, bolstering lane-level guidance. As regulation converges on safety standards, tier-one suppliers embed dual-redundant IMUs, turning INS into a core design element rather than an optional add-on.

High Cost of Navigation-Grade Systems

Navigation-grade assemblies priced between USD 50,000 and USD 200,000 have historically restricted penetration in cost-sensitive domains. Although MEMS yields are improving, the three-fold price gap versus tactical-grade alternatives still discourages adoption in emerging economies. Chip-scale optical gyros developed by Anello Photonics claim 0.1% distance error over 100 km while compressing bill-of-materials cost. Parallel research shows low-cost microcontroller-based sensor-fusion achieving sub-meter accuracy underwater, proving that algorithmic enhancements can partially offset hardware pricing. Suppliers are adopting fab-lite models and licensing arrangements to lower per-unit calibration overhead, yet affordability remains a mid-term drag on inertial navigation system market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand from Unmanned Systems (UAV, UGV, USV)

- Miniaturized INS Enabling Precision-Guided Munitions

- Cumulative Drift Error Versus GNSS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IMUs generated 42.5% of 2024 revenue, reinforcing their role as the foundational building block of the inertial navigation system market. Robust single-package integration of tri-axial accelerometers, gyroscopes, and optional magnetometers reduces wiring, weight, and calibration costs. This configuration is scaling into guided weapons, industrial bots, and consumer drones as unit economics improve. The segment is projected to post a 7.4% CAGR through 2030, fueled by wafer-level vacuum packaging and machine-learning-based error modeling that cut Allan variance by double-digit margins.

Autonomous warehouse and orchard robots illustrate emerging demand as GNSS reception degrades indoors or under dense foliage. A GRU-Transformer algorithm trimmed positional RMSE by 61.6% compared with traditional EKF, underscoring the multiplier effect of advanced filtering. Inventory robotics employ vision-aided IMUs to achieve 95.8% item detection on low shelves. These deployments reinforce IMUs' trajectory toward ubiquity and affirm their expanding share within the inertial navigation system market.

MEMS devices owned 37.0% revenue in 2024, a testament to foundry scale and maturing lithography. Lower power draw and shock resilience position MEMS gyros as logical choices for smartphones and automotive ADAS. Forecasts place an 8.6% CAGR on MEMS shipments as fabs switch to 200-mm silicon-carbide and deploy high-aspect ratio etching to realize Q-factors above 4 million.

High-precision niches still rely on ring laser or fiber-optic gyros, yet optical-waveguide-on-silicon solutions are narrowing the performance gap. An optical gyro-on-chip reports centimeter-grade positional accuracy while occupying less than 1 cm2 die area. Concurrently, ring laser researchers at INFN-Pisa improved fringe contrast stability, potentially extending MTBF for navigation-grade units. As these innovations commercialize, MEMS remains the fulcrum for volume growth in the inertial navigation system market.

Inertial Navigation System (INS) Market is Segmented by Component (Accelerometers, Gyroscopes, and More), Technology (Mechanical Gyro, Ring Laser Gyro, Fiber-Optic Gyro, and More), Performance Grade (Navigation Grade, Tactical Grade, Industrial Grade, and More), End-User Industry (Aerospace and Defense, Marine, and More), Platform (Airborne, Land, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 31.4% of the inertial navigation system market in 2024, energized by a defense budget cycle that prioritizes resilient PNT. Northrop Grumman closed 2025 Q1 with USD 91.5 billion backlog, emphasizing long-term runway for avionics and missile navigation upgrades. Regulatory streamlining, such as the Export Administration Regulations amendment, trims roughly 90 annual license applications and accelerates space technology deliveries. Robust private-sector funding for autonomous-vehicle pilots and commercial launch providers sustains technology refresh rates, reinforcing the region's leadership.

Asia-Pacific is projected to post a 9.3% CAGR through 2030, steered by defense modernization, semiconductor fabrication scale, and rapid adoption of unmanned aerial vehicles. Japan and South Korea are raising capital spend on ADAS and micro-mobility, while India's indigenous navigation constellation drives domestic INS integration in launch vehicles and missiles. Chinese smartphone OEMs continue to integrate dual-IMU set-ups to improve indoor positioning, helping pivot consumer perception toward premium navigation capabilities.

Europe benefits from vertically integrated aerospace champions and concerted NATO programs. Honeywell's purchase of Civitanavi bolsters the regional supply base for fiber-optic gyros. Thales noted a 49% upswing in orders from emerging markets, highlighting export attractiveness of European platforms thalesgroup.com. Energy exploration in the North Sea and Mediterranean demands subsea INS kits for pipeline inspection, offering incremental uplift. Smaller but steadily growing demand pockets in the Middle East, Africa, and South America stem from offshore drilling, mining, and border-security programs that all rely on GPS-independent navigation.

- Honeywell International Inc.

- Northrop Grumman Corp.

- Safran Electronics and Defense

- Thales Group

- Bosch Sensortec GmbH

- KVH Industries Inc.

- Trimble Inc.

- NovAtel Inc. (Hexagon)

- iXblue (Exail)

- VectorNav Technologies LLC

- MEMSIC Inc.

- Parker Hannifin - LORD MicroStrain

- Tersus GNSS Inc.

- Inertial Labs Inc.

- Oxford Technical Solutions Ltd.

- Inertial Sense LLC

- Aeron Systems Pvt. Ltd.

- STMicroelectronics NV

- Analog Devices Inc.

- Raytheon Technologies Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased military and defense spending

- 4.2.2 Growing adoption in autonomous vehicles

- 4.2.3 Rising demand from unmanned systems (UAV, UGV, USV)

- 4.2.4 Miniaturized INS enabling precision-guided munitions (under-the-radar)

- 4.2.5 Integration with GNSS for field robotics and smart farming (under-the-radar)

- 4.2.6 Commercial spaceflight need for radiation-hardened INS (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 High cost of navigation-grade systems

- 4.3.2 Cumulative drift error versus GNSS

- 4.3.3 Radiation-induced errors in deep-space missions (under-the-radar)

- 4.3.4 ITAR export controls limiting emerging-market adoption (under-the-radar)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Accelerometers

- 5.1.2 Gyroscopes

- 5.1.3 Magnetometers

- 5.1.4 Inertial Measurement Units (IMU)

- 5.1.5 Others

- 5.2 By Technology

- 5.2.1 Mechanical Gyro

- 5.2.2 Ring Laser Gyro (RLG)

- 5.2.3 Fiber-Optic Gyro (FOG)

- 5.2.4 Micro-Electro-Mechanical Systems (MEMS)

- 5.2.5 Hemispherical Resonator Gyro (HRG)

- 5.2.6 Others

- 5.3 By Performance Grade

- 5.3.1 Navigation Grade

- 5.3.2 Tactical Grade

- 5.3.3 Industrial Grade

- 5.3.4 Automotive Grade

- 5.3.5 Consumer Grade

- 5.4 By End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Marine

- 5.4.3 Automotive

- 5.4.4 Industrial and Manufacturing

- 5.4.5 Oil and Gas and Energy

- 5.4.6 Agriculture, Mining and Construction

- 5.4.7 Others

- 5.5 By Platform

- 5.5.1 Airborne

- 5.5.2 Land

- 5.5.3 Naval

- 5.5.4 Space

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 ASEAN

- 5.6.4.7 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of MEA

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Northrop Grumman Corp.

- 6.4.3 Safran Electronics and Defense

- 6.4.4 Thales Group

- 6.4.5 Bosch Sensortec GmbH

- 6.4.6 KVH Industries Inc.

- 6.4.7 Trimble Inc.

- 6.4.8 NovAtel Inc. (Hexagon)

- 6.4.9 iXblue (Exail)

- 6.4.10 VectorNav Technologies LLC

- 6.4.11 MEMSIC Inc.

- 6.4.12 Parker Hannifin - LORD MicroStrain

- 6.4.13 Tersus GNSS Inc.

- 6.4.14 Inertial Labs Inc.

- 6.4.15 Oxford Technical Solutions Ltd.

- 6.4.16 Inertial Sense LLC

- 6.4.17 Aeron Systems Pvt. Ltd.

- 6.4.18 STMicroelectronics NV

- 6.4.19 Analog Devices Inc.

- 6.4.20 Raytheon Technologies Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment