PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836481

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836481

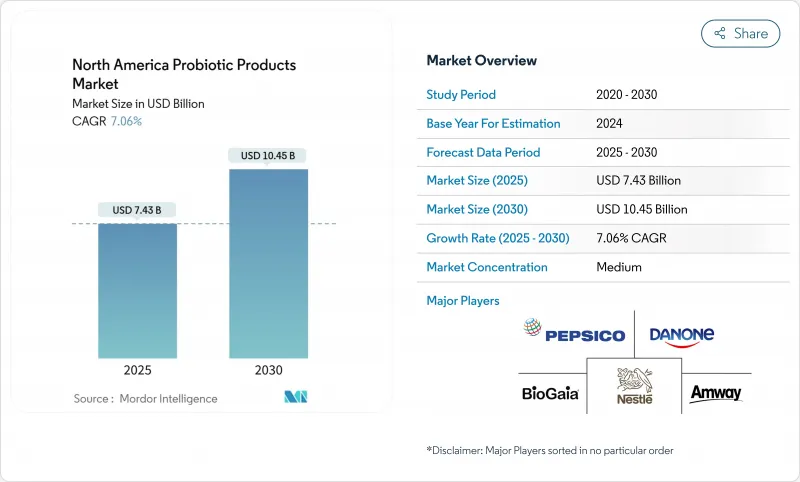

North America Probiotic Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America probiotic products market reached USD 7.43 billion in 2025 and is projected to expand to USD 10.45 billion by 2030, growing at a CAGR of 7.06% during the forecast period.

This growth is driven by increasing consumer awareness of gut-immune health connections and the role of digestive health in preventive healthcare. Probiotics offer significant benefits, including the prevention and treatment of conditions like lactose intolerance and inflammatory bowel disease. The market expansion is further supported by consumers' growing understanding of probiotic health benefits and improved accessibility to probiotic supplements. As consumers continue to prioritize preventive healthcare and digestive wellness, the North American probiotic products market is expected to maintain its robust growth trajectory. The market has witnessed substantial product innovation, with manufacturers introducing new formulations and delivery formats to meet diverse consumer preferences. The rising adoption of probiotic-enriched functional foods and beverages has created additional growth opportunities in the retail segment. Furthermore, the increasing integration of probiotics in dietary supplements and pharmaceutical products has expanded the market's scope beyond traditional dairy-based offerings.

North America Probiotic Products Market Trends and Insights

Rising Consumer Awareness of Gut Health Is Boosting Probiotic Consumption

Consumer education initiatives are fundamentally reshaping probiotic adoption patterns, with a notable shift from reactive to proactive health management. This transformation is evident in consumers' growing awareness and understanding of gut health benefits. The trend extends beyond traditional demographics, with younger generations driving demand through social media-influenced wellness behaviors that prioritize digestive health as foundational to overall wellbeing. Companies are responding by positioning probiotics not as supplements but as daily health maintenance tools. This strategic shift aligns with consumers' growing understanding of how microbiome imbalances contribute to chronic conditions, leading to sustained demand for probiotic products across age groups. As consumers increasingly integrate probiotics into their daily routines rather than using them as temporary interventions, the market continues to demonstrate strong growth potential. The North American market has witnessed increased investment in research and development by major manufacturers to develop innovative probiotic formulations targeting specific health conditions, as exemplified by Danone's 2024 establishment of the Activia Gut Health Board, which aims to provide expert guidance and support for improving gut health. Additionally, the expansion of distribution channels, including e-commerce platforms and specialty health stores, has improved product accessibility and convenience for consumers seeking probiotic solutions.

Adoption of Preventive Healthcare Promotes Daily Probiotic Use

The increasing focus on preventive healthcare has led consumers to adopt proactive health measures, including probiotic supplements. Probiotics support immune function and may reduce infection risk, appealing to consumers seeking to minimize healthcare costs. Younger consumers particularly view probiotics as a preventive health measure. Research linking gut health to immune function and disease prevention has established consistent consumption patterns, with users maintaining regular probiotic intake regardless of their current health status. This behavior creates stable revenue for manufacturers. The Centers for Medicare & Medicaid Services reported that United States healthcare spending increased by 7.5% in 2023, reaching USD 4.9 trillion (USD 14,570 per person), representing 17.6% of the nation's GDP . The rising healthcare costs have prompted consumers to invest in preventive supplements like probiotics, viewing them as a cost-effective way to maintain long-term health. Additionally, the growing awareness of the gut-brain connection and its impact on mental health has further strengthened the market demand for probiotic products in North America.

Growing Consumer Preference for Natural and Fresh Foods as Substitutes

The clean label movement poses a significant restraint for the probiotics products market as consumers increasingly favor whole foods and minimally processed alternatives. Traditional fermented foods like kimchi, sauerkraut, and kefir are gaining market share as consumers perceive them as more natural sources of beneficial bacteria compared to manufactured supplements. This shift particularly impacts the dietary supplements segment, where consumers question the necessity of isolated probiotic strains when whole food sources provide diverse microbial communities. Health-conscious demographics who prioritize food transparency are driving this trend, creating pressure on manufacturers to reformulate products with cleaner labels and fewer additives. Companies are responding by emphasizing minimal processing, organic certification, and traditional fermentation methods. In North America, this trend has prompted retailers to expand their fermented food sections and dedicate more shelf space to probiotic-rich whole foods. Additionally, local artisanal producers of fermented products are experiencing growth in the region, supported by consumers' increasing preference for small-batch, traditionally prepared probiotic foods.

Other drivers and restraints analyzed in the detailed report include:

- Innovations In Dairy-Free and Vegan Probiotic Formats Broaden Appeal

- Expansion of E-Commerce Enhances Accessibility to Premium Probiotic Products

- Lack of Standardized Labeling Affects Transparency and Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The probiotic products market is dominated by probiotic foods, which held a 60.11% market share in 2024. Probiotic drinks are emerging as the fastest-growing segment with a projected CAGR of 9.43% through 2030, driven by consumer demand for convenient, on-the-go formats and innovations in dairy-free alternatives like kombucha and fermented teas. The market growth is further supported by increasing consumer awareness of gut health benefits and the incorporation of probiotics into mainstream food products. Additionally, bakery products, breakfast cereals, and baby food segments are expanding through fortification strategies that align with consumption patterns and early-life microbiome development benefits. Manufacturers are investing in research and development to enhance probiotic stability in these food matrices, ensuring product efficacy throughout shelf life.

The dietary supplements segment is experiencing increased competition from functional foods as consumers shift towards obtaining probiotics through regular meals rather than supplements. While traditional capsules and tablets maintain their position in the market, new delivery formats such as gummies and powders are gaining popularity among younger consumers who seek more appealing ways to consume probiotics. The North American market has witnessed significant product innovation, with manufacturers focusing on strain-specific formulations targeting different health conditions. The region's robust distribution network, including pharmacies, supermarkets, and online retail channels, has facilitated wider product accessibility and market penetration, contributing to sustained growth in both functional foods and supplements categories.

The North America Probiotic Products Market is Segmented by Product Type (Probiotic Foods, Probiotic Drinks and Dietary Supplements), Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, Online Retail Stores and Other Distribution Channels), and Geography (United States, Canada, Mexico and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Danone SA

- Nestle SA

- PepsiCo Inc.

- BioGaia AB

- Chobani LLC

- Amway Corporation

- Lifeway Foods Inc.

- Reckitt Benckiser Group plc

- Yakult Honsha Co. Ltd.

- General Mills Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Green Valley Creamery

- Morinaga Milk Industry Co., Ltd.

- Arla Foods amba

- Now Foods

- Bio-K Plus International

- Fonterra Co-operative Group Limited

- Jarrow Formulas

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Nature's Way

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer awareness of gut health is boosting probiotic consumption

- 4.2.2 Adoption of preventive healthcare promotes daily probiotic use

- 4.2.3 Innovations in dairy-free and vegan probiotic formats broaden appeal

- 4.2.4 Expansion of e-commerce enhances accessibility to premium probiotic products

- 4.2.5 Increased awareness of probiotics' role in immunity supports market growth

- 4.2.6 Growing popularity of functional and fermented foods drives consumption

- 4.3 Market Restraints

- 4.3.1 Growing consumer preference for natural and fresh foods as substitutes

- 4.3.2 Lack of standardized labeling affects transparency and trust

- 4.3.3 Storage and formulation challenges reduce viability of probiotic strains

- 4.3.4 Strict regulatory approvals delay product launches in several regions

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Probiotic Foods

- 5.1.1.1 Yogurt

- 5.1.1.2 Bakery/Breakfast Cereals

- 5.1.1.3 Baby Food and Infant Formula

- 5.1.1.4 Other Probiotic Foods

- 5.1.2 Probiotic Drinks

- 5.1.2.1 Dairy-based Drinks

- 5.1.2.2 Fruit/Plant-based Drinks

- 5.1.2.3 Others (Kombucha and Fermented Tea)

- 5.1.3 Dietary Supplements

- 5.1.3.1 Capsules

- 5.1.3.2 Tablets

- 5.1.3.3 Powders

- 5.1.3.4 Gummies

- 5.1.3.5 Others

- 5.1.1 Probiotic Foods

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Pharmacies/Health Stores

- 5.2.3 Convenience Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 PepsiCo Inc.

- 6.4.4 BioGaia AB

- 6.4.5 Chobani LLC

- 6.4.6 Amway Corporation

- 6.4.7 Lifeway Foods Inc.

- 6.4.8 Reckitt Benckiser Group plc

- 6.4.9 Yakult Honsha Co. Ltd.

- 6.4.10 General Mills Inc.

- 6.4.11 Otsuka Pharmaceutical Co., Ltd.

- 6.4.12 Green Valley Creamery

- 6.4.13 Morinaga Milk Industry Co., Ltd.

- 6.4.14 Arla Foods amba

- 6.4.15 Now Foods

- 6.4.16 Bio-K Plus International

- 6.4.17 Fonterra Co-operative Group Limited

- 6.4.18 Jarrow Formulas

- 6.4.19 Mother Dairy Fruit & Vegetable Pvt. Ltd.

- 6.4.20 Nature's Way

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK