PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836482

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836482

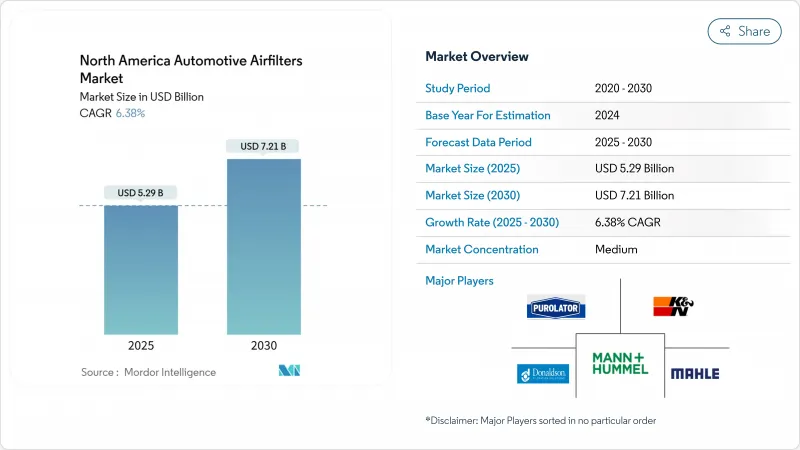

North America Automotive Airfilters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Automotive Air Filters market generated USD 5.29 billion in 2025 and is forecast to climb to USD 7.21 billion by 2030, advancing at a 6.38% CAGR.

Robust replacement demand from an ageing vehicle parc, tightening U.S.-Canada particulate and NOx limits, and migration toward premium cabin filtration underpin this steady expansion of the North America automotive air filters market. Cabin filters now dominate unit volumes because wildfire smoke episodes, urban smog, and prolonged daily commutes convert filtration from a maintenance chore into a health safeguard. Nanofiber media adoption accelerates as regulators press for higher filtration efficiency without airflow penalties, while online retail reshapes route-to-market economics by giving consumers transparent pricing and choice. At the same time, the rising share of battery electric vehicles erodes long-term engine-intake filter volumes, forcing suppliers to pivot toward HEPA cabin, thermal-management, and smart-sensor products within the North American automotive air filters market.

North America Automotive Airfilters Market Trends and Insights

Stricter U.S.-Canada PM & NOx Emission Norms Drive Filter Upgrade Cycles

U.S. EPA light- and medium-duty standards for model years 2027-2032 push fleet average CO2 targets to 85 g/mile, compelling automakers to specify higher-efficiency engines and cabin media that capture finer particulates without throttling airflow.California's Advanced Clean Cars II waiver, approved in December 2024, further tightens regional benchmarks that sooner or later cascade across the North American automotive air filters market. Nanofiber composites benefit by delivering the required capture efficiency with lower pressure drop, preserving fuel economy. Suppliers capable of documenting filtration performance under the tougher PM2.5 limit of 9 µg/m3 secure pricing power, whereas legacy cellulose lines suffer margin compression. Heavy-duty standards effective from 2027 raise durability and warranty thresholds, nudging light-duty buyers to perceive long-life filters as baseline value, reinforcing premium tiers within the North America automotive air filters market.

Rapid Cabin-Air Quality Awareness Post-Wildfire Seasons

Record wildfire smoke in 2024 blanketed California, Oregon, and British Columbia for weeks, pushing particulate readings above health-alert thresholds and igniting consumer demand for HEPA-grade cabin filters. State policy reviews now mandate high-efficiency filtration for buildings exposed to smoke plumes.That same mindset spills onto driveways: commuters treat vehicles as rolling shelters and seek filters with viral, allergen, and smoke removal claims. Mass-market OEMs respond by offering multi-layer cabin cartridges once limited to luxury trims, while aftermarket players package retrofit kits for older models. Promotional campaigns highlight World Health Organization PM2.5 guidance and children's respiratory health to justify a premium upsell. The feedback loop tightens as navigation apps overlay smoke maps, nudging drivers to activate recirculation and reminding them to change filters. This human-health narrative cements Cabin Media as the North American automotive air filter market's heartbeat.

Long-Life Washable Cotton Gauze Filters Cannibalizing Replacements

Reusable cotton-gauze filters marketed by performance brands extend service life from 12 months to nearly 5 years. Enthusiasts appreciate airflow gains and sustainability messaging, especially in desert states where dust traditionally forces frequent swaps. Retailers emphasize 50,000-mile warranties and lifetime cost savings, pulling value away from conventional paper lines. Mainstream uptake remains capped by a higher upfront price and the messy oil-recharge process that can foul mass-airflow sensors. Nevertheless, even modest conversion rates shave volumes in the aftermarket segment of the North America automotive air filters market. Manufacturers counter by launching drop-in washable cabin filters with antimicrobial linings, recapturing revenue while aligning with circular-economy goals.

Other drivers and restraints analyzed in the detailed report include:

- EV/HV Platforms Adopting Dedicated HEPA Cabin Filters

- Integration of IoT-Enabled Smart Filters With Predictive Replacement Apps

- BEV Adoption: Eliminating Engine-Intake Filter Demand By 2035

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nanofiber composites held a modest slice in 2024 yet are on course for 8.30% CAGR, the fastest of any material, as regulators focus on PM2.5 capture. While Paper/Cellulose still accounts for 43.25% of the North American automotive air filters market, paper and cellulose struggle to meet new efficiency targets without thickening pleats that choke airflow. Electrospun nanofibers remove 99.9998% of 300-500 nm particles at low pressure drop, a metric validated in Macromolecular Materials and Engineering studies. Suppliers blend nanofiber coatings with cellulose cores to keep costs palatable and to use existing production lines. Sustainability pressures add complexity: plant-based polymers and recycled cellulose draw R&D funding as OEMs pursue carbon-neutral supply chains. Graphene-oxide-reinforced cellulose nanofibers delivered 99.98% capture in laboratory tests while biodegrading in soil, signaling pathways for future mainstream deployment.

Price volatility in polypropylene and pulp hampers smaller firms with weak hedging strategies, pushing them toward contract manufacturing or specialty niches. Vertically integrated multinationals with pulp plantations and resin plants enjoy cost leverage and can experiment with hybrid stacks mixing melt-blown, spunbond and electrospun layers. Over 2025-2030, nanofiber adoption trickles down from turbo-gasoline SUVs into light commercial vans, raising the North America automotive air filters market size captured by the material from single digits to mid-teens by decade's end.

Cabin filters already control 55.10% of revenue. They are fighting engine-intake filters for every incremental dollar, a rare instance where a comfort feature outranks a drivetrain component in the North America automotive air filters market. Cabin units grow 7.50% CAGR, boosted by wildfire smoke, pandemics, and HEPA positioning. Engine filters remain essential for sold internal-combustion vehicles but confront longer service intervals and gradual volume attrition as BEVs scale. Research from the U.S. Department of Energy sets energy factors for air cleaners, indirectly nudging automotive engineers toward higher CADR (clean air delivery rate) targets. Automotive cabins copy home-air-purifier marketing language: multi-layer particulate-carbon-antimicrobial stacks, smartphone-controlled recirculation, and LED life indicators. Suppliers differentiate by impregnating activated carbon with copper or silver ions, promising viral inactivation within minutes, a claim validated by ISO 18184 tests. This technology shift cements cabin filters as the North America automotive air filter market's economic growth engine.

Despite the glamour around HEPA, mass-market vehicles continue to ship with particulate-only cabin filters that comply with cost ceilings. The aftermarket fills the gap: 30% of replacement cabin filters sold online in 2025 carry carbon or HEPA upgrades. As a result, distributors watch average selling price climb while the volume mix changes, improving margin contribution even as BEVs delete engine filters.

The North America Automotive Air Filters Market is Segmented by Material Type (Paper / Cellulose, Synthetic Gauze / Cotton, and More), Filter Type (Intake Filters and Cabin Filters), by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEMs and Aftermarket) and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Mann+Hummel

- Donaldson Company

- Purolator Filters LLC

- K&N Engineering

- AIRAID (Truck Hero)

- S&B Filters Inc.

- Mahle GmbH

- Bosch Automotive Aftermarket

- Denso Corporation

- Cummins Filtration

- Fram Group

- Clarcor (Part of Parker-Hannifin)

- ACDelco (GM)

- AFE Power

- Wix Filters

- Sogefi Group

- H&V (Engineered Media)

- Roki Co., Ltd.

- Champion Laboratories

- Luber-finer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter U.S.-Canada PM & NOx emission norms (EPA Tier-3, CARB LEV III)

- 4.2.2 Rapid cabin-air quality awareness post-wildfire seasons

- 4.2.3 Ageing light-vehicle parc greater than 12.5 yrs fueling aftermarket volumes

- 4.2.4 EV/HV platforms adopting dedicated HEPA cabin filters

- 4.2.5 Integration of IoT-enabled smart filters with predictive replacement apps

- 4.2.6 OEM shift toward low-restriction nanofiber engine media for turbo-gasoline SUVs

- 4.3 Market Restraints

- 4.3.1 Long-life washable cotton gauze filters cannibalising replacements

- 4.3.2 BEV adoption eliminating engine-intake filter demand by ~2035

- 4.3.3 Polypropylene & cellulose pulp price volatility squeezing margins

- 4.3.4 Proliferation of counterfeit e-commerce filters undermining branded share

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Material Type

- 5.1.1 Paper/Cellulose

- 5.1.2 Synthetic Gauze/Cotton

- 5.1.3 Foam

- 5.1.4 Nanofiber Composite

- 5.1.5 Others (Activated Carbon, Metal Mesh)

- 5.2 By Filter Type

- 5.2.1 Intake (Engine) Air Filters

- 5.2.2 Cabin Air Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles (LCV)

- 5.3.3 Medium and Heavy Commercial Vehicles (MHCV)

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.4.2.1 Independent Aftermarket

- 5.4.2.2 Authorized Service Centers

- 5.4.2.3 Online Retail

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mann+Hummel

- 6.4.2 Donaldson Company

- 6.4.3 Purolator Filters LLC

- 6.4.4 K&N Engineering

- 6.4.5 AIRAID (Truck Hero)

- 6.4.6 S&B Filters Inc.

- 6.4.7 Mahle GmbH

- 6.4.8 Bosch Automotive Aftermarket

- 6.4.9 Denso Corporation

- 6.4.10 Cummins Filtration

- 6.4.11 Fram Group

- 6.4.12 Clarcor (Part of Parker-Hannifin)

- 6.4.13 ACDelco (GM)

- 6.4.14 AFE Power

- 6.4.15 Wix Filters

- 6.4.16 Sogefi Group

- 6.4.17 H&V (Engineered Media)

- 6.4.18 Roki Co., Ltd.

- 6.4.19 Champion Laboratories

- 6.4.20 Luber-finer

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment