PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836591

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836591

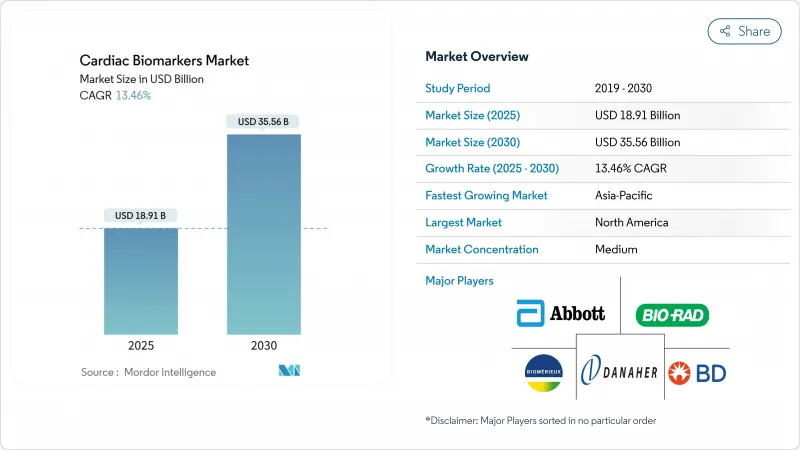

Cardiac Biomarkers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiac biomarkers market size stood at USD 18.91 billion in 2025 and is forecast to reach USD 35.56 billion by 2030, advancing at a 13.46% CAGR.

Adoption of high-sensitivity assays, rapid point-of-care platforms and AI-driven decision support systems is accelerating test volumes as health systems pursue earlier rule-out strategies for acute coronary events. Expansion of public- and private-sector proteomics funding is widening the discovery pipeline, while the FDA's first point-of-care high-sensitivity cardiac troponin approval in 2024 has shortened emergency department rule-out times from one hour to 17 minutes. Demand is further reinforced by the 127.9 million American adults living with cardiovascular disease, equivalent to 48.6% of the population. Meanwhile, Asia-Pacific regulatory modernization is creating attractive reimbursement-linked growth prospects for novel biomarkers and decentralized testing platforms.

Global Cardiac Biomarkers Market Trends and Insights

Increasing prevalence of cardiovascular diseases

Cardiovascular disorders remain the top global mortality driver, costing the United States USD 422.3 billion annually in direct medical expenses . Mandated ASCVD risk assessment coding under the CMS 2025 Physician Fee Schedule now requires evidence-based diagnostics that combine demographic variables with laboratory cardiac biomarkers, intensifying institutional uptake . As value-based care contracts expand, providers rely on biomarker-guided interventions to document measurable outcome gains and avoid readmission penalties.

Technological advances in high-sensitivity assays

FDA clearance of Siemens Healthineers' Atellica IM high-sensitivity troponin I test enables prognostic risk stratification for up to one year after an index event . Laboratory-quality microfluidic cartridges now quantify troponin at 10-fold lower concentrations than legacy assays and deliver results in minutes, achieving 100% sensitivity in multi-center validation studies. Sex-specific reference ranges are closing historical diagnostic gaps among female patients, while integrated biosensors allow finger-stick whole-blood testing without plasma separation.

Stringent regulatory frameworks

Europe's In-Vitro Diagnostic Regulation now obliges extensive clinical evidence, stretching CE-mark timelines. SpinChip Diagnostics expects to submit under IVDR by end-2025 with launch slated for 2026, illustrating prolonged pathways. In the United States, FDA draft rules for AI-enabled diagnostics require algorithmic transparency plus multi-ethnic validation cohorts, adding compliance costs and delaying commercial roll-out.

Other drivers and restraints analyzed in the detailed report include:

- Growing public- & private-sector R&D funding

- Expansion of multiplex panels for early rule-out protocols

- Reimbursement erosion from bundled-payment models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Troponins controlled 59.87% of the cardiac biomarkers market in 2024, validating decades of clinical trust in these gold-standard proteins. Segment revenues benefit from the shift to high-sensitivity formats that detect minute myocardial injury within two hours of symptom onset. Conversely, ischemia-modified albumin is expanding at a 14.21% CAGR, reflecting growing recognition that transient coronary vasospasm events demand markers able to capture reversible ischemia that troponin misses.

The cardiac biomarkers market size attributable to troponins reached USD 11.3 billion in 2025. Manufacturers are augmenting assay menus with microRNAs and inflammatory proteins, yet clinical uptake hinges on regulatory clearance and guideline endorsement. Creatine kinase is tapering as high-sensitivity troponins deliver superior specificity, while myoglobin remains a legacy option used primarily for ultra-early triage before troponin rises.

Applications in myocardial infarction generated 40.23% of segment revenue for the cardiac biomarkers market in 2024. Hospitals rely on troponin algorithms to meet door-to-needle targets, a metric directly tied to reimbursement bonuses. Acute coronary syndrome, however, is climbing at a 14.27% CAGR, driven by 0/2-hour rule-out pathways that safely discharge low-risk patients and decrease telemetry bed occupancy.

The cardiac biomarkers market size for acute coronary syndrome is estimated to be underpinned by payer incentives that reward avoidance of unnecessary admissions. Chronic care settings are also expanding use cases; BNP-based management of heart failure reduces readmission penalties under the Medicare Hospital Readmissions Reduction Program, while ASCVD coding requirements integrate biomarker panels into annual risk reviews.

The Cardiac Biomarkers Market is Segmented by Biomarker Type (Troponins, Creatine Kinase, and More), Application (Acute Coronary Syndrome, Myocardial Infarction, and More), Location of Testing (Central Laboratory Testing, and More), End-User (Hospitals, Diagnostic Laboratories, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.21% of the cardiac biomarkers market in 2024, supported by well-funded payers, mature laboratory networks and guideline alignment that validates high-sensitivity assays. CMS coding updates further entrench biomarker requirements within preventative cardiology workflows. The region's testing volumes will keep pace with population aging, yet pricing pressure from bundled payment models is likely to temper revenue expansion.

Europe follows as the second-largest region, with public healthcare systems anchoring troponin adoption for rapid rule-out protocols. Implementation of the In-Vitro Diagnostic Regulation increases compliance costs but also elevates trust in clinically validated assays, reinforcing adoption across Germany, France and the United Kingdom. Market momentum will hinge on balancing reimbursement ceilings with cost-effective multiplex panels that reduce downstream imaging utilization.

Asia-Pacific is the fastest-growing territory, poised to post a 14.52% CAGR. Japan's USD 40 billion medical device sector is already embracing high-sensitivity troponin and BNP testing, aided by PMDA expedited review channels. China's National Medical Products Administration has approved 61 innovative diagnostics in 2023, signaling a friendlier path for foreign and domestic biomarker vendors. Rising cardiovascular prevalence, coupled with government insurance expansion, drives demand for decentralized point-of-care solutions in secondary hospitals.

Middle East & Africa and South America represent emerging catch-up markets. Gulf Cooperation Council states are investing in tertiary cardiac centers equipped with high-throughput analyzers, while Brazil and Mexico roll out universal health coverage pilots that reimburse early myocardial infarction diagnostics. Suppliers able to deliver affordable, stable ambient-temperature reagents will gain share as freight and cold-chain constraints persist.

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher Corp. (Beckman Coulter)

- Thermo Fisher Scientific

- bioMerieux

- QuidelOrtho Corp.

- Randox Laboratories

- Bio-Rad Laboratories

- Beckton Dickinson

- PerkinElmer

- DiaSorin

- Tosoh Corp.

- Trinity Biotech plc

- Mindray

- Werfen SA

- LSI Medience Corp.

- LumiraDx Ltd.

- Response Biomedical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing prevalence of cardiovascular diseases

- 4.2.2 Technological advances in high-sensitivity assays

- 4.2.3 Growing public- & private-sector R&D funding

- 4.2.4 Expansion of multiplex panels for early rule-out protocols

- 4.2.5 AI-enabled predictive analytics integrating troponins with EHRs

- 4.2.6 Adoption of at-home finger-stick cardiac biomarker kits

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory frameworks

- 4.3.2 Reimbursement erosion from bundled-payment models

- 4.3.3 Analytical variability of novel POC devices

- 4.3.4 Limited specificity generating false-positive results

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Biomarker Type

- 5.1.1 Troponins

- 5.1.2 Creatine Kinase

- 5.1.3 Myoglobin

- 5.1.4 Ischemia-Modified Albumin

- 5.1.5 Other Biomarker Type

- 5.2 By Application

- 5.2.1 Acute Coronary Syndrome

- 5.2.2 Myocardial Infarction

- 5.2.3 Congestive Heart Failure

- 5.2.4 Atherosclerosis

- 5.2.5 Other Applications

- 5.3 By Location of Testing

- 5.3.1 Point-of-care Testing

- 5.3.2 Central Laboratory Testing

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Ambulatory Surgery Centers & Clinics

- 5.4.4 Home Healthcare Settings

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Siemens Healthineers

- 6.3.4 Danaher Corp. (Beckman Coulter)

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 bioMerieux SA

- 6.3.7 QuidelOrtho Corp.

- 6.3.8 Randox Laboratories Ltd.

- 6.3.9 Bio-Rad Laboratories Inc.

- 6.3.10 Becton, Dickinson and Company

- 6.3.11 PerkinElmer Inc.

- 6.3.12 DiaSorin SpA

- 6.3.13 Tosoh Corp.

- 6.3.14 Trinity Biotech plc

- 6.3.15 Shenzhen Mindray Bio-Medical Electronics

- 6.3.16 Werfen SA

- 6.3.17 LSI Medience Corp.

- 6.3.18 LumiraDx Ltd.

- 6.3.19 Response Biomedical Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment