PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836595

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836595

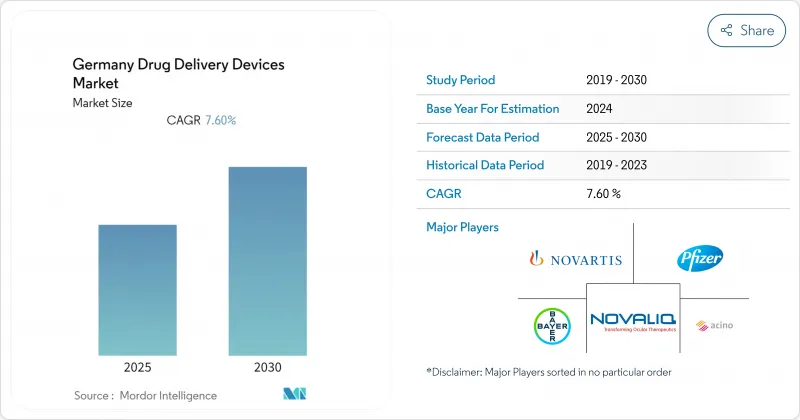

Germany Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany drug delivery devices market is valued at USD 10.45 billion in 2025 and is forecast to reach USD 15.90 billion by 2030, registering an 8.75% CAGR.

Continuous gains stem from the country's broad statutory insurance coverage, strong manufacturing base in high-value syringes and autoinjectors, and an expanding pipeline of biologics that require precise administration technologies. High diabetes prevalence, a rising cancer burden, and Germany's well-resourced hospital network keep demand for injectable systems elevated, while rapid shifts toward home-based care and sustainability goals are opening space for connected, reusable formats. EU-wide joint clinical assessments introduced in 2025, domestic fast-track pathways, and real-time digital adherence tools together shorten launch timelines and support uptake of next-generation devices, even as reference-price rules temper premium options.

Germany Drug Delivery Devices Market Trends and Insights

High Prevalence and Incidence of Chronic and Infectious Diseases

Germany reports higher-than-EU-average prevalence for diabetes (8.4%), cardiovascular diseases (6.8%), and chronic respiratory diseases (11.4%). This chronic-disease load drives steady demand for advanced injectors, insulin pens, smart pumps, and sustained-release implants that improve adherence and outcomes. Diabetes alone is projected to affect 10.9-14.2 million Germans by 2040, pushing continuous upgrades in automated insulin delivery ecosystems. Oncology demand follows a similar path: micro-/nano-robots under development at the German Cancer Research Center aim to raise tumour-site uptake while cutting systemic toxicity. Together, disease trends and research breakthroughs keep the Germany drug delivery devices market on an innovation-driven trajectory.

Growing Trend of Home Healthcare and Aging Population

People aged >= 65 will rise from 21% of the population in 2023 to nearly 30% by 2050. Concurrently, those requiring long-term care could climb to 14 million by 2050. These shifts amplify the need for devices that non-professionals can use safely in domestic settings. On-body injectors such as Gerresheimer's Gx SensAir(R) allow weekly subcutaneous dosing of monoclonal antibodies without clinical visits, cutting travel-related emissions and easing caregiver burdens. Consumer familiarity with telehealth platforms further accelerates uptake of connected inhalers, pens, and patches that integrate adherence dashboards, reinforcing market momentum in Germany drug delivery devices market.

Stringent Regulatory Requirements and Product Recalls

Germany enforces EU Medical Device Regulation (MDR) alongside its Medical Device Law Implementation Act. Combination products must satisfy dual drug-device evidence packages, and higher-risk classes require third-party conformity assessments.Resulting cost spikes and recall liabilities weigh heaviest on SMEs, occasionally pausing launches and trimming the Germany drug delivery devices market growth curve.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Investment in Biosimilar and Biologics Product Innovation and Development

- Government Initiatives Supporting Fast Track Approval and Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injectable devices represented 43.45% of all revenues in 2024, cementing their role in the Germany drug delivery devices market size. Sustained demand arises from biologic therapies that dominate new drug approvals and from continuing preference among clinicians for parenteral accuracy. SCHOTT Pharma's capacity surge in polymer and glass syringes underscores industry confidence.

Implantable pumps, micro-chips, and bioresorbable depots post the quickest gains at an 10.24% CAGR. Patient-friendly inhalers preserve share amid a high national burden of chronic respiratory illness, while transdermal patches earn incremental adoption for hormone and pain management. Across categories, embedded connectivity features enhance dose logging and feedback loops, lifting adherence and data-driven care pathways within the Germany drug delivery devices market.

Injectable delivery retained a 49.67% revenue stake in 2024, reflecting clinician trust in intravenous, subcutaneous, and intramuscular routes for vaccines and large-molecule drugs. This proportion anchors the Germany drug delivery devices market share and is bolstered by next-gen autoinjectors that lower activation force and support 2-5 mL volumes.

Transdermal formats scale fastest at a 10.03% CAGR on the back of microneedle arrays and wirelessly powered acoustic patches that raise payload size limits. Oral mucosal films gain traction for rapid pain relief, while inhaled, ocular, and nasal modalities extend options for targeted local therapy, together enriching clinical toolkits available to practitioners in the Germany drug delivery devices market.

Germany Drug Delivery Devices Market Report is Segmented by Device Type (Injectable Delivery Devices, Transdermal Patches, Infusion Pumps, and More), Route of Administration (Injectable, Inhalational, Transdermal, and More), Application (Diabetes, Oncology, Cardiovascular, and More), and End Users (Hospitals, Ambulatory Surgical Centres, Homecare Settings, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beckton Dickinson

- Gerresheimer

- Ypsomed

- Bayer

- Boehringer Ingelheim

- Pfizer

- Solventum

- Phillips-Medisize LLC

- Novartis

- Owen Mumford

- Novo Nordisk

- Medtronic

- West Pharmaceutical Services

- SCHOTT

- Haselmeier GmbH

- Sanofi

- Terumo

- Teva Pharmaceutical Industries

- Vetter Pharma-Fertigung GmbH & Co. KG

- Nemera La Verpilliere SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence and Incidence of Chronic and Infectious Diseases

- 4.2.2 Growing Trend of Home Healthcare and Aging Population

- 4.2.3 Increasing Investment in Biosimiliar and Biologics Product Innovation and Development

- 4.2.4 Government Initiatives Supporting Fast Track Approval and Reimbursemnet

- 4.2.5 Technological Advancement and Digitalization

- 4.2.6 Expansion of Contract-Manufacturing Hubs

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Requirements and Product Recalls

- 4.3.2 G-BA Price Regulation Capping Premiums for Innovative Systems

- 4.3.3 Market Saturation in Conventional systems Coupled with Patient Compliance and Acceptance Issues

- 4.3.4 Limited Availability of Specialized Microfluidics & Combination-Product Engineering Talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Injectable Delivery Devices

- 5.1.2 Inhalation Delivery Devices

- 5.1.3 Infusion Pumps

- 5.1.4 Transdermal Patches

- 5.1.5 Implantable Drug Delivery Systems

- 5.1.6 Ocular Inserts & Delivery Implants

- 5.1.7 Nasal & Buccal Delivery Devices

- 5.2 By Route of Administration

- 5.2.1 Injectable

- 5.2.2 Inhalation

- 5.2.3 Transdermal

- 5.2.4 Oral Mucosal (Buccal and Sublingual)

- 5.2.5 Ocular

- 5.2.6 Nasal

- 5.3 By Application

- 5.3.1 Diabetes

- 5.3.2 Oncology

- 5.3.3 Cardiovascular

- 5.3.4 Respiratory

- 5.3.5 Central Nervous System Disorders

- 5.3.6 Infectious Diseases

- 5.3.7 Others

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Homecare Settings

- 5.4.4 Clinics and Speciality Centres

- 5.4.5 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Becton, Dickinson and Company

- 6.4.2 Gerresheimer AG

- 6.4.3 Ypsomed Holding AG

- 6.4.4 Bayer AG

- 6.4.5 Boehringer Ingelheim International GmbH

- 6.4.6 Pfizer Inc.

- 6.4.7 Solventum

- 6.4.8 Phillips-Medisize LLC

- 6.4.9 Novartis AG

- 6.4.10 Owen Mumford Ltd

- 6.4.11 Novo Nordisk A/S

- 6.4.12 Medtronic plc

- 6.4.13 West Pharmaceutical Services Inc.

- 6.4.14 SCHOTT AG

- 6.4.15 Haselmeier GmbH

- 6.4.16 Sanofi S.A.

- 6.4.17 Terumo Corporation

- 6.4.18 Teva Pharmaceutical Industries Ltd.

- 6.4.19 Vetter Pharma-Fertigung GmbH & Co. KG

- 6.4.20 Nemera La Verpilliere SAS

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment