PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836530

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836530

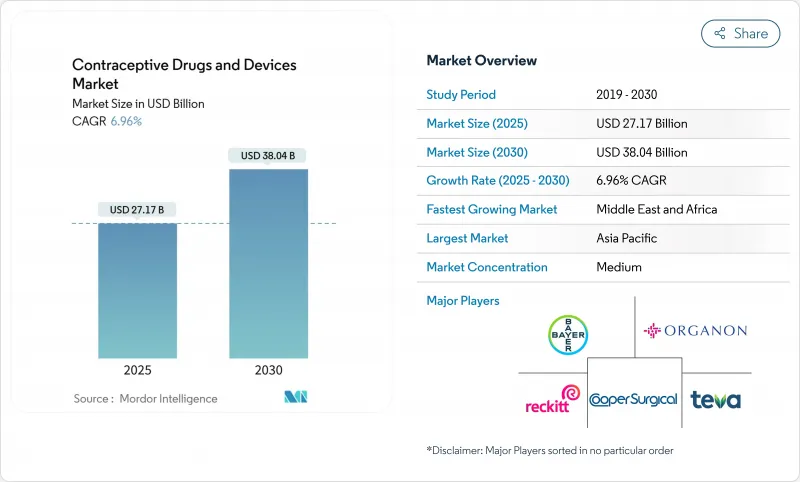

Contraceptive Drugs And Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The contraceptive drugs and devices market is valued at USD 27.17 billion in 2025 and is forecast to reach USD 38.04 billion by 2030, reflecting a 6.96% CAGR.

Growth is underpinned by sustained investment in long-acting reversible contraceptives (LARCs), rising demand for non-hormonal methods, and a steady shift toward digital purchasing channels that reduce access barriers. Asia-Pacific accounted for 33.33% of 2024 revenue, buoyed by government family-planning programs, while the Middle East & Africa is on track for the fastest expansion at 8.67% CAGR on the back of new reimbursement schemes that temper cultural resistance. Devices captured 65.34% of 2024 sales and are tracking an 8.2% yearly gain as implants and hormonal intrauterine devices deliver >99% effectiveness with limited user input. Online distribution, expanding 9.78% per year, is reshaping procurement by pairing telehealth consultations with direct-to-consumer logistics.

Global Contraceptive Drugs And Devices Market Trends and Insights

Rising Uptake of Long Acting Reversible Contraceptives

LARCs deliver >99% effectiveness and sharply reduce user error, positioning them as first-line recommendations among clinicians achi.net. Policy shifts such as separate Medicaid reimbursement for immediate postpartum placement lifted utilization by 0.74 percentage points. Innovation around biodegradable implants in Phase 1 trials aims to eliminate removal procedures. Cost savings accrue to payers as even modest migration from short-acting pills to LARCs lowers unintended pregnancy rates, strengthening payer support. Together, these dynamics keep the contraceptive drugs and devices market on a structurally higher growth path.

Expansion of Reimbursement Initiatives Coupled with Access and Awareness Programs

A USD 390 million U.S. Title X budget for 2025-up 36%-broadens subsidized access for low-income users. Fourteen other governments maintained or grew allocations, totaling USD 35.3 million. British Columbia's province-wide free-contraception policy demonstrates the volume lift when cost barriers vanish, though legacy providers must recalibrate revenue models optionsforsexualhealth.org. Digital partnerships-such as Bayer's collaborations with Your Life and UNFPA India-blend education and fulfillment, deepening penetration in low- and middle-income countries. These initiatives collectively raise modern-method prevalence and sustain the contraceptive drugs and devices market expansion.

Cultural-Religious Barrier in Adoption of Contraceptives

Religious objections account for 37% of non-use in Saudi Arabia, 42% in Nigeria, and 28% in Pakistan. Countries with strong faith influence post contraceptive prevalence rates 18 points lower than peers of similar income. Policy examples, such as Indiana's Medicaid restrictions on IUDs, illustrate the institutionalization of such barriers. Province-level disparities in Mozambique underline localized nuance contraceptionmedicine.biomedcentral.com. Manufacturers increasingly engage religious leaders and deploy community outreach to soften resistance and protect the contraceptive drugs and devices market trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancement and Innovation Pipeline

- Shift to E-commerce for OTC Barrier Products

- Regulatory Issues and Proliferation of Counterfeit Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Devices held 65.34% of 2024 revenue, giving them the largest contraceptive drugs and devices market share thanks to the >99% effectiveness of IUDs and implants. The category is growing 6.23% annually as biodegradable implants and extended-duration hormonal IUDs boost uptake. Hormonal IUDs also treat heavy bleeding, adding clinical appeal. Emerging non-hormonal devices like Ovaprene aim to address the side-effect-conscious segment.

Drug-based products represented the remaining 34.66% in 2024 but face faster growth. The contraceptive drugs and devices market size for emergency pills is nevertheless expanding in markets where awareness of the 72-hour window rises. FDA clearance of Opill for OTC sale in March 2024 removes prescription friction and could revive pill volumes.

Hormonal methods controlled 61.23% revenue, yet non-hormonal alternatives are expanding 8.78% yearly, far above the total contraceptive drugs and devices market CAGR. Copper IUD demand is also rising as users seek hormone-free choices. Ovaprene's 86-91% efficacy in early studies suggests a strong commercial outlook.

Lower-dose hormonal innovations seek to mitigate systemic effects while maintaining efficacy. Meanwhile, the Gates Foundation's USD 280 million annual pledge to non-hormonal R&D underscores investor conviction. This funding influx is expected to expand the contraceptive drugs and devices market size for hormone-free solutions.

The Contraceptive Drugs and Devices Market Report is Segmented by Product Type (Drugs [Oral Pills and More] and Devices[Barrier Devices and More]), Hormonal Class (Hormonal and Non-Hormonal), Gender (Male and Female), Age Group (15-24 Years, 25-34 Years and More), Distribution Channel (Hospital Pharmacies, Online Channels and More) and Geography (North America, Europe and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America benefits from strong reimbursement, with USD 390 million Title X funding in 2025 and OTC Opill availability that removes prescription hurdles. Nonetheless, initiatives such as Project 2025 threaten to curtail free emergency contraception for 48 million women, creating policy uncertainty.

Asia-Pacific holds the largest regional position with 33.33% share, yet intra-regional disparities persist. Only 20.2% of Bangladeshi women wishing to avoid pregnancy use LARCs, highlighting sizeable runway. Digital distribution and expanded reimbursement are expected to narrow this gap.

The Middle East & Africa's 8.67% CAGR through 2030 stems from enhanced funding and outreach, such as Zambia's plan to lift prevalence to 40% by 2026 scorecard.prb.org. Youth surveys in Uganda reveal 72.4% intend to use contraception once barriers ease.

Europe's mature market posts steady growth amid varied method mixes; hormonal usage ranges from 28% in southern to 54% in northern states. EMA approvals of three formulations in 2024 sustain product refresh cycles.

South America registers solid demand where no-cost LARCs drive adherence; Brazil reports 82.1% continuation for LNG IUDs at 24 months, validating public-sector procurement strategies.

- Bayer

- Organon

- Pfizer

- Teva Pharmaceutical Industries

- The Cooper Companies

- Reckitt Benckiser Group

- Church & Dwight

- Abbvie

- Agile Therapeutics Inc.

- Viatris

- Gedeon Richter Plc

- Glenmark Pharmaceuticals

- Cipla

- Pregna International Ltd

- Mayer Laboratories

- HLL Lifecare

- Karex Berhad

- Church & Dwight

- Okamoto Industries Inc.

- Femcap Inc.

- Amneal Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Uptake of Long Acting Reversible Contraceptives

- 4.2.2 Expansion Reimbursement Initiatives Coupled with Access and Awarness Programs

- 4.2.3 Technological Advancement and Innovation pipeline

- 4.2.4 Shift to e-commerce for OTC barrier products

- 4.2.5 Rising Awareness of Family Planning and Sexual Health

- 4.2.6 Rising Global Population and Unintended Pregnancy

- 4.3 Market Restraints

- 4.3.1 Cultural-religious Barrier in Adoption of Contraceptives

- 4.3.2 Side Effects, Risk Factors Associated with Contraceptives

- 4.3.3 Regulatory Issues and Proliferation of counterfeit Products

- 4.3.4 High Upfront Cost of devices coupled with Limited Access in Rural and Low Income Regions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Drugs

- 5.1.1.1 Oral Pills

- 5.1.1.2 Transdermal Patch

- 5.1.1.3 Injectable Contraceptives

- 5.1.1.4 Emergency Pills

- 5.1.2 Devices

- 5.1.2.1 Barrier Devices

- 5.1.2.1.1 Male Condom

- 5.1.2.1.2 Female Condom

- 5.1.2.1.3 Diaphragm

- 5.1.2.1.4 Cervical Cap

- 5.1.2.1.5 Contraceptive Sponge

- 5.1.2.2 Long-Acting Reversible

- 5.1.2.2.1 Hormonal IUD

- 5.1.2.2.2 Copper IUD

- 5.1.2.2.3 Sub-dermal Implant

- 5.1.2.2.4 Vaginal Ring

- 5.1.2.3 Permanent

- 5.1.2.3.1 Tubal Occlusion Device

- 5.1.1 Drugs

- 5.2 By Hormonal Class

- 5.2.1 Hormonal Methods

- 5.2.2 Non-Hormonal Methods

- 5.3 By Gender

- 5.3.1 Male

- 5.3.2 Female

- 5.4 By Age Group

- 5.4.1 15-24 Years

- 5.4.2 25-34 Years

- 5.4.3 35-44 Years

- 5.4.4 45+ Years

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies & Drug Stores

- 5.5.3 Online Channels

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Organon & Co.

- 6.4.3 Pfizer Inc.

- 6.4.4 Teva Pharmaceutical Industries Ltd

- 6.4.5 CooperSurgical Inc.

- 6.4.6 Reckitt Benckiser Group plc

- 6.4.7 Church & Dwight Co. Inc.

- 6.4.8 AbbVie Inc. (Allergan)

- 6.4.9 Agile Therapeutics Inc.

- 6.4.10 Viatris

- 6.4.11 Gedeon Richter Plc

- 6.4.12 Glenmark Pharmaceuticals Ltd

- 6.4.13 Cipla Ltd

- 6.4.14 Pregna International Ltd

- 6.4.15 Mayer Laboratories Inc.

- 6.4.16 HLL Lifecare Ltd

- 6.4.17 Karex Berhad

- 6.4.18 Church & Dwight Co. Inc.

- 6.4.19 Okamoto Industries Inc.

- 6.4.20 Femcap Inc.

- 6.4.21 Amneal Pharmaceuticals LLC

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment