PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836515

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836515

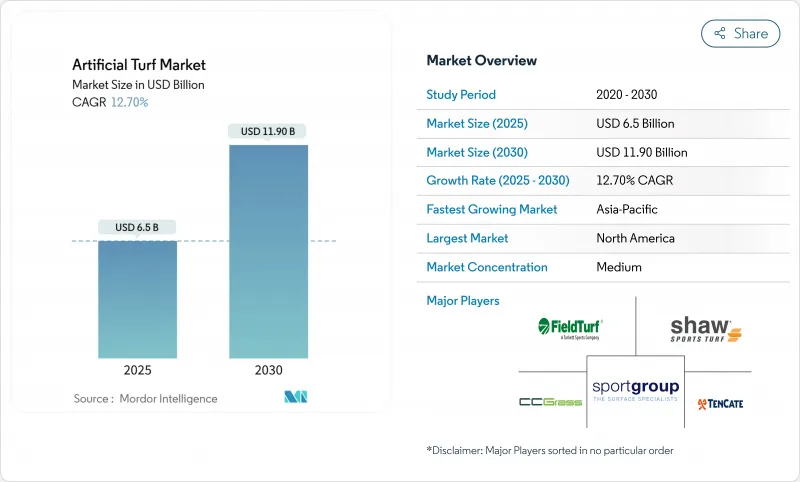

Artificial Turf - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The artificial turf market is valued at USD 6.5 billion in 2025 and is forecast to reach USD 11.9 billion by 2030, registering a 12.7% CAGR.

Heightened drought risk and mandatory water-conservation laws are shifting demand beyond sports venues into residential, commercial, and civic infrastructure. Competitive intensity remains moderate; global leaders such as Tarkett (FieldTurf) and TenCate Grass defend their share through large-scale extrusion capacity and early-stage recycling programs, while Shaw Sports Turf, CCGrass, and a growing cadre of regional specialists leverage proximity and price agility to win municipal and school contracts. Innovation now centers on low-heat fiber chemistries, PFAS-free formulations, and closed-loop recycling partnerships that address tightening EU microplastics rules and North American extended-producer-responsibility proposals. Buyers increasingly evaluate suppliers on end-of-life solutions and verified cooling performance, giving technology owners a pricing premium even as overall market fragmentation persists.

Global Artificial Turf Market Trends and Insights

Stringent Water-Conservation Mandates

California's AB 1572 and Colorado's SB 24-005 remove potable-water irrigation from nonfunctional lawns and ban new nonfunctional turf, converting discretionary upgrades into compliance obligations. Accelerated timelines strain installer capacity and pull forward replacement cycles, effectively anchoring the artificial turf market to public-policy calendars rather than team-season budgets. Municipalities in Arizona, Nevada, and parts of Australia have begun drafting parallel ordinances to safeguard dwindling aquifers.

Expanding Installation in Multi-Sport Stadia

Elite venues increasingly demand fields that can host football, soccer, and concerts within compressed scheduling windows. Mercedes-Benz Stadium's 2025 FieldTurf CORE installation and SoFi Stadium's hybrid turf pilot for the 2026 World Cup illustrate the visibility that large contracts create for next-generation systems. These specification uplifts migrate to collegiate and secondary facilities within two to three bid cycles, multiplying the revenue influence of each flagship project.

Micro- and Nano-Plastic Pollution Scrutiny

The European Chemicals Agency estimates sports pitches contribute 16,000 tons of microplastics annually, accelerating momentum for a continent-wide crumb-rubber phase-out Manufacturers must redesign infill containment and explore polymer-bound or plant-based alternatives, raising system costs by 8%-12%. Scientific studies have now confirmed nano-plastic fiber shedding under mechanical wear, strengthening arguments for tighter specification limits and extended producer responsibility schemes.

Other drivers and restraints analyzed in the detailed report include:

- Surging Residential and Commercial Landscaping Demand

- Urban Heat-Island Climate-Resilience Projects

- High Upfront Installation Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sports accounted for a 42.7% slice of the artificial turf market in 2024, anchoring recurring eight- to ten-year replacement cycles across professional and collegiate venues. Contact Sports, hockey, tennis and baseball fields pursue fiber blends that optimize ball roll and shock attenuation, reinforcing a premium tier that shields margins even when resin costs climb.

Upgrades now include heat-reflective pigments and stitched labels that log maintenance data for warranty validation. Meanwhile, the landscape cohort is advancing at a 15.3% CAGR to 2030, outpacing every sports sub-segment as municipalities pivot toward drought resilience. Commercial complexes adopt wide-roll products to cut seam labor, while playgrounds specify underlay pads that meet ASTM F1292 fall-height criteria.

The Artificial Turf Market is Segmented by Usage (Sports, Leisure, and Landscape) and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 38.2% stake underscores replacement-cycle regularity and regulatory pressure that lock in baseline demand. California's potable-water ban for nonfunctional lawns and Colorado's turf-planting moratorium create immediate compliance projects with limited scheduling flexibility. Mexico's municipal parks favor synthetics to curb rising water bills and extend play hours despite temperature spikes.

Asia-Pacific delivers the fastest growth at 14.4% CAGR through 2030, propelled by stadium construction in China and India, plus an Australian manufacturing scale that shortens supply chains. The region's freight advantage supports exports across Southeast Asia, while Japan's dense urban zones provide test beds for heat-mitigating fibers. Government grants in South Korea offset upfront costs for school pitches, accelerating penetration in primary education facilities.

Europe wrestles with environmental regulation complexity. The European ban on particulate infill forces clubs to transition to polymer-bound elastomers or mineral options, lifting system prices, but also extending service life. Wembley Stadium's zero-landfill pitch-recycling trial showcases a circular template that French Ligue 1 clubs are now evaluating for 2026 renovations.

- Tarkett (FieldTurf)

- TenCate Grass (Leonard Green & Partners, L.P.)

- Shaw Sports Turf

- CCGrass

- Sports Group (Polytan)

- Act Global (Beaulieu International Group)

- SprinTurf (Integrated Turf Solutions LLC)

- ForeverLawn

- SIS Pitches

- Victoria PLC

- Global Syn-Turf

- Lano Sports (Lano Carpets NV)

- Watershed Geo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent water-conservation mandates

- 4.2.2 Expanding installation in multi-sport stadia

- 4.2.3 Surging residential and commercial landscaping demand

- 4.2.4 Urban-heat-island climate resilience projects

- 4.2.5 Adoption of autonomous turf-laying robots

- 4.2.6 Circular turf recycling/EPR programs

- 4.3 Market Restraints

- 4.3.1 Micro and nano-plastic pollution scrutiny

- 4.3.2 High upfront installation cost

- 4.3.3 European Union ban on crumb-rubber infill

- 4.3.4 Player heat-stress litigation risk

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat from Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Usage

- 5.1.1 Sports

- 5.1.1.1 Contact Sports

- 5.1.1.2 Field Hockey

- 5.1.1.3 Tennis

- 5.1.1.4 Other Sports

- 5.1.2 Leisure

- 5.1.3 Landscape

- 5.1.1 Sports

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of Noth America

- 5.2.2 South America

- 5.2.2.1 Brazil

- 5.2.2.2 Argentina

- 5.2.2.3 Rest of South America

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Russia

- 5.2.3.7 Rest of Europe

- 5.2.4 Asia-Pacific

- 5.2.4.1 China

- 5.2.4.2 Japan

- 5.2.4.3 India

- 5.2.4.4 Australia

- 5.2.4.5 Rest of Asia-Pacific

- 5.2.5 Middle East

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Rest of Middle East

- 5.2.6 Africa

- 5.2.6.1 South Africa

- 5.2.6.2 Rest of Africa

- 5.2.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Tarkett (FieldTurf)

- 6.4.2 TenCate Grass (Leonard Green & Partners, L.P.)

- 6.4.3 Shaw Sports Turf

- 6.4.4 CCGrass

- 6.4.5 Sports Group (Polytan)

- 6.4.6 Act Global (Beaulieu International Group)

- 6.4.7 SprinTurf (Integrated Turf Solutions LLC)

- 6.4.8 ForeverLawn

- 6.4.9 SIS Pitches

- 6.4.10 Victoria PLC

- 6.4.11 Global Syn-Turf

- 6.4.12 Lano Sports (Lano Carpets NV)

- 6.4.13 Watershed Geo

7 Market Opportunities and Future Outlook