PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836581

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836581

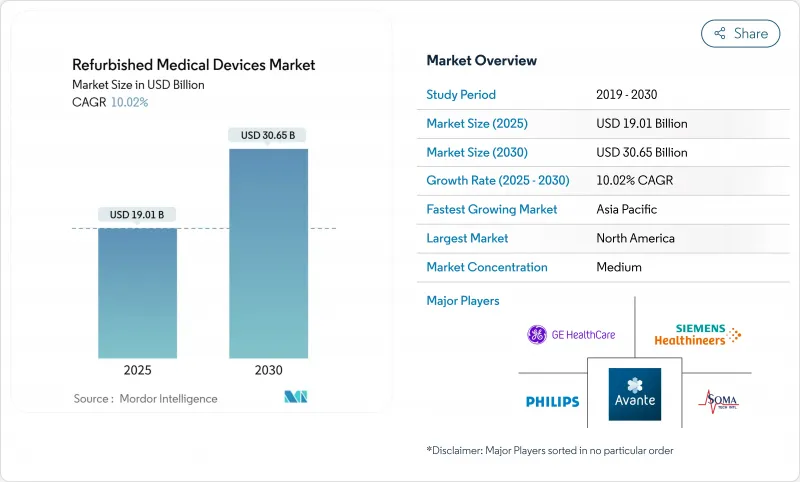

Refurbished Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The refurbished medical equipment market size is valued at USD 19.01 billion in 2025 and is projected to reach USD 30.65 billion by 2030, reflecting a 10.02% CAGR.

Hospitals, ambulatory surgical centers, and independent diagnostic providers increasingly prefer refurbished units because they combine reliable performance with 40-60% savings on capital outlays. The growth momentum also mirrors hospital budget constraints, a turn toward circular-economy purchasing rules, and faster certification cycles for AI-ready imaging systems. A widening pool of private diagnostic centers across Asia and Latin America compounds demand, while digital auction platforms boost liquidity in the secondary equipment chain. On the supply side, original-equipment-manufacturer (OEM) refurbishers retain brand trust and command premium price points, yet independent refurbishers are scaling rapidly by targeting underserved geographies and niche modalities.

Global Refurbished Medical Devices Market Trends and Insights

Healthcare cost-containment imperatives

Hospitals spent USD 146.9 billion on medical supplies in 2023 while facing USD 130 billion in Medicare and Medicaid under-payments, sharpening the need for equipment that stretches budgets without reducing care quality. Refurbished magnetic resonance scanners, which list 40-60% below the cost of a new unit, free capital for workforce and digital investments. In 2023, the average replacement age for imaging systems rose 7.1%, evidence that providers are lengthening asset cycles and viewing refurbished purchases as a strategic hedge against delayed reimbursements. The driver is most acute inside advanced reimbursement systems, especially in the United States, where marginal revenue pressure forces chief financial officers to treat total cost of ownership as the primary purchase criterion.

Circular-economy compliance push

Health systems across Europe embed lifecycle rules in capital budgets, rewarding equipment that re-enters value chains rather than entering landfill. OEMs respond by redesigning scanners and monitors with modular parts that can be swapped quickly during reconditioning. The refurbished medical equipment market benefits from these rules because sustainable procurement cuts raw-material demand while still meeting performance norms. Pilot projects that recycle metals and polymers from diagnostic probes now demonstrate safe reuse pathways. Broad acceptance requires manufacturers, regulators, and hospital groups to agree on shared testing benchmarks, but early adopters already report measurable emissions reductions alongside budget savings.

Post-market regulatory scrutiny

Divergent compliance rules complicate cross-border shipments of used devices. In the United States the Food and Drug Administration requires premarket clearance, whereas the European Union enforces conformity under the Medical Device Regulation (EU) 2017/745. These layered reviews lengthen lead times and increase document costs, particularly for complex products such as PET-CT scanners. Providers that operate multinational clinic networks therefore favor refurbishment partners with in-house regulatory teams.

Other drivers and restraints analyzed in the detailed report include:

- AI-ready imaging upgrade cycle

- Proliferation of private diagnostic centers

- Non-transferable OEM warranties

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medical imaging equipment accounts for the largest 40.13% slice of the refurbished medical equipment market in 2024 and continues to set price benchmarks for the category. The installed base of magnet resonance and computed tomography systems built between 2015 and 2020 is now entering second-life cycles, and refurbishers can restore those platforms by swapping coils, updating detectors, and upgrading software. X-ray and ultrasound units deliver lower ticket sizes yet sell in higher volume, especially into secondary hospitals in Southeast Asia and West Africa. The AI retrofit wave widens margins further because predictive analytics modules or computer-aided diagnosis plug-ins add tangible clinical value without new hardware. As a result, the refurbished medical equipment market size for the imaging segment is forecast to climb in line with the overall 10.02% trajectory.

The operating room and surgical equipment niche is the fastest-growing product cohort and is expected to record 11.85% CAGR through 2030. Ambulatory surgical centers favor refurbished anesthesia machines, tables, and endoscopy towers because these units accelerate time to revenue at lower risk. OEM parts availability has also improved, allowing refurbishment workshops to validate sterility and electrical safety to the same standards as new equipment. Electrosurgical platforms and laparoscopic systems lend themselves to modular component swaps, shortening refurbishment cycle times. End-user demand now spans community hospitals in the United States as well as high-acuity centers in the Gulf states, confirming that value recognition is spreading beyond budget-constrained facilities.

The Refurbished Medical Devices Market Report is Segmented by Product (Medical Imaging Equipment [X-Ray Machines and More], Operating Room and Surgical Equipment [Anaesthesia Machines and More], and More), Refurbishment Provider (OEM-Certified Refurbishers and More), End-User (Hospitals and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.02% of global revenue in 2024 as reimbursement pressures, large installed bases, and Section 179 deductions aligned to favor second-life equipment. Many hospital chains run centralized asset-management dashboards that benchmark refurbishment against new-buy scenarios, which helps justify upgrades that meet cyber-security guidelines. Canadian provincial health networks similarly analyze lifecycle costs, and their preference for proven OEM recertification maintains steady demand for high-end scanners and ventilators.

Asia-Pacific is the fastest-growing region, with the refurbished medical equipment market size projected to expand at 11.38% CAGR from 2025 to 2030. China and India anchor volume, but secondary hubs such as Vietnam and Indonesia illustrate the ripple effect as private insurance enrollment expands. The region's regulatory landscape is evolving, with countries like Malaysia developing specific guidelines for refurbishment through their Medical Device Authority, creating more structured pathways to market. Regional refurbishment centers in South Korea and Singapore shorten shipping times and simplify customs clearance, while newly issued guidelines from local regulators clarify intake inspections and labeling rules. The resulting predictability reassures private investors who run imaging chains or day-surgery clinics.

Europe retains a pivotal position, advancing at 9.68% CAGR. Environmental procurement directives and the Medical Device Regulation create both headwinds and tailwinds. Compliance costs rise, yet public hospitals now score tender bids partly on carbon footprint, a metric that naturally elevates refurbished options. Germany, France, and the United Kingdom lead volume, whereas Eastern European markets show the fastest percentage increases because structural funds earmark money for diagnostic build-outs. Regional innovators also pilot cloud-linked refurbishment documentation, which can feed directly into electronic equipment passports under EU policy.

- Agito Medical

- Amber Diagnostics

- Avante Health Solutions

- Block Imaging International

- Canon

- Fair Medical Co., Ltd

- FUJIFILM

- GE Healthcare

- Henry Schein Medical

- Hitachi

- Integrity Medical Systems

- Johnson & Johnson Services, Inc. (Sterilmed)

- Master Medical Equipment

- Medtronic

- Nationwide Imaging Services

- Koninklijke Philips

- Radio Oncology Systems

- Siemens Healthineers

- Skanray Technologies

- Soma Tech Intl.

- US Med-Equip

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Healthcare Cost-containment Imperatives

- 4.2.2 Circular-economy Compliance Push

- 4.2.3 AI-ready Imaging Upgrade Cycle

- 4.2.4 Proliferation of Private Diagnostic Centers

- 4.2.5 Tax Incentives for Pre-owned Medical Equipment

- 4.2.6 Emergence of Online Auction Platforms

- 4.3 Market Restraints

- 4.3.1 Post-market Regulatory Scrutiny

- 4.3.2 Non-transferable OEM Warranties

- 4.3.3 Standards Fragmentation & Price Volatility

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Medical Imaging Equipment

- 5.1.1.1 X-ray Machines

- 5.1.1.2 Ultrasound Systems

- 5.1.1.3 MRI Machines

- 5.1.1.4 CT Scanners

- 5.1.1.5 Nuclear Imaging (PET, SPECT, PET/CT)

- 5.1.1.6 Other Imaging Devices

- 5.1.2 Operating Room & Surgical Equipment

- 5.1.2.1 Anaesthesia Machines

- 5.1.2.2 Electrosurgical Units

- 5.1.2.3 Surgical Microscopes

- 5.1.2.4 CO? & Agent Monitors

- 5.1.2.5 Other OR Equipment

- 5.1.3 Patient Monitoring Devices

- 5.1.3.1 Multiparameter Monitors

- 5.1.3.2 ECG Devices

- 5.1.3.3 NIBP Monitors

- 5.1.4 Cardiovascular & Cardiology Equipment

- 5.1.5 Neurology Equipment

- 5.1.6 Endoscopy Systems

- 5.1.7 ICU & Critical-Care Equipment

- 5.1.8 Renal & Dialysis Equipment

- 5.1.9 Other Medical Equipment

- 5.1.1 Medical Imaging Equipment

- 5.2 By Refurbishment Provider

- 5.2.1 OEM-Certified Refurbishers

- 5.2.2 Independent & In-House Refurbishers

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Diagnostic Imaging Centers

- 5.3.4 Other End-Users

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Product Portfolio Analysis

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Agito Medical

- 6.4.2 Amber Diagnostics

- 6.4.3 Avante Health Solutions

- 6.4.4 Block Imaging International

- 6.4.5 Canon Medical Systems

- 6.4.6 Fair Medical Co., Ltd

- 6.4.7 Fujifilm Healthcare

- 6.4.8 GE HealthCare

- 6.4.9 Henry Schein Medical

- 6.4.10 Hitachi Healthcare Systems

- 6.4.11 Integrity Medical Systems

- 6.4.12 Johnson & Johnson Services, Inc. (Sterilmed)

- 6.4.13 Master Medical Equipment

- 6.4.14 Medtronic plc

- 6.4.15 Nationwide Imaging Services

- 6.4.16 Koninklijke Philips N.V.

- 6.4.17 Radio Oncology Systems

- 6.4.18 Siemens Healthineers

- 6.4.19 Skanray Technologies

- 6.4.20 Soma Tech Intl.

- 6.4.21 US Med-Equip

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment