PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836484

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836484

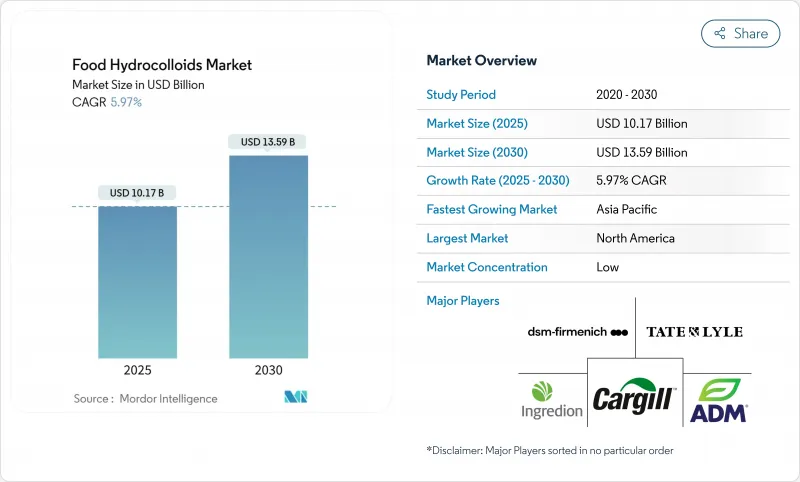

Food Hydrocolloids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The food hydrocolloids market stands at USD 10.17 billion in 2025, projected to reach USD 13.59 billion by 2030, representing a CAGR of 5.97%.

This growth trajectory reflects the industry's pivot toward clean label formulations and functional food applications, driven by consumer demand for transparent ingredient lists and enhanced nutritional profiles. The market's expansion is particularly pronounced in applications requiring sophisticated texture modification and stabilization properties, positioning hydrocolloids as essential enablers of next-generation food innovation. The increasing demand for processed and convenience food products is likely to present opportunities for the studied market during the forecast period. Moreover, over the short term, growing demand in the food and beverage industry and increased research and development, and innovations in hydrocolloids are expected to drive the market's growth.

Global Food Hydrocolloids Market Trends and Insights

Expanding Use of Hydrocolloid as Thickening and Gelling Agents in Processed Foods

The proliferation of hydrocolloids in processed food applications stems from manufacturers' need to achieve consistent texture profiles while extending shelf life and reducing production costs. Food processors increasingly recognize that hydrocolloids enable reformulation strategies that maintain sensory appeal while reducing fat, sugar, or sodium content without compromising consumer acceptance. The USDA's technical evaluation of seven key gums highlights their unique functional properties, with xanthan gum providing exceptional rheological characteristics and guar gum offering superior thickening efficiency. This functional versatility positions hydrocolloids as essential tools for meeting regulatory requirements and consumer health trends simultaneously. The trend accelerates as food manufacturers seek to differentiate products through texture innovation while maintaining cost competitiveness in increasingly crowded market segments. Processing efficiency gains from hydrocolloid integration often offset initial ingredient cost premiums through reduced waste and improved production consistency.

Rising Demand for Clean Label Ingredients in Food Manufacturing

Clean label considerations are increasingly influencing hydrocolloid selection, as manufacturers shift focus from purely functional attributes to consumer trust and ingredient transparency. This has accelerated the replacement of synthetic stabilizers with naturally derived alternatives such as acacia gum, gellan gum, and pectin, even when reformulation is necessary to preserve performance. According to data from CBI, the Ministry of Foreign Affairs, clean-label products are expected to account for over 70% of product portfolios by 2025-2026, up from 52% in 2021 . Beyond formulation, clean label positioning supports premium pricing models, enabling companies to justify higher input costs. As a result, hydrocolloids are now viewed as strategic tools for brand differentiation, favoring suppliers that offer verified natural sourcing, transparent production practices, and consistent technical reliability.

Health Concerns Regarding Overconsumption of Thickening Agent

Regulatory scrutiny of hydrocolloid consumption levels intensifies as usage expands across food categories, with health authorities evaluating potential cumulative exposure effects from multiple dietary sources. Consumer awareness of ingredient functionality drives questions about the necessity and safety of multiple thickening agents in processed foods, creating pressure for manufacturers to justify usage levels and explore reduction strategies. The challenge becomes more complex as clean label trends encourage natural hydrocolloid adoption, yet natural origin does not automatically eliminate health concerns related to overconsumption. Industry response focuses on developing more efficient hydrocolloids that achieve desired functional effects at lower usage rates, reducing overall exposure while maintaining product performance. Regulatory agencies increasingly require comprehensive exposure assessments that account for cumulative intake across all food sources rather than evaluating individual applications in isolation.

Other drivers and restraints analyzed in the detailed report include:

- Increase in Demand for Stabilizers in Dairy and Beverage Applications

- Amplifying Use of Xanthan Gum in Gluten Free and Low-Carb Baking

- Complex and Cost-Intensive Processing of Hydrocolloids

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gelatin commands 22.30% market share in 2024, reflecting its established position across pharmaceutical capsules, confectionery applications, and traditional food preparations where its unique thermoreversible gel properties remain unmatched. However, pectin emerges as the fastest-growing segment at 6.79% CAGR through 2030, driven by expanding applications beyond traditional jam and jelly uses into functional food formulations and clean label initiatives. Carrageenan maintains a significant presence in dairy applications despite supply chain challenges from key producing regions, while xanthan gum benefits from growing gluten-free and low-carb product segments. Agar applications expand in plant-based alternatives where its vegetarian credentials align with consumer preferences, though production remains concentrated in Asian markets with limited geographic diversification.

Locust bean gum and guar gum face price volatility from agricultural supply variations, creating opportunities for synthetic and microbial alternatives that offer more predictable cost structures. The USDA's evaluation of gum functionalities highlights how each type serves distinct technical requirements, with gellan gum forming thermoreversible gels and tragacanth gum providing acid resistance properties. Innovation focuses on developing hybrid formulations that combine multiple hydrocolloid types to achieve specific functional profiles while optimizing cost and regulatory compliance across global markets.

Powder formulations dominate with 71.44% market share in 2024, benefiting from extended shelf life, reduced transportation costs, and simplified inventory management for food manufacturers. The powder format's stability advantages become particularly important for global supply chains where temperature and humidity variations can compromise product integrity. However, liquid hydrocolloids accelerate at 6.54% CAGR through 2030 as manufacturers seek processing efficiency gains and reduced mixing time in high-volume production environments. Liquid formulations eliminate dust handling concerns and provide more consistent dispersion characteristics, particularly valuable in automated production systems where precise dosing is critical.

Processing equipment investments increasingly favor liquid handling systems that reduce labor requirements and improve workplace safety by eliminating powder inhalation risks. The liquid format enables pre-blended hydrocolloid solutions that combine multiple functional ingredients, simplifying formulation complexity for end users while creating value-added opportunities for suppliers. Cost considerations favor powder forms for smaller manufacturers and specialty applications where volume economics do not justify liquid handling infrastructure investments. Innovation in powder technology focuses on improving dispersibility and reducing agglomeration tendencies that can compromise product quality in challenging processing environments.

The Food Hydrocolloid Market Report is Segmented by Type (Alginate, Agar, Pectin, Guar Gum, and More), Form (Powder and Liquid), Source (Botanical, Microbial, Animal, and Synthetic), Application (Dairy and Desserts, Bakery and Confectionery, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 33.45% market share in 2024, supported by advanced food processing infrastructure and comprehensive regulatory frameworks. The region's growth through 2030 is driven by established food manufacturers focusing on clean label reformulations and functional ingredients. Consumers' readiness to pay higher prices for transparent and health-focused products creates opportunities for hydrocolloid applications, especially in organic and natural segments. The FDA's manufacturing guidelines provide regulatory clarity that enables innovation while maintaining safety standards. The region's technical capabilities and distribution networks facilitate quick adoption of new hydrocolloid technologies, making North America central to premium applications despite market maturity.

Asia-Pacific demonstrates the highest growth rate at 6.55% CAGR through 2030, propelled by middle-class expansion, urbanization, and government support for food processing advancement. The region benefits from major producing countries like Indonesia and the Philippines, while experiencing increased demand from evolving consumer preferences and food industry growth. Indonesia's seaweed industry developments focus on value-added processing, indicating a shift from raw material supply to processed hydrocolloid production. China and India emerge as key growth markets, with their expanding food processing sectors and changing consumer preferences driving hydrocolloid demand across food categories.

European markets focus on regulatory adherence and sustainability, with growth linked to clean label demands and environmental awareness. The EFSA's food additive re-evaluation program sets international benchmarks while ensuring market confidence in hydrocolloid safety. European purchasers demand sustainability certifications and traceability, creating opportunities for suppliers demonstrating responsible practices . South American and Middle Eastern markets show growth potential through developing food processing industries and shifting consumer preferences, though success requires investment in technical support and regulatory knowledge to address varied regulations and establish distribution networks.

- Cargill Inc.

- Ingredion Inc.

- Kimica Corporation

- International Flavors and Fragrances Inc.

- Archer Daniels Midland Company

- Ashland Global

- Tate & Lyle plc

- Kerry Group

- DSM-Firmenich

- Givaudan SA

- Fufeng Group

- Nexira

- Roquette Freres

- Riken Vitamin Co.

- Lucid Colloids

- BASF SE

- Deosen Biochemical

- Jungbunzlauer

- Darling Ingredients Inc.

- J.F. Hydrocolloids

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Use of Hydrocolliod as Thickening and Geling Agents in Processed Foods

- 4.2.2 Rising Demand for Clean Label Ingredinets in Food Manufacturing

- 4.2.3 Increase in Demand for Stabilizers in Dairy and Beverage Applications

- 4.2.4 Amplifying Use of Xanthan Gum in Gluten Free and Low-Carb Baking

- 4.2.5 Surging Demand For Hydrocolloids in Meat and Meat Products as Moisture Retainers

- 4.2.6 Accelerating Demand for Smooth and Creamy Food Textures Drives Market Growth

- 4.3 Market Restraints

- 4.3.1 Health Concerns Regarding Overconsumption of Thickening Agent

- 4.3.2 Complex and Cost-Intensive Processing of Hydrocolliods

- 4.3.3 Allergenic Potential of Plant-Based Gums

- 4.3.4 Incosistent Supply Chian For Seaweed-and Algae-Based Hydrocolloids

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Alginate

- 5.1.2 Agar

- 5.1.3 Pectin

- 5.1.4 Guar Gum

- 5.1.5 Locust Bean Gum

- 5.1.6 Gum Arabic

- 5.1.7 Gelatin

- 5.1.8 Carrageenan

- 5.1.9 Xanthan Gum

- 5.1.10 Other Hydrocolloids

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Source

- 5.3.1 Botanical

- 5.3.2 Microbial

- 5.3.3 Animal

- 5.3.4 Synthetic

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Dairy and Desserts

- 5.4.3 Beverages

- 5.4.4 Meat and Meat Products

- 5.4.5 Soups, Sauces, and Dressings

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Ingredion Inc.

- 6.4.3 Kimica Corporation

- 6.4.4 International Flavors and Fragrances Inc.

- 6.4.5 Archer Daniels Midland Company

- 6.4.6 Ashland Global

- 6.4.7 Tate & Lyle plc

- 6.4.8 Kerry Group

- 6.4.9 DSM-Firmenich

- 6.4.10 Givaudan SA

- 6.4.11 Fufeng Group

- 6.4.12 Nexira

- 6.4.13 Roquette Freres

- 6.4.14 Riken Vitamin Co.

- 6.4.15 Lucid Colloids

- 6.4.16 BASF SE

- 6.4.17 Deosen Biochemical

- 6.4.18 Jungbunzlauer

- 6.4.19 Darling Ingredients Inc.

- 6.4.20 J.F. Hydrocolloids

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK