PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836489

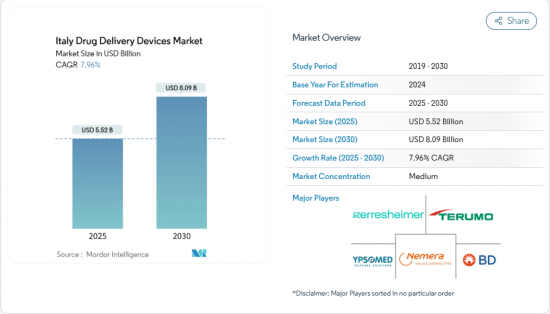

Italy Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy drug delivery devices market stood at USD 5.52 billion in 2025 and is forecast to reach USD 8.09 billion by 2030, reflecting a steady 7.96% CAGR.

Growth is anchored in the country's rapidly aging population, the high and rising prevalence of chronic diseases such as diabetes and COPD, and a policy shift that favors self-administration over hospital-based care. Regulatory streamlining by the Italian Medicines Agency (AIFA) since January 2024 has shortened approval cycles for innovative products, while investment in connected technologies is improving adherence and real-time monitoring. At the same time, specialty pharmacies and community-based distribution models are extending access beyond large hospitals, accelerating uptake across the Italy drug delivery devices market.

Italy Drug Delivery Devices Market Trends and Insights

Growing Adoption of Pre-Filled Injectable Pens

Demand for shorter 4 mm needles and 32 G gauges is rising because they lessen tissue trauma and improve adherence, a priority underscored by national guidelines from the Italian Society of Metabolism and Obesity (SIMDO). Next-generation connected pens automatically log dose data and sync to smartphone apps, closing information gaps in diabetes care. However, uptake remains uneven due to limited provider training, leaving space for targeted education and value-demonstration programs.

Expansion of Specialty Pharmacies Boosting Biologic Self-Administration

Italy's decentralized distribution approach-direct hospital supply (DD), distribution on behalf of hospitals (DPC), and affiliated channels-has widened patient access to complex biologics outside tertiary centers. Analytics models piloted during the pandemic show potential to redirect a larger drug volume through community outlets, cutting travel time and hospital bottlenecks while maintaining cost control.

Slow Reimbursement Approval

Average reimbursement time for orphan products remains 413 days, far exceeding the 100-day statutory target and slowing roll-out of advanced drug delivery devices. Regional follow-through can add between 1 day and 773 days before products reach patients, creating pronounced territorial inequity.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancement and Increasing Adoption of Smart and Connected Drug Delivery Devices

- High Burden of Chronic Diseases and Aging Population

- High Development and Manufacturing Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injectable formats generated 48.74% of Italy drug delivery devices market share in 2024 due to their established role in diabetes and autoimmune therapy regimens. Continuous refinement-such as 4 mm, 32 G insulin pen needles-improves tolerability and maintains the segment's broad user base. High-viscosity biologics are also benefiting from glass syringes engineered for superior break-resistance. In parallel, implantables are projected to post a 9.12% CAGR to 2030, marking the fastest trajectory within the Italy drug delivery devices market. Advances like 3-D printed polyvinyl alcohol matrices loaded with Rose Bengal enable sustained anticancer drug release for up to 90 days. Inhalation devices are pivoting to low-GWP propellants, while transdermal, ocular, and nasal platforms gain from novel polymers that extend residence time. Collectively, these innovations reinforce the long-term expansion of the Italy drug delivery devices market size at the modality level.

Injectables accounted for 61.22% of the Italy drug delivery devices market size in 2024, upheld by entrenched clinical protocols and the acceleration of automated insulin delivery systems that link pumps with continuous glucose monitors.Smart algorithms raise time-in-range and ease the burden of frequent dose decisions. Inhalation routes, expanding at a 8.64% CAGR, are propelled by triple combination pMDIs using the new HFA-152a propellant, which matches legacy efficacy while cutting global-warming potential by 90%. Transdermal, buccal, ocular, and nasal approaches are benefiting from micro-needle arrays and muco-adhesive gels that boost bioavailability yet face sterility and stability challenges.

Italy Drug Delivery Devices Market Report is Segmented by Device Type (Injectable Delivery Devices, Inhalation Delivery Devices, Infusion Pumps, and More), Route of Administration (Injectable, Inhalational, Transdermal Patches, Oral Mucosal and More), Application (Cancer, Cardiovascular, Diabetes and More), End User (Hospitals, Ambulatory Surgical Centers, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beckton Dickinson

- Gerresheimer

- Ypsomed

- Nemera

- Terumo

- Pfizer

- Novartis

- Roche

- Novo Nordisk

- Baxter

- Teva Pharmaceutical Industries

- Insulet

- Tandem Diabetes Care

- West Pharmaceutical Services

- AptarGroup Inc.

- B. Braun

- Owen Mumford

- Elcam Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of pre-filled injectable pens

- 4.2.2 Expansion of specialty pharmacies boosting biologic self-administration

- 4.2.3 Technological Advancement and Increasing Adoption of Smart and Connected Drug Delivery Devices

- 4.2.4 High Burden of Chronic Diseases and Aging Population

- 4.2.5 Expansion of Home-Care & Self-Administration

- 4.2.6 Supporting Reimbursement and Biosimilar Pen and Prefill Uptake

- 4.3 Market Restraints

- 4.3.1 Safety Concerns and Needlestick-injuries

- 4.3.2 Single-Use-Plastic Compliance Costs and Other Compliance Issues

- 4.3.3 High Development and Manufacturing Cost

- 4.3.4 Cultural Reluctance Toward Self-Injection Impacting Adherence

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Injectable Delivery Devices

- 5.1.2 Inhalation Delivery Devices

- 5.1.3 Infusion Pumps

- 5.1.4 Transdermal Patches

- 5.1.5 Implantable Drug Delivery Systems

- 5.1.6 Ocular Inserts & Delivery Implants

- 5.1.7 Nasal & Buccal Delivery Devices

- 5.2 By Route of Administration

- 5.2.1 Injectable

- 5.2.2 Inhalation

- 5.2.3 Transdermal

- 5.2.4 Oral Mucosal (Buccal & Sublingual)

- 5.2.5 Ocular

- 5.2.6 Nasal

- 5.3 By Application

- 5.3.1 Cancer

- 5.3.2 Cardiovascular

- 5.3.3 Diabetes

- 5.3.4 Infectious Diseases

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Home-care Settings

- 5.4.4 Other End Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BD (Becton, Dickinson and Company)

- 6.4.2 Gerresheimer AG

- 6.4.3 Ypsomed AG

- 6.4.4 Nemera

- 6.4.5 Terumo Corporation

- 6.4.6 Pfizer Inc.

- 6.4.7 Novartis AG

- 6.4.8 F. Hoffmann-La Roche Ltd

- 6.4.9 Novo Nordisk A/S

- 6.4.10 Baxter International Inc.

- 6.4.11 Teva Pharmaceutical Industries Ltd

- 6.4.12 Insulet Corporation

- 6.4.13 Tandem Diabetes Care

- 6.4.14 West Pharmaceutical Services Inc.

- 6.4.15 AptarGroup Inc.

- 6.4.16 B. Braun Melsungen AG

- 6.4.17 Owen Mumford Ltd.

- 6.4.18 Elcam Medical

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment