PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836551

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836551

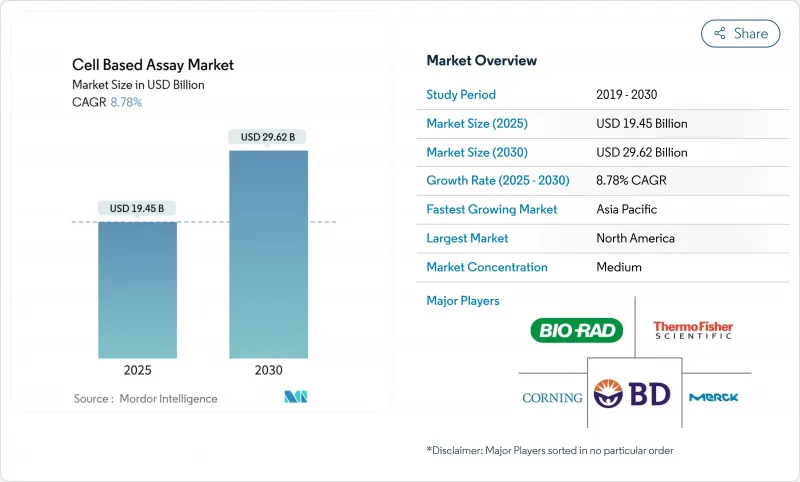

Cell Based Assay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cell Based Assay Market size is estimated at USD 19.45 billion in 2025, and is expected to reach USD 29.62 billion by 2030, at a CAGR of 8.78% during the forecast period (2025-2030).

The transition from animal studies to human-relevant in vitro models, bolstered by the April 2025 FDA decision to phase out animal testing, positions validated cellular platforms at the center of regulatory-compliant development. Companies are rapidly expanding automation, AI-driven analytics, and 3-D organoid models to improve predictive accuracy and reduce cycle times, while investment flows from major biopharma groups signal confidence in next-generation screening technologies. At the same time, rising chronic-disease prevalence, oncology pipelines, and regenerative-medicine projects sustain a robust demand outlook for high-throughput formats and label-free detection systems.

Global Cell Based Assay Market Trends and Insights

Rising Prevalence of Chronic & Lifestyle Diseases

Escalating cancer and metabolic-disease incidence is intensifying demand for sophisticated phenotypic screens that shorten discovery cycles. The National Cancer Institute budget rose by USD 407.6 million in 2024, earmarking funds for high-content platforms aimed at oncology pipelines. Vertex Pharmaceuticals committed USD 240 million to scale stem-cell therapeutics for type 1 diabetes, illustrating how disease-driven investment accelerates the cell-based assay market. As aging demographics widen clinical need, pharmaceutical groups integrate organoid panels and multiplex flow cytometry to improve translational relevance, reinforcing long-term growth.

Escalating Pharma-Biotech R&D Spending on Drug Discovery

Thermo Fisher Scientific has budgeted USD 2 billion (2025-2028) for U.S. manufacturing and R&D sites that include cell-analysis capabilities. AstraZeneca's USD 300 million cell-therapy facility in Maryland and Novo Nordisk's USD 4.1 billion injectable-therapeutic plant reveal broad capital reallocation toward in vitro testing workflows. Contract manufacturers such as Fujifilm Diosynth follow with USD 1.6 billion expansions focused on mammalian-cell processes, indicating multistakeholder confidence in the cell based assay industry

High Capital & Maintenance Costs of Advanced Platforms

Spectral flow systems can exceed USD 500,000, while annual service contracts add 20% of that figure, limiting uptake in price-sensitive academic and emerging-market settings. Financing schemes, including Beckman Coulter's modular upgrades, seek to lower entry barriers, but capital outlays remain a gating factor for broader cell-based assay market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Advances in High-Throughput & Label-Free Assays

- Growing Adoption of 3-D Organoid Models for Precision Oncology

- Shortage of Multi-Disciplinary, Assay-Development Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents and kits, benefiting from repeat-purchase economics, contributed 51.33% of the cell-based assay market in 2024, anchoring the consumables revenue base. Cell lines, however, represent the pivotal innovation engine, expanding at 10.17% CAGR on the back of induced pluripotent stem cell advances and CRISPR-engineered disease models. TreeFrog Therapeutics' USD 240 million C-Stem licensing deal with Vertex underscores rising valuations for scalable, high-quality cellular material.

The microplates subsegment enjoys steady gains from laboratory-automation compatibility, while specialty media and buffers mirror overall market expansion. Stem-cell-derived lines increasingly replace primary cultures due to improved consistency, a critical requirement for high-content screens.

High-throughput screening (HTS) platforms, long the backbone of pharmaceutical discovery, delivered 42.19% revenue in 2024. Yet, demand is shifting toward physiologically relevant 3-D models that more accurately recapitulate in-vivo biology. The 3-D culture segment's 8.25% CAGR is propelled by organoid standardization and regulatory endorsement. BD's spectral flow integration with robotic arms illustrates how established vendors are future-proofing HTS through automation and multi-modal detection.

Label-free detection and spectral cytometry broaden assay readouts, while automated liquid handlers compress sample-prep times, enhancing throughput. Together, these advances are expanding the cell based assay market size for integrated platforms expected to post double-digit growth within oncology workflows.

The Cell Based Assay Market Report is Segmented by Product (Cell Lines, Reagents and Kits, and More), Technology (High-Throughput Screening, and More), Application (Drug Discovery and Development, and More), End User (Pharmaceutical and Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.23% of 2024 revenue, underpinned by deep biopharma pipelines, NIH funding, and FDA guidance favoring human-relevant models. Government incentives and domestic manufacturing investments, for example, Thermo Fisher Scientific's USD 2 billion plan, fortify regional supply chains and enlarge the cell based assay market.

Asia-Pacific posts the fastest expansion at 9.13% CAGR. China's talent pool and infrastructure are scaling rapidly, highlighted by Cytek Biosciences' 50,000 sq ft manufacturing hub in Wuxi targeting high-dimensional cytometry systems. Japan's fast-track approval path for cell and gene therapies accelerates commercialization of assay-dependent products, reinforcing demand for 3-D cultures and AI-enhanced analytics.

Europe retains a substantial share through entrenched pharma clusters in Germany, Switzerland, and the UK. Harmonization of alternative-testing regulations with U.S. standards is catalyzing upgrades to label-free detection and organ-on-chip platforms. Meanwhile, Latin America, the Middle East, and Africa offer emerging opportunities where technology transfer and collaborative programs mitigate high-capital entry barriers. Collectively these regions add incremental volume to the global cell based assay market while progressing toward regulatory convergence.

- Beckton Dickinson

- Thermo Fisher Scientific

- Danaher

- Merck

- PerkinElmer

- Bio-Rad Laboratories

- Corning

- Lonza Group

- Promega

- Cell Signaling Technology

- Agilent Technologies

- Charles River

- Eurofins

- DiscoverX Corporation

- Revvity Life Sciences

- Abcam

- GE HealthCare Technologies Inc.

- Miltenyi Biotec

- Sartorius

- ATCC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic & Lifestyle Diseases

- 4.2.2 Escalating Pharma-Biotech R&D Spending on Drug Discovery

- 4.2.3 Continuous Advances in High-Throughput & Label-Free Assays

- 4.2.4 Growing Adoption of 3-D Organoid Models for Precision Oncology

- 4.2.5 AI-Powered High-Content Analytics Accelerating Screening Cycles

- 4.2.6 Global Regulatory Shift Toward In Vitro Alternatives to Animal Tests

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs of Advanced Platforms

- 4.3.2 Shortage of Multi-Disciplinary, Assay-Development Talent

- 4.3.3 Steep Learning Curve for Data Integration & Assay Interoperability

- 4.3.4 Fragile, Specialty-Reagent Supply Chains Post-Pandemic

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Cell Lines

- 5.1.1.1 Primary Cell Lines

- 5.1.1.2 Stem Cell Lines

- 5.1.1.3 Induced Pluripotent Cell Lines

- 5.1.1.4 Engineered / Recombinant Lines

- 5.1.1.5 Others

- 5.1.2 Reagents & Kits

- 5.1.2.1 Assay Reagents

- 5.1.2.2 Reporter Gene & Substrate Kits

- 5.1.2.3 Buffers & Media

- 5.1.2.4 Other Reagents

- 5.1.3 Microplates

- 5.1.4 Other Consumables

- 5.1.1 Cell Lines

- 5.2 By Technology

- 5.2.1 High-Throughput Screening

- 5.2.2 Flow Cytometry

- 5.2.3 Automated Liquid Handling

- 5.2.4 Label-free Detection

- 5.2.5 3-D Cell-Culture Assays

- 5.2.6 Others

- 5.3 By Application

- 5.3.1 Drug Discovery & Development

- 5.3.2 ADME & Toxicology Studies

- 5.3.3 Basic Research

- 5.3.4 Precision & Regenerative Medicine

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Contract Research Organizations

- 5.4.3 Academic & Government Institutes

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Danaher Corporation

- 6.3.4 Merck KGaA

- 6.3.5 PerkinElmer Inc.

- 6.3.6 Bio-Rad Laboratories Inc.

- 6.3.7 Corning Incorporated

- 6.3.8 Lonza Group AG

- 6.3.9 Promega Corporation

- 6.3.10 Cell Signaling Technology Inc.

- 6.3.11 Agilent Technologies Inc.

- 6.3.12 Charles River Laboratories

- 6.3.13 Eurofins Scientific SE

- 6.3.14 DiscoverX Corporation

- 6.3.15 Revvity Life Sciences

- 6.3.16 Abcam plc

- 6.3.17 GE HealthCare Technologies Inc.

- 6.3.18 Miltenyi Biotec

- 6.3.19 Sartorius AG

- 6.3.20 ATCC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment