PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836475

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836475

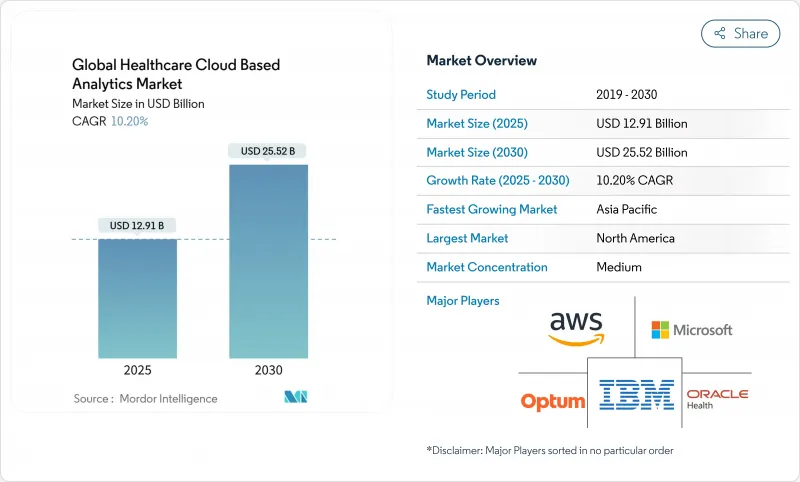

Global Healthcare Cloud Based Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Healthcare cloud-based analytics market is valued at USD 12.91 billion in 2025 and is forecast to reach USD 25.52 billion by 2030, advancing at a 14.6% CAGR.

Heightened pressure to prove measurable outcomes, surging volumes of digital patient information, and a decisive shift toward value-based reimbursement are accelerating investment in cloud-native analytics across hospitals, payers, and life-science sponsors. Regulatory mandates such as the 21st Century Cures Act, rapid telehealth adoption that funnels fresh data into clinical systems, and the promise of substantial infrastructure savings strengthen the economic rationale for cloud deployment. Providers that embraced cloud migration recorded infrastructure cost reductions of up to 95% in large-scale projects, demonstrating the fiscal appeal of elastic, on-demand computing. Talent shortages and intensifying cyber-risk temper momentum but simultaneously create white-space opportunities for vendors that bundle managed services with robust security architectures.

Global Healthcare Cloud Based Analytics Market Trends and Insights

Data Explosion from Digital Health Records

Nearly every U.S. hospital (96%) and more than three-quarters of ambulatory physicians (78%) now run certified electronic health record (EHR) systems. The torrent of structured, semi-structured, and unstructured information overwhelms legacy servers yet fuels demand for cloud-hosted analytic engines that sift text, images, waveforms, and streaming telemetry. Natural-language processing converts physician notes into usable data, while machine-learning pipelines uncover patterns that inform readmission prevention and staffing optimization. By blending genomic profiles, wearable metrics, and social determinants, providers compose granular patient portraits that underpin precision medicine and community-wide interventions.

Transition To Value-Based Care Reimbursement

As per the Centers for Medicare & Medicaid Services, all Medicare beneficiaries are slated to receive care under value-based models by 2030, a shift that rewards quality over volume.Providers, therefore, require real-time cohort visibility, risk scoring, and predictive alerts to avoid costs. Organizations participating in advanced payment arrangements have already shaved USD 28 million from annual spending through timely analytics-driven interventions, underscoring the fiscal upside of cloud scalability. As accountable-care participation widens in Europe, continual performance tracking becomes indispensable for both public and private systems.

Persistent Data Privacy and Cyber Security Threats

Healthcare recorded 677 major breaches affecting 182.4 million people in 2024, including the ransomware incident that compromised 100 million patient records. Average breach costs reached USD 9.77 million, pressuring providers to invest heavily in encryption, zero-trust architecture, and 24/7 monitoring. Many organizations still lack in-house expertise, prolonging procurement cycles and slightly dampening the healthcare cloud-based analytics market momentum.

Other drivers and restraints analyzed in the detailed report include:

- Cost Efficiency and Elasticity of Cloud Infrastructure

- Government Mandates for Healthcare Interoperability Standards

- Legacy Infrastructure and Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Predictive tools accounted for 40.8% of the healthcare cloud-based analytics market in 2024, highlighting provider appetite for foresight into readmissions, sepsis onset, and staffing needs. Solutions ingest longitudinal EHR records, real-time vitals, and socio-economic markers to trigger proactive care pathways that lift quality scores and compress costs. Integrated dashboards alert multidisciplinary teams to high-risk patients, reducing emergency utilization.

Prescriptive engines, though still nascent, are scaling fastest at a 16.1% CAGR through 2030. These platforms simulate "what-if" scenarios across medication regimens or operating-room throughput and recommend optimal interventions. Decision optimization resonates with health systems seeking continuous margin improvement under value-based contracts, positioning prescriptive modules as the next growth frontier.

Clinical analytics captured 45.5% of the 2024 healthcare cloud-based analytics market share because bedside decision support, imaging triage, and drug interactions deliver visible patient benefits. Deep-learning algorithms shorten radiology turnaround times and subtle pathologies, while real-time antimicrobial-stewardship dashboards curb resistance trends.

Population health platforms, expanding at 17.4% CAGR, aggregate claims, pharmacy, and social-needs data to stratify risk and orchestrate community interventions. As capitated payment models proliferate, payers and providers rely on cohort-level metrics to pinpoint gaps in care. Cloud scalability proves vital when crunching thousands of variables across millions of covered lives.

The Healthcare Cloud Based Analytics Market Report is Segmented by Technology Type (Predictive, Prescriptive and More), Application (Clinical Data, Administrative Data, and More), Component (Hardware, and More), Deployment Model (Public, Private, and More), End-User (Healthcare Providers, Payers, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains the leading revenue position, supported by near-universal EHR penetration, generous reimbursement for chronic-care management codes, and aggressive federal pushes for interoperability. Health systems shifting entire analytics workloads to hyperscalers report up to 95% cost savings and accelerated AI pilots that automatically draft progress notes. Cyber incidents remain an ever-present hazard, prompting widespread investment in zero-trust frameworks and influencing vendor selection criteria for the healthcare cloud-based analytics market.

Europe records solid double-digit growth as the European Health Data Space mandates cross-border record portability and research reuse. Country-specific rules, such as Germany's C5 and France's HDS, spur private-cloud or hybrid strategies that assure data residency. Health ministries allocate digital-transformation grants to tame workforce shortages, tightening cooperation between cloud vendors and public agencies. Integrated health regions leverage federated-learning models to run joint cancer-screening algorithms without exporting raw images, satisfying privacy watchdogs while expanding analytic prowess.

Asia Pacific exhibits the fastest trajectory, propelled by China's internet-health boom and Southeast Asia's burgeoning telehealth sector. Government programs in Japan, South Korea, and Singapore subsidize hospital cloud migration and clinical AI pilots to counter aging populations and clinician scarcity. Countries with limited specialist availability deploy remote-read solutions that route imaging studies to off-site radiologists, improving diagnostic reach. Investment momentum from regional technology giants fosters vibrant partnership ecosystems that tailor analytics offerings to local workflows and language nuances.

- Oracle

- Optum

- IBM (Merative)

- Microsoft

- Amazon Web Services

- Google Cloud Platform

- Allscripts (Veradigm)

- SAS Institute

- CitiusTech

- Health Catalyst

- Koninklijke Philips

- HP Enterprise

- Snowflake Inc.

- MedeAnalytics

- Verisk Health

- Mckesson

- Inovalon

- Flatiron Health

- IQVIA Analytics

- Arcadia IO

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data Explosion From Digital Health Records

- 4.2.2 Transition To Value Based Care Reimbursement

- 4.2.3 Cost Efficiency And Elasticity Of Cloud Infrastructure

- 4.2.4 Government Mandates For Healthcare Interoperability Standards

- 4.2.5 Telehealth Expansion Generating Continuous Patient Data Streams

- 4.2.6 Adoption Of Fhir And Open Api Ecosystems Enabling Cross Provider Analytics

- 4.3 Market Restraints

- 4.3.1 Persistent Data Privacy And Cyber Security Threats

- 4.3.2 Legacy Infrastructure And Integration Complexity

- 4.3.3 Shortage Of Cloud Native Healthcare Data Talent

- 4.3.4 Emerging Data Sovereignty And Carbon Footprint Regulations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology Type

- 5.1.1 Predictive Analytics

- 5.1.2 Prescriptive Analytics

- 5.1.3 Descriptive Analytics

- 5.2 By Application

- 5.2.1 Clinical Analytics

- 5.2.2 Administrative & Financial Analytics

- 5.2.3 Population Health & Research Analytics

- 5.2.4 Real-World Evidence & Pharmacovigilance

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Private Cloud

- 5.4.3 Hybrid Cloud

- 5.5 By End-user

- 5.5.1 Healthcare Providers

- 5.5.2 Payers

- 5.5.3 Life-Science & CROs

- 5.5.4 Public Health Agencies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Oracle (Cerner)

- 6.3.2 Optum

- 6.3.3 IBM (Merative)

- 6.3.4 Microsoft

- 6.3.5 Amazon Web Services

- 6.3.6 Google Cloud Platform

- 6.3.7 Allscripts (Veradigm)

- 6.3.8 SAS Institute

- 6.3.9 CitiusTech

- 6.3.10 Health Catalyst

- 6.3.11 Philips Healthcare

- 6.3.12 HP Enterprise

- 6.3.13 Snowflake Inc.

- 6.3.14 MedeAnalytics

- 6.3.15 Verisk Health

- 6.3.16 McKesson

- 6.3.17 Inovalon

- 6.3.18 Flatiron Health

- 6.3.19 IQVIA Analytics

- 6.3.20 Arcadia IO

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment