PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836593

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836593

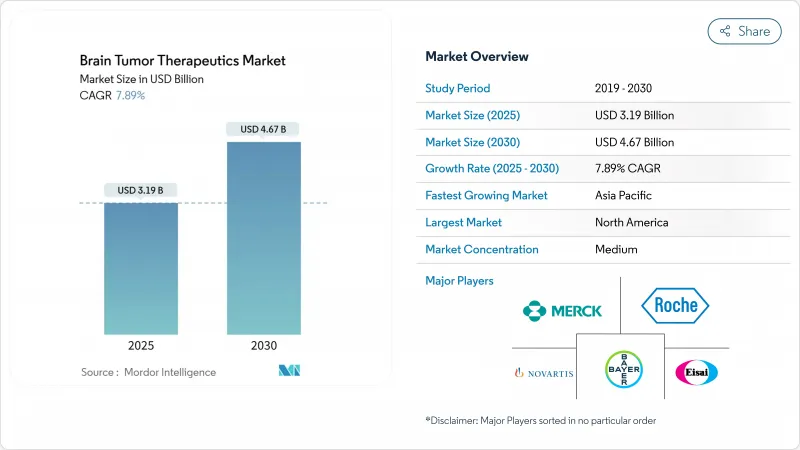

Brain Tumor Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The brain tumor therapeutics market reached USD 3.19 billion in 2025 and is forecast to climb to USD 4.67 billion by 2030, expanding at a 7.89% CAGR.

Robust growth reflects the convergence of precision-medicine breakthroughs, fast-track approvals, and a steady pipeline of late-stage assets that shorten the bench-to-bedside journey. The commercial roll-out of Boron Neutron Capture Therapy (BNCT) alongside AI-enabled drug-repurposing tools is shifting therapeutic expectations, particularly for glioma and other high-grade tumors. Intravenous regimens still dominate clinical practice because they allow tight pharmacokinetic control, yet oral targeted agents are gaining traction as blood-brain barrier solutions improve. Investors continue to funnel record sums into neuro-oncology, with large biopharma groups allocating more than USD 53 billion to neurological assets in the past two years. However, radio-isotope supply chain disruptions and elevated therapy costs temper near-term momentum.

Global Brain Tumor Therapeutics Market Trends and Insights

Late-stage pipeline expansion & accelerated FDA approvals

Regulatory speed continues to reshape the brain tumor therapeutics market. Vorasidenib's 2024 approval for grade 2 IDH-mutant glioma doubled median progression-free survival versus placebo, validating biomarker-guided development paths. Breakthrough therapy designations are compressing timelines, while investigational device exemptions now cover novel radiotherapy platforms such as Alpha DaRT's radium-224 seeds for recurrent glioblastoma. Collective momentum shortens commercialization cycles and encourages multi-arm master trials that match molecular subsets with targeted agents.

Precision-medicine shift toward biomarker-guided therapies

Routine testing for IDH mutation, MGMT promoter methylation, and 1p/19q codeletion now guides regimen selection in leading centers. Liquid biopsy platforms provide real-time molecular readouts, allowing therapy switches before radiographic progression. Machine-learning algorithms integrating multi-omics profiles already predict immunotherapy responses with 90%+ accuracy, a capability that is refining eligibility criteria for checkpoint blockade.

High cost of novel therapeutics & combination regimens

First-in-class cell and gene therapies often exceed USD 400,000 per course, while multi-agent combinations can add another USD 300,000 annually, straining payer budgets. Health systems now link reimbursement to real-world outcomes, creating coverage delays that limit early adoption in lower-income settings.

Other drivers and restraints analyzed in the detailed report include:

- Commercial roll-out of compact BNCT platforms

- AI-assisted drug repurposing for orphan brain tumors

- Blood-brain barrier limits small-molecule & biologic penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glioblastoma held 51.23% of brain tumor therapeutics market share in 2024 and is projected to grow at an 8.45% CAGR, sustaining the largest slice of the brain tumor therapeutics market size through 2030. High mortality, limited standard-of-care options, and the emergence of tumor-treating fields help maintain investor focus.

Continued device-drug pairings, peptide vaccines, and IDH-selective inhibitors illustrate capital concentration in this segment. Meningioma follows in value terms thanks to refined radiosurgery protocols, whereas pituitary tumors benefit from novel endocrine modulators that normalize hormone levels more predictably. Pediatric-leaning subtypes such as medulloblastoma and ependymoma now integrate risk-adapted radiotherapy with molecular diagnostics, improving five-year survival yet leaving relapsed disease an urgent research priority.

The Brain Tumor Therapeutics Market Report is Segmented by Type of Brain Cancer (Glioblastoma, Meningioma, and More), Therapy (Chemotherapy, Immunotherapy, Gene & Cell Therapy, and More), Route of Administration (Oral, Intravenous, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 40.34% market share in 2024 and enjoys unrivaled clinical-trial density, genomic testing adoption, and payer mechanisms that expedite new product uptake. The region's large installed base of Gamma Knife and BNCT systems supports combination regimens, and philanthropic funding from the Biden Cancer Moonshot sustains translational research programs.

Europe follows with steady contributions as EMA centralized approvals streamline access across member states, and public-private partnerships co-finance orphan-tumor projects. Germany, France, and Italy collectively host more than 120 ongoing brain tumor interventional studies, while pan-European registries supply real-world evidence to health technology assessment agencies.

Asia-Pacific, the fastest-growing region at 8.54% CAGR, benefits from China's regulatory modernization, where 60+ innovative drugs won clearance under accelerated pathways in 2024. Japan's early BNCT adoption makes the country a regional referral hub, and Australian institutions leverage favorable ethics timelines to recruit international patients. Improving reimbursement frameworks in South Korea and Singapore further broaden patient access to leading-edge regimens.

- Amgen

- AstraZeneca

- Bayer

- Bristol-Myers Squibb

- Eisai

- Roche

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Novocure Ltd.

- Celldex Therapeutic

- Kintara Therapeutics

- DelMar Pharmaceuticals

- Abbvie

- Daiichi Sankyo Co., Ltd.

- Sumitomo Heavy Industries (BNCT Systems)

- Neutron Therapeutics

- TAE Life Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Primary & Metastatic Brain Tumors

- 4.2.2 Continuous Late-stage Pipeline Expansion & Accelerated FDA Approvals

- 4.2.3 Precision-medicine Shift Toward Biomarker-guided Therapies

- 4.2.4 Government-sponsored Brain Cancer Initiatives & Funding Boosts

- 4.2.5 Boron Neutron Capture Therapy (BNCT) Commercial Roll-out Momentum

- 4.2.6 AI-enabled Drug-repurposing Accelerating Orphan-tumor Candidates

- 4.3 Market Restraints

- 4.3.1 High Cost of Novel Therapeutics & Combination Regimens

- 4.3.2 Blood-brain Barrier Limits Small-molecule & Biologic Penetration

- 4.3.3 Tumor Micro-environment-driven Immunotherapy Resistance

- 4.3.4 Radio-isotope Supply Shortages for BNCT Facilities

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Brain Cancer

- 5.1.1 Glioblastoma

- 5.1.2 Meningioma

- 5.1.3 Pituitary Tumors

- 5.1.4 Ependymoma

- 5.1.5 Medulloblastoma

- 5.1.6 Other Rare Tumors

- 5.2 By Therapy

- 5.2.1 Chemotherapy

- 5.2.2 Immunotherapy

- 5.2.3 Gene & Cell Therapy

- 5.2.4 Targeted Small-Molecule Therapy

- 5.2.5 Tumor-Treating Fields (TTF) & Electro-therapy

- 5.2.6 Radiotherapy Adjuncts

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Intravenous

- 5.3.3 Intrathecal / Intraventricular

- 5.3.4 Convection-Enhanced Delivery

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Amgen Inc.

- 6.3.2 AstraZeneca PLC

- 6.3.3 Bayer AG

- 6.3.4 Bristol-Myers Squibb Company

- 6.3.5 Eisai Co., Ltd.

- 6.3.6 F. Hoffmann-La Roche Ltd

- 6.3.7 GSK plc

- 6.3.8 Johnson & Johnson (Janssen)

- 6.3.9 Merck & Co., Inc.

- 6.3.10 Novartis AG

- 6.3.11 Pfizer Inc.

- 6.3.12 Novocure Ltd.

- 6.3.13 Celldex Therapeutics

- 6.3.14 Kintara Therapeutics

- 6.3.15 DelMar Pharmaceuticals

- 6.3.16 AbbVie Inc.

- 6.3.17 Daiichi Sankyo Co., Ltd.

- 6.3.18 Sumitomo Heavy Industries (BNCT Systems)

- 6.3.19 Neutron Therapeutics

- 6.3.20 TAE Life Sciences

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment