PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836519

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836519

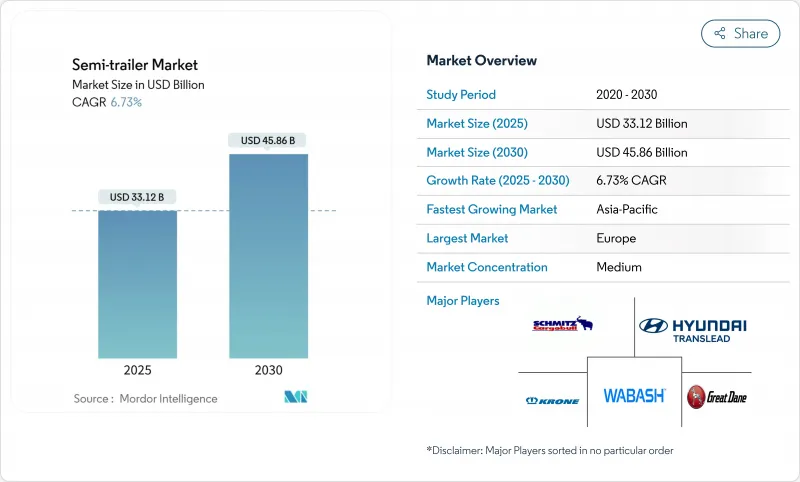

Semi-trailer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The semi-trailer market size is valued at USD 33.12 billion in 2025 and is forecast to reach USD 45.86 billion by 2030, translating into a 6.73% CAGR over the period.

Industry momentum stems from e-commerce's relentless pull on regional distribution networks, regulatory pushes for zero-emission freight, and rising investments in trailer-centric automation. Dry van units uphold volume leadership, yet refrigerated equipment sets the pace as cold-chain activity broadens. Electrified axles, advanced telematics, and aerodynamic packages increasingly shape purchase criteria, while infrastructure programs across emerging economies lift baseline fleet demand.

Global Semi-trailer Market Trends and Insights

E-commerce freight boom

Online sales growth reshapes route density and shipment size, intensifying call-off rates for versatile dry-van equipment that can service regional hubs while maneuvering in urban cores. Fleet managers add modular bodies to flex capacity for peak seasons, and telematics enable crew schedulers to avoid city-center congestion as truck delays in dense corridors exceed pre-pandemic levels . Courier and parcel operators increasingly spec high-cube trailers that maximize internal height, prompting suppliers to adopt composite panels to trim tare weight without sacrificing stiffness. Because this freight is time-critical, carriers favor equipment with predictive-maintenance sensors that flag door seal wear and wheel-end heat before failures occur. Together, these changes keep the semi-trailer market in close alignment with shifting consumer expectations for next-day delivery.

Expansion of global cold-chain logistics

Rising disposable incomes and pharmaceutical distribution push refrigerated trailer demand worldwide. Europe's cold-chain ecosystem already supports EUR 800 billion in commerce and employs over 29 million people, underscoring the structural scale of temperature-controlled freight . New Vector HE 17 refrigeration units from Carrier Transicold cut fuel burn by 30% relative to legacy systems, letting shippers meet tightening emission ceilings without sacrificing payload. Retailers and cooperative grocers such as Biocoop have pledged to electrify nearly one-third of reefer equipment by 2030, leveraging whisper-quiet operations to access night-time delivery slots.

High capex & interest-rate burden

Elevated borrowing costs delay replacement cycles, evidenced by Wabash National's 26.1% revenue drop in Q1 2025 as orders fell below fleet sustainment needs. Smaller carriers lack inexpensive credit facilities, prompting consolidation as buyers with superior capital access scoop distressed competitors. OEMs respond with extended-term leases bundled with maintenance, though higher residual-value risk inflates the overall cost of ownership, tempering near-term semi-trailer market growth.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure stimulus in emerging economies

- Electrified regenerative-axle trailers cut TCO

- Volatile steel & aluminum prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dry van platforms kept a 55.21% share of the semi-trailer market in 2024 as their universal interior fits general merchandise, palletized machinery, and packaged consumer goods. They anchor predictable replacement cycles among big-box retailers and contract carriers, sustaining steady build rates. Nevertheless, the refrigerated segment is charting a 9.14% CAGR to 2030, catalyzed by rapid grocery e-commerce and vaccine logistics. Equipment such as Carrier Transicold's all-electric Vector eCool cuts direct emissions to zero, letting operators enter low-noise downtown zones.

The semi-trailer market also sees flatbeds and lowboys ride infrastructure funding cycles, whereas tanker demand tracks chemical and fuel throughput, with regulatory oversight adding design complexity. Curtain-sider adoption remains pronounced in the EU for side-loading efficiency, though North America prioritizes full-enclosure bodies for theft deterrence. OEMs that deliver telematics-ready reefers with predictive temperature alerts differentiate in a landscape where load integrity trumps sticker price. As a result, the refrigerated category steers overall specification innovation within the semi-trailer market.

Trailers rated 25-50 ton hold 38.26% of revenues and maintain an 8.23% expansion rate, underpinned by versatility across cross-regional lanes without special permits. Operators prize these units for matching three-axle tractors and standard highway bridges, cutting toll surcharges that heavier rigs attract. The semi-trailer market size for this class is set to reach USD 20.3 billion by 2030 as shippers gravitate toward balanced payload efficiency.

Heavier 51-100 ton lowboys serve energy and construction megaprojects but hinge on cyclic commodity spending. Above-100-tonne modules remain niche, albeit critical for wind-turbine blades and refinery vessels. EU proposals to lift zero-emission truck combos to 44 tonnes could reshape demand curves, yet infrastructure cost concerns may delay full harmonization. Consequently, mid-weight platforms will continue to anchor volume in the semi-trailer market through the forecast horizon.

The Semi-Trailer Market Report is Segmented by Vehicle Type (Flat Bed, Dry Van, and More), Tonnage (Below 25 Ton, 25 Ton - 50 Ton, and More), Foot Length (28-45 Ft and Above 45 Ft), End-Use Industry (Transportation and Logistics, Food and Beverage, and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe anchored 35.22% of global revenue in 2024 as mature road networks, dense cross-border trade, and early emissions legislation stimulate rotational renewals. EU CO2 standards mandate trailer efficiency improvements of 15% by 2025 and up to 90% by 2040, channeling buyers toward aerodynamic skirts, low-rolling-resistance tires, and electrified axles. The semi-trailer market continues to benefit from synchronized rail-road combined transport, which has expanded 59% since 2010, keeping cross-border dwell times low. However, weight increases proposed for electric combinations trigger infrastructure cost debates and potential modal shifts back toward road, injecting cautious sentiment into procurement cycles.

Asia-Pacific stands out with a 7.68% CAGR, propelled by China's sustained highway build-out and India's freight-corridor rollouts. CIMC Vehicles booked 10.7 billion RMB revenue in H1 2024 and logged a 24.67% lift in semi-trailer sales under its Starlink optimization program, underscoring local production agility. India's truck-focused National Logistics Policy aims to compress logistics costs to under 10% of GDP-a change expected to swell the regional semi-trailer market by lifting asset turnover on the subcontinent. Japan's push for OEM consolidation between Hino and Mitsubishi Fuso adds competitive tension.

North America retains a solid base, buoyed by 250,000-280,000 projected Class 8 tractor sales in 2025 and a policy blueprint that targets 30% zero-emission commercial vehicle sales by 2030. PACCAR reports record USD 6.67 billion aftermarket parts turnover, signaling strong utilization of aging trailer pools. Yet prospective 25% tariffs on imported trucks could drive trailer price inflations of 9% and dent demand by 17%. South America relies heavily on road freight-Brazil moves 65% of goods by truck-while Middle East and Africa markets gain momentum as development banks funnel capital into transport corridors, altogether shaping a nuanced outlook for the semi-trailer market across global regions.

- Wabash National Corporation

- Great Dane LLC

- Hyundai Translead

- Utility Trailer Manufacturing Company

- Schmitz Cargobull AG

- Krone GmbH & Co. KG

- China International Marine Containers Co., Ltd.

- Manac Inc.

- MAC Trailer Manufacturing Inc.

- East Manufacturing Corporation

- Stoughton Trailers LLC

- Vanguard National Trailer Corp.

- Kogel Trailer GmbH

- Wielton S.A.

- Fontaine Trailer Co.

- Pitts Trailers

- Premier Trailer Mfg. Inc.

- Kassbohrer Fahrzeugwerke

- Schwarzmuller Gruppe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce freight boom

- 4.2.2 Expansion of global cold-chain logistics

- 4.2.3 Adoption of 60-ft dry-van rules in North America

- 4.2.4 Electrified regenerative-axle trailers cut TCO

- 4.2.5 Trailer telematics & real-time visibility adoption

- 4.2.6 Infrastructure stimulus in emerging economies

- 4.3 Market Restraints

- 4.3.1 High capex & interest-rate burden

- 4.3.2 Volatile steel & aluminium prices

- 4.3.3 EU weight/length regulatory limits

- 4.3.4 Sparse charging infra for electric TRUs & e-axles

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Flatbed

- 5.1.2 Dry Van

- 5.1.3 Refrigerated (Reefer)

- 5.1.4 Lowboy

- 5.1.5 Tanker

- 5.1.6 Curtain-Sider

- 5.1.7 Other Types

- 5.2 By Tonnage

- 5.2.1 Below 25 Ton

- 5.2.2 25 Ton - 50 Ton

- 5.2.3 51 Ton - 100 Ton

- 5.2.4 Above 100 Ton

- 5.3 By Foot Length

- 5.3.1 28 - 45 ft

- 5.3.2 Above 45 ft

- 5.4 By End-Use Industry

- 5.4.1 Transportation and Logistics

- 5.4.2 Food and Beverage

- 5.4.3 Construction nd Mining

- 5.4.4 Agriculture

- 5.4.5 Manufacturing and Industrial Goods

- 5.4.6 Retail and E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Wabash National Corporation

- 6.4.2 Great Dane LLC

- 6.4.3 Hyundai Translead

- 6.4.4 Utility Trailer Manufacturing Company

- 6.4.5 Schmitz Cargobull AG

- 6.4.6 Krone GmbH & Co. KG

- 6.4.7 China International Marine Containers Co., Ltd.

- 6.4.8 Manac Inc.

- 6.4.9 MAC Trailer Manufacturing Inc.

- 6.4.10 East Manufacturing Corporation

- 6.4.11 Stoughton Trailers LLC

- 6.4.12 Vanguard National Trailer Corp.

- 6.4.13 Kogel Trailer GmbH

- 6.4.14 Wielton S.A.

- 6.4.15 Fontaine Trailer Co.

- 6.4.16 Pitts Trailers

- 6.4.17 Premier Trailer Mfg. Inc.

- 6.4.18 Kassbohrer Fahrzeugwerke

- 6.4.19 Schwarzmuller Gruppe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment