PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836473

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836473

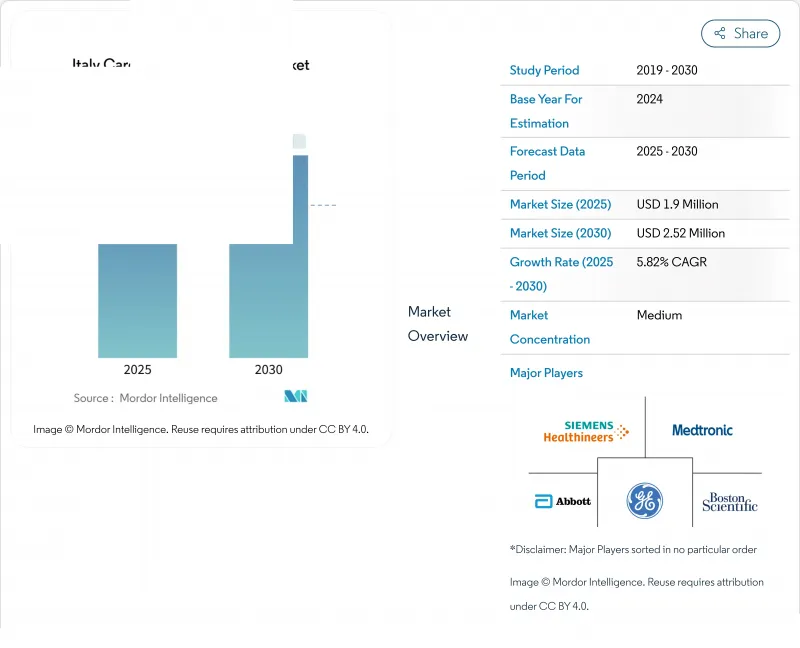

Italy Cardiovascular Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy Cardiovascular Devices Market size is estimated at USD 1.9 million in 2025, and is expected to reach USD 2.52 million by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

The expansion is supported by population ageing, early-stage screening initiatives and swift uptake of minimally invasive technologies. Investments under the National Recovery and Resilience Plan are refreshing hospital equipment and widening access to specialty centers, while post-pandemic shifts toward shorter stays and outpatient care are driving preference for portable and home-based solutions. At the same time, tighter price caps on premium implants, combined with the ongoing European Union Medical Device Regulation transition, are reshaping go-to-market strategies and accelerating consolidation across the Italian cardiovascular devices market.

Italy Cardiovascular Devices Market Trends and Insights

Government Incentives for Early TAVI Reimbursement under LEA

The listing of Transcatheter Aortic Valve Implantation in the Essential Levels of Assistance has cut the median inpatient stay from 7 to 5 days, saving hospitals USD 565 per patient while broadening patient eligibility. Favorable funding, paired with Italy's high-risk patient profile, is advancing uptake of next-generation self-expanding and balloon-expandable valves. Device makers are responding with low-profile delivery systems and durability-enhanced leaflet materials, reinforcing momentum in the Italian cardiovascular devices market.

Aging Population-Driven Surge in Peripheral Artery Disease Procedures

With 23.8% of residents aged 65 or older, Italy holds one of Europe's oldest populations. The prevalence of peripheral artery disease in people with type 2 diabetes has reached 19-22%. National clinical guidelines now prioritize ankle-brachial index screening and embolic-protection devices to curb procedural complications. These shifts prompt hospitals to expand inventories of covered stents, drug-coated balloons and atherectomy devices, keeping the Italian cardiovascular devices market on a solid growth path.

Other drivers and restraints analyzed in the detailed report include:

- National Screening Programs & Rising Coronary Angiography Volumes

- Rapid Technological Advancements and Minimally Invasive Procedures

- National Consip Price Caps Compressing ASPs for Stents & TAVI

- EU-MDR Re-certification Delays Causing Catheter Supply Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic and surgical devices command 58.20% of the Italian cardiovascular devices market, anchored by sustained implant volumes for drug-eluting stents, cardiac rhythm management systems and Transcatheter Aortic Valve Implantation. The Italian cardiovascular devices market size for therapeutic systems is projected to expand at 5.4% CAGR, supported by hospital upgrades and aging-driven procedure counts. Demand tilts toward platforms that shorten procedure time, such as rapid-exchange angioplasty balloons and single-access vascular closure devices, which improve throughput in busy cath labs.

Diagnostic and monitoring solutions, despite a smaller base, are forecast to rise at a 6.04% CAGR. Fractional flow reserve consoles, ECG-gated CT scanners and AI-powered echocardiography suites are registering the sharpest gains as physicians seek functional data to refine treatment plans eurointervention. Portable Holter monitors and insertable cardiac monitors with six-year battery life further broaden remote-care capabilities.

Italy's Cardiovascular Devices Market is Segmented by Device Type (Diagnostic & Monitoring Devices and Therapeutic & Surgical Devices), by Indication (Coronary Artery Disease, Arrhythmia and More), by End User (Hospitals, Home Care Settings and More). The Report Offers the Value (in USD Million) for the Above Segments. The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Medtronic

- Abbott Laboratories

- Boston Scientific

- Edward Lifesciences

- Terumo

- LivaNova

- BIOTRONIK

- Koninklijke Philips

- Siemens Healthineers

- GE HealthCare Technologies Inc.

- Merit Medical Systems

- Cook Group

- B. Braun

- Cardinal Health Inc. (Cordis)

- Johnson & Johnson MedTech (Biosense Webster)

- MicroPort Scientific Corp.

- Getinge

- Shockwave Medical Inc.

- W. L. Gore & Associates

- Lepu Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 National Screening Programs & Rising Coronary Angiography Volumes

- 4.2.2 Government Incentives for Early TAVI Reimbursement under LEA

- 4.2.3 Aging Population-Driven Surge in Peripheral Artery Disease (PAD) Procedures

- 4.2.4 Expansion of Public-Private Cardiovascular Centers

- 4.2.5 Post-COVID Backlog of Elective Cardiac Surgeries Accelerating PCI Adoption

- 4.3 Market Restraints

- 4.3.1 National Consip Price Caps Compressing ASPs for Stents & TAVI

- 4.3.2 EU-MDR Re-certification Delays Causing Catheter Supply Shortages

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 ECG Systems

- 5.1.1.2 Remote Cardiac Monitor

- 5.1.1.3 Cardiac MRI

- 5.1.1.4 Cardiac CT

- 5.1.1.5 Echocardiography / Ultrasound

- 5.1.1.6 Fractional Flow Reserve (FFR) Systems

- 5.1.2 Therapeutic & Surgical Devices

- 5.1.2.1 Coronary Stents

- 5.1.2.1.1 Drug-Eluting Stents

- 5.1.2.1.2 Bare-Metal Stents

- 5.1.2.1.3 Bioresorbable Stents

- 5.1.2.2 Catheters

- 5.1.2.2.1 PTCA Balloon Catheters

- 5.1.2.2.2 IVUS/OCT Catheters

- 5.1.2.3 Cardiac Rhythm Management

- 5.1.2.3.1 Pacemakers

- 5.1.2.3.2 Implantable Cardioverter Defibrillators

- 5.1.2.3.3 Cardiac Resynchronization Therapy Devices

- 5.1.2.4 Heart Valves

- 5.1.2.4.1 TAVR/TAVI

- 5.1.2.4.2 Mechanical Valves

- 5.1.2.4.3 Tissue/Bioprosthetic Valves

- 5.1.2.5 Ventricular Assist Devices

- 5.1.2.6 Artificial Hearts

- 5.1.2.7 Grafts & Patches

- 5.1.2.8 Other Cardiovascular Surgical Devices

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Indication

- 5.2.1 Coronary Artery Disease

- 5.2.2 Arrhythmia

- 5.2.3 Heart Failure

- 5.2.4 Valvular Heart Disease

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Home care Settings

- 5.3.3 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Medtronic plc

- 6.4.2 Abbott Laboratories

- 6.4.3 Boston Scientific Corporation

- 6.4.4 Edwards Lifesciences Corporation

- 6.4.5 Terumo Corporation

- 6.4.6 LivaNova PLC

- 6.4.7 Biotronik SE & Co. KG

- 6.4.8 Philips Healthcare

- 6.4.9 Siemens Healthineers AG

- 6.4.10 GE HealthCare Technologies Inc.

- 6.4.11 Merit Medical Systems Inc.

- 6.4.12 Cook Medical LLC

- 6.4.13 B. Braun Melsungen AG

- 6.4.14 Cardinal Health Inc. (Cordis)

- 6.4.15 Johnson & Johnson MedTech (Biosense Webster)

- 6.4.16 MicroPort Scientific Corp.

- 6.4.17 Getinge AB

- 6.4.18 Shockwave Medical Inc.

- 6.4.19 W. L. Gore & Associates

- 6.4.20 Lepu Medical Technology

7 Market Opportunities & Future Outlook