PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836572

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836572

Aircraft Health Monitoring Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

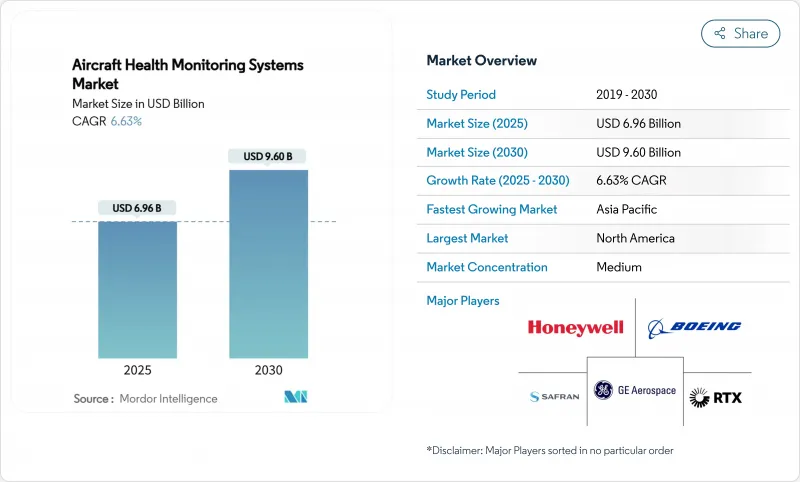

The aircraft health monitoring systems market size stood at USD 6.96 billion in 2025 and is projected to reach USD 9.60 billion by 2030, advancing at a 6.63% CAGR.

The upward trajectory reflects airline, MRO, and OEM investments in data-driven maintenance that cut unscheduled ground time and improve fleet availability. Regulatory bodies have tightened flight-data and structural-integrity rules, accelerating the installation of onboard analytics and secure connectivity systems. OEM digital platforms such as Airbus Skywise and Boeing Airplane Health Management scaled rapidly, providing real-time diagnostics across mixed fleets. Asia-Pacific fleet growth and urban-air-mobility prototypes further widened the application scope, while cybersecurity gaps and retrofit costs tempered near-term adoption.

Global Aircraft Health Monitoring Systems Market Trends and Insights

Predictive Maintenance Imperative

Airlines reported notable cuts in unscheduled maintenance events after adopting data-driven prognostics, with Honeywell indicating 99% prediction accuracy that avoided premature part removals. Rising labor costs and higher engine shop-visit rates made predictive maintenance a strategic hedge against budget pressure, especially as new-generation jets produce terabytes of sensor data per flight. Therefore, the aircraft health monitoring systems market transitioned from optional analytics to core operational infrastructure, embedding algorithms that flag anomalies during scheduled turnarounds. Wider adoption also improved asset-utilization metrics valuable to lessors and financiers. Collectively, these factors underpin a strong, multi-year stimulus for investment across the aircraft health monitoring systems market.

Regulatory Mandates for Flight and FOQA Data

The FAA's revised Flight Operational Quality Assurance circular compelled US operators to institute continuous data-monitoring programs. ICAO and EASA rules mirrored this stance, extending requirements to structural components and aging-aircraft safety. Operators above 20,000 kg MTOW must now archive and analyze large data sets, turning compliance into a guaranteed buyer pool for monitoring software and secure recorders. Protection measures that shield airlines from punitive misuse of FOQA findings fostered voluntary uptake, further enlarging the aircraft health monitoring systems market.

Cyber-security and Data-Integrity Risks

A 2024 GAO review pinpointed unpatched avionics software and supply-chain weaknesses that could permit data manipulation. IBM recorded a 74% jump in aviation-sector cyber incidents since 2020. A compromised sensor may feed spurious parameters to ground crews, undermining trust in predictive dashboards and potentially grounding aircraft until verification. Regulators drafted cohesive rules, yet operators still face integration costs for encryption, network segmentation, and continuous-monitoring tools. These uncertainties have postponed some retrofit programs and curbed near-term expansion of the aircraft health monitoring systems market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Commercial Fleet Expansion

- Connected-Aircraft and IoT Ecosystem Maturity

- High Capex/Retrofit Integration Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Airlines held 54.25% of the aircraft health monitoring systems market in 2024, reflecting their direct accountability for dispatch reliability and passenger safety. Many flag carriers embedded OEM dashboards that flag anomalies hours before landing, allowing part pre-positioning and faster turnarounds. The aircraft health monitoring systems market size for airlines is expected to progress steadily as digital-first start-ups enter service with fully connected fleets. Independent maintenance, repair, and overhaul providers posted a brisk 7.54% CAGR outlook, using analytics dashboards to deliver value-added contracts that rival OEM packages. Their growth has been propelled by deals such as Lufthansa Technik's AI-based inspection platform that cuts hangar time by 75%. Data-sharing protocols remain a sticking point because airlines aim to preserve proprietary flight-profile insights while MROs need access to refine predictive models. Consequently, partnerships that guarantee reciprocal access reshape procurement norms across the Aircraft Health Monitoring market.

In parallel, leasing companies demanded standardized data formats that support residual-value tracking, nudging airlines toward common interfaces. Low-cost carriers embraced non-proprietary software to sidestep vendor lock-in, stimulating open-architecture competition. The scale advantages of major network airlines continue to underpin bulk sensor-procurement agreements. Yet, regional players now tap cloud analytics on a subscription basis, widening entry pathways into the aircraft health monitoring systems market.

Aero-propulsion systems generated 42.30% of global revenue in 2024, underscoring the centrality of engine condition monitoring to flight safety and cost. High-bypass turbofan maintenance bills justify sophisticated vibration and performance analytics, making engine OEMs early movers in the aircraft health monitoring systems industry. Aircraft structures, however, are projected to advance at a 7.10% CAGR as fiber-optic strain sensors and embedded Bragg gratings become lighter and cheaper. Airlines that operate composite-fuselage wide-bodies seek real-time insight into hidden delamination, elevating demand for structural-health dashboards.

The aircraft health monitoring systems market share of structural applications could widen further once regulators accept virtual inspection records in lieu of some manual checks. Digital twin platforms that overlay live strain data onto simulated load maps have shortened engineering-change cycles, opening new service revenues for OEMs. Meanwhile, avionics, environmental control, and auxiliary power units expanded monitoring to satisfy airframers' performance-guarantee clauses. Market participants that blend multi-system analytics into a single cockpit view stand to capture incremental share within the aircraft health monitoring systems market.

The Aircraft Health Monitoring Systems Market Report is Segmented by End User (OEMs, Airlines, and MRO), Subsystem (Engines, and More), Component (Hardware, Software, and Services), Fit (Line-Fit and Retrofit), Transmission Mode (Onboard and Ground-Based), Aircraft Type (Fixed-Wing, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the principal revenue center with 40.6% of the aircraft health monitoring systems market in 2024 as FAA mandates, mature MRO infrastructure, and early digital-service adoption converged. US carriers began replacing legacy quick-access recorders with 25-hour versions that align with new safety mandates, driving a steady upgrade cycle. Canadian operators similarly adopted engine-health kits for winter reliability, keeping regional demand resilient. The aircraft health monitoring systems market size within the region is forecast to retain mid-single-digit growth amid strict cyber-compliance requirements.

Asia-Pacific is projected to post the fastest 7.25% CAGR through 2030. Domestic networks in China, India, Indonesia, and Thailand moved from schedule recovery to optimization, relying on predictive dashboards to manage high-utilization narrow-body fleets. Airlines deploying new A320neo and B737-8 aircraft obtained factory-installed diagnostics, expanding the Aircraft Health Monitoring market. Governments promoted indigenous MRO capability, which leveraged cloud analytics to win third-party business, reinforcing regional self-sufficiency.

Europe delivered steady replacement demand amid EASA-driven safety-management-system reforms that compel structural-health assessments on aging airframes. Lufthansa Technik, Air France-KLM, and multiple low-cost carriers used monitoring data to refine parts pooling, improving profit resilience under carbon-pricing pressure. The region's digital-twin research consortia attracted EU funding, enhancing analytic sophistication and ensuring that the aircraft health monitoring systems market remains a strategic component of broader aerospace innovation goals.

- The Boeing Company

- General Electric Company

- RTX Corporation

- Honeywell International Inc.

- Safran SA

- Rolls-Royce plc

- Meggitt PLC

- Curtiss-Wright Corporation

- FLYHT Aerospace Solutions Ltd.

- Lufthansa Technik AG

- MTU Aero Engines AG

- Ultra Precision Control Systems (Ultra Group)

- Eve Holding, Inc.

- Airbus SE

- EXSYN Aviation Solutions

- RSL Electronics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Predictive maintenance imperative

- 4.2.2 Regulatory mandates for flight and FOQA data

- 4.2.3 Rapid commercial fleet expansion

- 4.2.4 Connected-aircraft and IoT ecosystem maturity

- 4.2.5 Digital-twin-driven virtual sensor modelling

- 4.2.6 On-board edge-AI avionics processors

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-integrity risks

- 4.3.2 High capex/retrofit integration cost

- 4.3.3 Operator-lessor-OEM data-ownership disputes

- 4.3.4 Sensor ruggedization limits on ageing fleets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End User

- 5.1.1 OEMS

- 5.1.2 Airlines

- 5.1.3 MRO

- 5.2 By Sub-system

- 5.2.1 Engines

- 5.2.2 Avionics

- 5.2.3 Aircraft Structures

- 5.2.4 Environmental Control and Ancillary Systems

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.1.1 Sensors

- 5.3.1.2 Avionics

- 5.3.1.3 Flight Data Management Systems

- 5.3.1.4 Connected Aircraft Solutions

- 5.3.1.5 Ground Services

- 5.3.2 Software

- 5.3.2.1 Onboard Software

- 5.3.2.2 Diagnostics Analytics

- 5.3.2.3 Prognostics Analytics

- 5.3.3 Services

- 5.3.3.1 Integration and Customisation

- 5.3.3.2 MRO/Condition-Monitoring Services

- 5.3.1 Hardware

- 5.4 By Fit

- 5.4.1 Line-fit

- 5.4.2 Retrofit

- 5.5 By Transmission Mode

- 5.5.1 Onboard

- 5.5.2 Ground-based

- 5.6 By Aircraft Type

- 5.6.1 Fixed-Wing

- 5.6.1.1 Commercial Aviation

- 5.6.1.1.1 Narrowbody Aircraft

- 5.6.1.1.2 Widebody Aircraft

- 5.6.1.1.3 Regional Transport Aircraft

- 5.6.1.2 Military Aviation

- 5.6.1.2.1 Fighter Aircraft

- 5.6.1.2.2 Transport Aircraft

- 5.6.1.2.3 Special Mission Aircraft

- 5.6.1.3 Business and General Aviation

- 5.6.1.3.1 Business Jets

- 5.6.1.3.2 Light Aircraft

- 5.6.2 Rotary Wing

- 5.6.2.1 Commercial Helicopters

- 5.6.2.2 Military Helicopters

- 5.6.3 Military Unmmaned Aerial Vehicles

- 5.6.4 Advanced Air Mobility

- 5.6.1 Fixed-Wing

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Russia

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Australia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 The Boeing Company

- 6.4.2 General Electric Company

- 6.4.3 RTX Corporation

- 6.4.4 Honeywell International Inc.

- 6.4.5 Safran SA

- 6.4.6 Rolls-Royce plc

- 6.4.7 Meggitt PLC

- 6.4.8 Curtiss-Wright Corporation

- 6.4.9 FLYHT Aerospace Solutions Ltd.

- 6.4.10 Lufthansa Technik AG

- 6.4.11 MTU Aero Engines AG

- 6.4.12 Ultra Precision Control Systems (Ultra Group)

- 6.4.13 Eve Holding, Inc.

- 6.4.14 Airbus SE

- 6.4.15 EXSYN Aviation Solutions

- 6.4.16 RSL Electronics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment