PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836545

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836545

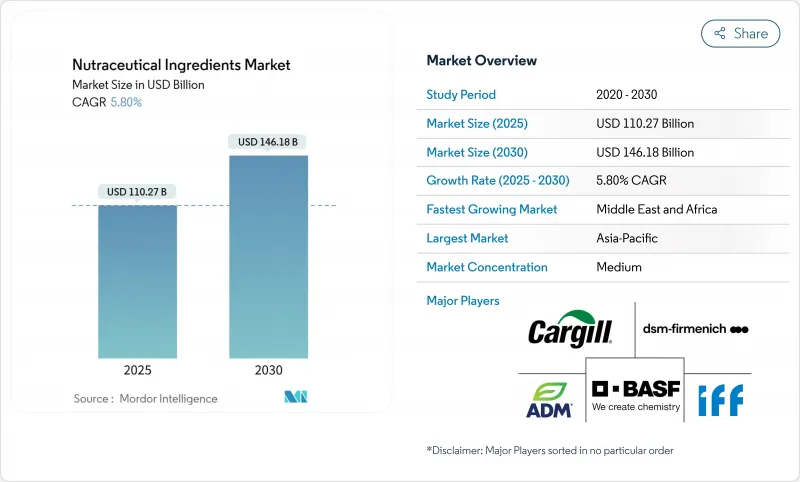

Nutraceutical Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Nutraceutical ingredients market is valued at USD 110.27 billion in 2025 and is forecast to reach USD 146.18 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.8% from 2025-2030.

This growth highlights a significant consumer preference for foods that provide specific health benefits. Key areas of focus include improving immunity, maintaining digestive health, and enhancing cognitive functions. The increasing emphasis on preventive nutrition, advancements in micro-encapsulation technologies, and the development of clean-label extraction methods are driving this demand. Additionally, the consistent introduction of ready-to-drink nutraceutical products is contributing to market expansion across various regions. Research and development efforts are intensifying, particularly in improving bioavailability and mainstreaming plant-based proteins. Furthermore, the incorporation of nutraceutical science into everyday food categories is broadening the consumer base, making these products more accessible to a wider audience. However, stricter regulatory requirements for evidence-based claims are prompting manufacturers to invest in clinical validation. This trend is raising technical barriers to entry, especially for smaller players, as the market becomes increasingly competitive.

Global Nutraceutical Ingredients Market Trends and Insights

Surging Demand for Preventive Healthcare Solution

The surging demand for preventive healthcare solutions is fueling the market growth. Governments and health organizations worldwide are increasingly promoting preventive healthcare to reduce the burden of chronic diseases. For instance, the World Health Organization (WHO) emphasizes the importance of nutrition in preventing non-communicable diseases (NCDs) such as diabetes and cardiovascular conditions. According to WHO, NCDs account for 74% of all global deaths, highlighting the critical need for preventive measures . Similarly, the United States Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have implemented guidelines and regulations to encourage the consumption of fortified foods and dietary supplements. Additionally, initiatives like India's National Nutrition Mission (POSHAN Abhiyaan) aim to improve nutritional outcomes, further boosting the demand for nutraceutical ingredients. The European Food Safety Authority (EFSA) also plays a pivotal role in regulating health claims on food products, ensuring consumer trust and driving market growth. These efforts underscore the growing recognition of preventive healthcare as a critical component of public health strategies, further propelling the nutraceutical ingredients market.

High Demand for Plant-Based Protein Fortification

The increasing demand for plant-based protein fortification is a key driver of the market. According to the Food and Agriculture Organization (FAO), plant-based proteins are gaining popularity due to their health benefits, sustainability, and lower environmental impact compared to animal-based proteins. Additionally, the Plant Based Foods Association (PBFA) reported a 27% growth in plant-based food sales in the United States in 2023 , highlighting the rising consumer preference for such products. Governments worldwide are also actively promoting plant-based diets to address environmental concerns, reduce greenhouse gas emissions, and improve public health. The European Union has introduced initiatives under its Farm to Fork Strategy, which supports the transition to sustainable food systems, including the promotion of plant-based alternatives. Furthermore, the Indian government has launched programs to support the production of plant-based proteins, aligning with its focus on sustainable agriculture and nutrition security. These factors collectively contribute to the growing adoption of plant-based protein fortification in the nutraceutical industry, as manufacturers increasingly incorporate these ingredients to meet evolving consumer demands and regulatory guidelines.

Complex Supply Chain for Bioactive Ingredients

The complex supply chain for bioactive ingredients acts as a significant restraint in the nutraceutical ingredients market. The production and distribution of these ingredients involve multiple stages, including sourcing raw materials, processing, quality control, and final delivery to manufacturers. Each stage requires stringent regulatory compliance, which increases operational challenges and costs. Additionally, the reliance on diverse suppliers and the need for consistent quality further complicate the supply chain. The sourcing of raw materials, often from geographically dispersed regions, adds another layer of complexity due to varying regulations, logistical challenges, and potential supply disruptions. Furthermore, maintaining the bioactivity and efficacy of these ingredients during processing and transportation demands advanced technologies and specialized handling, which can escalate costs. These factors collectively hinder the seamless flow of bioactive ingredients, impacting the overall growth of the nutraceutical ingredients market. The intricate nature of the supply chain also limits the ability of smaller players to compete effectively, as they may lack the resources to navigate these challenges efficiently.

Other drivers and restraints analyzed in the detailed report include:

- Probiotics-Infused Beverage Gaining Mainstream Appeal

- Adoption of Omega-3s in Mental and Heart Health Regimens

- Allergen Risks in Protein and Amino Acid Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Probiotics seize 29.47% of the market share in 2024, solidifying their role as the linchpin of the nutraceutical ingredients arena. This stronghold is bolstered by growing scientific validation of the gut's pivotal role in overall health. Probiotics are now recognized not just for gut health, but as essential players in immune function, mental well-being, and metabolic balance. Manufacturers are shifting from broad gut health assertions to crafting strain-specific solutions, targeting diverse health issues from stress relief to athletic recovery. The increasing consumer awareness regarding the benefits of probiotics, coupled with advancements in research and development, is further driving the segment's growth.

On the rise, omega-3 ingredients are set to be the fastest-growing segment, boasting a projected CAGR of 9.44% from 2025-2030. Their surge is fueled by broadening applications, now spanning cognitive and joint health alongside traditional heart benefits. Thanks to technological advancements in encapsulation, omega-3s are finding their way into food matrices once deemed challenging, broadening their application horizon. The vitamins and minerals segment enjoys consistent growth, driven by the standardization of fortification across food categories to address nutritional deficiencies. Meanwhile, proteins and amino acids ride the wave of the fitness and active nutrition trend, as consumers increasingly prioritize muscle health and recovery. Prebiotics are emerging as valuable partners to probiotics, with new studies underscoring their enhanced effects when used together in formulations, creating synergistic benefits for gut health and overall well-being.

The Nutraceutical Ingredients Market Report is Segmented Into Product Type (Prebiotics, Probiotics, Vitamins, Minerals and More), Form (Powder, Liquid), Application (Functional Food, Functional Beverage, Dietary Supplements, Animal Nutrition, Others) and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region solidifies its status as the leading market for nutraceutical ingredients, commanding a 36.49% share. This dominance is a result of blending age-old wellness traditions with contemporary nutritional science. While Japan and China anchor this leadership with their culturally ingrained nutraceutical ingredients, emerging markets like India and Indonesia are rapidly bolstering the region's stature. Factors such as urbanization, rising disposable incomes, and heightened health awareness-especially among the youth-fuel this growth. Notably, there's a surge in innovation, with traditional Asian botanicals being modernized for contemporary uses. The beverage sector thrives, with energy drinks and functional waters becoming favorites among urban professionals.

The Middle East & Africa is on the fast track, eyeing a robust CAGR of 9.78% from 2025-2030. This growth, especially pronounced in the UAE, Saudi Arabia, and South Africa, is spurred by a blend of expatriate demand and escalating chronic disease rates. As consumers become more health-conscious and premium products become more accessible, the region's nutraceutical ingredients market is rapidly evolving. Manufacturers are taking note, with strategic moves like dsm-firmenich's new premix and additives plant in Sadat City in September 2024. Egypt, underscoring the region's potential. Beauty-focused nutraceutical ingredients are gaining momentum, especially in Turkey, Morocco, and the GCC, highlighting a rising consumer interest in the link between nutrition and aesthetics. While the region's regulatory landscape is adapting to this growth, aligning standards across its diverse nations poses a challenge.

North America and Europe remain pivotal players in the nutraceutical ingredients arena. Both regions are characterized by advanced regulatory frameworks that ensure product safety and efficacy, fostering consumer trust. High levels of health awareness among consumers drive demand for innovative and premium nutraceutical products. Additionally, these regions benefit from well-established research and development ecosystems, enabling the continuous introduction of cutting-edge products. The growing focus on personalized nutrition and the increasing adoption of plant-based and clean-label ingredients further strengthen the market in these regions. Strategic collaborations between manufacturers and research institutions are also contributing to sustained growth and innovation.

- Cargill, Incorporated

- Archer Daniels Midland Company

- DSM-Firmenich

- BASF SE

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group plc

- Ingredion Incorporated

- Tate & Lyle PLC

- Associated British Foods PLC

- Amway Corporation

- FMC Corporation

- Lonza Group AG

- Givaudan S.A.

- Glanbia PLC

- Corbion N.V.

- Ajinomoto Co., Inc.

- Sabinsa Corporation

- Evonik Industries AG

- Balchem Corporation

- Novonesis A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for preventive healthcare solution

- 4.2.2 High demand for plant-based protein fortification

- 4.2.3 Probiotics-infused beverage gaining mainstream appeal

- 4.2.4 Adoption of omega-3s in mental and heart health regimens

- 4.2.5 Technological advancements in extraction and formulation

- 4.2.6 Growing demand for personalized nutrition solutions

- 4.3 Market Restraints

- 4.3.1 Complex supply chain for bioactive ingredients

- 4.3.2 Allergen risks in protein and amino acid products

- 4.3.3 Quality variation in omega-3 sourcing

- 4.3.4 High cost of premium ingredients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Prebiotics

- 5.1.2 Probiotics

- 5.1.3 Vitamin

- 5.1.4 Mineral

- 5.1.5 Proteins and Amino Acids

- 5.1.6 Omega-3 Ingredients

- 5.1.7 Others

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Appilcation

- 5.3.1 Functional Food

- 5.3.2 Functional Beverage

- 5.3.3 Dietary Supplements

- 5.3.4 Animal Nutrition

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 DSM-Firmenich

- 6.4.4 BASF SE

- 6.4.5 International Flavors & Fragrances Inc. (IFF)

- 6.4.6 Kerry Group plc

- 6.4.7 Ingredion Incorporated

- 6.4.8 Tate & Lyle PLC

- 6.4.9 Associated British Foods PLC

- 6.4.10 Amway Corporation

- 6.4.11 FMC Corporation

- 6.4.12 Lonza Group AG

- 6.4.13 Givaudan S.A.

- 6.4.14 Glanbia PLC

- 6.4.15 Corbion N.V.

- 6.4.16 Ajinomoto Co., Inc.

- 6.4.17 Sabinsa Corporation

- 6.4.18 Evonik Industries AG

- 6.4.19 Balchem Corporation

- 6.4.20 Novonesis A/S

7 Market Opportunities and Future Outlook