PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836527

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836527

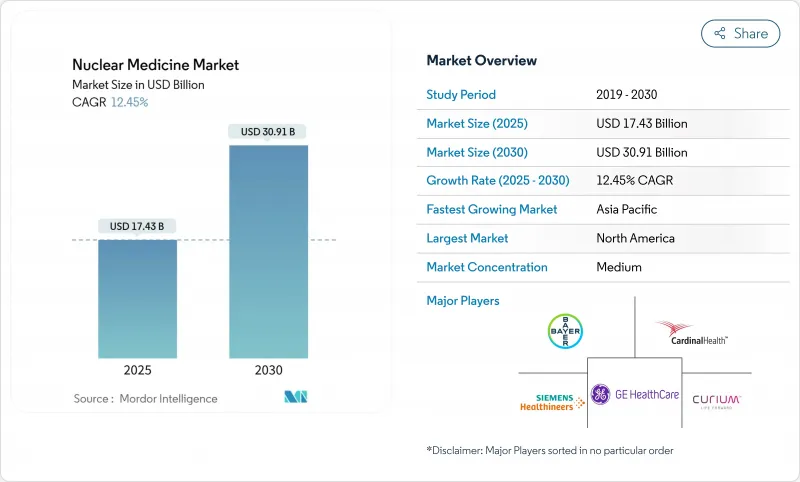

Nuclear Medicine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nuclear medicine market is valued at USD 17.43 billion in 2025 and is forecast to climb to USD 30.91 billion by 2030, expanding at a 12.15% CAGR.

Precision-oncology protocols, rapid regulatory approvals for next-generation radiopharmaceuticals, and imaging innovations that capture disease at earlier stages are the principal growth catalysts. Government initiatives that favor domestic isotope production, stronger reimbursement for high-cost tracers, and AI-enabled workflow acceleration further reinforce demand. Therapeutic radioligands are gaining momentum as lutetium-177 moves beyond prostate cancer, while diagnostics still command three-quarters of revenue thanks to technetium-99m's entrenched use in SPECT. North America retains leadership, yet Asia-Pacific is setting the growth pace on a double-digit trajectory as infrastructure investments and harmonized regulations close historical gaps. Supply-chain resilience now shapes competitive strategy, driving vertical integration and capacity expansions across the nuclear medicine market.

Global Nuclear Medicine Market Trends and Insights

Rising Burden of Targeted Diseases

Escalating prevalence of cardiovascular, oncologic, and neurological disorders is pushing clinicians toward modalities that offer molecular precision unavailable in conventional imaging. Cardiology alone represents 40.82% of procedures in 2024, yet oncology shows the fastest expansion as radioligand therapy gains evidence across metastatic indications. Pediatric clearance of lutetium Lu 177 dotatate widened the eligible population for neuroendocrine tumors, underscoring nuclear medicine's reach into rare-disease care. Ultra-high resolution PET systems now visualize sub-2 mm lesions, improving early neurological diagnoses and reinforcing the nuclear medicine market's role in complex-disease management.[2]

Growing Adoption of Targeted Radiotherapy

Radioligand therapies integrate diagnostic imaging and therapeutic dosing, reshaping cancer care pathways. The global theranostics field is projected to multiply fivefold by 2032 as alpha emitters such as actinium-225 demonstrate higher tumor-killing potency, prompting commercial production ramp-ups. Real-world data for 177Lu-PSMA-617 show 73.5% survival and clinically meaningful PSA responses, encouraging earlier-stage deployment and broadening indications. These outcomes reinforce confidence among oncologists and healthcare payers, propelling the nuclear medicine market.

Complex Multi-Agency Regulatory Approval

Radiopharmaceuticals must comply with drug, radiation, and sometimes device regulations, stretching timelines and raising costs. Europe operates nine distinct frameworks for unlicensed preparations, fragmenting access and slowing innovation. Conversely, the FDA has trimmed reporting burdens for low-risk diagnostics, spotlighting how harmonization can improve market agility.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancement in Imaging Modalities

- Shift Toward Personalized and Precision Medicines

- Short Half-Life Isotope Supply-Chain Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diagnostics generated 75.15% of revenue in 2024, supported by technetium-99m's ubiquity and well-established SPECT infrastructure. Yet therapeutics are forecast to grow at 19.78% annually, illustrating a pivot toward disease-modifying treatments. The nuclear medicine market size for therapeutics is expected to more than triple between 2025 and 2030 as prostate, neuroendocrine, and potentially renal cancers adopt radioligand regimens. FDA clearance of flurpiridaz F-18 simultaneously extends PET into stress-testing protocols, broadening diagnostic reach.

Beta emitters such as lutetium-177 dominate therapy today, but alpha emitters are entering clinical practice as capacity builds. Eckert & Ziegler's actinium-225 rollout and Curium's expanded lutetium-177 line promise to ease supply bottlenecks. Diagnostics are modernizing as total-body PET and AI report-generation penetrate routine practice, preserving their central role within the nuclear medicine market.

Technetium-99m retained 42.68% share in 2024, benefiting from decades of clinical evidence and global logistics built around its six-hour half-life. Nevertheless, lutetium-177 is advancing at a 15.37% CAGR, reflecting therapeutic momentum and emerging supply solutions such as ytterbium-176 quantum enrichment. The nuclear medicine market size for lutetium-177 therapies is set to expand as oncology indications multiply.

Fluorine-18 remains the workhorse PET isotope, leveraging cyclotron scalability and a near two-hour half-life that eases shipping. Novel isotopes like terbium-161 and lead-212 are progressing through trials, offering higher linear energy transfer or unique decay schemes that could further diversify the nuclear medicine market.

The Nuclear Medicine Market Report is Segmented by Product Type (Diagnostics[SPECT and PET], Therapeutics[alpha Emitters and More]), Radioisotope (Technetium-99m, Fluorine-18 and More), Application (Cardiology, Oncology, and More), End User (Hospital, Diagnostic Imaging Centers and More) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and More). He Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 45.99% of global revenue in 2024, supported by clear reimbursement, advanced infrastructure, and domestic manufacturing initiatives. CMS's payment separation policy in 2025 removes a key utilization barrier, while Indiana's emerging isotope hub houses new facilities from Cardinal Health, Eli Lilly, and Novartis, reinforcing supply security. First clinical doses of flurpiridaz F-18 administered in February 2025 mark a milestone that should broaden cardiac PET adoption across the nuclear medicine market.

Asia-Pacific is the fastest-growing region, expanding at 12.77% CAGR as China ramps domestic isotope programs and Japan deepens industry capacity through GE HealthCare's full acquisition of Nihon Medi-Physics. India's 300 plus centers of excellence and Australia's lead in advanced therapies further propel regional demand. Harmonized regulations and infrastructure investments are steadily reducing historic access gaps and positioning Asia-Pacific as a pivotal growth engine for the nuclear medicine market.

Europe retains a strong R&D footprint, buoyed by projects like Orano Med's lead-212 plant and Curium's new lutetium-177 site. Although national regulatory heterogeneity slows market entry, EU-funded consortia such as Thera4Care aim to streamline theranostic adoption.A 250% rise in molecular radiotherapy sessions since 2007 highlights clinical momentum despite policy complexity. These advances sustain Europe's relevance, albeit at a more measured growth pace compared with Asia-Pacific within the nuclear medicine market.

- GE Healthcare

- Cardinal Health

- Curium Pharma

- Bayer

- Siemens Healthineers

- Koninklijke Philips

- Novartis AG (AAA)

- Lantheus

- Bracco Imaging S.p.A.

- Telix Pharmaceuticals Ltd.

- Life Molecular Imaging

- NorthStar Medical Radioisotopes

- Eckert & Ziegler Radiopharma

- Jubilant Radiopharma

- Blue Earth Diagnostics

- Isotopia Molecular Imaging

- SOFIE Biosciences

- Actinium Pharmaceuticals

- IBA Molecular

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Targeted Diseases (Cardiovascular, Cancer and Neurological Disorders)

- 4.2.2 Growing Adoption of Targeted Radiotherapy

- 4.2.3 Technological Advancement in Imaging Modalities

- 4.2.4 Shift Towards Personalized and Precision Medicines

- 4.2.5 Increasing Focus of Government and Private Players in Nuclear Medicine

- 4.2.6 Adoption of Theranostics and Supportive reimbursement

- 4.3 Market Restraints

- 4.3.1 Complex Multi-Agency Regulatory Approval

- 4.3.2 Short Half-Life Isotope Supply Chain Risk

- 4.3.3 High Cost of Nuclear Medicine Procedures and Equipment

- 4.3.4 Scarcity Of Skilled Radio pharmacists

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Diagnostics

- 5.1.1.1 SPECT

- 5.1.1.2 PET

- 5.1.2 Therapeutics

- 5.1.2.1 Alpha Emitters

- 5.1.2.2 Beta Emitters

- 5.1.2.3 Brachytherapy Isotopes

- 5.1.1 Diagnostics

- 5.2 By Radioisotope

- 5.2.1 Technetium-99m

- 5.2.2 Fluorine-18

- 5.2.3 Iodine-131

- 5.2.4 Lutetium-177

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Oncology

- 5.3.2 Cardiology

- 5.3.3 Neurology

- 5.3.4 Endocrinology

- 5.3.5 Orthopedics & Pain Management

- 5.3.6 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Specialized Radiopharmacies

- 5.4.4 Research Institutes

- 5.4.5 Ambulatory Surgical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 GE HealthCare

- 6.3.2 Cardinal Health Inc.

- 6.3.3 Curium Pharma

- 6.3.4 Bayer AG

- 6.3.5 Siemens Healthineers

- 6.3.6 Koninklijke Philips N.V.

- 6.3.7 Novartis AG (AAA)

- 6.3.8 Lantheus Holdings Inc.

- 6.3.9 Bracco Imaging S.p.A.

- 6.3.10 Telix Pharmaceuticals Ltd.

- 6.3.11 Life Molecular Imaging

- 6.3.12 NorthStar Medical Radioisotopes

- 6.3.13 Eckert & Ziegler Radiopharma

- 6.3.14 Jubilant Radiopharma

- 6.3.15 Blue Earth Diagnostics

- 6.3.16 Isotopia Molecular Imaging

- 6.3.17 SOFIE Biosciences

- 6.3.18 Actinium Pharmaceuticals

- 6.3.19 IBA Molecular

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment