PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836521

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836521

Europe Automotive Airfilters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

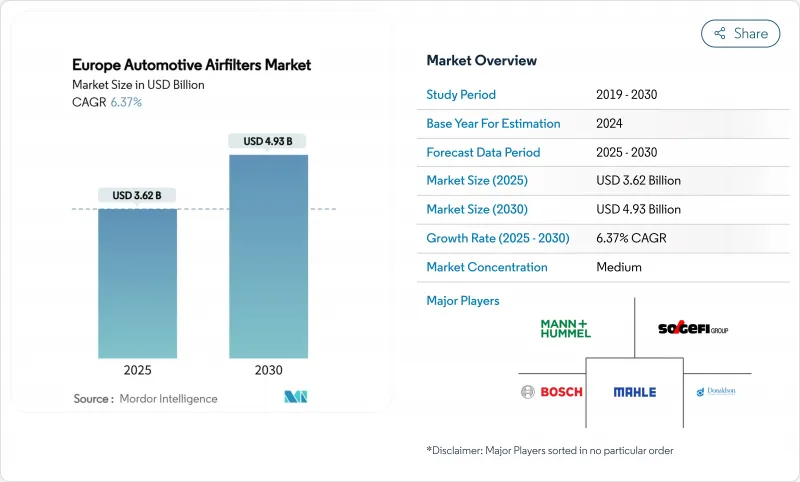

The Europe Automotive Airfilters Market size is estimated at USD 3.62 billion in 2025, and is expected to reach USD 4.93 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

Strong regulatory momentum around Euro 7, rapid expansion of city-level Low-Emission Zones, and persistent consumer health awareness anchor this expansion. Original-equipment manufacturers (OEMs) are redesigning intake and cabin filtration to meet nanometer-scale particulate limits, and independent aftermarket players are capitalizing on the continent's aging approximately 280 million-unit vehicle-parc. The Europe automotive air filters market is therefore transitioning from commodity volumes toward value-added performance, positioning filtration as a compliance-critical, consumer-visible, and telemetry-enabled component of next-generation mobility.

Europe Automotive Airfilters Market Trends and Insights

Ageing Car-Parc Expanding Independent Aftermarket Demand

Western Europe's average vehicle age reached 12 years in 2025, while Eastern European fleets stretch to 15-20 years. Older internal-combustion-engine (ICE) models require frequent intake and cabin filter swaps, and independent garages capture a considerable share of the regional aftermarket by offering competitive pricing and broad SKU coverage. Even as BEV penetration removes future intake filter demand, the residual ICE fleet guarantees long-dated volume, keeping the Europe automotive air filters market robust through at least one more full replacement cycle. Aftermarket specialists respond by widening SKU assortments for legacy platforms, introducing private-label activated-carbon cabin elements, and adopting e-commerce marketplaces to reach dispersed rural owners.

Euro 7 and Euro VI-D Emission Norms Accelerating Filter Replacement Cycles

The European Commission published Euro 7 rules in May 2024, introducing 10-nanometer particulate thresholds for gasoline vehicles and lifetime compliance for both tailpipe and non-exhaust particles. Because on-board diagnostics now monitor filter degradation, intake and cabin elements must sustain efficiency far longer than legacy, compressing real-world replacement to as low as possible in high-mileage fleets. OEM-grade suppliers therefore bundle higher-margin, multilayer elements that carry regulatory certificates and embedded RFID tags, lifting revenue per unit and reinforcing the Europe automotive air filters market as a critical compliance lever rather than a discretionary maintenance part.

BEV Adoption Shrinking Demand for Intake Engine Air-Filters

Battery-electric vehicles do not require combustion air filtration, removing entire intake filter bill-of-materials from new-vehicle demand. Germany assembled 1.35 million EVs in 2024 and is targeting 1.67 million units in 2025 under fleet-average CO2 rules, while Norway's new-car market reached majority of BEV share. The Europe automotive air filters market therefore confronts a structural volume headwind, chiefly in premium segments where electrification advances fastest. Counterbalancing growth arises in cabin filters, battery-pack cooling micro-filters, and air-drier cartridges-yet unit counts per vehicle fall on average. Medium-term revenue impact centers on high-value intake elements whose margins historically funded R&D budgets, compelling suppliers to pivot toward composite cabin and thermal-management niches.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Consumer Focus on In-Cabin Air Quality and Allergies

- OEM Drive for Ultra-Low Pressure-Drop Media to Maximize EV Range

- Vehicle Downsizing Reducing Number/Size of Filter Elements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper-based filters captured 56.17% of Europe automotive air filters market share in 2024, producing dependable airflow resistance and cost efficiency across high-volume passenger car lines. This traditional substrate underpinned Europe automotive air filters market size for decades, benefitting from mature supply chains and regional pulp processing capacity. Activated-carbon and emerging composite variants, however, are outpacing at 6.51% CAGR to 2030 as consumers demand volatile-organic-compound (VOC) adsorption and allergen neutralization within constrained cabin spaces.

OEMs are layering nanofibers atop cellulose backbones, creating hybrid sheets that trap 10-nanometer particles while holding pressure drops below 15 Pa. Gauze and foam remain niche options in performance tuning and off-highway equipment, respectively, where oil-impregnated layers or oversized pores suit dusty environments. As Euro 7 matures, paper's share erodes gradually but retains relevance due to recyclable composition and low embodied energy, ensuring coexistence rather than outright displacement inside the Europe automotive air filters market.

Cabin filters held 61.22% of the Europe automotive air filters market size in 2024, a position fortified by post-pandemic health concerns, urban smog episodes, and the marketing appeal of allergy certification. The segment grows at a 6.47% CAGR through 2030, outpacing intake filters, because replacement frequency can reach twice per year in polluted metropolitan zones. OEMs integrate filtration cartridge access behind glove boxes, simplifying do-it-yourself swaps and stimulating e-commerce sales by independent parts retailers.

Intake filters, covering the residual share, confront BEV substitution but still service Europe's large legacy ICE fleet. Turbulence in unit demand pushes suppliers to diversify toward dual-function cabin and HVAC micro-particle elements. Within EVs, cabin filter selection affects HVAC energy draw; thus, advanced low-pressure-drop designs win high-margin factory installs. Connected vehicle dashboards now alert drivers when particulate accumulation spikes, triggering timely replacements and preserving premium unit values across the Europe automotive air filters market.

The Europe Automotive Airfilters Market Report is Segmented by Material Type (Paper, Gauze, and More), Filter (Intake Filters and Cabin Filters), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MANN+HUMMEL

- MAHLE

- Sogefi

- Robert Bosch GmbH

- Donaldson

- Hengst SE

- Freudenberg Filtration Tech.

- Ahlstrom

- Cummins Inc.

- DENSO

- K&N Engineering

- Purolator Filters LLC

- Advanced Flow Engineering

- AIRAID

- S&B Filters

- AL Filters

- JS Automobiles

- Allena Group

- Wsmridhi Manufacturing

- UFI Filters

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing car-parc expanding independent aftermarket (IAM) demand

- 4.2.2 Euro 7 & Euro VI-D emission norms accelerating filter replacement cycles

- 4.2.3 Heightened consumer focus on in-cabin air quality & allergies

- 4.2.4 OEM drive for ultra-low pressure-drop media to maximise EV range

- 4.2.5 Expansion of city-level Low-Emission Zones (LEZs) across Europe

- 4.2.6 Subscription-based OTA cabin-air-quality services creating recurring filter revenue

- 4.3 Market Restraints

- 4.3.1 BEV adoption shrinking demand for intake engine air-filters

- 4.3.2 Vehicle downsizing reducing number/size of filter elements

- 4.3.3 Supply bottlenecks for specialty non-woven & activated-carbon media

- 4.3.4 Rising adoption of washable performance filters in premium segment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Material Type

- 5.1.1 Paper

- 5.1.2 Gauze

- 5.1.3 Foam

- 5.1.4 Activated-carbon / Composite

- 5.2 By Filter Type

- 5.2.1 Intake Filters

- 5.2.2 Cabin Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles & Buses

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 MANN+HUMMEL

- 6.4.2 MAHLE

- 6.4.3 Sogefi

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Donaldson

- 6.4.6 Hengst SE

- 6.4.7 Freudenberg Filtration Tech.

- 6.4.8 Ahlstrom

- 6.4.9 Cummins Inc.

- 6.4.10 DENSO

- 6.4.11 K&N Engineering

- 6.4.12 Purolator Filters LLC

- 6.4.13 Advanced Flow Engineering

- 6.4.14 AIRAID

- 6.4.15 S&B Filters

- 6.4.16 AL Filters

- 6.4.17 JS Automobiles

- 6.4.18 Allena Group

- 6.4.19 Wsmridhi Manufacturing

- 6.4.20 UFI Filters

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment