PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836559

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836559

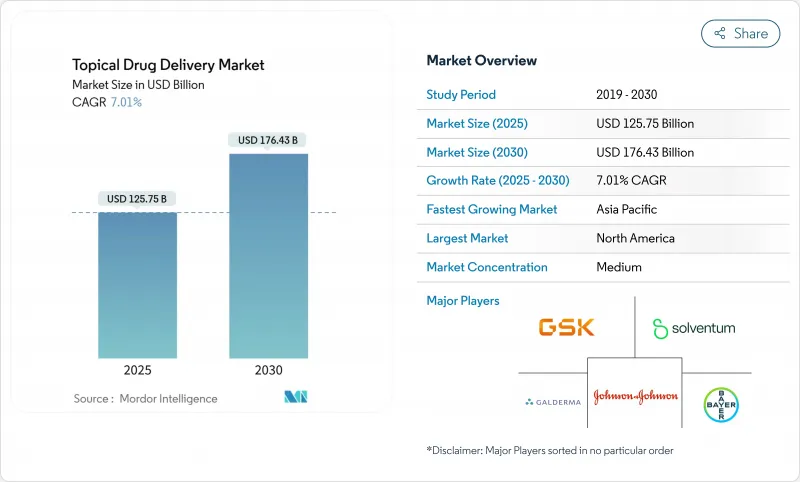

Topical Drug Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The topical drug delivery market stands at USD 125.75 billion in 2025 and is forecast to reach USD 176.43 billion by 2030, posting a 7.01% compound annual growth rate (CAGR).

This expansion reflects the shift from conventional creams and ointments toward precision-engineered patches, microneedle arrays, and smart, sensor-enabled devices that improve dosing accuracy and treatment adherence. Strong demand for non-invasive chronic-disease therapies, regulatory support for non-opioid pain solutions, and rapid progress in biologic formulations collectively sustain momentum. Companies also benefit from the steady launch pace of targeted dermatology drugs and the broadening role of connected health ecosystems that allow clinicians to monitor patient compliance remotely. Against this backdrop, the topical drug delivery market continues to attract both large pharmaceutical manufacturers and agile biotechnology firms that specialize in delivery platforms.

Global Topical Drug Delivery Market Trends and Insights

High prevalence of chronic & infectious skin diseases

Chronic skin disorders such as psoriasis and atopic dermatitis remain among the ten most common health conditions worldwide. Psoriasis alone affected more than 40 million people in 2024, spurring steady prescription growth for topical biologics. Galderma's Nemluvio, approved in December 2024, demonstrated superior itch reduction in trials with 1,900 patients, underscoring how IL-31 antagonists reshape moderate-to-severe atopic dermatitis management. Artificial-intelligence skin-mapping tools now guide personalized regimens, while multimodal vision models trained on two million images boost diagnostic accuracy in clinics. Together, epidemiologic pressure and technology convergence position chronic-disease care as a long-duration growth engine for the topical drug delivery market.

Rapid adoption of transdermal patches in pain & hormone therapy

The United States Food and Drug Administration cleared Journavx (suzetrigine) in January 2025 as the first non-opioid patch indicated for moderate to severe acute pain. The decision signals regulatory willingness to back novel, non-addictive analgesics. In hormone therapy, Bayer's elinzanetant New Drug Application targets vasomotor symptoms for the 1.2 billion global menopausal population anticipated by 2030. New adhesive chemistries such as Medherant's TEPI platform deliver uniform doses over extended wear periods, driving patient preference for patches over oral regimens. As a result, transdermal modalities continue to capture share within the broader topical drug delivery market.

Stringent global price controls on topical corticosteroids

Many governments have tightened reference pricing schemes, compressing margins on mainstream corticosteroid products and restricting cash flow available for novel delivery research. Patent expiries in 2025 for several branded formulations further intensify low-price competition, particularly in high-volume emerging markets. Suppliers are forced to re-engineer cost structures even as complex biologic pipelines demand higher R&D investment, creating a squeeze that could moderate growth in certain segments of the topical drug delivery market.

Other drivers and restraints analyzed in the detailed report include:

- Rising geriatric population

- Demand for self-administration & home-care-friendly formats

- Frequent contamination-driven product recalls & warning letters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dermal deliveries captured 45.33% of topical drug delivery market share in 2024, reflecting broad clinical familiarity and patient comfort. The topical drug delivery market size attached to dermal routes is forecast to expand steadily as biologics and smart patches penetrate dermatology and systemic indications. Nasal delivery, however, is registering the fastest 9.46% CAGR to 2030 as intranasal sprays for migraine, respiratory infections, and neurologic rescue therapy gain traction. A growing pipeline of antisense oligonucleotides formulated for the nasal cavity demonstrates commercial enthusiasm. Digital health integration now extends to dermal routes through sensor-equipped patches that relay dose records to electronic health records, while connected inhalers offer similar feedback loops for pulmonary applications. Ophthalmic therapy benefits from preservative-free multi-dose bottles that reduce ocular surface damage, and pulmonary devices leverage vibrating mesh technology to improve deep-lung deposition.

The convergence of microneedles with nasal and dermal platforms is widening access to large molecules. Smart interfaces guide users through app-based tutorials, lowering administration errors. Meanwhile, rectal and oral-mucosal routes maintain niche relevance for palliative care and buccal vaccine delivery, respectively. Across all pathways, formulation scientists increasingly employ permeation enhancers, nanoemulsions, and in situ gels to meet dosing targets without compromising safety. This broad toolbox strengthens each route's ability to address emerging clinical needs, reinforcing the long-term diversification of the topical drug delivery market.

Traditional creams, gels, lotions, and sprays represented 71.21% of topical drug delivery market size in 2024. Their entrenched physician acceptance and manufacturing scale keep volumes high. Semi-solids such as foams are popular with patients who prefer quick absorption, whereas liquids thrive in ophthalmology and nasal care where metered-dose applicators enhance accuracy. Solid films and powders remain small but essential for on-the-go wound care and pediatric dosing.

The devices category-comprising patches, microneedle arrays, smart bandages, and drug-eluting dressings-shows an 8.35% CAGR and is the clear momentum play. Solventum's V.A.C. Peel and Place system lowered hospital-labor time by 61% and treatment costs by 41% during clinical rollout. Programmable microneedle patches for weight-management agents such as Semaglutide demonstrate that devices can unlock monthly dosing cycles impossible with traditional creams. As electronics costs fall and flexible circuits mature, hybrid "formulation-plus-device" products blur category boundaries, adding value through monitoring and data capture.

The Topical Drug Delivery Market is Segmented by Route of Administration (Dermal, Ophthalmic, Nasal, and More), Product (Formulations [Solid, Semi-Solid and More] and Device [Transdermal Patches and More]), Indications (Dermal, Pain Management and More), End User (Hospitals, Home-Care Settings and More) and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained a 38.77% revenue share in 2024, backed by deep R&D pipelines, high healthcare expenditure per capita, and fast regulatory turnarounds for break-through devices. The United States drives patch adoption through value-based reimbursement that rewards fewer hospital visits. Canada shows strong demand for biosimilar creams within its single-payer scheme, while Mexico's private-sector clinics increasingly stock smart dressings for diabetic ulcer care.

Asia-Pacific shows the fastest 9.56% CAGR, even as venture funding fell 22% in 2024. China funds domestic microneedle startups and supports large-scale GMP plants that supply domestic and export demand. Japan faces accelerated aging, boosting sales of easy-to-apply analgesic patches. India's respiratory portfolio, led by Cipla, expanded 17.9% year over year and demonstrates rising domestic appetite for specialty devices. South Korea approved Rhopressa ophthalmic solution to address rising glaucoma prevalence, while Australia promotes remote monitoring solutions for rural patients.

Europe registers steady growth and leads in sustainability legislation, prompting rapid petrolatum replacement in Germany and the Nordic region. France and the United Kingdom pilot AI-linked dermatology networks that feed real-world evidence to regulators. Eastern Europe grows off a lower base but exhibits strong demand for generics, making it a target for contract manufacturers operating within the topical drug delivery industry. South America and the Middle East & Africa remain smaller today but represent future upside as healthcare infrastructure matures and digital-health connectivity widens.

- Bayer

- Johnson & Johnson

- GlaxoSmithKline

- Novartis

- Galderma

- Solventum

- Bausch Health

- Hisamitsu Pharmaceutical Co.

- Cipla

- Viatris

- MedPharm Ltd.

- Pfizer

- Leo Pharma

- Sun Pharma Industries Ltd.

- Abbvie

- Teva Pharmaceutical Industries

- Lupin

- Perrigo Company

- Taro Pharmaceutical Industries

- Glenmark Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence Of Chronic & Infectious Skin Diseases

- 4.2.2 Rapid Adoption Of Transdermal Patches In Pain & Hormone Therapy

- 4.2.3 Rising Geriatric Population

- 4.2.4 Demand For Self-Administration & Home-Care-Friendly Formats

- 4.2.5 Polymeric Microneedle Breakthroughs Enabling Large-Molecule Delivery

- 4.2.6 Smart/Connected Patches Driving Longitudinal Dosing Compliance

- 4.3 Market Restraints

- 4.3.1 Stringent Global Price Controls On Topical Corticosteroids

- 4.3.2 Frequent Contamination-Driven Product Recalls & Warning Letters

- 4.3.3 Limited Skin Permeation Of Biologics Without Enhancers

- 4.3.4 ESG-Driven Phase-Out Of Petrolatum Bases In Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Route of Administration

- 5.1.1 Dermal

- 5.1.2 Ophthalmic

- 5.1.3 Nasal

- 5.1.4 Oral Mucosal

- 5.1.5 Otic

- 5.1.6 Rectal

- 5.1.7 Vaginal

- 5.1.8 Pulmonary (Inhalational)

- 5.1.9 Others

- 5.2 By Product

- 5.2.1 Formulations

- 5.2.1.1 Solid (powders, films)

- 5.2.1.2 Semi-Solid

- 5.2.1.2.1 Creams

- 5.2.1.2.2 Ointments

- 5.2.1.2.3 Gels & Pastes

- 5.2.1.3 Liquid (solutions, sprays)

- 5.2.1.4 Foams

- 5.2.2 Devices

- 5.2.2.1 Transdermal Patches

- 5.2.2.2 Microneedle Patches

- 5.2.2.3 Inhalers & Nebulisers

- 5.2.2.4 Metered-Dose Sprayers

- 5.2.1 Formulations

- 5.3 By Indication

- 5.3.1 Dermatology (Eczema, Psoriasis, Acne)

- 5.3.2 Pain Management (Musculoskeletal, Neuropathic)

- 5.3.3 Ophthalmology (Dry-eye, Glaucoma)

- 5.3.4 Respiratory (Asthma, COPD)

- 5.3.5 ENT & Nasal Infections

- 5.3.6 Hormone Replacement Therapy

- 5.3.7 CNS Disorders (Migraine, Parkinson's)

- 5.3.8 Others

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Specialty Clinics & Dermatology Centers

- 5.4.3 Home-Care Settings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Bayer AG

- 6.3.2 Johnson & Johnson

- 6.3.3 GlaxoSmithKline plc

- 6.3.4 Novartis AG

- 6.3.5 Galderma SA

- 6.3.6 Solventum

- 6.3.7 Bausch Health Companies Inc.

- 6.3.8 Hisamitsu Pharmaceutical Co.

- 6.3.9 Cipla Ltd.

- 6.3.10 Viatris Inc.

- 6.3.11 MedPharm Ltd.

- 6.3.12 Pfizer Inc.

- 6.3.13 Leo Pharma A/S

- 6.3.14 Sun Pharma Industries Ltd.

- 6.3.15 AbbVie Inc. (Allergan)

- 6.3.16 Teva Pharmaceutical Industries

- 6.3.17 Lupin Ltd.

- 6.3.18 Perrigo Company plc

- 6.3.19 Taro Pharmaceutical Industries

- 6.3.20 Glenmark Pharmaceuticals

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment