PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836564

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836564

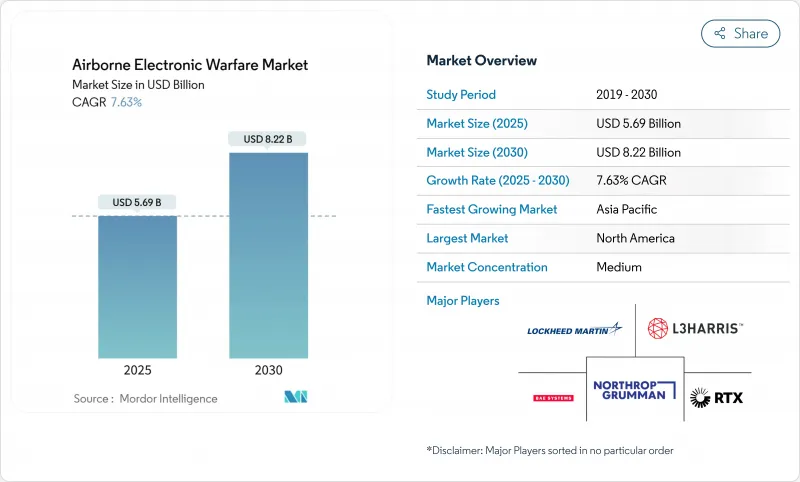

Airborne Electronic Warfare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The airborne electronic warfare market size stood at USD 5.69 billion in 2025 and is forecasted to reach USD 8.22 billion by 2030, advancing at a 7.63% CAGR.

This expansion reflects the priority militaries place on dominating the electromagnetic spectrum as advanced multi-band surface-to-air missile (SAM) systems proliferate and cognitive jamming becomes indispensable. Recent budget approvals-such as the United States setting aside USD 5 billion for electronic warfare (EW) programs in 2024-have reinforced demand for next-generation airborne EW suites. North America captured 45.21% of the airborne electronic warfare market share in 2024, yet Asia-Pacific is growing faster as China, Japan, and Australia acquire sophisticated EW capabilities. Platforms remain dominated by manned aircraft, but unmanned systems are outpacing in growth because ultra-lightweight payloads now fit Group 1-3 drones without compromising endurance. Consolidation continues: BAE Systems' acquisition of Kirintec and RTX's investments in AI/ML-enabled receivers illustrate how primes expand portfolios while securing intellectual property.

Global Airborne Electronic Warfare Market Trends and Insights

Rising Defense Budgets and Recapitalization Cycles

Defense spending acceleration boosted procurement of next-generation EW suites. The US Department of Defense planned at least USD 21 billion for EW development over five years, a 40% uplift versus the previous cycle.European states formed a multinational coalition to pool EW resources for lower unit costs and higher interoperability. Saudi Arabia and other Gulf nations have mirrored the trend, investing in fully integrated radar, missile, and EW solutions to counter Russian anti-access systems. Across regions, higher budgets shortened replacement cycles, pushing more orders for pod-mounted and embedded EW architectures that comply with open-system standards.

Growing Threat of Advanced Multi-Band SAM and Radar Systems

The spread of adaptable SAMs has forced air forces to adopt cognitive EW and be able to reprogram within milliseconds. PLA prototypes demonstrated jammers that create 3,600 false radar targets, accelerating US and NATO interest in wideband Active Electronically Scanned Array (AESA) countermeasures. Digital Radio Frequency Memory (DRFM) technology capable of simultaneous multi-band deception is now central in acquisition roadmaps, as evidenced by RTX's Next Generation Jammer Mid-Band contract covering US Navy and Royal Australian Air Force requirements.

Acquisition and Life-Cycle Cost Overruns of Next-Gen EW Pods

Pod programs such as the NGJ-Mid Band experienced multiple contract modifications that expanded cost profiles and delayed milestones, placing pressure on already stretched defense budgets. Integrating AI/ML algorithms into legacy fighters raised unforeseen technical risks, pushing schedules to the right as developers worked through electromagnetic compatibility issues across avionics suites. Extended test campaigns are now obligatory to prove reliability against adaptive threats, inflating support costs over product life cycles.

Other drivers and restraints analyzed in the detailed report include:

- Fighter Recapitalization Programmes Integrating Organic EW Suites

- UAV Fleet Expansion Requiring Ultra-Lightweight EW Payloads

- Electromagnetic-Spectrum Congestion and Deconfliction Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic attack accounted for 48.25% of the airborne electronic warfare market share in 2024, underscoring the premium placed on striking adversary radar and communications before kinetic weapons launch. Demand for wideband escort jamming and stand-off decoys kept the airborne electronic warfare market size for offensive payloads above USD 2.7 billion in 2025. Electronic support grew fastest at a 9.87% CAGR as armed services invested in real-time threat libraries and direction-finding sensors that feed cognitive jammers. Electronic protection retained steady budgets to harden satellite links and precision-navigation signals, particularly in joint operations where loss of GPS could cripple maneuver. Integrated suites that merge these three missions into a single processing stack became standard on new fighter and bomber programs, enhancing situational awareness while lowering sustainment costs.

Historical investments in electronic attack matured into exportable solutions, enabling NATO partners to field common waveforms and coordinate strike packages with minimal data latency. The airborne electronic warfare market now favors systems that deliver simultaneous detect-classify-jam functions within the same aperture. This trend reduces the need for multiple line-replaceable units and streamlines maintenance. Growth is also fueled by training ranges adopting high-fidelity threat emitters so that aircrews can rehearse against realistic multi-band radar clusters.

Manned aircraft continued representing 74.54% of the airborne electronic warfare market in 2024 because recapitalization programs for F-16, F-35, Typhoon, and EA-18G fleets commanded thousands of active airframes worldwide. The airborne electronic warfare market size for manned platforms is projected to expand at a 6.93% CAGR, driven by embedded architectures such as AN/ASQ-239 on the F-35. Unmanned systems, however, achieved an 11.25% CAGR through 2030 thanks to successful MQ-20 Avenger autonomous jamming trials by GA-ASI. Reduced risk to crews and lower operating costs supported procurement of attritable air-launched effects that distribute EW nodes across the battlespace. Doctrinally, unmanned platforms increasingly act as decoys to draw out threat emitters, allowing crewed aircraft to preserve stealth while orchestrating coordinated attack sequences.

UAV producers focused on open-systems payload bays so end users can swap EW cartridges quickly. The market welcomed lightweight gallium nitride transmitters that reduced power draw by 20%, extending loiter to beyond 24 hours on MALE UAVs. In parallel, manned platforms integrated autonomous decision aids developed for unmanned craft, illustrating cross-pollination of hardware and software that elevates the entire fleet's resilience.

The Airborne Electronic Warfare Market Report is Segmented by Capability (Electronic Attack, Electronic Protection, and More), Platform Type (Manned Aircraft and Unmanned Aircraft), Frequency Band (HF/ VHF, UHF/L/S, C/X, and Ku/Ka), Architecture (Pod-Mounted, Internally Integrated, and More), Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 45.21% of the airborne electronic warfare market revenue in 2024, anchored by multi-year US contracts such as Boeing's USD 615 million award for a next-generation Air Force EW system. The region's airborne electronic warfare market size is projected to grow at 6.5% CAGR through 2030, supported by the modernization of F-15, F-16, and EA-18G fleets and the ongoing development of B-21 bomber defensive suites. Canada's defense policy update earmarked funds for escort jammers on its future fighter, further strengthening regional demand.

Asia-Pacific is expected to post the fastest growth at 8.70% CAGR, reflecting China's 6G-enabled jamming trials and Japan's policy revisions that accelerated EW procurement for F-35 and next-generation fighter programs. Indigenous manufacturing centers in South Korea and India secured technology-transfer deals to assemble podded systems locally, reducing cost and building sovereign maintenance capacity. The airborne electronic warfare market thus benefited from both import acquisitions and emergent domestic production lines.

Europe remained resilient, buoyed by multinational initiatives to harmonize EW doctrines, including Germany's Eurofighter EK and the United Kingdom's Tempest future combat air system. Cooperative funding streams improved economies of scale and encouraged adoption of open-architecture standards, aligning with US SOSA profiles to guarantee coalition interoperability. Meanwhile, the Middle East and Africa concentrated spending among a smaller set of buyers, yet Saudi Arabia's integrated radar-EW roadmap and the UAE EDGE Group's export push highlighted strategic intent to field credible spectrum-dominance capabilities.

- RTX Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Saab AB

- Thales Group

- Leonardo S.p.A

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Mercury Systems, Inc.

- HENSOLDT AG

- Rohde and Schwarz GmbH

- Terma A/S

- QinetiQ Group

- Rafael Advanced Defense Systems Ltd.

- Honeywell International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising defense budgets and recapitalization cycles

- 4.2.2 Growing threat of advanced multi-band SAM and radar systems

- 4.2.3 Fighter recapitalization programmes integrating organic EW suites

- 4.2.4 UAV fleet expansion requiring ultra-lightweight EW payloads

- 4.2.5 Shift toward SOSA-aligned open EW architectures

- 4.2.6 AI-enabled cognitive EW for adaptive jamming

- 4.3 Market Restraints

- 4.3.1 Acquisition and life-cycle cost overruns of next-gen EW pods

- 4.3.2 Electromagnetic-spectrum congestion and deconfliction hurdles

- 4.3.3 Export-control regimes (ITAR/ML5) throttling cross-border deals

- 4.3.4 SWaP limits when integrating EW on Group 1-3 drones

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Capability

- 5.1.1 Electronic Attack

- 5.1.2 Electronic Protection

- 5.1.3 Electronic Support

- 5.2 By Platform Type

- 5.2.1 Manned Aircraft

- 5.2.2 Unmanned Aircraft

- 5.3 By Frequency Band

- 5.3.1 HF/ VHF

- 5.3.2 UHF/L/S

- 5.3.3 C/X

- 5.3.4 Ku/Ka

- 5.4 By Architecture

- 5.4.1 Pod-mounted

- 5.4.2 Internally Integrated

- 5.4.3 Payload/Pod for UAV

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 RTX Corporation

- 6.4.2 Northrop Grumman Corporation

- 6.4.3 BAE Systems plc

- 6.4.4 L3Harris Technologies, Inc.

- 6.4.5 Lockheed Martin Corporation

- 6.4.6 Saab AB

- 6.4.7 Thales Group

- 6.4.8 Leonardo S.p.A

- 6.4.9 Elbit Systems Ltd.

- 6.4.10 Israel Aerospace Industries Ltd.

- 6.4.11 Mercury Systems, Inc.

- 6.4.12 HENSOLDT AG

- 6.4.13 Rohde and Schwarz GmbH

- 6.4.14 Terma A/S

- 6.4.15 QinetiQ Group

- 6.4.16 Rafael Advanced Defense Systems Ltd.

- 6.4.17 Honeywell International Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment