PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836469

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836469

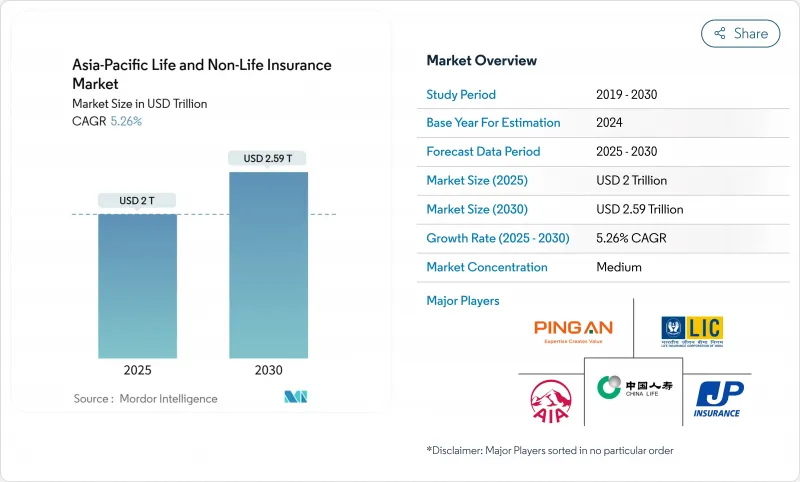

Asia-Pacific Life And Non-Life Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific life and non-life insurance market is valued at USD 2.00 trillion in 2025 and is forecast to reach USD 2.59 trillion by 2030, advancing at a 5.26% CAGR.

Demographic shifts, regulatory liberalization, and rapid digital adoption underpin this outlook as insurers move from traditional agency models toward embedded, ecosystem-based distribution that bundles protection with everyday financial services. Accelerating smartphone penetration, open-API regulation, and the rollout of national digital identity programs are lowering onboarding costs and opening untapped micro-segments, while climate-related loss events push carriers to recalibrate risk models and launch parametric covers that pay out within days rather than months. The Asia-Pacific life and non-life insurance market also benefits from rising middle-class disposable incomes in India, Indonesia, and Vietnam because newfound purchasing power generally converts into first-time health and savings policies that renew over the customer lifecycle. Competitive intensity is mounting as global insurers seek scale through mergers and as technology platforms embed usage-based policies within ride-hailing, e-commerce, and OEM ecosystems, compressing traditional commission structures.

Asia-Pacific Life And Non-Life Insurance Market Trends and Insights

Rising Middle-Class Disposable Incomes

Growing urban incomes across emerging economies feed directly into the Asia-Pacific life and non-life insurance market as newly affluent households prioritize health and savings protection. Domestic consumption is accelerating in Vietnam, where 2025 GDP growth of 8% and a 48.6% jump in inbound foreign investment are boosting personal financial assets. Higher earnings improve policy persistency, enabling insurers to cross-sell critical illness and retirement solutions that ride on compulsory digital payment rails introduced across ASEAN. Strong e-commerce penetration also exposes consumers to cyber risks, creating an entry point for bundled personal-cyber covers. Taken together, rising disposable income now influences the premium mix by shifting buyers from minimum-sum term plans toward multi-benefit products that include wellness rewards.

Aging Population & Growing Pension/Health Gaps

Fertility decline and rising longevity in Japan, South Korea, and coastal China widen pension and healthcare financing gaps, reinforcing demand for annuities, long-term care, and supplemental medical policies. Singapore projects that one in four citizens will be at least 65 by 2030, prompting carriers to redesign traditional endowment plans into lifetime income products. Medical inflation of 11%-12% in larger Asian cities further motivates households to lock in coverage before age-related exclusions apply, driving premium growth in the Asia-Pacific life and non-life insurance market well beyond headline GDP rates. Longevity-linked securities issued by reinsurers are also gaining regulatory acceptance, allowing primary writers to hedge surplus strain created by extended life expectancy. These demographics accelerate a pivot from savings-led life policies toward pure-risk products, improving capital efficiency.

Low Financial-Literacy & Trust Deficits

Penetration remains below 2% of GDP in populous markets such as Indonesia, where fewer than 60% of insurers use full digital marketing, hampering rural reach. Authorities have launched mass education drives and universal coverage targets, yet trust-building takes time, limiting near-term traction for the Asia-Pacific life and non-life insurance market. The scarcity of bilingual policy documents further hinders uptake among rural populations who transact primarily in local dialects. Without concerted agent training and digital literacy initiatives, churn rates may stay elevated, diluting long-term profitability.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Liberalization & Foreign-Ownership Caps Eased

- Accelerating Digital/InsurTech Distribution Adoption

- Fragmented Multi-Jurisdiction Regulation & Compliance Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Life policies generated 61.3% of 2024 premium income, anchoring the Asia-Pacific life and non-life insurance market. Yet the health & medical segment is expected to outpace at 7.89% CAGR to 2030 as post-pandemic households treat medical cover as essential spending. Personal-lines morbidity products now bundle telemedicine and wellness apps, with carriers reporting 30% higher cross-sell into critical-illness riders. Growth in health lines has already carved out USD 54 billion of the Asia-Pacific life and non-life insurance market size in 2025. Motor and property remain cyclical but benefit from EV adoption and parametric endorsements that accelerate claim settlement following climate events. New multi-line platforms also let consumers add travel, pet, or gadget covers to a single mobile wallet, boosting retention through convenience. Insurers reprice traditional savings-oriented plans toward term policies, freeing capital and aligning with IFRS 17 guidelines.

Continued pivot from savings-heavy endowments toward risk-focused term and annuity solutions safeguards spread margins, especially under new IFRS-based contract classification. As product design migrates to modular riders priced in real-time, life insurers diversify income through asset-management fees on participating funds, reducing sensitivity to interest-rate shocks. Health insurers experiment with value-based reimbursement models that link payouts to clinical outcomes rather than fee-for-service billing. Such innovation further entrenches health coverage as the growth engine within the Asia-Pacific life and non-life insurance market.

The Asia-Pacific Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance, Non-Life Insurance), Distribution Channel (Agency Force, Bancassurance, Brokers & IFAs, and More), Customer Segment (Retail / Mass Market, High-Net-Worth & Affluent, and More), and Region. The Market Forecasts are Provided in Value (USD).

List of Companies Covered in this Report:

- Ping An Insurance Group

- China Life Insurance Co.

- AIA Group

- Japan Post Insurance

- Life Insurance Corp. of India

- HDFC Life

- Reliance Nippon Life

- MS&AD Insurance Group

- Tokio Marine Holdings

- Dai-ichi Life Holdings

- AXA Asia

- Allianz SE (APAC)

- Manulife Asia

- Samsung Life

- Sompo Holdings

- Zurich Insurance Asia

- QBE Insurance Group

- Great Eastern Holdings

- ICICI Prudential Life

- Sun Life Asia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising middle-class disposable incomes

- 4.2.2 Ageing population & growing pension/health gaps

- 4.2.3 Regulatory liberalisation & foreign-ownership caps eased

- 4.2.4 Accelerating digital/InsurTech distribution adoption

- 4.2.5 Climate-risk prompts demand for parametric covers

- 4.2.6 Embedded insurance via super-apps & OEM ecosystems

- 4.3 Market Restraints

- 4.3.1 Low financial-literacy & trust deficits

- 4.3.2 Fragmented multi-jurisdiction regulation & compliance cost

- 4.3.3 Volatile investment yields pressuring life spreads

- 4.3.4 Big-Tech self-insurance models squeezing margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.1.1 Term Life

- 5.1.1.2 Whole / Participating Life

- 5.1.1.3 Endowment

- 5.1.1.4 Unit-Linked / Investment-Linked

- 5.1.1.5 Group Life

- 5.1.2 Non-Life Insurance

- 5.1.2.1 Motor

- 5.1.2.2 Property & Catastrophe

- 5.1.2.3 Health & Medical

- 5.1.2.4 Personal Accident & Travel

- 5.1.2.5 Marine, Aviation & Transport

- 5.1.2.6 Crop & Parametric

- 5.1.1 Life Insurance

- 5.2 By Distribution Channel

- 5.2.1 Agency Force

- 5.2.2 Bancassurance

- 5.2.3 Brokers & IFAs

- 5.2.4 Direct-to-Consumer (Digital / Tele-sales)

- 5.2.5 Affinity & Embedded Partnerships

- 5.3 By Customer Segment

- 5.3.1 Retail / Mass Market

- 5.3.2 High-Net-Worth & Affluent

- 5.3.3 SMEs & Commercial Lines

- 5.4 By Region

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia

- 5.4.6 Indonesia

- 5.4.7 Vietnam

- 5.4.8 Singapore

- 5.4.9 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Ping An Insurance Group

- 6.4.2 China Life Insurance Co.

- 6.4.3 AIA Group

- 6.4.4 Japan Post Insurance

- 6.4.5 Life Insurance Corp. of India

- 6.4.6 HDFC Life

- 6.4.7 Reliance Nippon Life

- 6.4.8 MS&AD Insurance Group

- 6.4.9 Tokio Marine Holdings

- 6.4.10 Dai-ichi Life Holdings

- 6.4.11 AXA Asia

- 6.4.12 Allianz SE (APAC)

- 6.4.13 Manulife Asia

- 6.4.14 Samsung Life

- 6.4.15 Sompo Holdings

- 6.4.16 Zurich Insurance Asia

- 6.4.17 QBE Insurance Group

- 6.4.18 Great Eastern Holdings

- 6.4.19 ICICI Prudential Life

- 6.4.20 Sun Life Asia

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment