PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836554

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836554

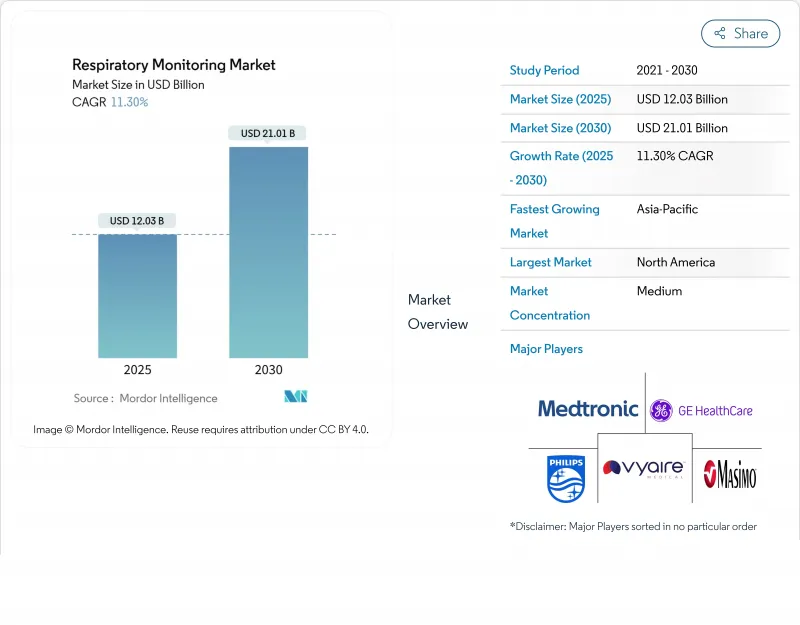

Respiratory Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The respiratory monitoring devices market reached USD 12.03 billion in 2025 and is projected to attain USD 21.01 billion by 2030, advancing at an 11.3% CAGR.

Momentum stems from the rapid fusion of AI, IoT, and miniaturized sensors that enable continuous, contextual respiratory data collection across care settings. Hospital demand remains strong, yet a fundamental shift toward home-based monitoring is underway, spurred by pandemic-era telehealth adoption and payer emphasis on cost containment. Wearable platforms are eroding the dominance of tabletop and handheld systems by providing real-time insight into chronic disease trajectories. Meanwhile, stringent post-recall regulatory scrutiny is lengthening approval timelines, nudging manufacturers toward earlier engagement with regulators and investment in rigorous safety validation.

Global Respiratory Monitoring Market Trends and Insights

Surge in AI-Powered Remote Respiratory Telemonitoring Adoption

The respiratory monitoring devices market is transforming as AI analytics migrate from research labs into commercial platforms that process breath sounds, flow rates, and oxygen saturation in real time. An Annals of Family Medicine study showed AI-enabled home stethoscopes identifying pediatric asthma flare-ups with 93.2% accuracy. Algorithms trained on longitudinal data sets now detect subtle pattern deviations that precede COPD exacerbation, prompting earlier therapy adjustments and reducing emergency department utilization. Hospitals are integrating these predictive dashboards into electronic health records so that care teams receive automated alerts flagged by clinical severity scores. Vendors are likewise embedding federated-learning techniques that anonymize data at the edge, addressing privacy mandates without sacrificing insight quality. For pediatric and geriatric cohorts who struggle with active self-reporting, passive AI listening systems offer a less burdensome alternative to conventional spirometry.

Rise in the Number of Respiratory Diseases

Global COPD and asthma prevalence are climbing, with chronic respiratory disorders ranking among the top five causes of disability-adjusted life years in 2025. Payers are linking reimbursement bonuses to documented reductions in hospital readmissions, pushing providers to adopt continuous monitoring pathways. The respiratory monitoring devices market is answering with multi-parameter devices that combine oximetry, airflow, and acoustic analytics to catch inflammatory events sooner than symptom-based escalation models. Caltech's EBCare mask, which detects nitrite in exhaled breath condensate, exemplifies how biomarker sensing is moving from bench to bedside. Pulmonologists now embed wearable data into risk-stratification algorithms that dynamically adjust inhaled corticosteroid dosage, demonstrating measurable declines in acute care visits. Governments in high-burden countries are launching public procurement schemes to subsidize remote monitoring kits for COPD patients, ensuring earlier intervention and easing tertiary-care loads.

Stringent Regulatory Approval

Post-recall turbulence has intensified FDA scrutiny, elevating respiratory monitoring devices to the forefront of safety oversight. Class II devices must now submit expanded bench testing and post-market surveillance protocols under updated 510(k) guidance. The 2024 consent decree against Philips Respironics underscores the financial and reputational stakes of non-compliance. Consequently, small innovators face protracted validation cycles that strain capital reserves and delay revenue realization. To mitigate risk, venture investors are channeling funds toward start-ups that embed quality-by-design documentation from the prototype phase onward. Some manufacturers are pursuing Breakthrough Device designation to accelerate review, though the evidence burden remains significant. In Europe, alignment with the Medical Device Regulation has likewise raised documentary thresholds, adding translation and notified-body costs that pinch margins.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Smartphone-Based Spirometry Apps Driving Early COPD Detection

- High Prevalence of Tobacco Smoking

- High Price of the Monitoring Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pulse oximeters contributed 37.1% to the respiratory monitoring devices market share in 2024 and are projected to maintain the largest revenue pool through 2030 due to essential status across surgical, critical-care, and ambulatory settings. Their universal applicability, non-invasive design, and established reimbursement paths underpin durable demand. The segment's innovation pipeline centers on multispectral sensors that capture perfusion index and respiratory rate alongside SpO2, adding clinical value without workflow disruption. Vendors are also rolling out Bluetooth-enabled fingertip models that auto-transmit data to hospital EMRs, improving continuous ward surveillance.

Capnographs, although representing a smaller share, exhibit the highest forecast CAGR at 8.8%, driven by broader application beyond operating rooms. Emergency departments now deploy compact mainstream sensors for rapid airway assessment during resuscitation, while procedural sedation suites rely on capnography to flag hypoventilation earlier than pulse oximetry. Portable sidestream units sized for ambulances are extending monitoring into pre-hospital environments, a capability increasingly mandated in advanced life-support protocols. The respiratory monitoring devices market is consequently witnessing bundled sales packages that combine oximetry and capnography modules, offering a holistic respiratory profile in trauma settings.

The Respiratory Monitoring Devices Market is Segmented by Device Type (Spirometers, Peak Flow Meters, Pulse Oximeters, and More), Technology (Wearable Respiratory Sensors and Non-wearable/Table-top & Hand-Held Devices), End-User (Hospitals & Clinics, Home-Care Settings, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 42% of global revenue in 2025, reflecting robust payer reimbursement, entrenched telemedicine infrastructure, and a COPD prevalence nearing 6.3% of adults. The respiratory monitoring devices market in the United States benefits from the FDA Breakthrough Device Program, which accelerates AI-driven solutions such as predictive capnography algorithms for sepsis-screened ICU patients. Academic-industry collaborations, like the 2025 Philips-Mass General Brigham partnership, channel large real-world data pools into refined clinical-decision rules that elevate device utility. Canada, incentivizing home oxygen therapy cost offsets, is piloting nationwide oximetry tracking networks that feed provincial analytics hubs.

In Europe, National Health Service procurement frameworks favor devices with proven cost-avoidance outcomes, encouraging vendors to supply structured health-economic dossiers. Germany's DIGA pathway, allowing prescription of digital health applications, has added four respiratory apps since 2024, boosting physician confidence in smartphone spirometry. The European respiratory monitoring devices market is also shaped by the Medical Device Regulation's post-market surveillance demands, prompting manufacturers to pre-package long-term warranty upgrades that align with mandatory vigilance reporting.

Asia Pacific exhibits the fastest expansion, logging a 14.2% CAGR as urbanization, air-quality deterioration, and smoking prevalence converge to swell respiratory caseloads. China and India collectively imported over 3 million handheld oximeters in 2024, yet domestic production capacity is scaling rapidly with government incentives for med-tech self-reliance. Local start-ups leverage cost-efficient printed electronics to create sub-USD 50 sensors, democratizing access across tier-2 cities. In Japan, a rapidly aging population is driving the adoption of AI-augmented cough monitors integrated into smart speakers, offering unobtrusive elder-care oversight. Australia's remote Indigenous communities benefit from satellite-enabled wearables that transmit lung function metrics to metropolitan pulmonology teams, bridging the tyranny of distance.

- Koninklijke Philips

- Medtronic plc (Covidien)

- GE Healthcare

- Masimo

- Dragerwerk

- Vyaire Medical

- Nihon Kohden

- Smiths Group

- Resmed

- Hamilton Medical

- Getinge

- Fisher & Paykel Healthcare

- Nonin Medical

- Honeywell International (Healthcare Sensors)

- Hill-Rom (Baxter)

- AirSep Corporation (CAIRE Inc.)

- VitalConnect Inc.

- Microlife Corp.

- Mindray Bio-Medical Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in AI-Powered Remote Respiratory Telemonitoring Adoption

- 4.2.2 Rise in the Number of Respiratory Diseases

- 4.2.3 Rise of Smartphone-Based Spirometry Apps Driving Early COPD Detection and Development of Advanced Technologies

- 4.2.4 High Prevalence of Tobacco Smoking

- 4.2.5 Government-Funded Neonatal Respiratory Screening Programs across Nordic Nations

- 4.2.6 Stringent Workplace Safety Mandates Accelerating Continuous Respiratory Monitoring in Industrial Settings

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Approval

- 4.3.2 High Price of the Monitoring Devices

- 4.3.3 Supply-Chain Bottlenecks for Micro-Optical Sensors Driving Device Backlogs

- 4.3.4 High Calibration-Frequency Requirement Limiting Wearable Gas Analyzer Acceptance in Pediatric Care

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Spirometers

- 5.1.2 Peak Flow Meters

- 5.1.3 Sleep Test Devices (Polysomnographs)

- 5.1.4 Gas Analyzers

- 5.1.5 Pulse Oximeters

- 5.1.6 Capnographs

- 5.1.7 Other Monitoring Devices

- 5.2 By Technology

- 5.2.1 Wearable Respiratory Sensors

- 5.2.2 Non-wearable/Table-top & Hand-held Devices

- 5.3 By End-user

- 5.3.1 Hospitals & Clinics

- 5.3.2 Home-care Settings

- 5.3.3 Ambulatory Surgical & Specialty Centers

- 5.3.4 Emergency Medical Services & Field Use

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 Medtronic plc (Covidien)

- 6.3.3 GE Healthcare

- 6.3.4 Masimo Corporation

- 6.3.5 Dragerwerk AG & Co. KGaA

- 6.3.6 Vyaire Medical, Inc.

- 6.3.7 Nihon Kohden Corporation

- 6.3.8 Smiths Medical (ICU Medical)

- 6.3.9 ResMed Inc.

- 6.3.10 Hamilton Medical AG

- 6.3.11 Getinge AB

- 6.3.12 Fisher & Paykel Healthcare

- 6.3.13 Nonin Medical Inc.

- 6.3.14 Honeywell International (Healthcare Sensors)

- 6.3.15 Hill-Rom (Baxter)

- 6.3.16 AirSep Corporation (CAIRE Inc.)

- 6.3.17 VitalConnect Inc.

- 6.3.18 Microlife Corp.

- 6.3.19 Mindray Bio-Medical Electronics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment