PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836574

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836574

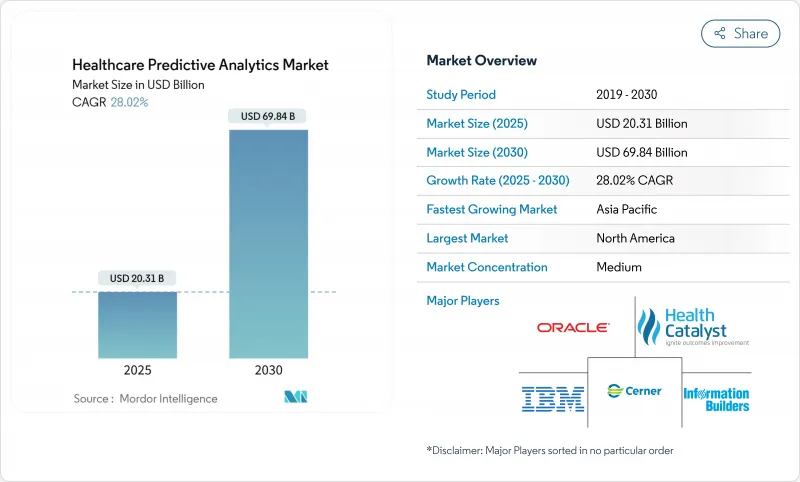

Healthcare Predictive Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Healthcare Predictive Analytics Market size is estimated at USD 20.31 billion in 2025, and is expected to reach USD 69.84 billion by 2030, at a CAGR of 28.02% during the forecast period (2025-2030).

Rapid uptake of AI-enabled clinical decision support, growing cloud infrastructure, and regulatory clarity from the United States Food and Drug Administration (FDA) anchor this expansion. Real-time data from electronic health records (EHRs), wearables, and connected medical devices supplies the raw material for increasingly accurate risk models, while payers link reimbursement to measurable outcomes. Established EHR vendors integrate native analytics to lock in existing clients, and specialist firms compete with synthetic data tools that address rare-event prediction challenges. Regional adoption varies: North America currently leads, but Asia-Pacific's digitization programs, including national cloud-first policies, signal the next demand surge for the healthcare predictive analytics market.

Global Healthcare Predictive Analytics Market Trends and Insights

Personalized & Evidence-Based Medicine Adoption

Providers embed multi-omic and social-determinant inputs into risk engines, advancing precision therapies and reducing adverse events. FDA guidance issued in 2025 outlines lifecycle controls that encourage transparent, bias-mitigated algorithms. Large academic centers now allocate nearly half of AI budgets to personalized monitoring and diagnostics solutions. Genomic-EHR integration accelerates oncology breakthroughs, and early adopters report higher patient engagement scores due to more individualized care plans.

Efficiency Pressure from Value-Based Reimbursement Models

Alternative payment arrangements reward outcome improvements and cost containment, pushing real-time risk stratification into daily workflows. CMS incentives in the United States spur rapid deployments that demonstrate double-digit operating margin gains. Health systems use predictive triage to prevent unplanned admissions and coordinate post-acute services, achieving documented returns on analytics investments above 120%. Timely alerts also aid staffing optimization, reducing overtime expenses that escalated after 2022 labor shortages.

Inadequate Enterprise-Grade Data Infrastructure

Fragmented architectures hinder dataset consolidation, with 94% of executives flagging upgrades as a top-three priority in 2024. Only 28% report high organizational data literacy, slowing model operationalization. Smaller hospitals struggle to finance cloud migrations or high-performance compute nodes critical for real-time inference, extending project timelines and limiting early clinical wins.

Other drivers and restraints analyzed in the detailed report include:

- Need to Curb Avoidable Healthcare Expenditure

- Proliferation of IoT / Wearable Data Streams

- Shortage of Analytics-Savvy Healthcare Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Financial analytics retained 27.92% of the healthcare predictive analytics market in 2024, driven by revenue cycle optimization and fraud detection. The segment remains vital because capitated contracts penalize coding errors and denials. In parallel, the healthcare predictive analytics market size for clinical analytics is projected to climb at a 30.52% CAGR, reflecting provider intent to close outcome gaps and personalize therapy. Clinical deployments span sepsis alerts, mortality prediction, and operating-room scheduling, generating measurable improvements in patient safety and resource use.

Continued investment in synthetic data augments rare-disease modeling a tuberculosis study achieved 91% diagnostic accuracy and this capability is now bundled into wider clinical analytics suites. Population health modules aggregate claims, pharmacy, and social-determinant inputs, supporting proactive outreach. Operations and supply-chain applications add incremental value by trimming inventory carry costs and balancing surgical caseloads, rounding out a diversified demand profile that supports long-run expansion of the healthcare predictive analytics market.

Descriptive tools held 51.43% revenue share of the healthcare predictive analytics market in 2024 as organizations sought basic visibility into historical performance. Those platforms act as feeders for advanced techniques, but maturity is shifting. The healthcare predictive analytics market size attributed to cognitive analytics will expand at a 37.47% CAGR, underpinned by natural language processing that parses unstructured notes and generative AI that drafts patient summaries.

Regulatory guardrails now permit adaptive algorithms, accelerating the migration from static scorecards to agentic AI that proposes interventions. Explainability remains essential: vendors embed interpretable layers that trace variable influence, satisfying compliance teams. Prescriptive modules, still nascent, recommend medication titration or staffing changes. Peer benchmarking suggests early users cut decision cycles by one-third, favoring deeper enterprise roll-outs.

The Healthcare Predictive Analytics Market Report Segments the Industry Into by Application (Clinical Data Analytics, Financial Data Analytics, and More), Analytics Type (Descriptive, Predictive, and More), Component (Software, and More), Mode of Delivery (On-Premise, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.12% of 2024 global revenue for the healthcare predictive analytics market, buoyed by widespread EHR penetration, CMS quality incentives, and proactive FDA oversight. Leading integrated delivery networks deploy multi-disciplinary analytics teams that span clinical, financial, and operational domains, producing validated models that feed hospital command centers. Average returns on analytics investments exceed 120%, reinforcing recurrent budgeting.

Europe follows with well-funded national digitization plans and the European Union AI Act, which prioritizes data protection and algorithmic transparency. Germany, the United Kingdom, and France support government grants that offset start-up costs and accelerate vendor certification. Ethical review boards further insulate deployments from public trust erosion, though administratively heavy processes slow commercialization relative to US timelines.

Asia-Pacific is projected to record a 31.71% CAGR through 2030, making it the growth epicenter of the healthcare predictive analytics market. National payer reforms in China, Japan, and India underwrite telehealth, cloud hosting, and AI research, catalyzing mass adoption. Public-private partnerships upgrade hospital IT estates, and regional cloud providers localize data centers to comply with sovereignty laws. Strategic roadmaps prioritize predictive analytics for disease surveillance and disaster preparedness, cementing long-term regional momentum.

- Allscripts

- Oracle

- IBM (Merative & Watson Health)

- Optum

- SAS Institute

- Health Catalyst

- MedeAnalytics

- Mckesson

- Verisk Analytics

- Cerner

- Epic Systems

- SCIO Health Analytics

- Truven Health Analytics

- AyasdiAI

- HealthEC

- Inovalon

- Information Builders

- Alteryx

- AdvancedMD

- Clarify Health

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Personalized & Evidence-Based Medicine Adoption

- 4.2.2 Efficiency Pressure from Value-Based Reimbursement Models

- 4.2.3 Need to Curb Avoidable Healthcare Expenditure

- 4.2.4 Proliferation of Iot / Wearable Data Streams

- 4.2.5 Integration of Social-Determinant Datasets into Models

- 4.2.6 Rapid Growth of Synthetic Data Tools for Rare-Event Prediction

- 4.3 Market Restraints

- 4.3.1 Inadequate Enterprise-Grade Data Infrastructure

- 4.3.2 Shortage of Analytics-Savvy Healthcare Professionals

- 4.3.3 Heightened Regulatory Scrutiny Over Algorithmic Bias

- 4.3.4 Interoperability Gaps for Unstructured & Genomics Data

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Clinical Data Analytics

- 5.1.2 Financial Data Analytics

- 5.1.3 Research Data Analytics

- 5.1.4 Operations & Supply-Chain Management

- 5.1.5 Other Niche Applications

- 5.2 By Analytics Type

- 5.2.1 Descriptive

- 5.2.2 Predictive

- 5.2.3 Prescriptive

- 5.2.4 Cognitive

- 5.3 By Component

- 5.3.1 Software

- 5.3.2 Services

- 5.3.3 Hardware

- 5.4 By Mode of Delivery

- 5.4.1 On-Premise

- 5.4.2 Cloud-Based

- 5.4.3 Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Allscripts Healthcare Solutions

- 6.3.2 Oracle Corporation

- 6.3.3 IBM (Merative & Watson Health)

- 6.3.4 Optum

- 6.3.5 SAS Institute

- 6.3.6 Health Catalyst

- 6.3.7 MedeAnalytics

- 6.3.8 McKesson

- 6.3.9 Verisk Analytics

- 6.3.10 Cerner Corporation

- 6.3.11 Epic Systems

- 6.3.12 SCIO Health Analytics

- 6.3.13 Truven Health Analytics

- 6.3.14 AyasdiAI

- 6.3.15 HealthEC

- 6.3.16 Inovalon

- 6.3.17 Information Builders Inc.

- 6.3.18 Alteryx

- 6.3.19 AdvancedMD

- 6.3.20 Clarify Health

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment