PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836586

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836586

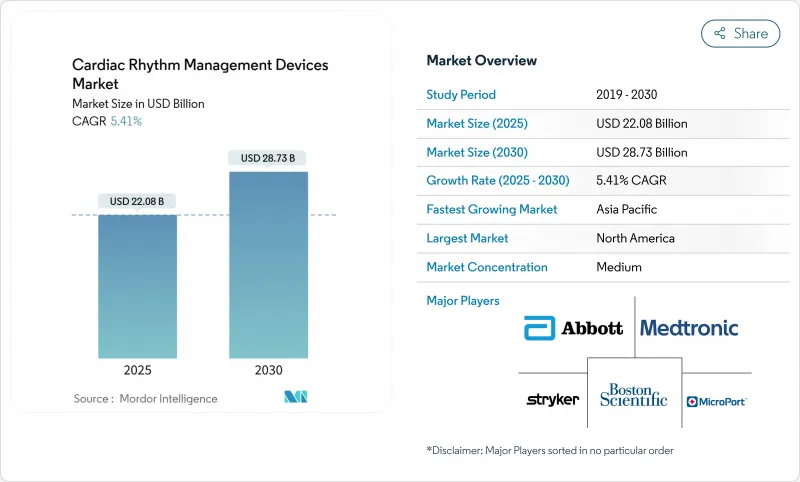

Cardiac Rhythm Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiac rhythm management market is valued at USD 22.08 billion in 2025 and is forecast to reach USD 28.73 billion by 2030, advancing at a 5.41% CAGR.

Growth is underpinned by an aging global population, rising arrhythmia incidence, and the expanding use of implantable devices that lower rehospitalization risks.Rapid advances in leadless pacemakers and artificial-intelligence (AI)-enabled monitoring platforms are improving clinical outcomes while reducing procedure times and follow-up visits. Reimbursement reforms that now cover next-generation devices in major markets are widening patient access, and remote patient-monitoring mandates are generating steady recurring revenue for device makers. Supply-chain pressures tied to semiconductor tariffs and specialty-metal price swings continue to tighten margins, but sustained R&D investment and targeted acquisitions keep competitive intensity high.

Global Cardiac Rhythm Management Devices Market Trends and Insights

Surge in Cardiovascular Disease and Population Aging

Cardiovascular disease will affect nearly 45 million U.S. adults by 2050, with hypertension prevalence expected to climb to 61% during the same period.Similar demographic shifts across Europe and parts of Asia increase demand for durable pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization devices. Longer life expectancy extends device replacement cycles, raising the lifetime value of each implantation. Payers favor rhythm management over repeated hospitalizations, underpinning steady procedural volumes. The resulting uptick in elective implants cushions the cardiac rhythm management market against cyclical funding pressures.

Wider Adoption and Reimbursement of Next-Generation Systems

Medicare added specific billing codes for leadless pacemakers in mid-2024, removing a key barrier to adoption. European authorities continue moving toward value-based payment models, rewarding devices that demonstrate lower rehospitalization rates. Japan's reference-pricing revisions pressure list prices yet still allow premium positioning when clinical evidence shows superior outcomes. Together these policies shorten the path from regulatory approval to widespread clinical use, lifting procedural volumes and driving incremental revenue for manufacturers.

Cyber-Vulnerability of Connected Devices

The FDA now requires cybersecurity plans as part of pre-market submissions, citing recent alerts that certain patient monitors could be remotely accessed. Older implants lacking modern encryption remain in service, exposing hospitals to network breaches and creating liability concerns. Manufacturers are investing in over-the-air patching and zero-trust architectures, but any data-breach headline can slow adoption of cloud-connected platforms, dampening cardiac rhythm management market growth.

Other drivers and restraints analyzed in the detailed report include:

- Public-Access AED Roll-Outs in Transport Hubs

- Remote Monitoring and Telehealth Integration

- Lengthy Regulatory Approval Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Defibrillators represented 39.48% of the cardiac rhythm management market in 2024, anchored by widespread clinical guidelines that recommend ICD therapy for sudden-death prevention. New extravascular ICDs show 98.7% effective defibrillation rates, adding non-intravascular alternatives for infection-prone patients. External AED demand rises alongside mandated public installations, though real-world utilization remains below targets. Complementary service contracts add recurring revenue, supporting the cardiac rhythm management market size for defibrillator makers.

Pacemakers deliver the fastest expansion, advancing at a 7.56% CAGR as leadless designs eliminate pocket infections and venous complications. Dual-chamber leadless systems preserve physiologic pacing and achieve near-universal implant success, attracting electrophysiologists who previously hesitated to forgo transvenous leads. AI-driven alert filtering suppresses false positives by 85%, improving clinic efficiency and reinforcing the cardiac rhythm management market size advantage for connected pacemaker platforms.

Cardiac Rhythm Management Devices Market Report is Segmented by Product (Defibrillators [Implantable Cardioverter Defibrillators and External Defibrillators], Pacemakers [Implantable and More], Cardiac Resynchronization Therapy Devices), Implant Approach (Transvenous Systems, Leadless Systems and More), End User (Hospitals, Cardiac Specialty Centers and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 36.45% of 2024 sales thanks to favorable reimbursement and rapid uptake of AI-enabled monitoring. Updated CMS codes for leadless pacemakers widened access across U.S. electrophysiology centers. Canada's national tender programs and Mexico's private cardiology clinics add to regional demand, stabilizing the cardiac rhythm management market size in the short term.

Europe maintains steady growth on the back of value-based procurement that rewards outcome improvements. CE-marked dual-chamber leadless systems launched widely in 2024, accelerating replacements of legacy single-chamber devices. Country-level cost-containment pressures persist, yet proven reductions in rehospitalizations offset initial device premiums.

Asia-Pacific is the fastest-growing arena, expanding at a 7.89% CAGR. Japan's device market encourages technology adoption despite price cuts, while China's localization policies spur domestic production alongside foreign joint ventures. India scales public-health spending and private cardiac centers, and Australia subsidizes remote-monitoring platforms for rural populations, supporting sustained region-wide momentum within the cardiac rhythm management market.

- Medtronic

- Abbott Laboratories

- Boston Scientific

- BIOTRONIK

- MicroPort CRM (MicroPort Scientific)

- Koninklijke Philips

- LivaNova plc

- Asahi Kasei

- Stryker

- Mindray

- Schiller

- Lepu Medical

- Terumo

- EBR Systems

- Nihon Kohden

- AliveCor

- MicroPort CardioFlow MedTech

- Impulse Dynamics

- Cardiac Science

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge In Cardiovascular Disease Prevalence Coupled with Increasing Aging Population

- 4.2.2 Expanding Adoption and Reimbursement For Rhythm Management Systems

- 4.2.3 Large Public-Access AED Roll-Outs In Transport Hubs

- 4.2.4 Remote Patient Monitoring and Telehealth Integration

- 4.2.5 Technological Advancement and Device Miniaturization

- 4.2.6 Increasing Adoption of Implantable Devices Coupled with Launch of New Products

- 4.3 Market Restraints

- 4.3.1 Cyber-Vulnerability Of Connected CRM Devices

- 4.3.2 Lengthy Regulatory Approval Cycles

- 4.3.3 Post-Radiation Malfunctions In Implantables

- 4.3.4 Lithium & Tantalum Price Volatility Inflates Bom Costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Defibrillators

- 5.1.1.1 Implantable Cardioverter Defibrillators (TV-ICD, S-ICD)

- 5.1.1.2 External Defibrillators (Manual, AED, Wearable)

- 5.1.2 Pacemakers

- 5.1.2.1 Implantable (Single, Dual, Leadless, MRI-compatible)

- 5.1.2.2 External Pacemakers

- 5.1.3 Cardiac Resynchronization Therapy Devices

- 5.1.3.1 CRT-Defibrillators (CRT-D)

- 5.1.3.2 CRT-Pacemakers (CRT-P)

- 5.1.1 Defibrillators

- 5.2 By Implant Approach

- 5.2.1 Transvenous Systems

- 5.2.2 Leadless Systems

- 5.2.3 Subcutaneous Systems

- 5.2.4 Extravascular / Substernal Systems

- 5.2.5 External / Non-invasive Systems

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Cardiac Specialty Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Home & Pre-Hospital Care Settings

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Abbott Laboratories

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Biotronik SE & Co. KG

- 6.3.5 MicroPort CRM (MicroPort Scientific)

- 6.3.6 Koninklijke Philips N.V.

- 6.3.7 LivaNova plc

- 6.3.8 Asahi Kasei

- 6.3.9 Stryker

- 6.3.10 Shenzhen Mindray Bio-Medical Electronics

- 6.3.11 Schiller AG

- 6.3.12 Lepu Medical Technology

- 6.3.13 Terumo

- 6.3.14 EBR Systems

- 6.3.15 Nihon Kohden Corporation

- 6.3.16 AliveCor Inc.

- 6.3.17 MicroPort CardioFlow MedTech

- 6.3.18 Impulse Dynamics

- 6.3.19 Cardiac Science

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment