PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836546

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836546

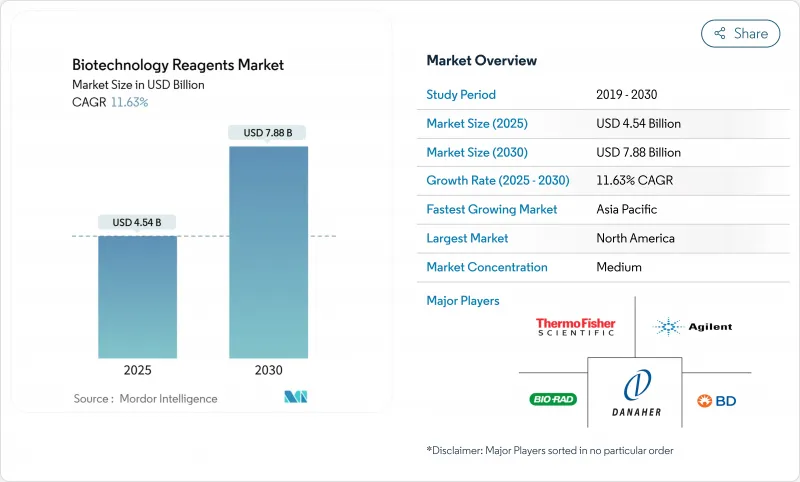

Biotechnology Reagents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Biotechnology Reagents Market size is estimated at USD 47.84 billion in 2025, and is expected to reach USD 66.93 billion by 2030, at a CAGR of 6.95% during the forecast period (2025-2030).

Intensifying investment in AI-enabled drug discovery, growing biomanufacturing capacity, and rapid adoption of single-cell analytics enlarge the addressable demand for high-performance reagents. Multinational mergers that integrate consumables with data-analysis platforms accelerate end-to-end solution uptake, while government incentives in Asia support local production of GMP-grade inputs. Ongoing digitalisation of laboratories further boosts demand for pre-optimised, automation-ready reagent kits, particularly in oncology and regenerative-medicine pipelines. Meanwhile, stricter global quality standards lengthen product-validation cycles, pressuring smaller suppliers to partner with established players.

Global Biotechnology Reagents Market Trends and Insights

High R&D Spending by Biotech Firms & Swelling Startup Pipeline

Venture funding in precision fermentation and synthetic biology startups surged, channeling USD 2 billion into new platforms that rely on premium-grade reagents for cell-and gene-therapy workflows. Each biologic candidate requires bespoke analytical consumables, driving recurring demand in the global bioprocess technology market. Fragmented demand lets specialist suppliers command premium pricing, while platform-based discovery models push labs to standardise reagent systems compatible with multiple targets. Consequently, procurement strategies increasingly favour vendors that offer modular, AI-ready kits with validated performance data.

Expanding Stem-Cell & Regenerative-Medicine Studies

Adult stem-cell protocols dominate, prompting innovation in isolation and expansion reagents that preserve phenotype. APAC governments co-fund large-scale GMP facilities, such as Aurora Biosynthetics' AUD200 million (USD 129.4 million) plant, boosting regional demand for compliant consumables. As personalised regenerative procedures proliferate, suppliers must deliver flexible formulations capable of small-batch, patient-specific processing.

Stringent Multi-Jurisdictional Quality & Safety Certifications

FDA and EMA divergence on reference-standard validation forces suppliers to duplicate studies, adding 6-12 months to product launches and raising development costs by up to 30%. Achieving ISO 13485 certification for each production site strains smaller firms, while Quality-by-Design documentation now covers entire life-cycles, pushing demand toward larger, vertically integrated players able to absorb compliance costs.

Other drivers and restraints analyzed in the detailed report include:

- Oncology-Centric Omics Projects Demanding High-Throughput Reagents

- AI-Assisted Reagent Optimisation Shortening Development Cycles

- Volatile Bioprocess Raw-Material Supply Chain Post-COVID

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Life-Science Reagents captured 55.62% of biotechnology reagents market share in 2024. Strong utilisation in PCR-based diagnostics and next-generation sequencing keeps the segment ahead, while continuing investment in COVID-era molecular infrastructure supports baseline demand. Analytical Reagents, though smaller, are set to surpass overall biotechnology reagents market growth with a 9.29% CAGR, benefitting from regulatory emphasis on deep characterisation and the proliferation of mass-spectrometry-driven proteomics. Emerging hybrid kits that integrate sample prep with assay reagents promise workflow simplification valued by high-throughput labs.

Second-generation chromatography buffers and single-use filtration reagents enable continuous bioprocessing, while electrophoresis consumables optimise resolution for cell-free systems. Suppliers increasingly bundle software licences with reagents to capture recurring analytics revenue, signalling convergence between wet-lab and digital offerings.

The Biotechnology Reagents Market Report Segments the Industry Into by Reagent Type (Life-Science Reagents [PCR, and More], Analytical Reagents [Chromatography, and More]), Application (Protein Synthesis & Purification, and More), End User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America anchored 39.24% of 2024 revenues on the back of entrenched biopharmaceutical clusters, deep venture capital pools, and a supportive regulatory climate. Federal programmes promoting advanced biomanufacturing generate steady requisitions for GMP-validated reagents. In Europe, continued adherence to sustainability mandates propels interest in green-chemistry formulations and recyclable packaging, prompting suppliers to revamp product life-cycle assessments.

Asia-Pacific tops global expansion, expected to post 9.64% CAGR through 2030. China's Circular No. 53 has trimmed review timelines and expanded data-protection windows, catalysing local innovation and inbound partnerships. Japan's goal of tripling its biotech economy by 2030 underwrites domestic demand for clinical-grade reagents, while Southeast Asia's CDMO rise creates fresh outlets for single-use consumables. Local suppliers leverage government subsidies to close capability gaps, although adherence to international QC standards remains a hurdle.

Markets in the Middle East, Africa, and South America record mid-single-digit growth. Technology-transfer agreements sponsored by multilateral health agencies facilitate local reagent fill-finish operations, reducing import reliance. However, limited cold-chain infrastructure and fluctuating currency valuations temper the adoption of premium products, incentivising suppliers to offer modular, cost-tiered reagent lines tailored to regional purchasing power.

- Abbott Laboratories

- Agilent Technologies

- Danaher (Cytiva & Beckman Coulter)

- Beckton Dickinson

- Bio-Rad Laboratories

- bioMerieux

- Siemens Healthineers

- Merck KGaA (MilliporeSigma)

- Thermo Fisher Scientific

- Waters Corporation

- Eurofins

- Takara Bio

- QIAGEN

- Illumina

- PerkinElmer (Revvity)

- Promega

- Roche

- Lonza Group

- Bio-Techne (R&D Systems)

- New England Biolabs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High R&D Spending by Biotech Firms & Swelling Startup Pipeline

- 4.2.2 Expanding Stem-Cell & Regenerative-Medicine Studies

- 4.2.3 Oncology-Centric Omics Projects Demanding High-Throughput Reagents

- 4.2.4 AI-Assisted Reagent Optimisation Shortening Development Cycles

- 4.2.5 Rising Point-Of-Care Molecular Diagnostics Adoption

- 4.2.6 Government Biomanufacturing Localisation Incentives in Asia

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Jurisdictional Quality & Safety Certifications

- 4.3.2 Volatile Bioprocess Raw-Material Supply Chain Post-COVID

- 4.3.3 Rising Average Selling Price of Premium-Grade Reagents

- 4.3.4 Sustainability Pressures on Hazardous Reagent Components

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Reagent Type

- 5.1.1 Life-Science Reagents

- 5.1.1.1 PCR

- 5.1.1.2 Cell Culture

- 5.1.1.3 Hematology

- 5.1.1.4 In-vitro Diagnostics

- 5.1.1.5 Other Technologies

- 5.1.2 Analytical Reagents

- 5.1.2.1 Chromatography

- 5.1.2.2 Mass Spectrometry

- 5.1.2.3 Electrophoresis

- 5.1.2.4 Flow Cytometry

- 5.1.2.5 Other Analytical Reagents

- 5.1.1 Life-Science Reagents

- 5.2 By Application

- 5.2.1 Protein Synthesis & Purification

- 5.2.2 Gene Expression

- 5.2.3 DNA & RNA Analysis

- 5.2.4 Drug Testing

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Contract Research Organisations (CROs)

- 5.3.3 Academic & Research Institutes

- 5.3.4 Clinical & Diagnostic Laboratories

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Agilent Technologies

- 6.3.3 Danaher (Cytiva & Beckman Coulter)

- 6.3.4 Becton Dickinson & Company

- 6.3.5 Bio-Rad Laboratories

- 6.3.6 bioMerieux SA

- 6.3.7 Siemens Healthineers

- 6.3.8 Merck KGaA (MilliporeSigma)

- 6.3.9 Thermo Fisher Scientific

- 6.3.10 Waters Corporation

- 6.3.11 Eurofins Scientific

- 6.3.12 Takara Bio Inc.

- 6.3.13 QIAGEN N.V.

- 6.3.14 Illumina Inc.

- 6.3.15 PerkinElmer (Revvity)

- 6.3.16 Promega Corporation

- 6.3.17 Roche Diagnostics

- 6.3.18 Lonza Group

- 6.3.19 Bio-Techne (R&D Systems)

- 6.3.20 New England Biolabs

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment