PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836536

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836536

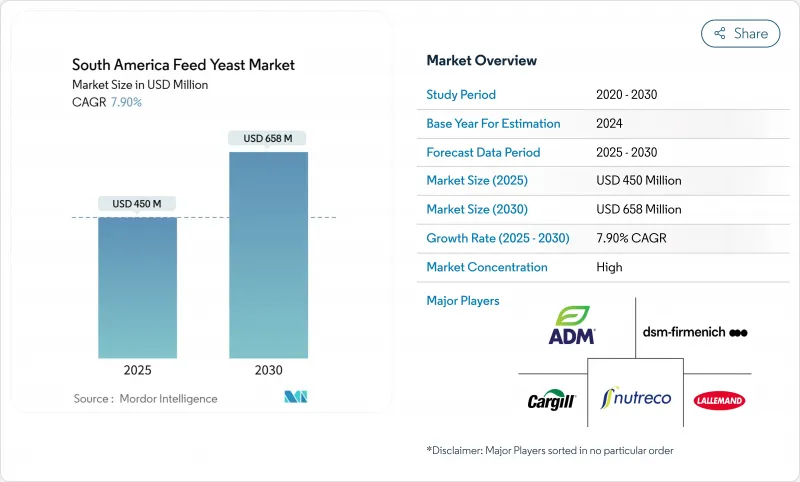

South America Feed Yeast - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South American feed yeast market is valued at USD 450 million in 2025 and is projected to reach USD 658 million by 2030, advancing at a 7.9% CAGR.

The rise comes as regulators curb antibiotic growth promoters, prompting livestock producers to switch to natural additives that protect animal health and export eligibility. Brazil leads growth thanks to plentiful sugarcane-ethanol sidestreams that cut production costs, a mature poultry export complex, and extensive fermentation know-how. Demand also benefits from the rapid scaling of aquaculture in Peru, regulatory convergence across MERCOSUR, and retailer pressure for traceable, ESG-aligned feed inputs. Nonetheless, the South American feed yeast market faces cost volatility tied to molasses and corn syrup, capital-intensive drying facilities, and freight bottlenecks at Amazonian and Plata ports that can disrupt just-in-time deliveries.

South America Feed Yeast Market Trends and Insights

Growing Livestock Production Volumes

South America's share of global animal protein output keeps climbing. Between 2000 and 2018 regional poultry tonnage more than doubled, while pork output rose 64.3%. Brazil alone now consumes 2,539 million bushels of corn annually for feed, underscoring the scale at which producers are searching for efficiency boosters. National feed associations forecast further expansion in 2025, with chicken exports from Brazil projected to rise by 1.9%. Those volumes amplify interest in yeast supplements that improve gut integrity and feed conversion. The South American feed yeast market, therefore, gains a structural demand floor as herd and flock sizes climb.

Poultry-Export Boom from Brazil and Chile

Export-driven integrators must satisfy residue-free protocols set by buyers in the United States and the European Union. Chile's vertically integrated firms, such as Agrosuper, also chase premium export niches that reward natural feed profiles. As Brazil's grain output stays on a record-setting path, companies lock in raw material security to capitalize on shifting U.S.-China trade flows. In this premium channel, yeast commands higher margins than synthetic growth promoters, reinforcing the growth outlook for the South American feed yeast market.

High Upfront Fermentation and Drying CAPEX

Greenfield yeast plants that meet GMP standards cost tens of millions of USD. DSM-Firmenich's facility in Sete Lagoas illustrates the capital hurdle newcomers must clear. Port upgrade needs to add further spending as 58 Brazilian terminals require dredging for post-Panamax traffic. These factors deter entrants and preserve incumbent power within the South American feed yeast market.

Other drivers and restraints analyzed in the detailed report include:

- Ban on Antibiotic Growth Promoters (AGPs)

- Sustainability Push Toward Natural Additives

- Volatile Molasses and Corn Syrup Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Live cell yeast generated the largest slice of the South American feed yeast market size in 2024, accounting for 42.5% of sales. Producers favor its proven benefits in rumen fermentation and pathogen exclusion. Yeast derivatives, though still a smaller base, are accelerating at a 10.9% CAGR thanks to Beta-glucan-rich fractions that bind aflatoxin B1 and improve villus height in broilers. In 2024, spent brewer's yeast supplied a 28.0% share, leveraged by low input costs, while dry inactive formats provided a 16.0% share, mainly to aquafeed.

Looking ahead, high-selenium yeast is gaining traction, growing 9.5% annually as integrators bundle micronutrient delivery with probiotic action. Modified Beta-D-glucans now capture zearalenone and T-2 toxin efficiently. Suppliers responding with multi-functional derivatives can capture premium niches and reinforce conversion to value-added SKUs in the South American feed yeast market.

Instant yeast maintained 46.0% of 2024 revenue due to ease of batching and long shelf life. The segment anchors baseline demand for feed premixes across Brazil and Argentina. Liquid slurry is the star performer, forecast to expand 11.5% annually through 2030 as automated mills seek micro-dosing accuracy without dust loss. Active wet yeast still holds a 25.0% share for high-viability uses, though chilled logistics limit its reach to nearby farms.

Liquid's momentum stems from stabilizers that extend viability beyond 90 days, and findings that liquid Saccharomyces boulardii reduces heat-stress markers in finishing pigs. Suppliers that master aseptic packaging and cold chain distribution can tap the fast-growing channel inside the South American feed yeast market.

The South America Feed Yeast Market Report is Segmented by Product Type (Live Cell Yeast, Spent Yeast, and More), by Form (Active, Instant, and More), by Animal Type (Ruminant, Poultry, and More), by Functional Objective (Gut Health and Immunity, Growth Performance, Heat-Stress Mitigation, and More), and by Geography (Brazil, Argentina, Peru, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Archer Daniels Midland Company

- Cargill, Incorporated

- Lallemand Inc.

- dsm-firmenich AG

- Nutreco N.V. (SHV Holdings)

- Alltech, Inc.

- Lesaffre et Compagnie S.A.

- Kemin Industries, Inc.

- ICC Brazil

- Evonik Industries AG

- Provita Supplements S.A.S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing livestock production volumes

- 4.2.2 Poultry-export boom from Brazil and Chile

- 4.2.3 Ban on antibiotic growth promoters (AGPs)

- 4.2.4 Sustainability push toward natural additives

- 4.2.5 Sugarcane-ethanol sidestreams enabling low-cost single-cell yeast

- 4.2.6 Blockchain feed-traceability mandates by meat packers

- 4.3 Market Restraints

- 4.3.1 High upfront fermentation and drying CAPEX

- 4.3.2 Volatile molasses and corn syrup pricing

- 4.3.3 Competition from bacterial probiotics and enzymes

- 4.3.4 Logistics chokepoints at Amazonian and Plata ports

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Live Cell Yeast

- 5.1.2 Spent Yeast

- 5.1.3 Dry/Inactive Yeast

- 5.1.4 Yeast Derivatives (Beta-glucan, MOS, etc.)

- 5.1.5 High-Selenium Yeast

- 5.1.6 Others

- 5.2 By Form

- 5.2.1 Active (Wet)

- 5.2.2 Instant

- 5.2.3 Fresh Cake

- 5.2.4 Liquid Slurry

- 5.3 By Animal Type

- 5.3.1 Ruminant

- 5.3.2 Poultry

- 5.3.3 Swine

- 5.3.4 Aquaculture

- 5.3.5 Companion Animals (Pets)

- 5.4 By Functional Objective

- 5.4.1 Gut Health and Immunity

- 5.4.2 Growth Performance

- 5.4.3 Mycotoxin Binding

- 5.4.4 Heat-Stress Mitigation

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Peru

- 5.5.5 Colombia

- 5.5.6 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill, Incorporated

- 6.4.3 Lallemand Inc.

- 6.4.4 dsm-firmenich AG

- 6.4.5 Nutreco N.V. (SHV Holdings)

- 6.4.6 Alltech, Inc.

- 6.4.7 Lesaffre et Compagnie S.A.

- 6.4.8 Kemin Industries, Inc.

- 6.4.9 ICC Brazil

- 6.4.10 Evonik Industries AG

- 6.4.11 Provita Supplements S.A.S

7 Market Opportunities and Future Outlook