PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836494

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836494

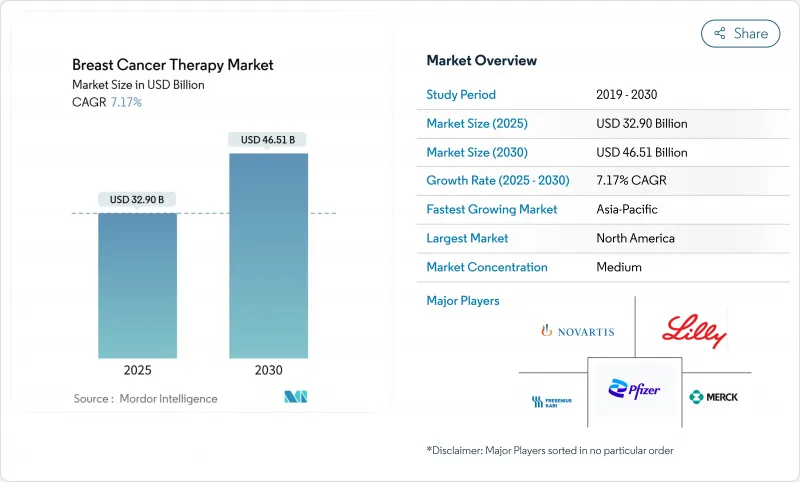

Breast Cancer Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The breast cancer therapy market stood at USD 32.90 billion in 2025 and is forecast to reach USD 46.51 billion by 2030, expanding at a 7.17% CAGR.

Consistent incidence growth, accelerated regulatory approvals and the rapid uptake of antibody-drug conjugates (ADCs) are underpinning sustained demand. Rising use of biomarker-guided treatment, earlier adoption of CDK4/6 inhibitors and payer acceptance of premium-priced targeted agents are widening the revenue base. Immunotherapy combinations are broadening treatment algorithms, while subcutaneous formulations and e-commerce channels are reshaping care delivery. Despite capacity limits for high-potency payloads and complex multi-regional approvals, strong R&D investment and AI-enabled discovery pipelines continue to reinforce the long-term outlook of the breast cancer therapy market.

Global Breast Cancer Therapy Market Trends and Insights

High Incidence & Prevalence of Breast Cancer

Breast cancer ranks as the most frequently diagnosed malignancy worldwide, driving enduring demand for therapeutics. Population ageing and lifestyle shifts are accelerating incidence, particularly in Asia-Pacific markets where urbanisation trends are evident. The MENA region expects a 50% rise in cancer cases by 2040, with breast cancer leading the increase. Earlier detection and improved survival elevate the prevalent patient pool, ensuring persistent growth for the breast cancer therapy market as healthcare systems move from reactive to proactive models.

Rising R&D Spending and Oncology Deal-Making

Record oncology investment is fuelling accelerated trials and premium valuations for differentiated mechanisms. Examples include Sanofi's Orano Med acquisition and Eli Lilly's Radionetics purchase, both designed to secure next-generation radioligand capabilities. These deals shorten timelines for smaller biotechs and create a cycle where successful launches finance further pipeline expansion, boosting the breast cancer therapy market.

Adverse Effects & Toxicity Management Costs

Complex regimens such as ADCs require intensive monitoring and supportive care, sometimes doubling total treatment expense. FDA's Project Optimus underscores the need for dose optimisation. Limited supportive infrastructure in lower-income settings dampens uptake, constraining the breast cancer therapy market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of HER2/CDK4-6 Targeted Agents

- Growing Access to Screening in Emerging Economies

- Stringent Multi-Regional Regulatory Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Targeted therapies generated 63.25% of 2024 revenue, underscoring their central role in the breast cancer therapy market. Trastuzumab deruxtecan's expansion into HER2-low disease and inavolisib's activity in PIK3CA-mutated tumours enlarge eligible cohorts. Immunotherapy, the fastest segment at a 14.25% CAGR, is propelled by checkpoint inhibitor-ADC combinations in triple-negative disease. Hormonal approaches retain relevance in HR-positive populations, whereas chemotherapy volumes contract as tolerability improves with newer modes. Radiation therapy adoption endures in adjuvant settings, strengthened by advances such as stereotactic body techniques that reduce exposure and visits. Combination regimens blending modalities are reshaping practice patterns and encourage development of companion diagnostics.

Targeted agents increasingly move into earlier lines of care, and their superior risk-benefit profile supports continued reimbursement in price-sensitive systems. Developers are leveraging AI to refine patient selection, further improving efficacy signals. The breast cancer therapy market size for targeted modalities is projected to rise steadily, reflecting robust pipelines and sustained investment.

HR+/HER2- disease accounted for 65.53% of 2024 spending in the breast cancer therapy market. Nonetheless, TNBC is expanding at a 12.35% CAGR, lifted by sacituzumab govitecan and follow-on TROP2 ADCs. HER2-positive disease retains momentum as trastuzumab deruxtecan extends to ultralow expression cohorts. The delineation of quadruple-negative subsets through molecular profiling signals further stratification ahead.

Clinical data have shifted perception of TNBC from an orphan subset to a high-value opportunity. Success breeds additional investment in antibody engineering, bispecific constructs and novel payloads. As biomarker testing becomes routine, developers will tune trial designs, supporting persistent share gains for TNBC therapies within the breast cancer therapy market.

The Breast Cancer Therapy Market Report is Segmented by Therapy (Radiation Therapy, Targeted Therapy, Hormonal Therapy, and More), Molecular Subtype (HR+ / HER2-, HER2+, and More), Disease Stage (Early and Metastatic), Route of Administration (Intravenous, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.42% of 2024 revenue to the breast cancer therapy market, reflecting rapid uptake of novel agents and broad insurance coverage. FDA initiatives such as Project Optimus influence global dosing standards. Biosimilar penetration, notably trastuzumab follow-ons, is curbing spend growth but widening access.

Asia-Pacific is forecast to grow at 12.12% CAGR, making it the prime expansion engine for the breast cancer therapy market. Health-system investment, broader screening and rising disposable incomes propel volumes in China and India. Japan demonstrates effective biosimilar incentives that drive adoption, while South Korea and Australia act as innovation test beds.

Europe's multi-payer environment tempers pricing but remains sizeable. Health technology assessment requirements elevate the importance of long-term outcomes data. Eastern European modernisation offers incremental upside. The Middle East and Africa lag in access, yet national cancer plans in Saudi Arabia signal improving availability. South America shows mixed performance; Brazil leads uptake whereas smaller economies battle affordability issues.

- Roche

- Novartis

- Pfizer

- AstraZeneca

- Eli Lilly and Company

- Bristol-Myers Squibb

- Merck

- Johnson & Johnson

- GlaxoSmithKline

- Eisai

- Teva Pharmaceutical Industries

- Fresenius

- Baxter

- Hikma Pharmaceuticals

- Celltrion Healthcare

- Viatris

- Abbvie

- Amgen

- Sanofi

- Bayer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Incidence & Prevalence Of Breast Cancer

- 4.2.2 Rising R&D Spending And Oncology Deal-Making

- 4.2.3 Rapid Uptake Of HER2 / CDK4-6 Targeted Agents

- 4.2.4 Growing Access To Screening In Emerging Economies

- 4.2.5 AI-Enabled Biomarker Discovery Fast-Tracking Pipelines

- 4.3 Market Restraints

- 4.3.1 Adverse Effects & Toxicity Management Costs

- 4.3.2 Stringent Multi-Regional Regulatory Timelines

- 4.3.3 Scarcity Of High-Potency ADC Payload Manufacturing

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapy

- 5.1.1 Radiation Therapy

- 5.1.2 Hormonal Therapy

- 5.1.3 Chemotherapy

- 5.1.4 Targeted Therapy

- 5.1.5 Immunotherapy

- 5.2 By Molecular Subtype

- 5.2.1 HR+ / HER2-

- 5.2.2 HER2+

- 5.2.3 Triple-Negative (TNBC)

- 5.2.4 Quadruple-Negative (QNBC)

- 5.3 By Disease Stage

- 5.3.1 Early / Adjuvant

- 5.3.2 Metastatic / Advanced

- 5.4 By Route of Administration

- 5.4.1 Intravenous

- 5.4.2 Sub-cutaneous

- 5.4.3 Oral

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail & Specialty Pharmacies

- 5.5.3 E-commerce

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Roche Holding AG

- 6.3.2 Novartis AG

- 6.3.3 Pfizer Inc.

- 6.3.4 AstraZeneca PLC

- 6.3.5 Eli Lilly and Company

- 6.3.6 Bristol-Myers Squibb

- 6.3.7 Merck & Co.

- 6.3.8 Johnson & Johnson (Janssen)

- 6.3.9 GSK plc

- 6.3.10 Eisai Co. Ltd

- 6.3.11 Teva Pharmaceutical

- 6.3.12 Fresenius Kabi

- 6.3.13 Baxter International

- 6.3.14 Hikma Pharmaceuticals

- 6.3.15 Celltrion Healthcare

- 6.3.16 Viatris Inc.

- 6.3.17 AbbVie Inc.

- 6.3.18 Amgen Inc.

- 6.3.19 Sanofi S.A.

- 6.3.20 Bayer AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment