PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836480

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836480

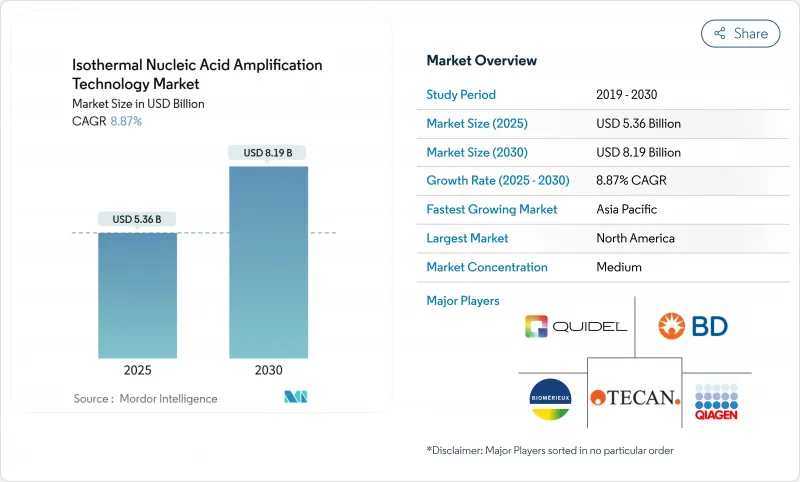

Isothermal Nucleic Acid Amplification Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Isothermal Nucleic Acid Amplification Technology Market size is estimated at USD 5.36 billion in 2025, and is expected to reach USD 8.19 billion by 2030, at a CAGR of 8.87% during the forecast period (2025-2030).

Growth is fuelled by constant-temperature amplification, which removes the need for bulky thermal cyclers and supports rapid point-of-care testing. Hospitals deploy INAAT platforms in emergency units to cut result turnaround from hours to minutes, while reagent suppliers benefit from steady, high-margin consumable sales. Manufacturers are integrating microfluidics, lyophilised reagents and colourimetric detection that lower per-test costs and broaden use in non-laboratory settings. Asia-Pacific adoption accelerates as streamlined device approvals shorten time-to-market, whereas North America leads on revenue owing to established reimbursement frameworks.

Global Isothermal Nucleic Acid Amplification Technology Market Trends and Insights

Point-of-care infectious-disease adoption

Emergency departments now rely on INAAT respiratory panels that deliver lab-quality answers in minutes, boosting patient throughput and antibiotic stewardship. FDA clearance of Cepheid's Xpert HCV in June 2024 allows same-visit hepatitis C diagnosis from a fingertip blood sample, a milestone that removes multi-visit loss to follow-up. Result accuracy remains on par with PCR while constant-temperature reactions suit battery-powered, portable devices useful in resource-limited settings.

Aging population & chronic-disease burden

Populations over 65 years demand regular biomarker checks for infections and cancer recurrence. INAAT-based liquid-biopsy systems can detect minimal residual disease with 94.1% sensitivity, enabling home or community clinic monitoring. Integration with telemedicine platforms streamlines result review, curbing unnecessary hospital visits and lowering system costs.

Competition From PCR & DCR Platforms

Established PCR infrastructure represents significant switching costs for laboratories that have invested in thermal cycling platforms, automated sample handling systems, and technician training programs optimized for traditional amplification workflows. Digital PCR platforms further intensify competition by offering absolute quantification capabilities that INAAT currently cannot match, particularly in applications requiring precise viral load monitoring or copy number variation analysis. Laboratory directors cite workflow disruption concerns when evaluating INAAT adoption, as existing quality control procedures, regulatory validations, and staff competencies align with PCR methodologies.

Other drivers and restraints analyzed in the detailed report include:

- Workflow shift from PCR to INAAT

- Lower per-test cost economics

- Awareness and Reimbursement Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LAMP captured 44.34% of the Isothermal Nucleic Acid Amplification Technology market in 2024 and is forecast to grow at 13.36% CAGR to 2030. The methodology targets six gene regions, conferring high specificity without thermal cycling. Complementary approaches like HDA and NEAR address low-temperature use cases, while TMA retains value in blood screening where RNA detection matters.

Detection innovation is reshaping the Isothermal Nucleic Acid Amplification Technology market as developers pair LAMP with CRISPR-Cas systems to reach attomolar sensitivity in 30 minutes. Colourimetric lateral-flow strips integrate directly into cartridges, widening adoption in clinics lacking fluorescence readers.

Reagents and consumables generated 63.56% of 2024 revenue, providing recurring cash flow that subsidises R&D. Bst polymerase supply resilience remains critical because it underpins most INAAT kits. Instruments are set to expand 11.24% annually as vendors embed microfluidics and one-step extraction, evidenced by iPonatic's 30-minute cartridge achieving full workflow automation.

Instrument innovation focuses on integration and miniaturization, with manufacturers developing portable platforms that combine sample preparation, amplification, and detection in single-use cartridge formats. The iPonatic system exemplifies this trend, delivering complete nucleic acid testing within 30 minutes using room-temperature extraction and integrated detection capabilities. Microfluidic integration enables precise fluid handling and thermal control while reducing reagent consumption and contamination risks, though manufacturing complexity and cost considerations limit adoption to high-value applications.

The Isothermal Nucleic Acid Amplification Technology (INAAT) Market Report Segments the Industry Into by Technology (Helicase-Dependent Amplification (HDA), and More), Product (Instruments, and More), Application (Infectious-Disease Diagnostics, and More), End-User (Hospitals and Reference Labs, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads with 35.67% revenue in 2024, underpinned by FDA pathways such as CLIA waiver rules that bring fifteen-minute respiratory panels into clinics fda.gov. Extensive insurance coverage permits hospitals to adopt INAAT without budget disruption. Research funding and robust venture capital accelerate domestic device launches.

Asia-Pacific is the growth engine, forecast at 15.64% CAGR. China's NMPA shortened review timelines from 24 to 12 months, attracting multinationals to localise production nmpa.gov.cn. Japan's senior population spurs home-based diagnostics, while India's public-health programmes source affordable INAAT kits for tuberculosis and dengue surveillance. Local manufacturing dampens currency risk and secures supply during global disruptions.

Europe grows steadily as the IVDR harmonises standards, though smaller innovators face higher evidence hurdles for CE marking. Germany and the United Kingdom anchor demand through strong hospital networks and translational research output. Cost-containment policies favour constant-temperature systems that save energy and labour compared with PCR.

- Abbott Laboratories

- Amplifica Labs

- Beckton Dickinson

- bioMerieux

- DiaSorin

- Eiken Chemical Co., Ltd.

- Genomera Inc.

- Hologic

- Lucigen (LGC Biosearch)

- Meridian Bioscience

- Molbio Diagnostics

- New England Biolabs

- OptiGene Ltd.

- QIAGEN

- QuidelOrtho Corp.

- Roche

- Tecan Group

- Thermo Fisher Scientific

- TwistDx Ltd.

- Ustar Biotechnologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Point-of-Care Infectious-Disease Adoption

- 4.2.2 Aging Population and Chronic-Disease Burden

- 4.2.3 Workflow Shift from PCR to INAAT

- 4.2.4 Lower Per-Test Cost Economics

- 4.2.5 Microfluidic Battery-Powered Cartridges (UTR)

- 4.2.6 Crispr-Enhanced Assay Specificity (UTR)

- 4.3 Market Restraints

- 4.3.1 Competition From PCR and DCR Platforms

- 4.3.2 Awareness and Reimbursement Gaps

- 4.3.3 Enzyme-Supply Volatility for Bst Reagents

- 4.3.4 Stringent CLIA-Waiver / IVDR Evidence Hurdles (UTR)

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Technology

- 5.1.1 Helicase-Dependent Amplification (HDA)

- 5.1.2 Nicking Enzyme Amplification Reaction (NEAR)

- 5.1.3 Loop-Mediated Isothermal Amplification (LAMP)

- 5.1.4 Strand Displacement Amplification (SDA)

- 5.1.5 Nucleic Acid Sequence-Based Amplification (NASBA)

- 5.1.6 Transcription-Mediated Amplification (TMA)

- 5.1.7 Single-Primer Isothermal Amplification (SPIA)

- 5.1.8 Other Technologies

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Reagents & Consumables

- 5.3 By Application

- 5.3.1 Infectious-Disease Diagnostics

- 5.3.2 Oncology and Liquid Biopsy

- 5.3.3 Blood-Screening and Transfusion Safety

- 5.3.4 Food- & Water-Safety Testing

- 5.3.5 Veterinary and Agricultural Diagnostics

- 5.4 By End-User

- 5.4.1 Hospitals & Reference Labs

- 5.4.2 Point-of-Care / Decentralised Clinics

- 5.4.3 Academic & Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Amplifica Labs

- 6.3.3 Becton, Dickinson & Co.

- 6.3.4 BioMerieux SA

- 6.3.5 DiaSorin SpA

- 6.3.6 Eiken Chemical Co., Ltd.

- 6.3.7 Genomera Inc.

- 6.3.8 Hologic Inc.

- 6.3.9 Lucigen (LGC Biosearch)

- 6.3.10 Meridian Bioscience

- 6.3.11 Molbio Diagnostics

- 6.3.12 New England Biolabs

- 6.3.13 OptiGene Ltd.

- 6.3.14 Qiagen N.V.

- 6.3.15 QuidelOrtho Corp.

- 6.3.16 Roche Diagnostics

- 6.3.17 Tecan Genomics Inc.

- 6.3.18 Thermo Fisher Scientific

- 6.3.19 TwistDx Ltd.

- 6.3.20 Ustar Biotechnologies

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment