PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836488

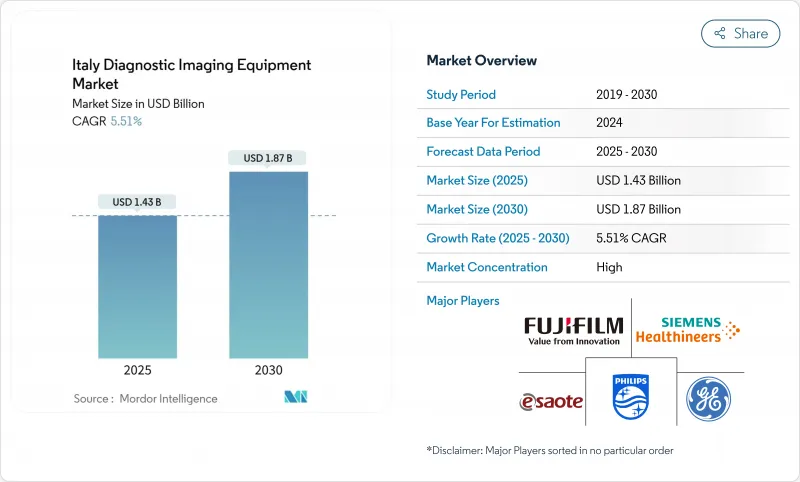

Italy Diagnostic Imaging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy diagnostic imaging equipment market size is estimated at USD 1.43 billion in 2025, and is expected to reach USD 1.87 billion by 2030, at a CAGR of 5.51% during the forecast period (2025-2030).

Capacity upgrades financed by the National Recovery and Resilience Plan (PNRR) and private-sector investments are accelerating equipment replacement cycles and digital connectivity. Demand is reinforced by population aging, the high burden of oncological and cardiovascular diseases, and progressive adoption of artificial intelligence (AI) for image interpretation. Vendors respond with photon-counting CT, open-architecture MRI, and mobile X-ray systems that shorten exam times and fit emerging point-of-care workflows. Regional convergence policies and uniform national tariffs introduced in 2025 are expected to lift procedure volumes in historically underserved Southern provinces, while the hospitality of Italy's sprawling private diagnostics network continues to attract self-pay and cross-border patients.

Italy Diagnostic Imaging Equipment Market Trends and Insights

Demographic Aging and Escalating Chronic-Disease Incidence

Citizens aged >=65 are expected to climb from 24% to 34% by 2050, driving multi-modality follow-up for cancers, heart disease, and musculoskeletal conditions. Hospital radiology departments report increasing examination complexity that favors higher-throughput CT scanners, wide-bore MRI, and iterative reconstruction software. Workflow automation and patient-comfort features gain priority as frail patients require longer positioning times. Vendors that combine low-dose protocols with rapid image reconstruction gain a competitive edge in the Italy diagnostic imaging equipment market.

Large-Scale Government & EU Recovery Funding for Healthcare Modernization

The PNRR sets aside funds to replace 3,100 legacy systems and digitalize 280 emergency departments, triggering a concentrated equipment buying cycle that benefits premium vendors able to guarantee cyber-secure interoperability. Southern hospitals receive above-average budget shares, narrowing the historic North-South technology gap. Public tenders favor systems offering AI-ready architectures, remote service diagnostics, and energy-saving standby modes, reinforcing high-spec replacements across the Italy diagnostic imaging equipment market.

High Cost of Imaging Equipment & Procedures

Out-of-pocket healthcare spending rose 10.3% in 2023, and 4.5 million citizens skipped care due to cost. Capital budgets in smaller hospitals lag behind recommended five-to-seven-year replacement cycles, suppressing demand for high-end MRI and hybrid scanners. Service contracts, software upgrades, and energy costs compound financial strain, limiting purchasing power in parts of the Italy diagnostic imaging equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technological Breakthroughs in Multimodal Imaging

- Rising Uptake of Point-of-Care, Portable and Mobile Imaging Platforms

- Lengthy Regulatory, Reimbursement and Public-Tender Procedures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

X-ray retained 30.84% share in 2024, underpinned by universal clinical use and economical operating costs. Digital radiography upgrades continue to replace film systems, securing steady replacement demand within the Italy diagnostic imaging equipment market. Advanced detectors and dose-reduction algorithms enhance image quality while easing regulatory compliance.

MRI, however, is set to grow at a 7.28% CAGR as open-bore systems reduce claustrophobia and 3 T platforms shorten scan times. Esaote's Magnifico Open drove a 3.3% sales increase in 2023. Neuro-oncology, musculoskeletal sports injuries, and cardiac viability studies widen clinical indications, elevating the MRI slice of the Italy diagnostic imaging equipment market size for hospital and private settings alike.

Fixed units held 81.79% of 2024 revenues, anchored by high-throughput CT, MRI, and angio suites that integrate with PACS and hospital information systems. PNRR budgets prioritize like-for-like replacements, ensuring short-term stability in this segment of the Italy diagnostic imaging equipment market.

Mobile and handheld devices are scaling at 6.92% CAGR. Wireless ultrasound probes and wheeled DR carts support surge capacity in ICUs and emergency departments. Their flexibility aligns with evolving care models such as hospital-at-home, expanding the Italy diagnostic imaging equipment market share for vendors that optimize weight, battery life, and image quality.

The Italy Diagnostic Imaging Equipment Market Report is Segmented by Modality (MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging (PET / SPECT), Fluoroscopy and Mammography), Portability (Fixed Systems and Mobile and Hand-Held Systems), Application (Cardiology, Oncology, Neurology, and More), and End-User (Hospitals, Diagnostic Imaging Centres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens Healthineers

- Koninklijke Philips

- GE Healthcare

- Canon

- FUJIFILM

- Esaote

- Italray

- Gilardoni SpA

- Hologic

- Carestream Health

- Agfa-Gevaert

- SAMSUNG (SamsungHealthcare.com)

- Shimadzu

- Mindray

- Bracco

- GMM Group

- Villa Sistemi Medicali Spa

- Guerbet SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demographic ageing and escalating chronic-disease incidence

- 4.2.2 Large-scale government & EU recovery funding for healthcare modernization

- 4.2.3 Rapid technological breakthroughs in multimodal imaging

- 4.2.4 Rising uptake of point-of-care, portable and mobile imaging platforms

- 4.2.5 Growing emphasis on precision, preventive and value-based care models

- 4.2.6 Expansion of private diagnostics and outpatient imaging networks

- 4.3 Market Restraints

- 4.3.1 High cost of imaging equipment & procedures

- 4.3.2 Lengthy regulatory, reimbursement and public-tender procedures

- 4.3.3 Persistent shortage of qualified radiologists and technologists

- 4.3.4 Regional disparities in imaging infrastructure utilization and access

- 4.4 Pricing Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Modality

- 5.1.1 MRI

- 5.1.2 Computed Tomography

- 5.1.3 Ultrasound

- 5.1.4 X-Ray

- 5.1.5 Nuclear Imaging (PET/SPECT)

- 5.1.6 Fluoroscopy

- 5.1.7 Mammography

- 5.2 By Portability

- 5.2.1 Fixed Systems

- 5.2.2 Mobile and Hand-held Systems

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Neurology

- 5.3.4 Orthopedics

- 5.3.5 Gastroenterology

- 5.3.6 Gynecology & Obstetrics

- 5.3.7 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Other End Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Siemens Healthineers AG

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 GE HealthCare

- 6.3.4 Canon Medical Systems Corporation

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Esaote SpA

- 6.3.7 Italray SRL

- 6.3.8 Gilardoni SpA

- 6.3.9 Hologic Inc.

- 6.3.10 Carestream Health

- 6.3.11 Agfa-Gevaert Group

- 6.3.12 SAMSUNG (SamsungHealthcare.com)

- 6.3.13 Shimadzu Corporation

- 6.3.14 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.3.15 Bracco Imaging SpA

- 6.3.16 GMM Group

- 6.3.17 Villa Sistemi Medicali Spa

- 6.3.18 Guerbet SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment