PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836549

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836549

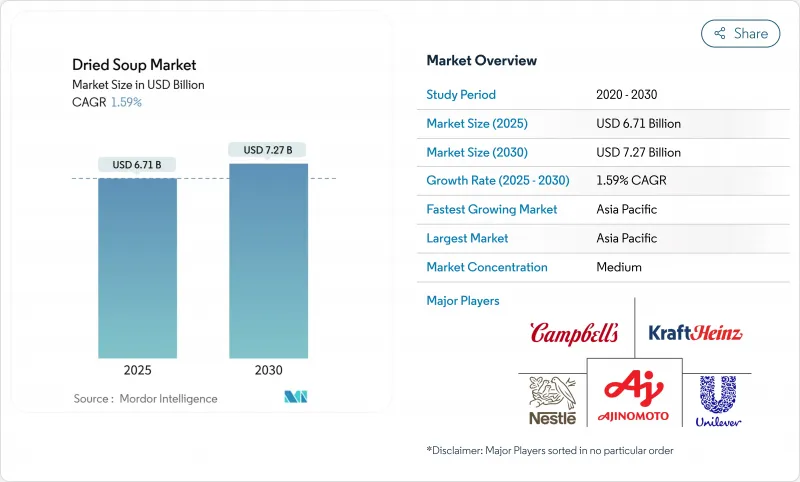

Dried Soup - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dried soup market was valued at USD 6.71 billion in 2025 and is projected to reach USD 7.27 billion by 2030, growing at a 1.59% CAGR.

This muted growth pattern signals a mature category in which legacy brands contend with consumers who now scrutinize price, nutrition, and ingredient transparency as strongly as they once prioritized convenience. Authenticity narratives, plant-forward formulations, and digital-first retail experiences are recasting the value of categories, forcing incumbents to justify their shelf space through differentiated propositions. In parallel, urbanization drives higher demand for portable meals. However, increased consumer interest in cooking and improved availability of fresh food reduce the consumption of packaged food products. The market competition has shifted beyond traditional concentration metrics, as niche companies build customer retention through targeted brand positioning and direct-to-consumer distribution models.

Global Dried Soup Market Trends and Insights

Rising Popularity of Vegan and Plant-Based Soups

Plant-based formulations are expanding the market as manufacturers develop alternatives that meet consumer demand for ethical and health-conscious products. According to the International Food Information Council data from 2024, 3% of the United States population consumed plant-based food exclusively, while 55% incorporated it for health benefits . The trend has evolved beyond simple ingredient substitution to transform the entire value chain, establishing plant-based soups as premium products. The combination of health, environmental, and ethical factors drives demand growth across various demographic segments. Manufacturers are expanding their product portfolios to include innovative plant-based ingredients, diverse flavor profiles, and enhanced nutritional content to capture a broader consumer base. This expansion strategy encompasses new product development, improved distribution channels, and targeted marketing campaigns to increase market penetration.

Premiumization and Gourmet Soups

Premium positioning enables manufacturers to maintain profitability through differentiated offerings that command higher prices, helping offset commodity price volatility and margin pressure. This strategy is particularly effective in developed markets where consumers increasingly view food as a lifestyle choice rather than basic sustenance. Products featuring gourmet ingredients, organic certifications, and specialized recipes create meaningful differentiation from private label competitors. The incorporation of premium ingredients and innovative formulations allows manufacturers to establish unique value propositions that resonate with quality-conscious consumers. Manufacturers are investing in research and development to create sophisticated product variants that justify premium pricing. As commodity inflation continues to affect standard product margins, manufacturers are strategically shifting their portfolios toward premium offerings to preserve and enhance profitability in competitive market conditions. This transition requires careful market analysis, consumer insight integration, and strategic pricing decisions to ensure the successful implementation of premium positioning strategies.

Consumer Preference for Fresh and Homemade Alternatives

Health consciousness and culinary engagement drive consumer migration toward fresh ingredients and home preparation methods that provide greater control over nutritional content and flavor customization. Pandemic-induced cooking skill development created lasting behavioral changes as consumers discovered satisfaction in meal preparation and ingredient sourcing that extends beyond convenience considerations. Social media platforms amplify fresh cooking trends through recipe sharing and cooking demonstrations that position homemade alternatives as achievable and desirable lifestyle choices. The availability of fresh ingredients through improved supply chains and online grocery delivery reduces barriers to home cooking that previously favored processed alternatives. Economic considerations increasingly favor fresh ingredients as commodity price inflation affects packaged goods more severely than basic agricultural products, creating cost advantages for home preparation.

Other drivers and restraints analyzed in the detailed report include:

- Sustainable and Eco-Friendly Packaging

- Long Shelf Life and Portability

- Negative Perceptions Regarding Healthiness

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Instant dried soup holds a 54.36% market share in 2024 and is projected to grow at a 1.86% CAGR through 2030. This growth stems from improved flavor preservation technology and simplified preparation methods that attract time-pressed consumers. The instant segment's market leadership reflects consumers' preference for convenience over traditional cooking, especially in urban areas where limited kitchen space and time favor quick meal solutions. Dehydrated dried soup variants make up the remaining market share, positioning themselves as premium options with enhanced flavor profiles and visible ingredients for consumers who can dedicate more time to preparation.

Improved manufacturing processes in instant soup production reduce costs while maintaining profit margins across distribution channels. The segment's growth aligns with increasing global urbanization, which drives consistent demand for convenient meal options among working professionals and single-person households. Product development in the instant segment now emphasizes organic certification, plant-based options, and unique flavors to distinguish products from standard offerings and support premium pricing. For instance, in October 2023, the Atlante company launched a range of instant legume cup soups, available in different flavors such as curry, picante, and Mediterranean. The products are vegan-friendly and rich in protein.

The Dried Soup Market is Segmented by Product Type (Instant Dried Soup and Dehydrated Dried Soup), Category (Vegetarian and Non-Vegetarian), Distribution Channels (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, and Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 33.47% market share in 2024, combined with 2.96% CAGR growth through 2030, positions the region as the primary driver of dried soup market expansion, fueled by rapid urbanization and evolving dietary preferences that favor convenience without abandoning traditional flavor profiles. The region's demographic transition toward dual-income households and extended commuting times creates sustained demand for quick meal solutions that maintain nutritional value and cultural authenticity. According to data from the Ministry of Internal Affairs and Communications for 2024, there were 13 million dual-income households in Japan . Rising health consciousness across the region increasingly favors products with clean labels and functional ingredients that align with traditional wellness philosophies while providing modern convenience benefits.

North American and European markets demonstrate mature consumption patterns with moderate growth rates that reflect established market penetration and increasing competition from fresh alternatives and insurgent brands challenging traditional players. European markets lead sustainability initiatives through regulatory frameworks that drive packaging innovation and ingredient sourcing transparency, creating competitive advantages for brands that successfully integrate environmental responsibility into value propositions. The region's focus on premium positioning and artisanal quality enables margin expansion despite volume pressures from health-conscious consumers migrating toward fresh preparation methods.

Emerging markets in South America, the Middle East, and Africa present significant growth opportunities driven by urbanization, rising disposable income, and infrastructure development that supports modern retail distribution channels. These regions benefit from lower market penetration rates that create expansion potential for both international brands and local manufacturers who understand cultural preferences and price sensitivity requirements. Economic development patterns in these markets favor convenience products as lifestyle changes reduce available cooking time while increasing exposure to global food trends through digital media and international travel. Supply chain development and local manufacturing capabilities become critical success factors for capturing growth in emerging markets where import costs and currency volatility can significantly impact product accessibility and pricing competitiveness.

- The Campbell Soup Company

- Unilever PLC

- Nestle S.A.

- The Kraft Heinz Company

- Premier Foods Group Ltd

- Ottogi Co., Ltd.

- General Mills Inc.

- Conagra Brands Inc.

- Baxters Food Group Ltd

- Ajinomoto Co., Inc.

- Hain Celestial Group

- B&G Foods Holding Corp.

- Nissin Foods Holdings Co.

- Tata Consumer Products Limited

- Pacific Foods of Oregon

- Maruchan Inc.

- Bonduelle S.A.

- Ainsley Harriott Food Company Limited

- Funk Foods Private Limited (Simplify Foods)

- Kettle & Fire Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Popularity of Vegan and Plant-Based Soups

- 4.2.2 Premiumization and Gourmet Soups

- 4.2.3 Sustainable and Eco-Friendly Packaging

- 4.2.4 Long Shelf Life and Portability

- 4.2.5 Influence of Social Media and Influencers

- 4.2.6 Demand for Quick and Easy Meal Solutions

- 4.3 Market Restraints

- 4.3.1 Consumer Preference for Fresh and Homemade Alternatives

- 4.3.2 Negative Perceptions Regarding Healthiness

- 4.3.3 Production Efficiency Challenges

- 4.3.4 Supply Chain Disruptions

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Instant Dried Soup

- 5.1.2 Dehydrated Dried Soup

- 5.2 By Category

- 5.2.1 Vegetarian Soup

- 5.2.2 Non-Vegetarian Soup

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 The Campbell Soup Company

- 6.4.2 Unilever PLC

- 6.4.3 Nestle S.A.

- 6.4.4 The Kraft Heinz Company

- 6.4.5 Premier Foods Group Ltd

- 6.4.6 Ottogi Co., Ltd.

- 6.4.7 General Mills Inc.

- 6.4.8 Conagra Brands Inc.

- 6.4.9 Baxters Food Group Ltd

- 6.4.10 Ajinomoto Co., Inc.

- 6.4.11 Hain Celestial Group

- 6.4.12 B&G Foods Holding Corp.

- 6.4.13 Nissin Foods Holdings Co.

- 6.4.14 Tata Consumer Products Limited

- 6.4.15 Pacific Foods of Oregon

- 6.4.16 Maruchan Inc.

- 6.4.17 Bonduelle S.A.

- 6.4.18 Ainsley Harriott Food Company Limited

- 6.4.19 Funk Foods Private Limited (Simplify Foods)

- 6.4.20 Kettle & Fire Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK