PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836499

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836499

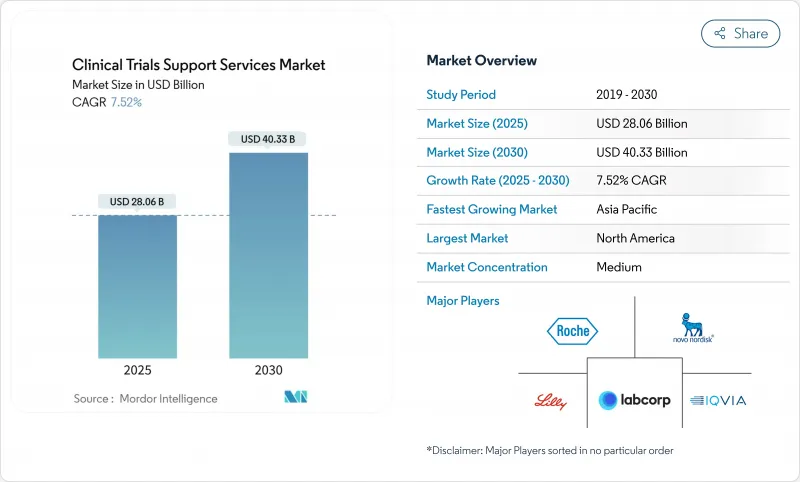

Clinical Trials Support Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The clinical trial support services market size reached USD 28.06 billion in 2025 and is forecast to climb to USD 40.33 billion by 2030 at a 7.52% CAGR.

Expansion is driven by growing R&D pipelines, rising demand for specialized outsourcing models, and wider adoption of artificial intelligence that shortens patient enrollment timelines. Sponsors are placing greater emphasis on end-to-end partners capable of harmonizing data privacy, supply-chain integrity, and real-world evidence generation. Regulatory initiatives such as the updated CONSORT 2025 guideline are increasing transparency requirements, which favors providers with integrated quality systems. Emerging-market participation is reshaping clinical operations, and a wave of acquisitions is giving larger vendors scale advantages in complex therapeutic areas such as oncology.

Global Clinical Trials Support Services Market Trends and Insights

Outsourcing Shift Among Pharma & Biotech Toward Full-Service Providers

Global drug sponsors are consolidating vendor lists to cut coordination gaps and boost accountability. Full-service partners combine protocol design, data management, and regulatory filing under a single contract, lowering cycle times and administrative overhead. Technology alliances-such as NVIDIA's collaboration with IQVIA that embeds AI models into clinical workflows-help vendors automate site identification, electronic source review, and adverse-event detection. The approach is especially valuable for oncology and rare-disease programs, where multidisciplinary expertise and continuous data review are critical. Biotech firms, managing capital constraints and accelerated timelines, increasingly rely on these integrated offerings to convert early-stage assets into pivotal studies.

Expansion of Clinical Trials Into Cost-Efficient Emerging Markets

Sponsors achieve 40-60% cost relief by shifting activities to Asia-Pacific hubs while accessing treatment-naive populations that speed recruitment. China's 3SBio secured a USD 6 billion licensing deal that demonstrates the region's growing sophistication in late-phase execution. National regulators, such as India's CDSCO, continue to streamline approvals, trimming site-initiation lead times. Nonetheless, infrastructure gaps and investigator training remain success determinants for sustained regional momentum.

Stringent Data-Privacy Regulations (GDPR, HIPAA, etc.)

Data-governance mandates add complexity and cost. A U.S. federal ruling that vacated sections of the HIPAA online-tracking guidance highlights ongoing uncertainty for digital recruitment tools. Multinational programs often divert 15-20% of budgets to compliance experts, secure hosting, and consent-management platforms. Forty-four percent of healthcare organizations struggle with data-governance reporting, amplifying the demand for specialized risk-management software.

Other drivers and restraints analyzed in the detailed report include:

- Growing R&D Expenditure in Innovative Therapeutics & Vaccines

- Demand for Complex Biologics & Personalized Medicine Trials

- Shortage of Qualified Investigators & Accredited Trial Sites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phase III commanded the largest 45.52% revenue share in 2024, reflecting its pivotal role in proving safety and efficacy to regulators. These late-stage studies often involve thousands of participants, multiple geographic regions, and stringent data-integrity checks, demanding sophisticated monitoring and real-time analytics. Sponsors increasingly integrate adaptive design elements that allow modifications without compromising statistical validity. Despite its size, Phase III cost pressures motivate companies to optimize protocol designs and leverage risk-based monitoring to reduce on-site visits.

Phase I displays the fastest 9.25% CAGR through 2030 as venture-backed biotech firms push novel modalities into first-in-human trials. Gene therapy entrants such as BlackfinBio secured Food and Drug Administration clearance for Phase 1/2 hereditary spastic paraplegia study protocols that rely on advanced viral vectors and complex dose-escalation schemes. This surge requires service partners with expertise in pharmacokinetic modeling, sentinel dosing, and intensive safety surveillance. Adaptive seamless approaches that bridge Phase I and Phase II are gaining popularity, further blurring traditional phase definitions and heightening demand for flexible, technology-ready vendors.

Patient recruitment and retention dominated with 28.53% share of the clinical trial support services market size in 2024, highlighting persistent enrollment challenges. Vendors deploy AI tools to match patients, predict dropout risk, and tailor engagement content to improve adherence metrics. Regulatory and consulting services, growing at 10.35% CAGR, address global guidance shifts such as the FDA's M13A bioequivalence framework, which deepens demand for dossier preparation and strategic advice. Providers with region-specific knowledge can accelerate approvals by aligning local documentation with international standards.

Logistics innovations also propel growth. Panasonic's VIXELL container maintains deep-frozen temperatures for ten days without power, a vital feature for mRNA and cell-therapy shipments. Integrated manufacturing and packaging arrangements help sponsors mitigate supply-chain risks and ensure investigational product integrity across continents. Advanced bio-analytical labs expand assay offerings to accommodate companion diagnostics and multi-omics endpoints, strengthening end-to-end service propositions.

The Clinical Trial Support Services Market Report is Segmented by Phase (Phase I, Phase II, and More), Service Types (Clinical Trial Site Management, Patient Recruitment & Retention, and More), End User (Pharmaceutical Companies, Biotechnology Companies, and More), Therapeutic Area (Oncology, Cardiology, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific is advancing at an 11.62% CAGR and is set to overtake traditional hubs by the end of the decade. Government incentives, large treatment-naive populations, and faster ethics approval processes attract first-in-human studies that previously defaulted to Western sites. Countries such as China build high-throughput phase-I units capable of managing complex biologics, and technology firms in Japan deliver tailored AI agents that reduce data-entry workloads for investigators.

North America still accounts for the largest 38.82% clinical trial support services market share, supported by the Food and Drug Administration's structured feedback mechanisms and high investigator density. Yet the region wrestles with escalating wage inflation and burnout among site staff. Resource constraints at the FDA raise concerns that application review timelines could lengthen, potentially slowing study starts and prompting sponsors to diversify geography.

Europe is respected for rigorous scientific standards and access to specialist investigators, but General Data Protection Regulation compliance complexity and elevated energy costs pressure budgets, especially for ultra-low-temperature logistics. South America and the Middle East & Africa contribute a growing share of phase II and phase III enrollment, aided by bilingual investigators, improving infrastructure, and cost savings. Long-term success in these regions will depend on sustained investments in site accreditation, cyber-secure data platforms, and region-specific patient-engagement strategies.

- IQVIA

- LabCorp

- Thermo Fisher Scientific Inc. (PPD)

- Charles River

- ICON

- Parexel International

- Syneos Health

- MedPace

- WuXi App Tec

- SGS Life Sciences

- Clinigen Group

- Catalent

- Pfizer

- Eli Lilly and Company

- Roche

- Sanofi

- Novo Nordisk

- GlaxoSmithKline

- AstraZeneca

- Novartis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Outsourcing Shift Among Pharma & Biotech Toward Full-Service Providers

- 4.2.2 Expansion Of Clinical Trials Into Cost-Efficient Emerging Markets

- 4.2.3 Growing R&D Expenditure In Innovative Therapeutics & Vaccines

- 4.2.4 Demand For Complex Biologics & Personalized Medicine Trials

- 4.2.5 AI-Driven Patient Pre-Screening Accelerating Recruitment

- 4.2.6 Blockchain-Based Traceability For Investigational Supply Chains

- 4.3 Market Restraints

- 4.3.1 Stringent Data-Privacy Regulations (GDPR, HIPAA, Etc.)

- 4.3.2 Shortage Of Qualified Investigators & Accredited Trial Sites

- 4.3.3 Escalating Energy Costs Impacting Cold-Chain Logistics

- 4.3.4 Carbon-Footprint Scrutiny On Global Trial Logistics

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Phase

- 5.1.1 Phase I

- 5.1.2 Phase II

- 5.1.3 Phase III

- 5.1.4 Phase IV / Post-marketing

- 5.2 By Service Type

- 5.2.1 Clinical Trial Site Management

- 5.2.2 Patient Recruitment & Retention

- 5.2.3 Assay Development & Bio-analytical Testing

- 5.2.4 Contract Manufacturing & Packaging

- 5.2.5 Storage & Distribution

- 5.2.6 Regulatory & Consulting Services

- 5.2.7 Commercialization Support

- 5.2.8 Other Services

- 5.3 By End User

- 5.3.1 Pharmaceutical Companies

- 5.3.2 Biotechnology Companies

- 5.3.3 Medical Device Manufacturers

- 5.3.4 Contract Research Organizations (CROs)

- 5.3.5 Academic & Research Institutes

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Cardiology

- 5.4.3 Neurology

- 5.4.4 Infectious Diseases

- 5.4.5 Immunology & Autoimmune

- 5.4.6 Other Indications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 IQVIA Holdings Inc.

- 6.3.2 Laboratory Corporation of America Holdings (Labcorp)

- 6.3.3 Thermo Fisher Scientific Inc. (PPD)

- 6.3.4 Charles River Laboratories International Inc.

- 6.3.5 ICON plc

- 6.3.6 Parexel International Corporation

- 6.3.7 Syneos Health

- 6.3.8 Medpace Holdings Inc.

- 6.3.9 WuXi AppTec

- 6.3.10 SGS Life Sciences

- 6.3.11 Clinigen Group plc

- 6.3.12 Catalent Inc.

- 6.3.13 Pfizer Inc.

- 6.3.14 Eli Lilly and Company

- 6.3.15 F. Hoffmann-La Roche Ltd

- 6.3.16 Sanofi S.A.

- 6.3.17 Novo Nordisk A/S

- 6.3.18 GSK plc

- 6.3.19 AstraZeneca plc

- 6.3.20 Novartis AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment