PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836504

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836504

Maritime Patrol Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

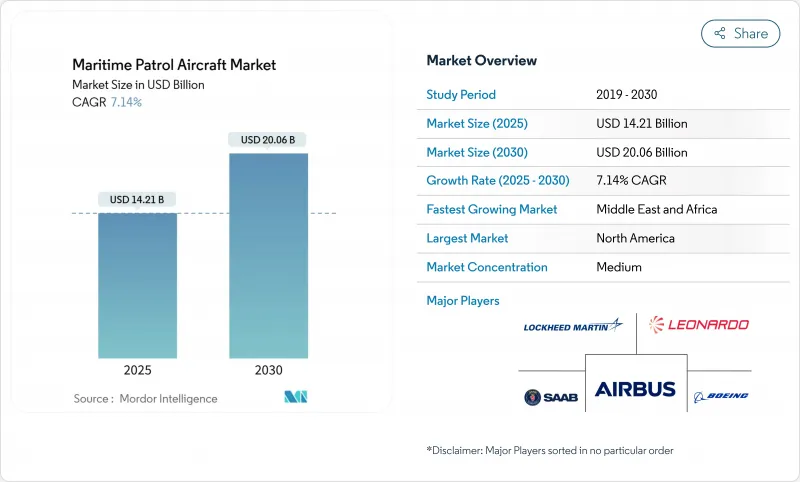

The maritime patrol aircraft market size reached USD 14.21 billion in 2025 and is forecasted to expand at a 7.14% CAGR, achieving USD 20.06 billion by 2030.

Growing submarine activity, rising blue-economy enforcement, and the shift toward manned-unmanned teaming underpin sustained demand. Fleet-replacement cycles for Cold War-era aircraft continue to generate large, multi-year procurement pipelines, while cost pressures are accelerating interest in modular sensor pods and hybrid-electric propulsion. North America maintains leadership on the back of the US Navy's P-8A program and allied standardization. Yet, the Middle East and Africa show the fastest growth as coastal states fund new maritime-security missions. Supply-chain bottlenecks in specialized sonobuoys and export-control limits on advanced radars remain structural constraints that could alter competitive dynamics over the decade.

Global Maritime Patrol Aircraft Market Trends and Insights

Escalating Long-Range Anti-Submarine Warfare Requirements

Renewed submarine build-ups by China and Russia compelled navies to prioritise platforms with 11-plus-hour endurance, multistatic sonar processing, and extended sensor fusion. The US Navy completed P-8A Increment 3 Block 2 upgrades in 2025 to meet these requirements. Germany's order of 8 P-8As and Japan's record JPY 7.95 trillion (USD 54.70 billion) defence budget underline the shift from coastal to blue-water ASW. Indo-Pacific nations with expansive EEZs see persistent surveillance as essential for deterring undersea incursions that legacy P-3 fleets cannot counter.

Replacement of Ageing P-3/P-8 Fleets with Multi-Mission Platforms

More than 600 veteran Orion aircraft across 20 countries are nearing retirement, positioning fleet renewal as the largest modernisation wave in maritime aviation history. South Korea accelerated its transition to P-8A after a 2025 P-3 crash, illustrating how safety events compress replacement timelines. France's Airbus A321 MPA choice over a smaller Falcon platform signals a preference for payload-rich, multi-mission airframes. Nations lacking large defence budgets are adopting lower-cost C295 or C-130 mission kits to bridge capability gaps.

Ballooning Unit Cost Amid Low Production Volumes

Unit prices climbed as programs such as MQ-4C dropped from 70 to 27 aircraft, raising per-aircraft cost beyond USD 400 million and stressing customer budgets. Despite adopting an efficiency-focused production system, Boeing faces similar diseconomies while scaling P-8A output to 1.5 jets per month. RAND analysis shows that each 10% uptick in annual volume can trim about 3% from flyaway cost, underscoring the affordability challenge small-batch buyers endure. Rising complexity in sensor suites magnifies this price curve, creating difficult trade-offs for nations with constrained defence spending.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Unmanned "Loyal-Wingman" Concepts with MPAs

- Modular Sensor Pods Enabling Rapid Role Change

- Supply-Chain Chokepoints for Specialised ASW Sonobuoys

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The manned fleet retained 75.54% share of maritime patrol aircraft market revenue in 2024, anchored by the P-8A Poseidon and Japan's P-1, both suited for complex, crew-intensive missions. However, unmanned platforms post a 10.25% CAGR and will steadily erode manned dominance as AI-enabled autonomy matures. Loyal-wingman trials confirm operational viability, and the US Navy's strong interest in MQ-28 insertion aboard carriers illustrates strategic commitment to mixed fleets.

Cost efficiency, endurance beyond crew limits, and lower risk in contested zones sustain the unmanned appeal. SeaGuardian's 2024 RIMPAC debut featured sonobuoy dispense and LRASM cueing, proving that UAVs can now execute core ASW and anti-surface tasks. Hybrid architectures where a manned MPA orchestrates multiple autonomous sentinels will dominate force-design discussions through 2030.

Jet engines controlled 85.32% of revenue in 2024, yet hybrid-electric demonstrators such as DARPA's XRQ-73 achieved first flight, supporting a 12.45% CAGR for electric systems. GE Aerospace's 1-MW hybrid module for Group 3 UAVs under US Army funding showcases transition momentum.

Electric propulsion reduces acoustic signature, increases loiter time, and aligns with defence-sector carbon goals. The maritime patrol aircraft market size for hybrid-electric demonstrators is modest today, but benefits from dual civilian-military R&D paths. Turboshafts retain relevance for vertical-lift patrol craft, yet sustained electrification funding in Europe and North America hints at wider adoption after 2028.

The Maritime Patrol Aircraft Market Report is Segmented by Platform (Manned and Unmanned), Propulsion System (Jet Engine, and More), Mission Type (Anti-Submarine Warfare, Intelligence, Surveillance and Reconnaissance, Search and Rescue, and More), End User (Naval Forces, Coast Guards and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.56% of the maritime patrol aircraft market revenue in 2024, buoyed by the US Navy's USD 3.4 billion P-8A buy for Canada and Germany and the ongoing CP-140 Aurora replacement. Indigenous production capacity, established subsystem suppliers, and continuous R&D pipelines safeguard the region's leadership. Canada's participation underpins interoperability, while Mexico's prospective procurement reflects trilateral security integration. Coast Guard Force Design 2028, targeting 15,000 new personnel and next-generation ISR assets, reinforces sustained domestic demand.

Europe continues a robust modernisation cycle as NATO fleets phase out P-3 Orions. Germany's first P-8A, delivered in February 2025, marked a pivotal milestone in alliance standardisation. France's Airbus A321 MPA decision underscores the influence of industrial policy on procurement, while Spain's 16-aircraft C295 order sustains regional workshare. European sustainability policies spur investment in hybrid-electric concepts and sustainable aviation fuel trials for MPAs.

The Middle East and Africa are the fastest expanding regions at 10.54% CAGR to 2030 as Gulf states and African littoral nations strengthen maritime-security architectures. UAE completed its 5-aircraft GlobalEye program and signed a USD 190 million support contract ensuring readiness through the decade. Nigeria's 50-aircraft procurement pipeline includes patrol models that address piracy and illegal bunkering threats. Offshore energy infrastructure, rising illegal fishing, and Red Sea security tensions drive spending across the region.

Asia-Pacific demonstrates dynamic, multi-tier demand. Japan's record defence budget funds enhanced P-1 upgrades, while South Korea advances P-8A induction by 2027. India's C-295 buy for the navy and coast-guard roles exemplifies dual-service acquisition models. Australia's capital expenditure surge to AUD 6.27 billion by 2029 prioritises maritime domain awareness. Collectively, vast EEZs, contested sea lanes, and accelerating submarine activity underpin a strong regional outlook.

- The Boeing Company

- Saab AB

- Dassault Aviation SA

- Lockheed Martin Corporation

- Airbus SE

- Kawasaki Heavy Industries, Ltd.

- Leonardo S.p.A.

- Textron Inc.

- Israel Aerospace Industries Ltd.

- Diamond Aircraft Industries GmbH

- Northrop Grumman Corporation

- Hindustan Aeronautics Limited (HAL)

- Aviation Industry Corporation of China, Ltd. (AVIC)

- Bombardier Inc.

- Singapore Technologies Engineering Ltd.

- De Havilland Aircraft of Canada Limited

- Gulfstream Aerospace Corporation

- ShinMaywa Industries, Ltd.

- General Atomics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating long-range anti-submarine warfare requirements

- 4.2.2 Replacement of ageing P-3/P-8 fleets with multi-mission platforms

- 4.2.3 Integration of unmanned "loyal-wingman" concepts with MPAs

- 4.2.4 Modular sensor pods enabling rapid role change

- 4.2.5 Blue-economy monitoring mandates (IUU fishing, seabed mining)

- 4.2.6 Defence "Green-Deal" push for hybrid-electric propulsion

- 4.3 Market Restraints

- 4.3.1 Ballooning unit cost amid low production volumes

- 4.3.2 Preference shift toward maritime-surveillance drones

- 4.3.3 Supply-chain chokepoints for specialised ASW sonobuoys

- 4.3.4 Export-control barriers on next-gen AESA maritime radars

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Platform Type

- 5.1.1 Manned

- 5.1.2 Unmanned

- 5.2 By Propulsion System

- 5.2.1 Jet Engine

- 5.2.1.1 TurboFan

- 5.2.1.2 TurboProp

- 5.2.1.3 TurboShaft

- 5.2.2 Electric Propulsion

- 5.2.1 Jet Engine

- 5.3 By Mission Type

- 5.3.1 Anti-Submarine Warfare

- 5.3.2 Intelligence, Surveillance and Reconnaissance (ISR)

- 5.3.3 Search and Rescue (SAR)

- 5.3.4 Anti-Surface Warfare

- 5.3.5 Border / EEZ Patrol

- 5.4 By End User

- 5.4.1 Naval Forces

- 5.4.2 Coast Guards

- 5.4.3 Other Government Agencies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Boeing Company

- 6.4.2 Saab AB

- 6.4.3 Dassault Aviation SA

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 Airbus SE

- 6.4.6 Kawasaki Heavy Industries, Ltd.

- 6.4.7 Leonardo S.p.A.

- 6.4.8 Textron Inc.

- 6.4.9 Israel Aerospace Industries Ltd.

- 6.4.10 Diamond Aircraft Industries GmbH

- 6.4.11 Northrop Grumman Corporation

- 6.4.12 Hindustan Aeronautics Limited (HAL)

- 6.4.13 Aviation Industry Corporation of China, Ltd. (AVIC)

- 6.4.14 Bombardier Inc.

- 6.4.15 Singapore Technologies Engineering Ltd.

- 6.4.16 De Havilland Aircraft of Canada Limited

- 6.4.17 Gulfstream Aerospace Corporation

- 6.4.18 ShinMaywa Industries, Ltd.

- 6.4.19 General Atomics

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment