PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836576

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836576

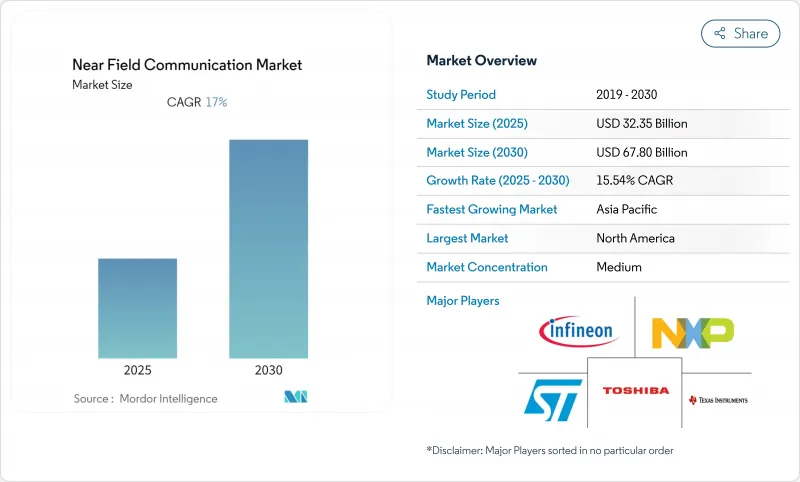

Near Field Communication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Near Field Communication market is valued at USD 32.35 billion in 2025 and is forecast to reach USD 67.80 billion by 2030, reflecting a brisk 15.54% CAGR.

Growth is powered by the permanent shift toward touch-free commerce, with contactless payments now representing 79% of day-to-day consumer purchases worldwide.Smartphone makers have normalised NFC chip integration across mid-tier and premium devices, broadening the addressable base for mobile wallets and emerging identity services. Europe's decision to compel open access to handset NFC interfaces is accelerating competition among banks and fintechs, while Asia Pacific's mobile-first economies continue to drive scale through high digital-wallet penetration. On the supply side, makers of 13.56 MHz front-end components are scrambling to lift output to meet surging reader and tag demand. Parallel progress in EV charging, smart city infrastructure, and digital product passports underscores NFC's transition from a payment-centric tool to a multipurpose secure-proximity platform.

Global Near Field Communication Market Trends and Insights

Proliferation of Contactless Payments Post-COVID-19

Consumers embraced tap-to-pay behaviour during the pandemic and have retained it for speed and convenience. Mastercard reports that 74% of users plan to keep paying contactlessly in the future. Cash withdrawals in France have fallen sharply, signalling a structural decline in ATM reliance. Rising contactless limits in more than 50 markets further lift average transaction values. In emerging economies, merchants leapfrog mag-stripe infrastructure by adopting QR-based wallets and NFC-enabled terminals in tandem. Payment networks' tokenisation roadmaps, aimed at removing manual card entry for e-commerce by 2030, cement NFC's role as the foremost in-store authentication method while positioning it for friction-free online checkout.

Smartphone OEMs Pre-Installing NFC Chips

Apple's decision to include NFC in every iPhone since 2018 set an industry baseline, and Android brands quickly followed suit with secure-element support in Snapdragon and Exynos platforms.Broader chip integration turns NFC from a premium extra into default plumbing for mobile commerce, transit ticketing, and digital keys. The NFC Forum's Multi-Purpose Tap specification, published in 2024, lets a single tap launch payment, loyalty, and access actions simultaneously, boosting daily user engagement. New Release 15 security upgrades, finalised in June 2025, extend cryptographic agility and improve interoperability, encouraging OEMs to deepen system-level integration. As a result, the installed base of NFC-ready phones provides critical mass for developers who can target billions of devices without hardware fragmentation.

Data-Security and Privacy Concerns

Higher transaction volumes magnify the consequences of NFC relay, cloning, and skimming attacks documented in academic literature. While tokenised credentials mitigate card-number theft, 25% of online transactions still bypass tokenisation, exposing gaps in the security chain. Biometric cards from Infineon and distance-bounding protocols under development promise stronger defences, yet they also raise deployment costs and integration complexity. Regulators in the EU are tightening PSD3 compliance requirements, obliging issuers to adopt multifactor authentication and continuous fraud monitoring. The extra steps can increase friction at checkout and may slow adoption in sectors that favour frictionless flows over maximum security, such as quick-service retail.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Opening of Handset NFC to Third-Party Wallets

- EV "Plug-and-Charge" Authentication via NFC

- Short-Range / Interference Limits versus BLE and UWB

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, readers captured 41.2% of the Near Field Communication market share, reflecting heavy merchant investment in EMV-compliant point-of-sale hardware. Mandatory liability-shift deadlines nudged retailers to favour all-in-one terminals that support mag-stripe, chip and tap, boosting unit volumes and ASPs. Government stimulus for small-business digitisation in India, Indonesia and Brazil added further momentum. The reader segment also benefits from software-updatable firmware that keeps terminals current with evolving card-scheme requirements. Conversely, tags-although accounting for a smaller revenue base-are forecast to register a 16.9% CAGR to 2030, the fastest within the Near Field Communication market. Europe's Digital Product Passport regulation obliges luxury-goods, electronics and automotive brands to embed immutable traceability into items, and NFC tags supply a low-cost, standards-based method to comply. Growing adoption of smart shelves, interactive packaging, and anti-counterfeit labels across Asia further widens the addressable tag pool.

Second-tier hardware lines such as antennas and discrete ICs trail the main segments yet profit from design-win richness in wearables and medical devices. Miniaturised antenna arrays now support metal-backed smartwatch casings without detuning. Software and services-though only a single-digit slice of revenue-record higher gross margins by layering token-lifecycle management, analytical dashboards and loyalty engines on top of installed hardware. Retailers using campaign-linked tags report conversion-rate uplifts approaching 30% after replacing QR codes with NFC, illustrating the recurring-revenue potential of post-deployment services.

Read/write mode dominated the Near Field Communication market size with 46% share in 2024, thanks to legacy uptake in access cards, poster tapping and file transfer. The mode's simplicity, requiring only a tag and a reader, underpins adoption in libraries, museums and smart posters where cost trumps security. Card emulation, however, is projected to accelerate at a 17.13% CAGR on the back of open-wallet initiatives and digital-ID projects. Host Card Emulation lets software replicate a card applet without a physical secure element, cutting bill-of-materials for mass-market phones. Release 15 elevates secure-channel-based peer authentication, persuading banks and transit authorities to roll out software-based tickets confidently. Peer-to-peer lags due to Bluetooth's faster file-transfer speeds, yet it remains relevant in device-pair provisioning where Wi-Fi credentials or Zigbee keys must pass securely without cloud connectivity.

As consumer interest in frictionless interactions grows, the NFC Forum's Multi-Purpose Tap could blur mode boundaries by chaining emulation and read/write operations into a single gesture. Retail pilots indicate checkout time reductions of up to 15%, illustrating how UX gains may reshape mode preferences. Developers are likewise bundling telemetry upload, software licence validation and loyalty accrual into one tap to avoid app-switching fatigue

The Near Field Communication Market Report is Segmented by Product Type (NFC Tags, NFC Readers, and More), Operating Mode (Read / Write, Peer-To-Peer, and More), Application (Payments, Access Control, Pairing and Commissioning, and More), End-Device (Smartphones, Wearables, Medical Equipment, and More), End-User Vertical (BFSI, Healthcare, and More), and Geography

Geography Analysis

Asia Pacific leads the Near Field Communication market with 37.8% share in 2024 and an estimated 17.02% CAGR to 2030. Mobile-first economies benefit from smartphone penetration exceeding 63% of the population, and mobile services already contribute 5.3% to regional GDP. China's transit operators processed more than 60 billion NFC metro rides in 2024, while India's Unified Payments Interface saw daily tap-and-pay volumes triple year-on-year. Government e-ID and national health-card schemes further stimulate identity and authentication use cases, helping the region outpace global averages.

Europe sits second in value thanks to regulatory tailwinds that force handset-level NFC openness and push strong customer authentication. The EU's Digital Product Passport regulation mandates traceability tags for luxury goods and automotive components, catalysing a tag supply-chain ramp. Tokenisation initiatives by card networks aim to eradicate manual card entry by decade's end, promising a surge in in-browser tap-to-pay flows. Nordic banks have already reported 90% market penetration for contactless debit, signalling maturity yet still healthy transaction-value expansion.

North America records steady mid-teen growth, buoyed by its rapid roll-out of EV charging infrastructure and enterprise security upgrades. The federal universal plug-and-charge framework, effective 2025, sets a baseline for nationwide interoperability and is expected to lift charger-reader deployments sharply. Manufacturing onshoring programmes and tax credits under the CHIPS Act encourage domestic NFC component fabrication, partly mitigating global supply tightness. Meanwhile, Middle East and Africa exhibit early-stage adoption, constrained by fragmented regulation and lower POS penetration but aided by mobile-money initiatives that prioritise low-cost, secure proximity payments.

- NXP Semiconductors

- STMicroelectronics N.V.

- Infineon Technologies AG

- Broadcom Inc.

- Sony Group Corp.

- Samsung Electronics

- Qualcomm Technologies

- Toshiba Electronic Devices and Storage Corp.

- Texas Instruments Inc.

- Zebra Technologies Corp.

- HID Global

- Thales (Gemalto)

- Renesas Electronics

- Shanghai Fudan Microelectronics

- Identiv Inc.

- Smartrac Technology

- Marvell Technology Group

- Inside Secure (Verimatrix)

- Huawei Technologies

- Apple Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of contactless payments post-COVID-19

- 4.2.2 Smartphone OEMs pre-installing NFC chips

- 4.2.3 Regulatory opening of handset NFC to third-party wallets

- 4.2.4 EV "plug-and-charge" authentication via NFC

- 4.2.5 EU Digital Product Passport mandates for embedded NFC tags

- 4.2.6 Foldable/XR wearables adopting NFC for spatial UX

- 4.3 Market Restraints

- 4.3.1 Data-security and privacy concerns

- 4.3.2 Short-range/interference limits vs BLE and UWB

- 4.3.3 13.56 MHz front-end chip supply constraints

- 4.3.4 Merchant tokenisation fees slowing acceptance in emerging markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 Impact of COVID-19 and Macroeconomic Headwinds

- 4.10 Impact of Geopolitical Tensions

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 NFC Tags

- 5.1.2 NFC ICs / Secure Elements

- 5.1.3 NFC Readers

- 5.1.4 NFC Antennas

- 5.1.5 Software and Services

- 5.2 By Operating Mode

- 5.2.1 Read / Write

- 5.2.2 Peer-to-Peer

- 5.2.3 Card Emulation

- 5.3 By Application

- 5.3.1 Payments

- 5.3.2 Access Control

- 5.3.3 Pairing and Commissioning

- 5.3.4 Identity and Authentication

- 5.3.5 Smart Posters and Marketing

- 5.3.6 IoT Provisioning and Others

- 5.4 By End-Device

- 5.4.1 Smartphones

- 5.4.2 Wearables

- 5.4.3 PCs and Other Consumer Electronics

- 5.4.4 Medical Equipment

- 5.4.5 Automotive Infotainment / EV Chargers

- 5.4.6 Other Devices

- 5.5 By End-User Vertical

- 5.5.1 BFSI

- 5.5.2 IT and Telecommunications

- 5.5.3 Retail and e-Commerce

- 5.5.4 Healthcare

- 5.5.5 Hospitality and Transportation

- 5.5.6 Government and Public Sector

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NXP Semiconductors

- 6.4.2 STMicroelectronics N.V.

- 6.4.3 Infineon Technologies AG

- 6.4.4 Broadcom Inc.

- 6.4.5 Sony Group Corp.

- 6.4.6 Samsung Electronics

- 6.4.7 Qualcomm Technologies

- 6.4.8 Toshiba Electronic Devices and Storage Corp.

- 6.4.9 Texas Instruments Inc.

- 6.4.10 Zebra Technologies Corp.

- 6.4.11 HID Global

- 6.4.12 Thales (Gemalto)

- 6.4.13 Renesas Electronics

- 6.4.14 Shanghai Fudan Microelectronics

- 6.4.15 Identiv Inc.

- 6.4.16 Smartrac Technology

- 6.4.17 Marvell Technology Group

- 6.4.18 Inside Secure (Verimatrix)

- 6.4.19 Huawei Technologies

- 6.4.20 Apple Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment