PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836556

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836556

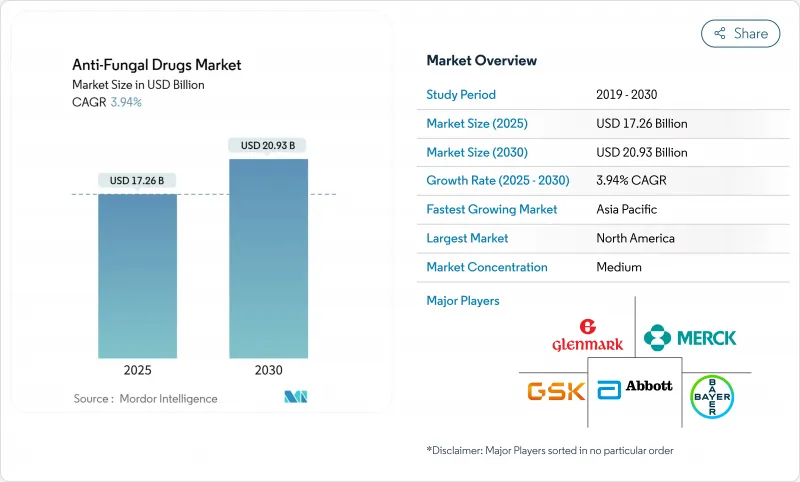

Anti-Fungal Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Anti-Fungal Drugs Market size is estimated at USD 17.26 billion in 2025, and is expected to reach USD 20.93 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

The moderate climb reflects a maturing therapeutic space that must balance larger immunocompromised populations with drug-resistant pathogens and supply chain fragility. Rising ambient temperatures, wider agricultural azole use, and expanding oncology programs are jointly widening the clinical footprint of fungal disease, while regulators are accelerating reviews of novel mechanisms to close treatment gaps. Digitization of care, new long-acting formulations, and expanding online pharmacy networks are reshaping patient access channels. In parallel, climate-driven pathogen migration is forcing healthcare systems to revisit surveillance and stewardship strategies across temperate and tropical regions.

Global Anti-Fungal Drugs Market Trends and Insights

Rising incidence of immunocompromised patients

Oncology advances and organ-transplant programs are enlarging the pool of individuals who require systemic antifungal prophylaxis or therapy. Invasive fungal infection rates surpass 25% in several high-risk cancer cohorts, while invasive aspergillosis mortality reaches 43.4% among liver failure patients compared with 15.75% for non-infected counterparts. Once-weekly echinocandin regimens such as rezafungin are aligning with outpatient care models, reducing infusion frequency and freeing hospital capacity. As transplant centers expand in emerging economies, longer prophylaxis windows inflate per-patient drug volumes, directly supporting the anti-fungal drugs market.

Growing OTC availability of topical antifungals

Retail access is broadening product reach beyond prescription channels. Medicare Part D recorded 6.5 million topical antifungal claims, costing USD 231 million. Primary care prescribers wrote 40% of these scripts, signaling mainstream clinician engagement. Yet only 31.2% of clotrimazole-betamethasone orders matched confirmed fungal diagnoses, underscoring stewardship gaps that may accelerate resistance. Nanoparticle carriers improve skin penetration and shorten treatment courses, while resistant strains such as Trichophyton indotineae spur demand for alternative topical azoles.

Escalating drug resistance across major antifungal classes

Multidrug-resistant Candida auris now spans more than 40 countries and shows reduced susceptibility to azoles, echinocandins, and polyenes. Meta-analyses reveal rising resistance in Hypocreales and Microascales orders, reflecting environmental azole exposure. Only seven FDA-approved systemic classes exist, and breakthrough mold infections during prophylaxis are becoming more common, heightening the urgency for novel targets.

Other drivers and restraints analyzed in the detailed report include:

- Heightened awareness and diagnostics for fungal infections

- Shifting climate patterns driving pathogenic fungi emergence

- Adverse-event profile and product recalls of systemic agents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Azoles retained 53.47% revenue in 2024, grounding the anti-fungal drugs market in well-established, broad-spectrum protocols. Their fungistatic action across Candida and Aspergillus species still underpins first-line therapy for many indications. The once-weekly echinocandin rezafungin, however, introduces a convenience advantage that is expected to propel the class at a 4.91% CAGR to 2030. Hospitals are integrating long-acting echinocandins into outpatient parenteral antifungal programs to curtail inpatient stays. Polyenes such as liposomal amphotericin B continue to anchor salvage regimens when resistance or renal impairment narrows options. Allylamines confront terbinafine-resistant dermatophytes, forcing clinicians to switch to systemic azoles earlier in treatment courses. Antimetabolite use remains confined to combination therapy for cryptococcosis and severe candidiasis but offers synergy that may preserve azole efficacy. Combination regimens overall are gaining prominence as resistance pressures grow.

A pull toward stewardship is also reshaping purchasing dynamics. Cost-optimized azole generics dominate formularies, whereas premium-priced echinocandins rely on pharmaco-economic justification linked to shorter hospital stays. As a result, the anti-fungal drugs market maintains a two-tier competitive field: scale-driven azole producers and innovation-led echinocandin developers.

Candidiasis accounted for 39.82% of 2024 revenue, reflecting its frequency among immunosuppressed patients and its association with invasive care settings. High mortality linked to drug-resistant Candida auris keeps systemic treatment protocols under constant review and sustains investment in hospital antifungal budgets. Onychomycosis, conversely, will expand the fastest at a 4.66% CAGR, supported by aging populations and the global rise of diabetes. Japanese prescription audits underline the monetary burden of newer therapies and hint at wider traction as patient willingness to pay for shorter regimens grows. Dermatophytosis retains solid volume demand in tropical regions, though climate change is expected to broaden its prevalence in temperate zones.

Patient-centric innovations are reshaping consumer expectations. Oral terbinafine courses are giving way to brunch-dose itraconazole pulse regimens that lessen hepatic strain. Proactive screening in transplant centers is increasing early candidemia detection, while rapid antigen tests in outpatient foot clinics are raising treatment rates for nail infections. Each of these dynamics feeds incremental volumes into the anti-fungal drugs market.

The Anti-Fungal Drugs Market Report is Segmented by Drug Class (Azoles, Echinocandins, Polyenes, Allylamines, and Antimetabolites), Indication (Candidiasis, Dermatophytosis, and More), Dosage Form (Capsules, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest regional revenue slice at 34.81% in 2024. High oncology and transplant caseloads sustain systemic antifungal demand, and swift FDA review cycles grant first-in-class therapies rapid market entry. Medicare data showing annual topical antifungal spending of USD 231 million illustrates robust outpatient activity. As valley fever spreads northward, the region is ramping surveillance budgets to track soil-borne pathogens and adjust local treatment guidelines. Strong reimbursement frameworks support premium pricing for next-generation agents, though stewardship mandates are tightening formulary thresholds.

Asia-Pacific is the fastest-growing geography with a 5.17% CAGR forecast to 2030. Rising discretionary incomes and public insurance expansion are lifting diagnosis and treatment rates. India's generic manufacturers anchor global supply, and firms such as Glenmark hold 26.4% domestic share in topical segments. PIC/S alignment is simplifying cross-border trade and inviting multinational investment in regional production hubs. Digital pharmacies and tele-dermatology platforms further expand access, particularly in secondary cities where brick-and-mortar pharmacy density remains low. Growing elderly and diabetic cohorts translate into sustained onychomycosis demand, reinforcing the anti-fungal drugs market trajectory.

Europe faces climate-related exposure shifts, with Aspergillus habitat models forecasting a 77.5% rise in population at risk. Agricultural azole regulation aims to curb cross-resistance, but implementation varies across member states, complicating stewardship consistency. Brexit has triggered parallel supply chains as companies establish EU-based production to secure uninterrupted distribution. The region's focus on antimicrobial stewardship is fuelling investments in rapid diagnostics and targeted prophylaxis protocols. Cold-chain optimization projects are underway in Mediterranean countries where summertime temperatures exceed historical norms, ensuring stable echinocandin delivery.

- Abbott Laboratories

- Astellas Pharma

- Bayer

- GlaxoSmithKline

- Glenmark Pharma Ltd.

- Arcadia Consumer Healthcare

- Merck

- Novartis

- Pfizer

- SCYNEXIS

- Mycovia Pharmaceuticals

- Apex Laboratories Pvt Ltd.

- Gilead Sciences

- Basilea Pharmaceutica Ltd.

- Sun Pharmaceuticals Industries

- Cipla

- Cadila Healthcare (Zydus Lifesciences)

- Hikma Pharmaceuticals

- Alkem Laboratories Ltd.

- Lupin

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Immunocompromised Patients

- 4.2.2 Growing OTC Availability of Topical Antifungals

- 4.2.3 Heightened Awareness & Diagnostics for Fungal Infections

- 4.2.4 Shifting Climate Patterns Are Contributing to the Emergence and Spread of Pathogenic Fungi

- 4.2.5 Extensive Use of Azole Fungicides in Agriculture Accelerating Clinical Resistance

- 4.2.6 Ongoing Innovation in Antifungal R&D Pipelines

- 4.3 Market Restraints

- 4.3.1 Escalating Drug Resistance Across Major Antifungal Classes

- 4.3.2 Adverse-Event Profile & Product Recalls of Systemic Agents

- 4.3.3 Cold-Chain Limitations for Parenteral Echinocandins in LMICs

- 4.3.4 Lengthy Regulatory Processes and High Development Costs

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Drug Class

- 5.1.1 Azoles

- 5.1.2 Echinocandins

- 5.1.3 Polyenes

- 5.1.4 Allylamines

- 5.1.5 Antimetabolites

- 5.2 By Indication

- 5.2.1 Candidiasis

- 5.2.2 Dermatophytosis

- 5.2.3 Aspergillosis

- 5.2.4 Onychomycosis

- 5.2.5 Other Systemic & Opportunistic Mycoses

- 5.3 By Dosage Form

- 5.3.1 Capsules

- 5.3.2 Topical Ointments/Creams

- 5.3.3 Parenteral Injectables

- 5.3.4 Powders & Sprays

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Astellas Pharma Inc.

- 6.3.3 Bayer AG

- 6.3.4 GSK plc

- 6.3.5 Glenmark Pharma Ltd.

- 6.3.6 Arcadia Consumer Healthcare

- 6.3.7 Merck & Co., Inc.

- 6.3.8 Novartis AG

- 6.3.9 Pfizer Inc.

- 6.3.10 SCYNEXIS Inc.

- 6.3.11 Mycovia Pharmaceuticals Inc.

- 6.3.12 Apex Laboratories Pvt Ltd.

- 6.3.13 Gilead Sciences Inc.

- 6.3.14 Basilea Pharmaceutica Ltd.

- 6.3.15 Sun Pharmaceutical Industries Ltd.

- 6.3.16 Cipla Ltd.

- 6.3.17 Cadila Healthcare (Zydus Lifesciences)

- 6.3.18 Hikma Pharmaceuticals plc

- 6.3.19 Alkem Laboratories Ltd.

- 6.3.20 Lupin Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment