PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836502

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836502

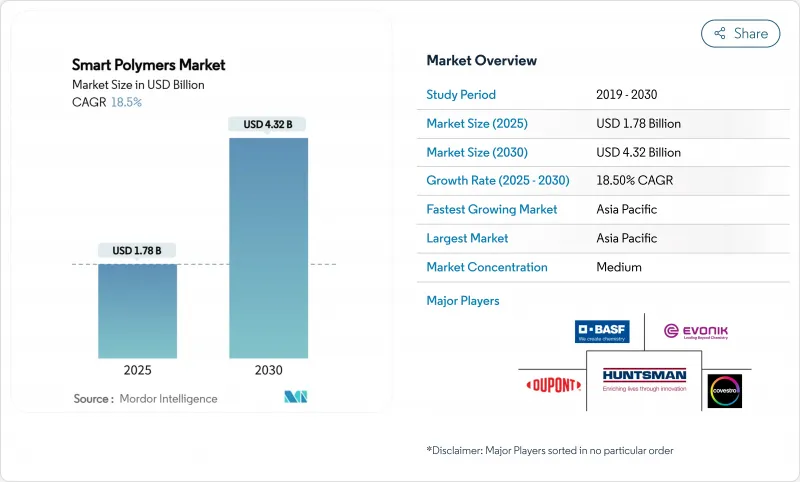

Smart Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Smart Polymers Market size is estimated at USD 1.78 billion in 2025, and is expected to reach USD 4.32 billion by 2030, at a CAGR of 18.5% during the forecast period (2025-2030).

Momentum comes from rapid breakthroughs in materials chemistry, surging demand for minimally invasive healthcare solutions, and the accelerating replacement of passive plastics with responsive polymers in consumer electronics, textiles, and mobility. Asia-Pacific's strong manufacturing base and government-backed research and development spending in China, Japan, and South Korea position the region as the primary production and consumption hub. Suppliers are diversifying product portfolios from single-trigger to multi-trigger systems to meet industry calls for tunable stiffness, autonomous healing, and embedded conductivity. Concurrently, capital-efficient scale-up technologies-continuous flow reactors, precision extrusion, and AI-guided formulation are narrowing the cost gap with conventional engineering plastics, widening adoption prospects in value-conscious sectors such as packaging and apparel.

Global Smart Polymers Market Trends and Insights

Increasing Application of Shape-Memory Polymers in the Textile Industry

Textile producers are embedding shape-memory polymers (SMPs) into fibers that actively regulate comfort by contracting or relaxing with temperature changes. Athleisure brands now specify SMP-blended yarns that wick moisture in high-heat conditions and tighten weave density when ambient temperatures fall, maintaining a stable microclimate around the wearer. SRTX Labs demonstrated ballistic-grade SMPs re-engineered for knits that are 10 times stronger than steel and lighter than water, integrating antimicrobial functionality without topical coatings. Universities are coupling SMP substrates with flexible sensor threads; a University of British Columbia team printed low-cost piezoresistive arrays that capture gait dynamics and vital signs, turning hoodies and compression sleeves into medical devices.

Self-Healing Coatings Demand

Electronics, automotive, and industrial OEMs are shifting from manual repainting and over-engineering toward coatings that autonomously repair scratches, micro-cracks, and pinholes. A landmark study by Cicoira produced PEDOT: PSS films doped with ethylene glycol and tannic acid that recover electrical integrity after 90% tensile strain, sustaining conductivity near 17 S cm-1 even after repeated cuts. The formulation adheres to metals, polyolefins, and thermoplastic polyurethanes, opening pathways in conformal sensors, flexible batteries, and corrosion-resistant architectural panels.

High Production Cost and Scale-up Complexity

Laboratory batches rely on precision catalysts, cryogenic feeds, and multi-step purification. When scaled to tonne-level reactors, viscosity changes and side reactions hamper reproducibility, inflating unit costs beyond engineering polymers. Continuous-flow synthesis and reactive-extrusion lines promise cost compression, yet capital intensity remains high for SMEs, slowing entry into low-margin packaging and footwear markets.

Other drivers and restraints analyzed in the detailed report include:

- Wearable-Electronics Boom in Asia

- EU Lightweight-Composites Mandates in Automotive

- Regulatory Uncertainty for Clinical Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Though smaller in revenue today, the biological stimuli-responsive category is accelerating with a 22.7% CAGR as drug-delivery specialists exploit enzyme, glucose, and antigen triggers for targeted release. Physical stimuli-responsive grades still dominate 41% of the Smart Polymers market share, anchored by shape-memory alloys and thermochromic coatings specified in aerospace fairings and smart windows.

Researchers are merging pH and redox sensitivity into a single polymer backbone, enabling localized chemotherapeutic release only in the tumor micro-environment, reducing systemic toxicity. Hybrid platforms employ imprinted recognition sites that emulate antibodies yet withstand sterilization cycles. Such customizability is attracting diagnostics firms that embed these polymers into point-of-care biosensors.

The Smart Polymers Market Report Segments the Industry by Type (Physical Stimuli-Responsive, Chemical Stimuli-Responsive, Biological Stimuli-Responsive, Self-Healing Polymers, and Others), End-User Industry (Biomedical and Healthcare, Electrical and Electronics, Textile, Automotive, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific leads with 35% of Smart Polymers market revenue and exhibits the fastest regional growth at 19.6% CAGR. China's "Made in China 2025" program earmarks responsive materials as a strategic pillar, granting tax rebates for domestic production lines. Japanese conglomerates scale ionomer-based SEBS blends for haptic feedback actuators in gaming suits, while South Korean electronics giants co-develop stretchable circuit inks for foldable displays.

North America is backed by NIH and DARPA grants, funding bioresorbable stents and smart sutures. Collaborative clusters around Boston and the San Francisco Bay Area pair medical-device start-ups with contract manufacturing organizations that specialize in GMP-grade smart polymer extrusion.

Europe enforces stringent sustainability directives, catalyzing demand for recyclable and biodegradable grades. Horizon Europe projects sponsor bio-based thermoplastic elastomers designed for closed-loop recovery, aligning with automotive OEM decarbonization targets.

South America and MEA markets remain nascent, yet Brazil's orthopedic-implant makers and the UAE's smart-city initiatives are early adopters of moisture-responsive sealants and temperature-modulating facade panels.

- BASF

- Covestro AG

- Dow

- DuPont

- Evonik Industries, AG

- Huntsman International LLC

- Mitsubishi Chemical Group Corporation

- SABIC

- SMP Technologies Inc

- Spintech Holdings Inc.

- The Lubrizol Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Application of Shape Memory Polymer in Textile Industry

- 4.2.2 Self-Healing Coatings Demand

- 4.2.3 Wearable-Electronics Boom Accelerating Conductive Smart Polymers (Asia)

- 4.2.4 EU Lightweight-Composites Mandates in Automotive

- 4.2.5 4-D Printing Adoption in Aerospace by NASA and ESA

- 4.3 Market Restraints

- 4.3.1 High Production Cost and Scale-up Complexity

- 4.3.2 Regulatory Uncertainty for Clinical Approvals

- 4.3.3 Lack of Recycling Pathways for Multi-Component Smart Polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Physical Stimuli-Responsive

- 5.1.2 Chemical Stimuli-Responsive

- 5.1.3 Biological Stimuli-Responsive

- 5.1.4 Self-Healing Polymers

- 5.1.5 Other Smart Polymer Types

- 5.2 By End-User Industry

- 5.2.1 Biomedical and Healthcare

- 5.2.2 Electrical and Electronics

- 5.2.3 Textile

- 5.2.4 Automotive

- 5.2.5 Other Industries (Energy and Power, Packaging, Oil and Gas, Construction)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 DuPont

- 6.4.5 Evonik Industries, AG

- 6.4.6 Huntsman International LLC

- 6.4.7 Mitsubishi Chemical Group Corporation

- 6.4.8 SABIC

- 6.4.9 SMP Technologies Inc

- 6.4.10 Spintech Holdings Inc.

- 6.4.11 The Lubrizol Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment