PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836560

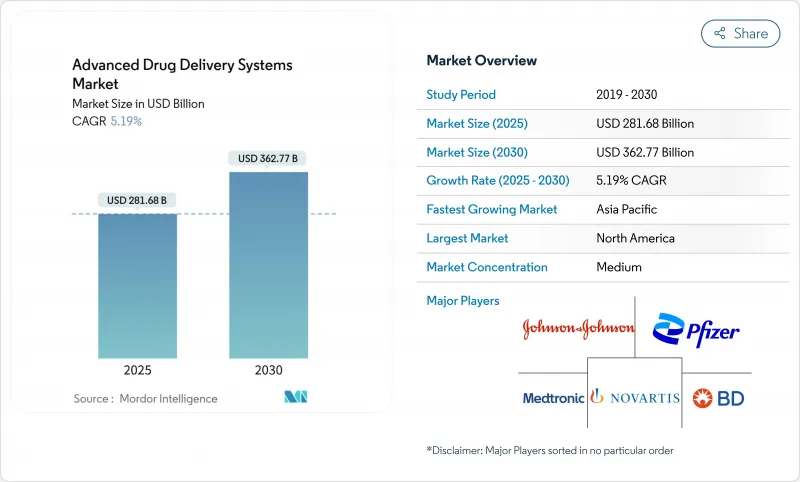

Advanced Drug Delivery Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The advanced drug delivery systems market is valued at USD 281.68 billion in 2025 and is forecast to reach USD 362.77 billion by 2030, expanding at a 5.19% CAGR.

This steady climb reflects how sustained biologics innovation, nano-carrier breakthroughs, and patient-centric care models are reshaping therapeutic delivery. Lipid-based nanoparticles, which already dominate formulation choices, are gaining traction in mRNA and siRNA pipelines, while smart electro-responsive implants show the fastest volume growth as they automate drug release in real time. Therapeutic demand concentrates in oncology, yet ophthalmology now logs the quickest rise owing to sustained-release ocular implants and drug-eluting contact lenses. Regionally, the advanced drug delivery systems market continues to lean toward North America, but Asia-Pacific's regulatory convergence and low-cost production capacity are closing the gap. Competitive momentum intensifies as large pharmaceutical companies acquire agile platform developers to secure pipeline access and shorten launch timelines.

Global Advanced Drug Delivery Systems Market Trends and Insights

Biologics Pipeline Expansion

A widening biologics pipeline is reshaping delivery demands as proteins, antibodies, and nucleic-acid therapies require carriers that protect fragile structures and target complex tissues. Pfizer's partnership with Bar-Ilan University on DNA nanorobots illustrates the push to marry biologic payloads with precision carriers. Oncology programs underscore this need: biologics now form more than 60% of active cancer trials, prompting delivery designs that cross vascular and cellular barriers without compromising potency. Combination products, such as Johnson & Johnson's AKEEGA dual-action tablet, highlight how integrating two distinct mechanisms in one delivery format can cut disease progression by nearly half in BRCA-altered prostate cancer.

Nano-carrier Design Breakthroughs

Recent nano-carrier design wins are improving cell uptake, immune evasion, and payload capacity. Cubosome formulations achieve up to eight-fold greater cellular entry than traditional liposomes by fusing directly with membranes. Ganglioside-based lipid nanoparticles remove PEG yet maintain stealth capabilities, addressing false-positive immunogenicity concerns. Artificial-intelligence screening now evaluates tens of millions of ionizable lipid candidates in silico, compressing discovery cycles and yielding delivery vectors optimized for mRNA therapeutics. Oregon State University's lung-targeting nanoparticles extend these advantages into cystic fibrosis gene therapy trials.

Batch-to-batch Complexity & Recalls

The FDA's 2025 guidance on uniformity pressures manufacturers to adopt real-time analytics and continuous processing. Minor particle-size shifts in lipid nanoparticles can alter biodistribution and efficacy, exposing companies to costly recalls. Continuous manufacturing promises tighter control but demands high capital outlay and extensive validation, straining smaller firms.

Other drivers and restraints analyzed in the detailed report include:

- Chronic-disease Prevalence & Adherence Focus

- Venture Funding for Platform DDS Start-ups

- Stringent CMC & Combination-product Regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oral formulations retained 45.32% revenue share of the advanced drug delivery systems market in 2024, supported by familiar dosing and efficient manufacturing. Transdermal platforms are gaining at a 7.35% CAGR as microneedle patches and permeation enhancers deliver biologics without injections. The advanced drug delivery systems market size for oral products is projected to expand steadily, yet its share may slip as injectables and inhalables capture molecules that degrade in the gut. 3D-printed multilayer tablets, now in pilot production, show how oral systems will evolve to support precision dosing. Meanwhile, transdermal candidates leverage biodegradable microneedles that dissolve after insertion, eliminating sharp-waste handling. Pharmaceutical companies allocate R&D budgets toward long-acting transdermal contraceptives and hormone therapies that promise monthly or quarterly replacement cycles, boosting adherence and reducing clinic visits.

Patient acceptance drives this shift. Surveys indicate that more than 70% of adults prefer patch-based administration when equivalent efficacy is assured. Drug developers also appreciate the lower regulatory burden for line-extension strategies in transdermal formats because many excipients already hold GRAS status. However, achieving consistent flux across variable skin types remains a technical barrier. Collaborations with dermatology specialists aim to refine formulation rheology and backing-layer design to mitigate these challenges.

Oncology therapies commanded 30.27% of 2024 sales, a reflection of complex payload requirements and willingness to pay for targeted carriers. The advanced drug delivery systems market size for oncology is set to remain dominant as CAR-T, ADC, and radioligand pipelines reach commercialization. Johnson & Johnson's TAR-200 intravesical system achieved an 82.4% complete response in bladder cancer, underscoring the potential of site-directed depots. Ophthalmology, however, grows fastest on the back of sustained-release implants like bimatoprost intracameral rings and anti-VEGF reservoirs. These devices cut injection frequency from monthly to twice yearly, reducing clinic burden.

Long-acting ocular inserts also widen chronic glaucoma coverage in regions with limited specialist access. Cardiovascular applications adopt biodegradable polymer stents that elute antiproliferative agents, while metabolic disorders advance weekly injectable GLP-1 analogs. Central nervous system indications face the blood-brain barrier hurdle, prompting research into focused ultrasound-activated carriers and intranasal routes that bypass systemic circulation.

The Advanced Drug Delivery Systems Market Report is Segmented by Type (Oral Drug Delivery System, Injection-Based Drug Delivery System, and More), Application (Cardiovascular, Oncology, and More), Technology Platform (Pro-Drug & Stimuli-Responsive, Lipid-Based Nanocarriers and More), End User (Hospitals & Clinics, Home-Care & Self-Administration and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.47% revenue share in 2024, buoyed by a mature reimbursement system, deep venture pools, and the FDA's support for innovative manufacturing pathways. The region also houses major contract manufacturers that can scale lipid nanoparticle production within validated clean-room suites. Johnson & Johnson allotted USD 1.56 billion for advanced delivery technologies within its MedTech division, ensuring sustained pipeline throughput. Novartis opened an Indianapolis radioligand facility to support targeted prostate cancer therapy, signaling confidence in complex carrier formats.

Asia-Pacific, expanding at an 8.16% CAGR, capitalizes on lower fabrication costs and robust government incentives. China channels public funds into nanotechnology hubs, while South Korea's semiconductor expertise accelerates smart implant production. India's pharmaceutical base is upgrading to accommodate sterile lipid nanoparticle lines, leveraging Make-in-India subsidies. Regulatory agencies across ASEAN align more closely with ICH guidelines, smoothing multi-country approvals.

Europe remains influential through rigorous safety standards and green manufacturing priorities. EMA's guidance on nanotoxicology drives global benchmarks, compelling developers to adopt biodegradable excipients. Germany's precision-engineering firms supply micro-molding equipment for implant housings, and Switzerland's biotech cluster advances antibody-drug conjugate delivery. Post-Brexit, the United Kingdom implements accelerated pathways to keep pace with US fast-track programs.

- Beckton Dickinson

- Johnson & Johnson (Janssen & Ethicon)

- Pfizer

- Novartis

- Medtronic

- Abbott Laboratories

- Baxter

- Bayer

- Boston Scientific

- Kindeva Drug Delivery

- Ypsomed

- Abbvie

- AstraZeneca

- Gerresheimer

- Catalent

- West Pharmaceutical Services

- SHL Medical

- Insulet

- Nemera

- Elcam Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Biologics Pipeline Expansion

- 4.2.2 Nano-Carrier Design Breakthroughs

- 4.2.3 Chronic-Disease Prevalence & Adherence Focus

- 4.2.4 Venture Funding For "Platform" DDS Start-Ups

- 4.2.5 Micro-Reservoir Implants For Digital Therapeutics

- 4.2.6 3-D Printed Personalized Dosage Forms

- 4.3 Market Restraints

- 4.3.1 Batch-To-Batch Complexity & Recalls

- 4.3.2 Stringent CMC & Combination-Product Regulation

- 4.3.3 Cold-Chain Cost Escalation For Biologic DDS

- 4.3.4 Nano-Carrier Environmental Toxicity Concerns

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Type

- 5.1.1 Oral Drug Delivery System

- 5.1.2 Injection-based Drug Delivery System

- 5.1.3 Inhalation/Pulmonary Drug Delivery System

- 5.1.4 Transdermal Drug Delivery System

- 5.1.5 Trans mucosal Drug Delivery System

- 5.1.6 Carrier-based Drug Delivery System

- 5.1.7 Other Types

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Cardiovascular

- 5.2.3 Metabolic (Diabetes, Obesity)

- 5.2.4 CNS Disorders

- 5.2.5 Infectious Diseases

- 5.2.6 Ophthalmology

- 5.2.7 Urology & Women's Health

- 5.2.8 Others

- 5.3 By Technology Platform

- 5.3.1 Pro-drug & Stimuli-responsive

- 5.3.2 Lipid-based Nanocarriers (liposomes, LNP, SLN)

- 5.3.3 Polymeric Nanocarriers (PLGA, PEG, micelles)

- 5.3.4 Targeted Ligand-conjugated

- 5.3.5 Smart Implantables & Electro-responsive

- 5.3.6 3-D Printed & Micro-needle

- 5.3.7 Others

- 5.4 By End-user

- 5.4.1 Hospitals & Clinics

- 5.4.2 Home-care & Self-administration

- 5.4.3 Specialty & Ambulatory Centers

- 5.4.4 CRO / CDMO & Academic Labs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company

- 6.3.2 Johnson & Johnson (Janssen & Ethicon)

- 6.3.3 Pfizer Inc.

- 6.3.4 Novartis AG

- 6.3.5 Medtronic Plc

- 6.3.6 Abbott Laboratories

- 6.3.7 Baxter International

- 6.3.8 Bayer AG

- 6.3.9 Boston Scientific Corp.

- 6.3.10 Kindeva Drug Delivery

- 6.3.11 Ypsomed AG

- 6.3.12 AbbVie Inc.

- 6.3.13 AstraZeneca Plc

- 6.3.14 Gerresheimer AG

- 6.3.15 Catalent Inc.

- 6.3.16 West Pharmaceutical Services

- 6.3.17 SHL Medical

- 6.3.18 Insulet Corporation

- 6.3.19 Nemera

- 6.3.20 Elcam Medical

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment