PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836584

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836584

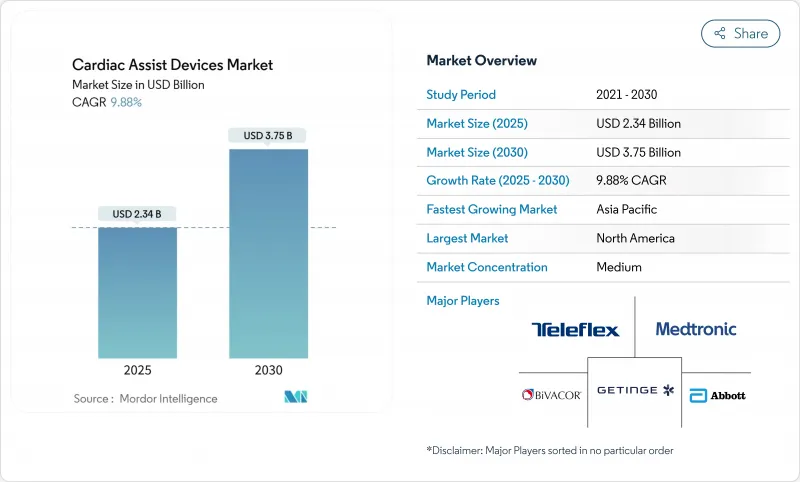

Cardiac Assist Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiac assist devices market size for the ventricular assist devices (VAD) core segment stood at USD 2.34 billion in 2025 and is projected to reach USD 3.75 billion by 2030, translating to a 9.88% CAGR mordorintelligence.com.

The cardiac assist devices market is expanding as hospitals confront rising end-stage heart failure prevalence, donor-heart shortages, and growing confidence in continuous-flow technology. Breakthroughs in magnetically levitated pumps, percutaneous micro-pumps, and pediatric indications are enabling earlier intervention, while reimbursement expansion in Asia-Pacific is widening access. Regulatory momentum, exemplified by FDA approvals for pediatric Impella 5.5 and Impella CP, is encouraging destination-therapy uptake earlier in the disease course. Simultaneously, safety recalls-such as the HeartMate 3 EOGO event-are intensifying post-market surveillance and prompting iterative design improvements. Sustained venture investment in total artificial hearts and ambulatory counterpulsation systems signals that the cardiac assist devices market will remain a fertile arena for engineering innovation and business growth.

Global Cardiac Assist Devices Market Trends and Insights

Donor-Heart Shortage Intensifying Reliance on Mechanical Circulatory Support

Fewer than 100 pediatric heart transplants occur annually in China despite 40,000 children hospitalised for heart failure each year. The cardiac assist devices market therefore sees healthcare systems adopting mechanical circulatory support as first-line therapy rather than bridge solutions. Destination-therapy programmes now use devices such as the Aeson artificial heart, which has supported 30 bridge-to-transplant cases with median 156 days of assistance. Newly approved pediatric Impella systems extend percutaneous support to children weighing >=30 kg, broadening the candidate pool. Survival outcomes with HeartMate 3 exceed five years, rivaling transplant benchmarks. This sustained efficacy repositions mechanical circulatory support as a definitive modality and underpins long-term growth of the cardiac assist devices market.

Continuous-Flow and Percutaneous Devices Lowering Complications Versus Legacy Systems

Full MagLev technology in HeartMate 3 eliminates mechanical wear points, while Impella's axial-flow design reduces vascular trauma. The ARIES-HM3 study showed patients off aspirin experienced 40% fewer bleeding events, and the DanGer Shock trial reported a 12.7% absolute mortality reduction with Impella CP in STEMI cardiogenic shock jnjmedtech.com. Same-day discharge protocols and subclavian access enable outpatient recovery, lowering inpatient costs and enlarging the cardiac assist devices market. Reduced complication rates, combined with portability, make these systems attractive for both bridge-to-transplant and destination therapy pathways.

Reimbursement Expansion in Japan & South Korea for Destination Therapy

Japan and South Korea now reimburse destination-therapy implantation costs, acknowledging durable VADs' cost-effectiveness versus repeated hospitalisation. These decisions reduce out-of-pocket expenses and stimulate hospital investment in specialised programmes. With continuous-flow devices achieving longer durability and lower stroke rates, payers foresee improved quality-adjusted life years. Early reimbursement momentum in Asia-Pacific underpins the region's double-digit CAGR within the cardiac assist devices market.

Other drivers and restraints analyzed in the detailed report include:

- Expanded Indications for TAVR/MCS and Percutaneous Support in Moderate HF

- Class-I Recalls and Safety Concerns Across Device Categories

- Anticoagulation-Related Bleeding & Stroke Risk Still >20% for Implantable Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Left ventricular assist devices captured 77.33% of cardiac assist devices market share in 2024, reflecting robust evidence and broad surgical familiarity. The cardiac assist devices market size attributed to LVADs is forecast to grow alongside destination-therapy uptake, buoyed by HeartMate 3's five-year survival benchmark. Total artificial hearts, such as BiVACOR's titanium unit, are projected to advance at 10.45% CAGR, offering biventricular support for complex cases. Percutaneous Impella systems complement durable devices by treating acute cardiogenic shock and high-risk PCI, with more than 330,000 patients treated to date jnjmedtech.com. Right ventricular and biventricular assist devices fulfil niche needs, while intra-aortic balloon pumps retain relevance for short-term hemodynamic stabilisation. Collectively these modalities diversify the cardiac assist devices market and mitigate clinical risk across patient cohorts.

Continuous-flow engineering, miniaturisation, and magnetic levitation underpin most next-generation platforms. BrioVAD's fully levitated rotor aims for quieter operation and reduced hemolysis, whereas magnetically levitated percutaneous micro-pumps promise lower vascular trauma. FDA breakthrough designations accelerate timelines, enabling competitive parity between emerging firms and incumbents. Successful early-feasibility implants validate performance and strengthen investor confidence, sustaining R&D momentum within the cardiac assist devices industry.

The Cardiac Assist Devices Market Report Segments the Industry Into by Device Type (Left Ventricular Assist Devices (LVAD), Right Ventricular Assist Devices (RVAD) and More ), by Application (Bridge-To-Transplant, Destination Therapy and More), by End User (Hospitals, Cardiac & Transplant Centres and More), and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.50% of global revenue in 2024, supported by early FDA approvals, specialised surgical capacity, and robust private-payer coverage. Leading institutions such as the Texas Heart Institute propel first-in-human trials for total artificial hearts, keeping the cardiac assist devices market at the forefront of innovation. Canada and Mexico add incremental demand through cross-border referrals and public-payer programmes.

Europe holds the second-largest share, with Germany, France, and the United Kingdom spearheading adoption through CE-harmonised approvals and integrated transplant programmes. The cardiac assist devices market benefits from universal health coverage, stable reimbursement, and mature surgical training pipelines. Southern European nations leverage medical tourism, while Nordic countries adopt outpatient LVAD pathways, further enhancing utilisation.

Asia-Pacific is the fastest-growing region at 12.03% CAGR, catalysed by China's post-2024 reforms that incentivise domestic innovation, resulting in the world's smallest 45-gram artificial heart implant. Japan's and South Korea's reimbursement expansions for destination therapy create fertile ground for continuous-flow devices, whereas India and Australia expand catheter-based pump programmes. Regional public-health investment and accelerating cardiovascular disease prevalence sustain long-term growth for the cardiac assist devices market.

- Abbott Laboratories

- Johnson & Johnson MedTech (Abiomed)

- Berlin Heart

- SynCardia Systems

- Medtronic

- Jarvik Heart

- Carmat

- BiVACOR

- EvaHeart Inc.

- LivaNova

- Calon Cardio-Technology

- Terumo

- Getinge (Maquet Cardiopulmonary)

- Fresenius Medical Care (Novalung)

- Boston Scientific

- Edward Lifesciences

- Magenta Medical

- Leviticus Cardio

- Windmill Cardiovascular Systems

- ReliantHeart Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Donor-heart shortage intensifying reliance on LVAD & TAH

- 4.2.2 Continuous-flow LVADs lowering rehospitalisation versus pulsatile pumps

- 4.2.3 Expanded indications for TAVR / MCS in moderate HF (FDA & EMA)

- 4.2.4 Reimbursement expansion in Japan & South Korea for destination therapy

- 4.2.5 Magnetically-levitated micro-pumps enabling full out-of-hospital support (under-reported)

- 4.2.6 Surge in China's domestic VAD clinical trials after 2024 tender reforms (under-reported)

- 4.3 Market Restraints

- 4.3.1 Class-I recalls (HeartMate 3 EOGO, Medtronic HVAD withdrawal)

- 4.3.2 Anticoagulation-related bleeding & stroke risk still >20 %

- 4.3.3 Limited paediatric-sized fully implantable pumps (capacity bottleneck) (under-reported)

- 4.3.4 Supply-chain dependence on rare-earth magnets for MagLev rotors (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Device Type (Value)

- 5.1.1 Left Ventricular Assist Devices (LVAD)

- 5.1.2 Right Ventricular Assist Devices (RVAD)

- 5.1.3 Bi-ventricular Assist Devices (BiVAD)

- 5.1.4 Intra-aortic Balloon Pump (IABP)

- 5.1.5 Total Artificial Heart (TAH)

- 5.1.6 Other Circulatory Support Devices

- 5.2 By Application (Value)

- 5.2.1 Bridge-to-Transplant

- 5.2.2 Destination Therapy

- 5.2.3 Bridge-to-Recovery

- 5.2.4 Other Applications

- 5.3 By End-User (Value)

- 5.3.1 Hospitals

- 5.3.2 Cardiac & Transplant Centres

- 5.3.3 Ambulatory / Specialty Clinics

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Abbott Laboratories

- 6.3.2 Johnson & Johnson MedTech (Abiomed)

- 6.3.3 Berlin Heart GmbH

- 6.3.4 SynCardia Systems LLC

- 6.3.5 Medtronic plc

- 6.3.6 Jarvik Heart Inc.

- 6.3.7 Carmat SA

- 6.3.8 BiVACOR Inc.

- 6.3.9 EvaHeart Inc.

- 6.3.10 LivaNova PLC

- 6.3.11 Calon Cardio-Technology Ltd

- 6.3.12 Terumo Corporation

- 6.3.13 Getinge (Maquet Cardiopulmonary)

- 6.3.14 Fresenius Medical Care (Novalung)

- 6.3.15 Boston Scientific Corporation

- 6.3.16 Edwards Lifesciences

- 6.3.17 Magenta Medical Ltd

- 6.3.18 Leviticus Cardio

- 6.3.19 Windmill Cardiovascular Systems

- 6.3.20 ReliantHeart Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment