PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836524

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836524

Gene Expression Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

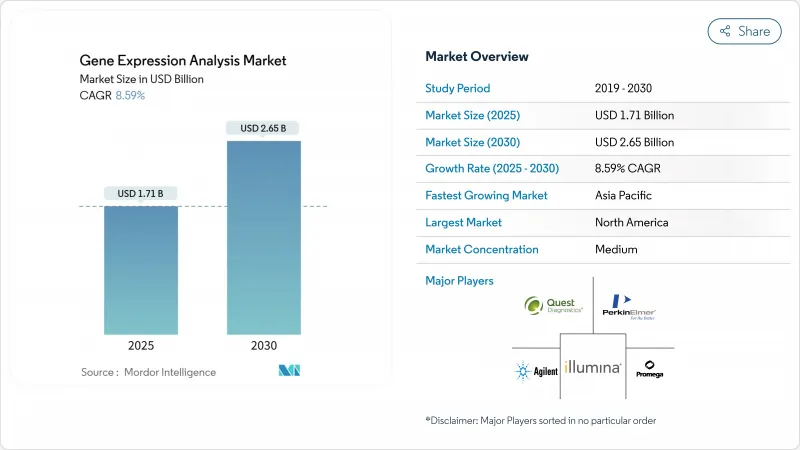

The Gene Expression Analysis Market size is estimated at USD 1.71 billion in 2025, and is expected to reach USD 2.65 billion by 2030, at a CAGR of 8.59% during the forecast period (2025-2030).

This expansion reflects the steady integration of artificial intelligence into sequencing workflows, the widening clinical use of multi-omics profiling, and supportive reimbursement and regulatory frameworks. Demand accelerates as laboratories adopt spatial biology tools that map gene activity within intact tissue, and as governments channel funding toward genomic infrastructure that links research discoveries to routine patient care. Platform suppliers respond with faster, more accurate instruments, while service providers scale cloud-based bioinformatics that lessen the skills shortage. Consolidation among reagent vendors and instrument makers intensifies price competition, yet supply chain fragility for synthetic nucleotides and data-sovereignty rules remain persistent risks to growth.

Global Gene Expression Analysis Market Trends and Insights

Rapid Technological Advancement in NGS & qPCR Platforms

Next-generation sequencing now reaches telomere-to-telomere assemblies that uncover structural variants and epigenetic marks missed by short-read systems. Oxford Nanopore's long-read instruments deliver direct RNA data without amplification steps, while AI-enhanced base-calling lowers error rates and computing needs. Integration with quantitative PCR shortens confirmatory workflows and boosts total throughput. QIAGEN's AI-powered Ingenuity Pathway Analysis converts raw reads into biological pathways that clinicians can interpret within hours. Collectively, these advances cut turnaround times and widen adoption in routine diagnostics.

Increased Government Funding for Genomics

National programs treat genomics as a competitiveness asset. The US National Institutes of Health assigned USD 27 million in 2024 to weave genomic data into learning health systems. India finished sequencing 10,000 genomes in 2025 to create population-specific references. China's Human Genome Project II proposal seeks to sequence 1% of the global population, while Australia's Genomics Health Futures Mission earmarks AUD 500.1 million over ten years. Such funding shifts the focus from discovery science to clinical deployment and sustains long-term demand for sequencing capacity.

High Capital Costs of Advanced Sequencers

Top-tier spatial biology platforms often exceed USD 1 million per unit and require extra imaging modules and high-performance computing. Smaller laboratories in Latin America, Africa, and parts of Asia delay purchases or rely on service providers, which concentrates volume among well-funded hubs. Illumina's target of USD 200 per genome remains distant, reinforcing cost barriers. Leasing agreements spread payments but increase total outlay and reduce user control over data pipelines.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Precision Medicine

- Integration of Spatial-Omics & Single-Cell Profiling

- Shortage of Skilled Bioinformaticians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The gene expression analysis market size for technology segments with quantitative PCR retaining 34.28% revenue while spatial transcriptomics registers an unmatched 15.23% CAGR. Spatial tools preserve tissue context and reveal cell-cell interactions that bulk assays mask. Next-generation sequencing remains essential in diagnostics but now integrates long-read chemistry that resolves structural variants. Digital PCR gains users who need absolute quantification, and microarrays decline yet stay relevant for targeted panels.

Spatial methods reshape discovery pipelines. Oxford Nanopore's Mk1D MinION provides bedside sequencing for infectious disease outbreaks, and its ElysION robot automates library prep. Comparative benchmarks show 10x Genomics' Chromium Fixed RNA Profiling kit outperforming peers on sensitivity, while Becton Dickinson's Rhapsody kit offers budget options. Artificial intelligence reduces run-time error correction, broadening usability. Together these trends elevate spatial biology's profile and sustain high growth inside the gene expression analysis market.

Services posted a 13.23% CAGR, the fastest within the gene expression analysis industry, as labs outsource multi-omics analytics that exceed internal capacity. Reagents and consumables still delivered 48.65% of 2024 revenue, confirming their anchoring role in daily workflows. Cloud-hosted bioinformatics attracts hospitals and pharmaceutical sponsors seeking quick turnaround without hiring data scientists. Contract research organizations expand menu offerings, including single-cell analytics, to tap this demand.

Firms pivot toward higher-margin software and services. QIAGEN expanded its Digital Insights portfolio with five planned launches while BD partnered with Biosero to link flow cytometry and robotics. Instrument growth decelerates since platform life spans now exceed five years, yet upgrades remain necessary for spatial imaging add-ons. Robotic handling lowers contamination risk and keeps batch quality consistent, which appeals to diagnostic labs scaling test volumes.

The Gene Expression Analysis Market Report Segments the Industry Into by Technology (Polymerase Chain Reaction, Quantitative PCR, and More), Product Type (Instruments, and More), Application (Oncology, and More), End-User (Pharmaceutical and Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.56% of 2024 revenue and benefits from insurance mandates that compel coverage of biomarker tests. The National Institutes of Health investment in genomics-enabled health systems steers data into clinical workflows. FDA approvals of eight cell and gene therapies in 2024 confirm regulatory acceptance and stimulate test utilization. Canada expands precision medicine programs, while Mexico channels funds toward infectious disease sequencing; yet growth moderates as the market approaches maturity.

Asia-Pacific exhibits the fastest trajectory at 11.64% CAGR, and its share of the gene expression analysis market is rising quickly. India completed the 10,000-genome project that yields a culturally relevant reference set. China's Human Genome Project II proposal underlines ambitions to sequence 1% of the global population, and Japan's Omics Browser tailors multi-omics tools to East Asian genomes. Australia's Genomics Health Futures Mission funds 88 projects despite coordination challenges. South Korea backs start-ups that combine AI and long-read sequencing.

Europe maintains steady expansion through Horizon research calls and national healthcare budgets. Robotic genomic testing at the UK's Royal Marsden hospital doubles throughput and lowers errors. Germany and France streamline reimbursement for NGS tumor panels. The Middle East and Africa explore public-private genomics centers, with Saudi Arabia signing memoranda with QIAGEN. South America records slower gains; however, Brazil and Argentina join international collaborations that give laboratories affordable access to sequencing reagents.

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Agilent Technologies

- Bio-Rad Laboratories

- Roche

- PerkinElmer

- Novogene Co., Ltd.

- Luminex

- Quest Diagnostics

- Promega

- Oxford Nanopore Technologies

- Pacific Bioscience

- Takara Bio

- BGI Genomics Co., Ltd.

- 10x Genomics

- NanoString Technologies Inc.

- Fluidigm

- Genscript

- Merck

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Technological Advancement in NGS & qPCR Platforms

- 4.2.2 Increased Government Funding for Genomics

- 4.2.3 Growing Adoption of Precision Medicine

- 4.2.4 Integration of Spatial-Omics & Single-Cell Profiling

- 4.2.5 AI-Driven Bioinformatics Pipelines

- 4.2.6 Cell & Gene-Therapy Manufacturing QC Demand

- 4.3 Market Restraints

- 4.3.1 High Capital Costs of Advanced Sequencers

- 4.3.2 Shortage of Skilled Bioinformaticians

- 4.3.3 Data-Sovereignty Regulations on Genomic Data

- 4.3.4 Reagent Supply-Chain Fragility (Synthetic Nucleotides)

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Polymerase Chain Reaction (PCR)

- 5.1.2 Quantitative PCR (qPCR)

- 5.1.3 Digital PCR (dPCR)

- 5.1.4 Next-Generation Sequencing (NGS)

- 5.1.5 Microarrays

- 5.1.6 Spatial Transcriptomics

- 5.1.7 Others

- 5.2 By Product Type

- 5.2.1 Instruments

- 5.2.2 Reagents & Consumables

- 5.2.3 Services

- 5.3 By Application

- 5.3.1 Oncology

- 5.3.2 Genetic Disease Research

- 5.3.3 Infectious Disease Diagnostics

- 5.3.4 Agriculture & Plant Genomics

- 5.3.5 Other Applications

- 5.4 By End-user

- 5.4.1 Pharmaceutical and Biotechnology Companies

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Academic & Research Centers

- 5.4.4 Contract Research Organizations (CROs)

- 5.4.5 Hospitals & Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Illumina Inc.

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 QIAGEN N.V.

- 6.3.4 Agilent Technologies

- 6.3.5 Bio-Rad Laboratories Inc.

- 6.3.6 F. Hoffmann-La Roche Ltd

- 6.3.7 PerkinElmer Inc.

- 6.3.8 Novogene Co., Ltd.

- 6.3.9 Luminex Corporation

- 6.3.10 Quest Diagnostics Incorporated

- 6.3.11 Promega Corporation

- 6.3.12 Oxford Nanopore Technologies

- 6.3.13 Pacific Biosciences of California, Inc.

- 6.3.14 Takara Bio Inc.

- 6.3.15 BGI Genomics Co., Ltd.

- 6.3.16 10x Genomics

- 6.3.17 NanoString Technologies Inc.

- 6.3.18 Fluidigm Corporation

- 6.3.19 GenScript Biotech Corporation

- 6.3.20 Merck KGaA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment