PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836471

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836471

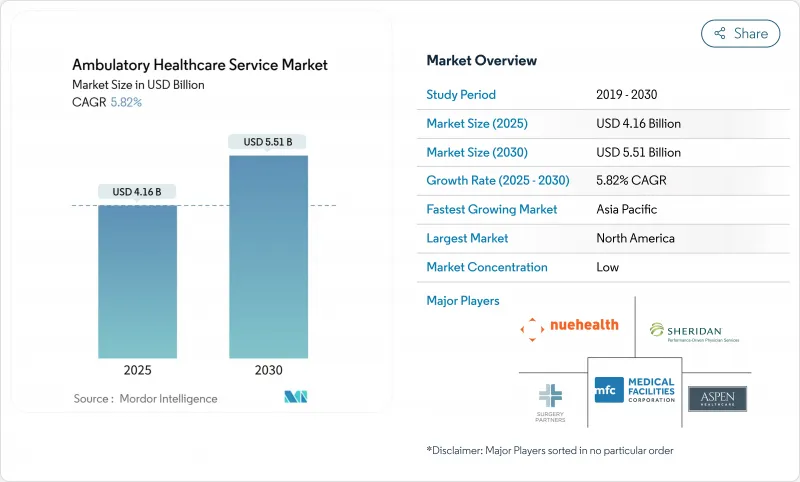

Ambulatory Healthcare Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ambulatory Healthcare Service Market size is estimated at USD 4.16 billion in 2025, and is expected to reach USD 5.51 billion by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

Expansion is propelled by the steady shift of procedures from inpatient hospitals to cost-efficient outpatient facilities, stronger payer incentives for value-based care, and rising demand for chronic-disease management. North America continues to anchor global revenues on the back of mature reimbursement policies, while Asia-Pacific records the most rapid uptake as governments scale outpatient infrastructure. Technology that supports minimally invasive surgeries, real-time analytics, and remote monitoring further widens the clinical scope of ambulatory centers. Concurrently, labor shortages, cyber threats, and rising urban real-estate costs temper growth momentum by adding operational risk and capital pressure.

Global Ambulatory Healthcare Service Market Trends and Insights

Rising Burden of Chronic Diseases and a Growing Elderly Population

Demand for the ambulatory healthcare service market deepens as multimorbidity rates climb among seniors who prefer community-based care. Payers now tie 75% of home- and community-care reimbursements to government programs, embedding outpatient delivery in national health strategies. Community clinics respond by enlarging chronic-disease panels, integrating nutrition services, and deploying point-of-care diagnostics that shorten referral loops. Population-health contracts increasingly include performance metrics for hypertension, diabetes, and COPD management conducted in ambulatory settings. These patterns confirm that outpatient care is becoming a structural component of health-system capacity rather than a discretionary adjunct.

Technological Innovations Enabling Shift Toward Minimally Invasive Surgeries

Advances in robotics, imaging, and AI reduce incision size, operating-room time, and recuperation periods, allowing procedures once limited to hospital theaters to migrate to ambulatory surgery centers. Photon-counting CT and digital SPECT scanners shrink scan sequences and radiation exposure, aligning with outpatient throughput targets. Cardiovascular interventions such as atherectomy and peripheral stenting are increasingly reimbursed for ambulatory venues, expanding procedure mix. Automated image-analysis tools offset shortages of radiologists by triaging scans and flagging anomalies for rapid review. Collectively, these technologies help facilities boost case volumes without proportional increases in clinical manpower.

Persistent Workforce Shortages and Increasing Clinician Burnout

A projected deficit of up to 139,000 physicians by 2033 tightens labor supply, with only 42.2% of physicians still in private practice as employment shifts toward hospital systems. Burnout rates climb as clinicians juggle high visit counts and electronic documentation, prompting early retirement and reduced hours. Ambulatory centers struggle to staff evening and weekend clinics, limiting throughput during peak periods. Rural areas face compounded shortages because telehealth licensing requirements vary by state, slowing specialist deployment. Workforce gaps elevate salary expenses, pressuring margins that are already thinner than hospital counterparts.

Other drivers and restraints analyzed in the detailed report include:

- Policy Initiatives Promoting Favorable Reimbursement and Site-of-Care Mandates

- Entry of Retail Giants and Big-Tech Players Accelerating Digital Innovation

- Rising Cybersecurity Threats and Fragmented Data Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary care clinics generated the largest revenue stream, accounting for 40.32% of the ambulatory healthcare service market in 2024. They serve as gatekeepers for disease prevention, prescription renewals, and referrals, positioning them as indispensable nodes in population-health programs. Continuity of care fosters strong patient relationships, leading to higher adherence and lower downstream costs. Investment in advanced triage tools and chronic-care dashboards enables clinics to manage rising multimorbidity without proportional physician headcount. Telehealth and virtual clinics, though smaller in absolute terms, are on track for a 7.74% CAGR through 2030, reflecting consumer preference for convenient, on-demand access.

Rapid virtual uptake brings fresh competition and raises expectations for 24/7 availability, pushing traditional practices to adopt hybrid models. Urgent care centers, numbering more than 14,000, continue to relieve emergency-room congestion by handling non-life-threatening episodes. Diagnostic imaging hubs prosper as payers shift high-cost scans out of hospital radiology departments. In parallel, home-health agencies leverage remote vitals monitoring to extend the reach of clinicians, particularly for post-acute recovery and palliative support. The segment mosaic underscores how diversified points of care jointly reinforce the ambulatory healthcare service market flow of patients and revenue.

The Ambulatory Healthcare Service Market Report is Segmented by Service Setting (Primary Care Clinics, Surgical Specialty Clinics, and More), Specialty (Ophthalmology, Orthopedics, and More), Ownership Model (Physician-Owned, Hospital / Health-System-Owned, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 43.67% of global ambulatory revenues in 2024, underpinned by expansive payer coverage, favorable site-of-service differentials, and a mature supply of more than 14,000 urgent care centers. The United States benefits from a 2.9% Medicare payment bump for ASCs, creating immediate cash-flow lift, while Canada's provincial reforms reward community-based chronic-disease clinics. Mexico's medical-tourism clusters generate incremental procedure volume that fortifies regional share. Telehealth adoption now touches 23% of encounters, a signal that digital pathways are firmly embedded in the ambulatory healthcare service market.

Asia-Pacific posts a leading 10.36% CAGR by 2030 as governments fast-track outpatient construction to relieve public-hospital congestion. Singapore's integrated surgery centers demonstrate best-in-class throughput, China prioritizes domestic production of minimally invasive devices, and Japan subsidizes tele-rehabilitation for seniors. India's insurance-expansion policies and medical-tourism inflows also funnel capital into multispecialty ambulatory hubs. Demographic aging in the region ensures sustainable demand for cardiovascular, ophthalmic, and orthopedic day surgeries.

Europe exhibits steady growth as national health systems tighten budgets and encourage shift-left initiatives. Germany's gynecology procedures now occur 98% in private free-standing units, and EU-wide value-based frameworks tie reimbursement to care-quality metrics that outpatient sites can meet efficiently. Adoption of teleradiology mitigates radiologist shortages, while relaxed cross-border directives ease patient flow within the bloc. Emerging markets in the Middle East, Africa, and South America invest in private outpatient clusters that complement often overstretched public hospitals, extending the global footprint of the ambulatory healthcare service market.

- Aspen Pharmacare

- Healthway Medical Group

- Medical Facilities

- NueHealth

- Envision / Sheridan Healthcare

- Surgery Partners

- SCA Health (Surgical Care Affiliates)

- Terveystalo Healthcare

- United Surgical Partners International (USPI)

- AmSurg

- Tenet Healthcare

- HCA Healthcare

- Community Health Systems

- TeamHealth

- FastMed Urgent Care

- NextCare Urgent Care

- One Medical

- Oak Street Health

- CVS MinuteClinic

- DaVita Kidney Care

- Kaiser Permanente

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Chronic Diseases and a Growing Elderly Population

- 4.2.2 Technological Innovations are Enabling the Shift Toward Minimally Invasive Surgeries

- 4.2.3 Policy Initiatives Promoting Favorable Reimbursement and Site-of-Care Mandates

- 4.2.4 Entry of Retail Giants and Big-Tech Players Accelerating Digital Innovation

- 4.2.5 Hybrid ASC-OBL (Office-Based Lab) Facilities Supporting the Migration of Cardiovascular Procedures

- 4.2.6 Adoption of Value-Based Care and Bundled Payment Models

- 4.3 Market Restraints

- 4.3.1 Persistent Workforce Shortages and Increasing Clinician Burnout

- 4.3.2 Rising Cybersecurity Threats and Fragmented Data Systems

- 4.3.3 High Real Estate Costs in Urban and High-Growth Corridors Pose Barriers to ASC Expansion

- 4.3.4 Operational Complexity from Managing Multispecialty Practices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Setting

- 5.1.1 Primary Care Clinics

- 5.1.2 Surgical Specialty Clinics

- 5.1.3 Urgent Care Centers

- 5.1.4 Freestanding Emergency Departments

- 5.1.5 Diagnostic Imaging Centers

- 5.1.6 Specialty Clinics

- 5.1.7 Home Healthcare Agencies

- 5.1.8 Telehealth & Virtual Clinics

- 5.2 By Specialty

- 5.2.1 Ophthalmology

- 5.2.2 Orthopedics

- 5.2.3 Gastroenterology

- 5.2.4 Cardiovascular

- 5.2.5 Pain Management

- 5.2.6 Dermatology

- 5.2.7 ENT

- 5.2.8 Oncology

- 5.2.9 Others

- 5.3 By Ownership Model

- 5.3.1 Physician-Owned

- 5.3.2 Hospital / Health-System-Owned

- 5.3.3 Corporate / Private-Equity-Owned

- 5.3.4 Joint-Ventures

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Aspen Healthcare

- 6.3.2 Healthway Medical Group

- 6.3.3 Medical Facilities Corporation

- 6.3.4 NueHealth

- 6.3.5 Envision / Sheridan Healthcare

- 6.3.6 Surgery Partners

- 6.3.7 SCA Health (Surgical Care Affiliates)

- 6.3.8 Terveystalo Healthcare

- 6.3.9 United Surgical Partners International (USPI)

- 6.3.10 AmSurg

- 6.3.11 Tenet Healthcare Corporation

- 6.3.12 HCA Healthcare

- 6.3.13 Community Health Systems

- 6.3.14 TeamHealth

- 6.3.15 FastMed Urgent Care

- 6.3.16 NextCare Urgent Care

- 6.3.17 One Medical

- 6.3.18 Oak Street Health

- 6.3.19 CVS MinuteClinic

- 6.3.20 DaVita Kidney Care

- 6.3.21 Kaiser Permanente

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment