PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836594

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836594

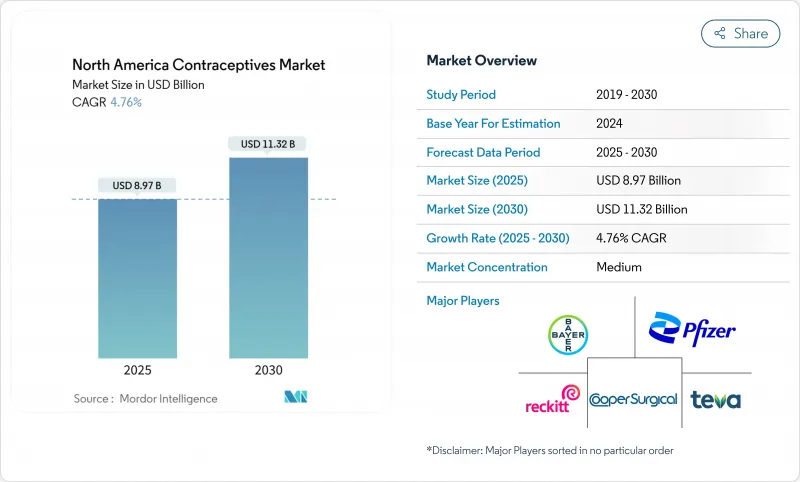

North America Contraceptives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America contraceptive market was valued at USD 8.97 billion in 2025 and is forecast to reach USD 11.32 billion by 2030, reflecting a 4.76% CAGR over the period.

Growing regulatory support for over-the-counter products, wider digital-health integration, and persistent demand for long-acting reversible contraception are sustaining expansion despite legislative headwinds in parts of the United States. Consumers are shifting toward device-based options that avoid hormones, while insurers and public programs continue to prioritize cost-effective methods that lower unintended-pregnancy rates. Meanwhile, venture funding in male methods and AI-driven cycle-tracking applications is reshaping competitive strategies and enlarging the total addressable population. Across Canada and Mexico, universal-coverage initiatives and maternal-mortality targets are accelerating uptake, providing fresh growth channels for established and emerging brands.

North America Contraceptives Market Trends and Insights

Regulatory approval for OTC hormonal pills

The FDA clearance of Opill in 2023 significantly broadened access by removing prescription barriers, prompting insurers to debate zero-cost coverage and nudging manufacturers to re-evaluate pricing levers. Early sales data indicate incremental users rather than simple cannibalization, pointing to net market expansion.

Expanded Title X and Medicaid contraception budgets

Federal spending of USD 286.5 million for FY 2025 underpins safety-net clinics serving 2.8 million clients, though political uncertainty keeps providers cautious about long-term investments. Where funding is stable, private firms seize opportunities to partner with public programs.

Post-Dobbs legal uncertainty dampens provider availability

States enforcing abortion restrictions saw 5.6% drops in birth-control prescriptions and clinic closures that limit contraceptive counseling capacity.

Other drivers and restraints analyzed in the detailed report include:

- Rising STI incidence boosts condom & LARC demand

- Employer-backed telehealth benefits

- Social-media misinformation on hormonal side effects

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contraceptive devices held 61.56% of the North America contraceptive market in 2024 on the strength of long-acting IUDs and hormone-free barrier methods. The segment benefits from nonprofit price reductions such as Medicines360's LILETTA under the 340B program. Condoms retain relevance due to dual-protection needs amid STI spikes.

Pharmaceutical methods, though smaller, are pacing a 5.48% CAGR to 2030. The North America contraceptive market size for pills, patches, and injectables is expanding after OTC approval of Opill, while safety revisions around DMPA reshape prescribing patterns.

North America Contraceptives Market Report is Segmented by Product (Drugs [Oral Contraceptives, Topical Contraceptives and Contraceptive Injectables] and Devices [Condoms, Diaphragms, Cervical Caps, Sponges, Vaginal Rings, and More]), Gender (Male and Female), Hormonal Class (Hormonal Methods and Non-Hormonal Methods), and Geography (United States, Canada and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer

- Pfizer

- Insud Pharma

- Teva Pharmaceutical Industries

- Agile Therapeutics Inc.

- The Cooper Companies

- Organon

- Evofem Biosciences Inc.

- Church & Dwight

- Reckitt Benckiser Group

- Johnson & Johnson

- Abbvie

- Mayer Laboratories

- Femcap Inc.

- Amneal Pharmaceuticals

- Karex Berhad

- Cadence Health Inc.

- HRA Pharma

- Mayer Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Approval for over-the-counter hormonal contraceptives

- 4.2.2 Government funding boosts Title X & Medicaid contraception budgets

- 4.2.3 Spike in STI incidence drives condom & LARC uptake

- 4.2.4 Employer telehealth benefits widen reach of Rx contraceptives

- 4.2.5 Venture-backed male-contraceptive pipeline gains clinical momentum

- 4.2.6 AI-powered cycle-tracking apps integrating Rx fulfillment

- 4.3 Market Restraints

- 4.3.1 Post-Dobbs state-level legal uncertainty dampens provider availability

- 4.3.2 Social-media misinformation on hormonal side-effects

- 4.3.3 Supply-chain shocks for LNG IUDs (single-source API risk)

- 4.3.4 Reimbursement caps on advanced LARCs in public programs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Products

- 5.1.1 Drugs

- 5.1.1.1 Oral Contraceptives

- 5.1.1.2 Topical Contraceptives

- 5.1.1.3 Contraceptive Injectables

- 5.1.2 Devices

- 5.1.2.1 Condoms

- 5.1.2.2 Diaphragms

- 5.1.2.3 Cervical Caps

- 5.1.2.4 Sponges

- 5.1.2.5 Vaginal Rings

- 5.1.2.6 Intrauterine Devices

- 5.1.2.7 Other Devices

- 5.1.1 Drugs

- 5.2 By Gender

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Hormonal Class

- 5.3.1 Hormonal Methods

- 5.3.2 Non-Hormonal Methods

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Bayer AG

- 6.3.2 Pfizer Inc.

- 6.3.3 Insud Pharma

- 6.3.4 Teva Pharmaceutical Industries Ltd.

- 6.3.5 Agile Therapeutics Inc.

- 6.3.6 CooperSurgical Inc

- 6.3.7 Organon & Co.

- 6.3.8 Evofem Biosciences Inc.

- 6.3.9 Church & Dwight Co. Inc.

- 6.3.10 Reckitt Benckiser Group plc

- 6.3.11 Johnson & Johnson

- 6.3.12 AbbVie Inc.

- 6.3.13 Mayer Laboratories Inc.

- 6.3.14 Femcap Inc.

- 6.3.15 Amneal Pharmaceuticals LLC

- 6.3.16 Karex Berhad

- 6.3.17 Cadence Health Inc.

- 6.3.18 HRA Pharma

- 6.3.19 Mayer Laboratories Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment