PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836547

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836547

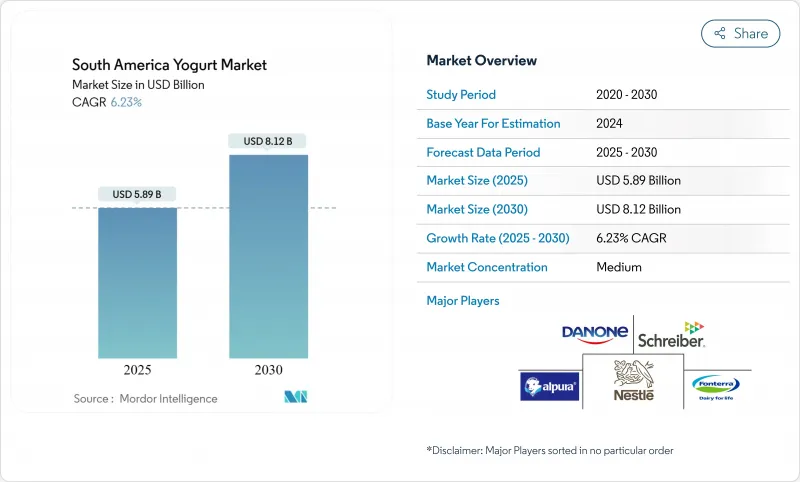

South America Yogurt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South American Yogurt Market is valued at USD 5.89 billion in 2025 and is projected to reach USD 8.12 billion by 2030, growing at a CAGR of 6.23% during the forecast period (2025-2030).

The market's expansion is driven by multiple factors, including health-conscious consumer preferences, expanding cold chain infrastructure, and flexitarian dietary shifts. The growing urban population and rising disposable incomes have significantly influenced consumption patterns, while sustainability concerns have created a strategic need for manufacturers to diversify their product portfolios. The market encompasses traditional, Greek-style, and flavored yogurts, with major dairy companies expanding their production capacities to meet demand. While the trend toward natural and organic variants, innovative packaging solutions, and new flavor combinations continues to shape market dynamics, challenges persist in the form of volatile milk prices and import tariffs on probiotic cultures. These challenges particularly affect small and medium enterprises striving to maintain profit margins while meeting consumer demands for premium offerings. The increasing adoption of yogurt as a breakfast option and healthy snack alternative further supports market growth across South America.

South America Yogurt Market Trends and Insights

Rising demand for functional probiotic dairy products

The functional probiotic yogurt segment is experiencing significant growth across South America, primarily driven by increasing consumer awareness of gut health benefits and immune system support. This trend is particularly evident where urban middle-class consumers demonstrate willingness to pay premium prices for products with scientifically backed health claims. The market's development is supported by regulatory frameworks, such as ANVISA in Brazil, which has established specific guidelines requiring manufacturers to provide evidence of health benefits and strain viability. This creates a competitive advantage for companies with strong research and development capabilities. In response to growing demand and the rising prevalence of digestive health issues, manufacturers are expanding their product lines and launching innovative offerings. For example, LALA introduced LALA Gold in November 2024, a premium product line featuring high-protein yogurt variants in both drinkable and spoonable formats, containing real fruit, active probiotics, and no added sugar, with protein content ranging from 20 to 25 grams per serving. As consumer interest in functional foods continues to grow and regulatory frameworks evolve, the market is expected to maintain its growth trajectory, offering opportunities for both established manufacturers and new entrants.

Flavor innovation using local fruits accelerating yogurt uptake

The incorporation of indigenous South American fruits into yogurt products is driving market growth while providing manufacturers with competitive advantages. Companies are developing varieties featuring regional fruits like acai, guarana, berries and passion fruit to appeal to local taste preferences and meet consumer demand for authentic flavors. The integration of these fruits enables manufacturers to differentiate their products in an increasingly competitive market landscape. Major manufacturers like Danone and Nestle have launched products combining traditional yogurt with indigenous fruits from the Amazon region. These ingredients not only offer distinct flavors and high antioxidant content but also allow manufacturers to command premium prices while reducing transportation costs and supporting regional agricultural communities. This trend continues to expand, as demonstrated by Yasso's April 2024 launch of new frozen Greek yogurt bars featuring real fruit flavors: Strawberry Chocolate Crunch, Strawberries and Cream, and Creamy Mango. The success of these fruit-based innovations has encouraged other manufacturers to explore similar product developments, leading to increased diversification in the yogurt market.

Volatile milk prices compressing dairy-based yogurt margins

The South American yogurt market faces significant challenges due to fluctuating milk prices, which directly affect production costs and profit margins. Brazil and Argentina, the region's largest dairy producers, experience frequent price volatility in raw milk due to weather conditions, feed costs, and economic instability. These price variations force yogurt manufacturers to either absorb the increased costs or pass them on to consumers, potentially affecting demand. Additionally, the region's complex dairy supply chain and limited cold storage infrastructure contribute to higher operational costs. The situation is particularly challenging for small and medium-sized yogurt producers who have limited bargaining power with milk suppliers and restricted ability to hedge against price fluctuations.

Other drivers and restraints analyzed in the detailed report include:

- Cold-chain retail expansion enabling premium Greek yogurt

- Surge of flexitarians fueling plant-based yogurt

- Short shelf life and spoilage risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dairy-based yogurt maintains its commanding position with 92.05% market share in 2024, benefiting from established consumer preferences and cultural traditions across South America. The dairy segment's dominance is reinforced by extensive distribution networks and price advantages, with production costs approximately 30% lower than plant-based alternatives. Brazil's dairy industry, which produces approximately 25.7 billion liters of milk annually, provides a stable supply base for conventional yogurt production despite occasional price volatility as per the U.S. Dairy Export Council.

Plant-based yogurt is experiencing explosive growth at 7.21% CAGR (2025-2030), driven by increasing flexitarian dietary patterns and sustainability concerns. This segment faces persistent challenges in sensory attributes, with research indicating that unexpected sourness and texture issues remain barriers to broader adoption. The Good Food Institute reports that despite challenges in the broader plant-based market, innovations in taste and texture are steadily improving consumer acceptance, with manufacturers increasingly targeting the flexitarian demographic rather than exclusively vegans

In the product form segmentation, spoonable/set yogurt maintains market leadership with 68.11% share in 2024, appealing to traditional consumption patterns and versatile usage occasions. This segment benefits from its established position as a breakfast staple and snack option across South American households, supported by innovations in premium offerings, particularly Greek-style products that deliver higher protein content and creamier textures. The segment's dominance is further reinforced by its widespread retail presence and consumer familiarity with traditional yogurt formats.

Drinkable yogurt is emerging as the market's growth driver, expanding at 8.33% CAGR (2025-2030) and steadily increasing its market share. This growth is driven by urbanization and busier lifestyles across South American metropolitan areas, where consumers prioritize on-the-go nutrition. The development of ambient yogurt technology has enhanced market penetration in tropical climates and areas with limited refrigeration infrastructure, particularly benefiting younger demographics and rural regions previously constrained by cold chain limitations.

The South America Yogurt Market Report is Segmented by Category (Dairy-Based Yogurt and Non-Dairy/Plant-Based Yogurt), Product Form (Spoonable/Set Yogurt and More), Flavor Profile (Plain/Natural and More), Packaging Type (Cups, Containers and Tubs; and More), Distribution Channel (Off-Trade and On-Trade), and Geography (Brazil, Argentina, Chile, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Danone SA

- Nestle SA

- Grupo Alpura

- Schreiber Foods Inc.

- Fonterra Co-operative Group

- Chobani LLC

- General Mills, Inc.

- Groupe Lactalis S.A..

- Yakult Honsha Co. Ltd.

- Emmi Group

- Grupo Lala

- Laticinios Bela Vista

- Alpina Productos Alimenticios

- Sigma Alimentos (Santa Clara)

- FAGE International S.A

- Conaprole

- Tirol Alimentos

- Grupo Gloria

- Colun

- Lacteos Los Andes

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for functional probiotic dairy products

- 4.2.2 Flavor innovation using local fruits accelerating yogurt uptake

- 4.2.3 Growth of convenience-pack drinkable yogurts

- 4.2.4 Cold-chain retail expansion enabling premium greek yogurt

- 4.2.5 Surge of flexitarians fueling plant-based yogurt

- 4.2.6 Growing health consciousness among consumers and increasing awareness of probiotic benefits

- 4.3 Market Restraints

- 4.3.1 Volatile milk prices compressing dairy-based yogurt margins

- 4.3.2 Import tariffs on probiotic cultures raising sme costs

- 4.3.3 Short shelf life and spoilage risk

- 4.3.4 High competition from traditional dairy products and local fermented beverages

- 4.4 Value/Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Dairy-based Yogurt

- 5.1.2 Non-dairy/Plant-based Yogurt

- 5.2 By Product Form

- 5.2.1 Spoonable/Set Yogurt

- 5.2.2 Drinkable Yogurt

- 5.3 By Flavor Profile

- 5.3.1 Plain/Natural

- 5.3.2 Flavored

- 5.4 By Packaging Type

- 5.4.1 Cups, Containers and Tubs

- 5.4.2 Bottles

- 5.4.3 Tetra Packs and Pouches

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 Off-Trade

- 5.5.1.1 Supermarkets/Hypermarkets

- 5.5.1.2 Convenience Stores

- 5.5.1.3 Online Retail

- 5.5.1.4 Other Distribution Channels

- 5.5.2 On-trade

- 5.5.1 Off-Trade

- 5.6 By Geography

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Chile

- 5.6.4 Colombia

- 5.6.5 Peru

- 5.6.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 Grupo Alpura

- 6.4.4 Schreiber Foods Inc.

- 6.4.5 Fonterra Co-operative Group

- 6.4.6 Chobani LLC

- 6.4.7 General Mills, Inc.

- 6.4.8 Groupe Lactalis S.A..

- 6.4.9 Yakult Honsha Co. Ltd.

- 6.4.10 Emmi Group

- 6.4.11 Grupo Lala

- 6.4.12 Laticinios Bela Vista

- 6.4.13 Alpina Productos Alimenticios

- 6.4.14 Sigma Alimentos (Santa Clara)

- 6.4.15 FAGE International S.A

- 6.4.16 Conaprole

- 6.4.17 Tirol Alimentos

- 6.4.18 Grupo Gloria

- 6.4.19 Colun

- 6.4.20 Lacteos Los Andes

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK